Macrolide Antibiotics Market Size:

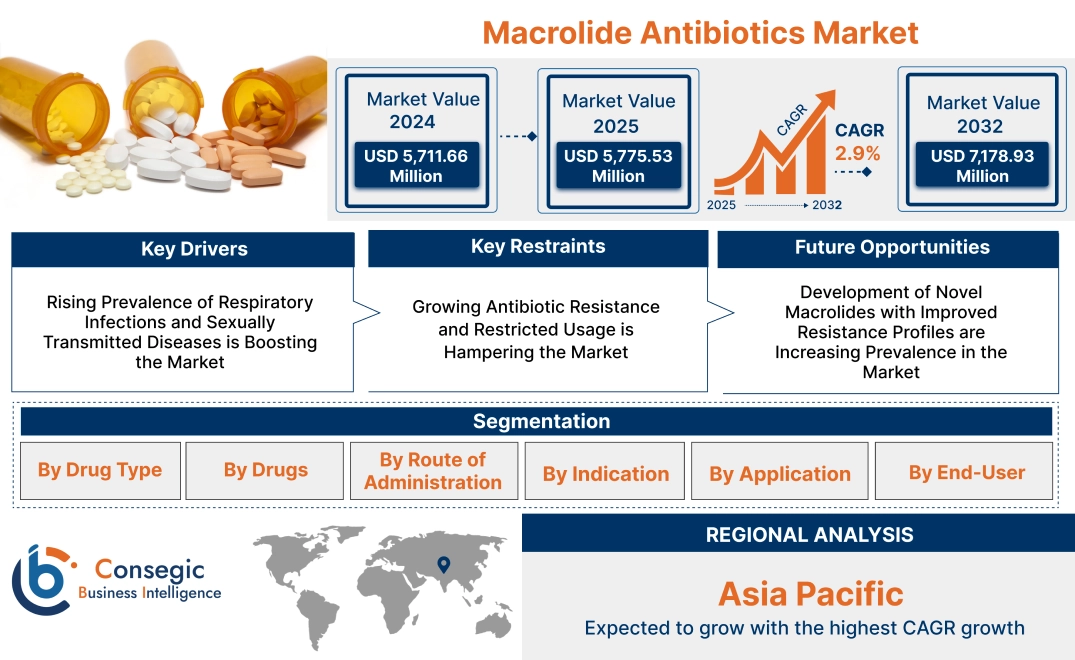

Macrolide Antibiotics Market size is estimated to reach over USD 7,178.93 Million by 2032 from a value of USD 5,711.66 Million in 2024 and is projected to grow by USD 5,775.53 Million in 2025, growing at a CAGR of 2.9% from 2025 to 2032.

Macrolide Antibiotics Market Scope & Overview:

Macrolide antibiotics are a class of broad-spectrum antibacterial drugs characterized by a large macrocyclic lactone ring to which one or more deoxy sugars are attached. They primarily work by inhibiting bacterial protein synthesis through reversible binding to the 50S ribosomal subunit of susceptible bacteria, thus preventing the translocation of aminoacyl-tRNA and the elongation of peptide chains. Common examples include erythromycin, azithromycin, and clarithromycin, which are frequently used to treat respiratory tract infections, skin infections, and certain sexually transmitted infections, especially in individuals allergic to penicillin.

Macrolide Antibiotics Market Dynamics - (DRO) :

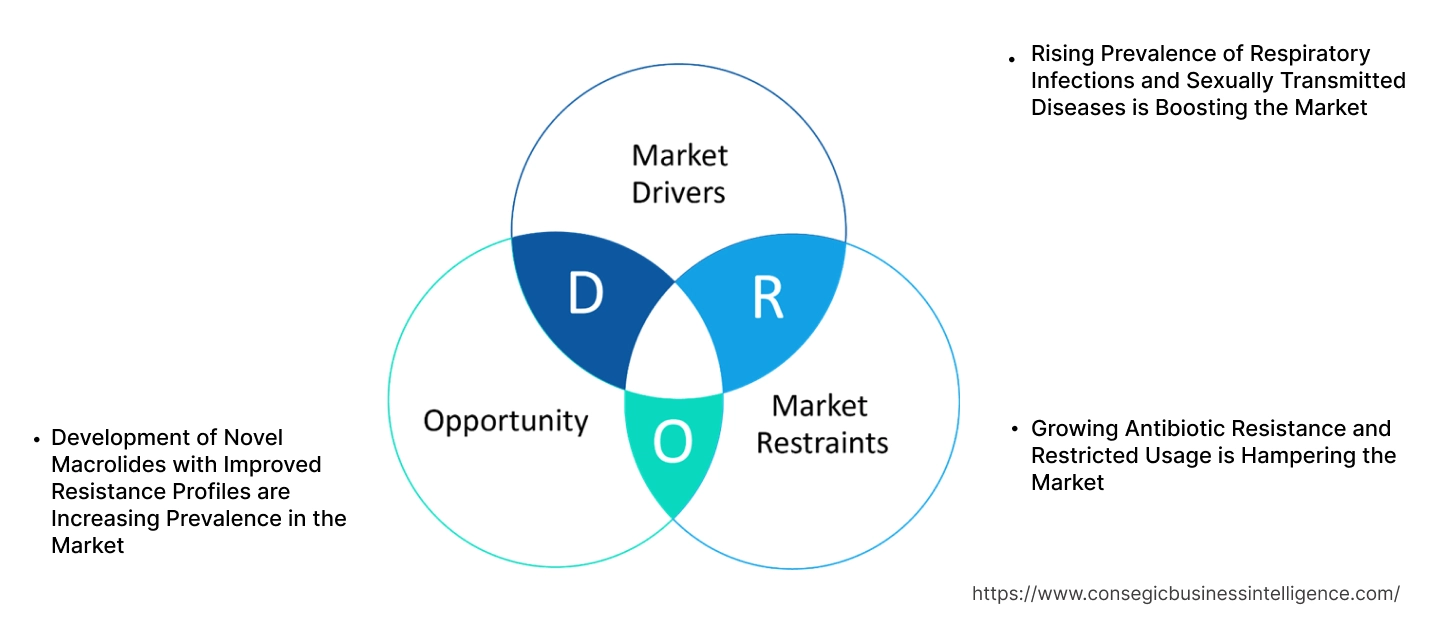

Key Drivers:

Rising prevalence of bacterial infections is driving macrolide antibiotics market growth

A higher incidence of bacterial infections across various types, such as respiratory tract infections (pneumonia, bronchitis, sinusitis, pharyngitis), skin and soft tissue infections, and sexually transmitted infections, directly translates to a greater need for effective antibacterial treatments like macrolides. Macrolides are considered first-line treatment options for certain types of infections, particularly in individuals with allergies to penicillin or when atypical bacteria are suspected. An increase in these specific scenarios directly boosts macrolide usage, consequently driving the macrolide antibiotics market size.

- For instance, in 2019 CDC report highlighted the success of U.S. prevention and infection control measures, leading to an 18% overall reduction in deaths from antibiotic-resistant infections, with a nearly 30% decrease in hospital settings.

Consequently, the rising prevalence of bacterial infections is driving macrolide antibiotics market growth.

Key Restraints:

Growing antibiotic resistance and restricted usage is restraining the global macrolide antibiotics market

The growing problem of antimicrobial resistance to macrolides poses a significant hurdle for industry. Overuse and misuse are fostering resistant bacteria like Streptococcus pneumoniae and Mycoplasma genitalium, weakening the effectiveness of these drugs. Stricter regulations aimed at controlling antibiotic misuse, including limiting macrolide use to confirm susceptible infections, are being implemented by authorities. Additionally, the development of newer antibiotics that are more effective and less prone to resistance is decreasing the dependence on macrolides, particularly in regions with well-developed healthcare systems, further hampering the market expansion.

Therefore, as per the analysis, these combined factors are significantly hindering macrolide antibiotics market share.

Future Opportunities :

Development of novel macrolides is projected to create macrolide antibiotics market opportunity

The most compelling issue facing the current macrolide market is the rising prevalence of resistance. Novel macrolides with modified chemical structures or mechanisms of action are expected to overcome existing resistance mechanisms in key bacterial pathogens. If these new drugs prove effective against strains resistant to older macrolides like erythromycin and azithromycin, they will become a valuable therapeutic option, capturing a significant market share in treating infections, hence boosting macrolide antibiotics market trend.

- For instance, the emergence of "macrolones" as a novel class of macrolide antibiotics with promising activity against resistant respiratory pathogens is a significant development in the fight against antimicrobial resistance.

Hence, based on the analysis, the development of novel macrolides is expected to create macrolide antibiotics market opportunities.

Macrolide Antibiotics Market Segmental Analysis :

By Drug Type:

Based on the Drug Type, the market is categorized into 14-Membered Macrolides, 15-Membered Macrolides, and 16-Membered Macrolides.

14-membered macrolides contain a 14-membered lactone ring, and include drugs such as erythromycin, clarithromycin, and azithromycin. Moreover, 16-membered macrolides have a larger lactone ring and include a slightly different spectrum of activity. They are often used in specific clinical situations, particularly in treating certain resistant strains of bacteria. Additionally, 16-membered macrolides offer several benefits, such as lack of drug-drug interactions, better gastrointestinal tolerance, and activity against certain resistant bacterial strains.

Trends in the Drug Type:

- Rising trend towards the adoption of 16-membered macrolides to have better gastrointestinal tolerability compared to erythromycin.

- Some 16-membered macrolides, like tylosin A, have shown antimalarial activity, opening potential new therapeutic avenues.

14-Membered Macrolides accounted for the largest revenue share in 2024.

The 14-membered macrolide segment, featuring well-established drugs like erythromycin and clarithromycin has a significant market size due to their widespread use in treating prevalent respiratory and skin infections. Furthermore, their increasing application in both pediatric and adult populations for infections stemming from Gram-positive bacteria contributes to positive market trends. Advancements in drug formulations, such as the development of extended-release versions, have improved patient adherence, thereby boosting the macrolide antibiotics market size. Thus, as per the macrolide antibiotics market analysis, the aforementioned factors are driving 14-membered macrolide segment.

15-Membered Macrolides are also projected to register the fastest CAGR during the forecast period.

The 15-membered macrolide, azithromycin, is expected to witness CAGR due to its convenient once-daily dosing and enhanced ability to penetrate tissues. Its increasing use in treating both respiratory tract infections and sexually transmitted infections is a significant factor propelling the growth of this segment. Furthermore, the growing inclusion of azithromycin in clinical guidelines for managing Mycoplasma pneumoniae infections is further contributing to its advancement in the market. Thus, as per the macrolide antibiotics market analysis, the aforementioned factors are accelerating 15-membered macrolide segment growth.

By Drug:

Based on the Drug, the market is classified into Azithromycin, Clarithromycin, Erythromycin, Fidaxomicin, and Telithromycin.

Azithromycin is an antibiotic that is commonly used to treat respiratory infections such as pneumonia and bronchitis, skin infections, ear infections, and others. Clarithromycin is used for treating respiratory tract infections, skin infections, and Helicobacter pylori, a bacteria that causes stomach ulcers. Additionally, erythromycin is used for respiratory tract infections, skin and soft tissue infections, acute pelvic inflammatory disease, and others.

Trends in the Drug:

- Clarithromycin is a well-established macrolide used for respiratory infections, skin infections, and Helicobacter pylori eradication.

- Telithromycin belongs to the ketolide class, a second generation of macrolide antibiotics designed to overcome some resistance mechanisms seen with earlier macrolides.

Azithromycin accounted for the largest market share in 2024 and is also projected to witness fastest CAGR.

Azithromycin is a widely prescribed antibiotic globally due to its convenient once-daily dosing, broad spectrum of activity (covering respiratory, skin, and some sexually transmitted infections), and favorable pharmacokinetic profile. Azithromycin's strong effectiveness in treating both respiratory tract infections and sexually transmitted infections has established it as the most frequently prescribed macrolide antibiotic. Furthermore, its increased use in combination therapies for COVID-19 and other emerging infectious diseases is significantly macrolide antibiotics market demand. Thus, as per the macrolide antibiotics market analysis, the aforementioned factors are driving azithromycin segment growth.

By Route of Administration:

Based on the Route of Administration, the market is divided into Oral, Intravenous (IV), and Topical.

Macrolide antibiotics can be administered through oral, intravenous, and topical routes, according to different clinical situations. Oral administration is the most common route of administration, in which medications are taken by mouth, typically in tablet or liquid form. Meanwhile, intravenous route of administration is usually implemented for more severe infections or for patients who cannot take oral medications. Additionally, topical macrolides are generally applied directly to the skin or mucous membranes, primarily for localized infections.

Trends in the Route of Administration:

- Increasing trend of topical application for direct delivery of the antibiotic to the site of infection, minimizing systemic exposure and potentially reducing systemic side effects.

- For most community-acquired infections, oral macrolides are the mainstay of treatment.

Oral Administration accounted for the largest revenue in 2024.

The oral route is the favored method for administering macrolide antibiotics due to its convenience, ease of use outside of hospitals, and extensive application in treating infections. The wide array of available oral formulations, such as tablets, capsules, and liquid suspensions, further solidifies this segment's dominance. The growing reliance on oral macrolides for managing mild to moderate respiratory and skin infections is a key factor in its continued advancement. Moreover, improvements in drug bioavailability and the development of extended-release formulations have enhanced the effectiveness of oral macrolide treatments. Thus, the above-mentioned factors are boosting the market growth.

Intravenous (IV) is predicted to register the fastest CAGR during the forecast period.

Intravenous (IV) macrolides are projected to play a vital role in the treatment of serious infections like pneumonia and cerebral toxoplasmosis in hospitalized individuals. The increasing emphasis on rapid and effective antibiotic therapy in critical care settings is driving their greater adoption. Furthermore, advancements in IV formulations, such as ready-to-use solutions, are making administration easier and contributing to macrolide antibiotics market growth. The rising incidence of multidrug-resistant bacterial infections is also anticipated to fuel the demand for IV macrolide antibiotics as a crucial treatment option. Subsequently, the above-mentioned factors are contributing notably in spurring macrolide antibiotics market expansion.

By Application:

Based on the Application, the market is divided into Respiratory Tract Infections, Skin and Soft Tissue Infections, Sexually Transmitted Infections, Otitis Media, Gastrointestinal Infections and Others.

Macrolides are commonly used to treat various infections including respiratory tract infections, skin and soft tissue infections, sexually transmitted infections, gastrointestinal infections and others. Macrolides offer several benefits including effectiveness against atypical pathogens in respiratory illnesses, broad spectrum of activity, and anti-inflammatory properties, which makes them ideal for use in aforementioned applications.

Trends in the Application:

- Increasing trend of the adoption of macrolides for certain skin and soft tissue infections, caused by Gram-positive cocci like Streptococcus pyogenes and Staphylococcus aureus.

- Topical and oral erythromycin and azithromycin are used in the management of acne vulgaris due to their antibacterial and anti-inflammatory properties.

Respiratory Tract Infections accounted for the largest revenue in 2024.

Macrolides, particularly azithromycin and clarithromycin, are frequently prescribed for a wide range of RTIs, including community-acquired pneumonia, bronchitis, sinusitis, and pharyngitis. Additionally, increasing resistance among key respiratory pathogens like Streptococcus pneumoniae and Mycoplasma pneumoniae is a significant concern, impacting the long-term efficacy of macrolides for these infections. Thus, macrolides remain valuable for treating infections caused by atypical bacteria such as Mycoplasma pneumoniae, Chlamydophila pneumoniae, and Legionella pneumophila. The anti-inflammatory properties of some macrolides (especially clarithromycin) are being explored for their potential benefits in certain chronic respiratory conditions. Subsequently, the above-mentioned factors are boosting the market expansion.

Gastrointestinal Infections are predicted to register the fastest CAGR during the forecast period.

The gastrointestinal infections segment of the macrolide antibiotics market is experiencing growth primarily due to fidaxomicin's specific effectiveness against Clostridium difficile. Growing awareness regarding the potential of certain macrolides in mitigating antibiotic-associated diarrhea is also contributing to macrolide antibiotics demand. Furthermore, the heightened focus on controlling healthcare-associated infections within hospital settings is driving trends in this area. The expansion of antibiotic stewardship programs that advocate for the use of macrolides in specific gastrointestinal indications is anticipated to further propel market trends in this segment.

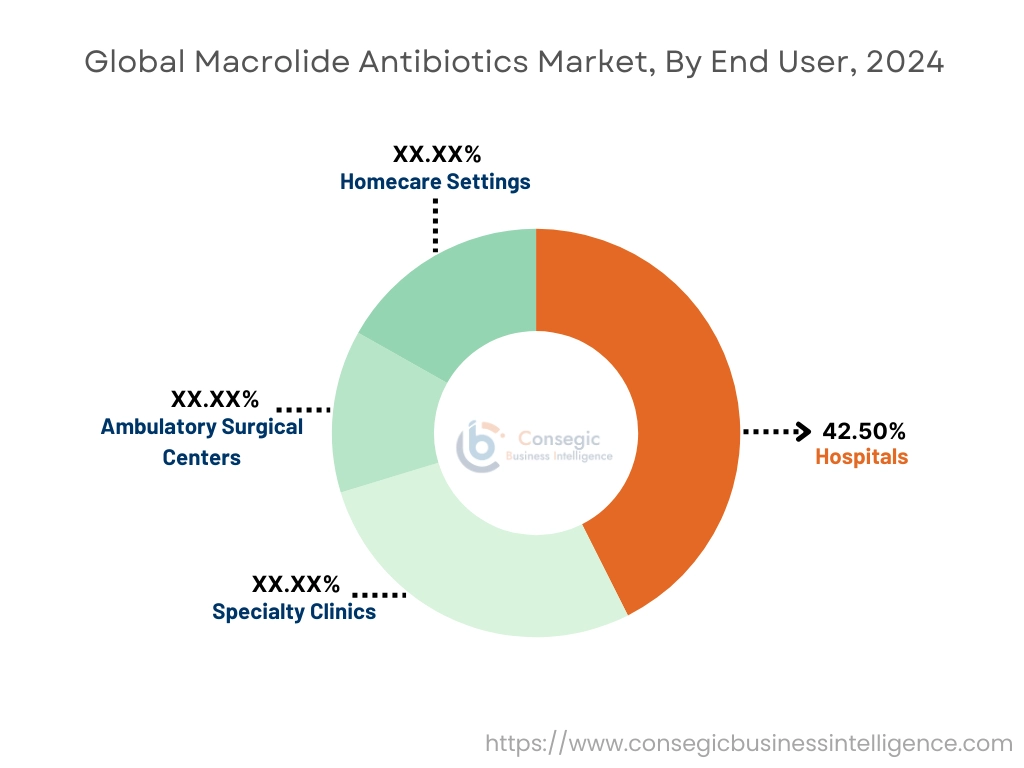

By End-User:

Based on the End-User, the market is divided into Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Homecare Settings.

Macrolide antibiotics are primarily used across various healthcare settings, including hospitals, specialty clinics, ambulatory surgical centers, and homecare settings. Their high effectiveness against a broad range of bacterial infections, including atypical pathogens, anti-inflammatory properties, and tolerable side effects make them ideal for use in both inpatient and outpatient treatments in the aforementioned end users.

Trends in the End-User:

- Topical and oral macrolides (like erythromycin and azithromycin) are used in dermatology clinics for treating acne vulgaris and other skin infections.

- Ambulatory Surgical Centers handle less complex surgical procedures compared to hospitals. Macrolide use is generally for prophylactic purposes in specific clean-contaminated surgeries or for treating minor post-operative infections.

Hospitals accounted for the largest revenue of 42.50% in the market in 2024.

Hospitals are major consumers of macrolides, particularly intravenous (IV) formulations, for treating severe community-acquired and hospital-acquired infections like pneumonia and sepsis. Hospitals are increasingly implementing stringent antibiotic stewardship programs to optimize antibiotic use, combat resistance, and reduce costs. This involves careful selection, dosing, and duration of macrolide therapy, often guided by infectious disease specialists and local antibiograms.

Homecare Settings are predicted to register the fastest CAGR during the forecast period.

The demand for macrolide antibiotics in homecare settings is being fueled by the increasing adoption of oral formulations for self-administration and outpatient treatment. The growing availability of user-friendly options, including liquid suspensions and extended-release tablets, is further supporting market development. The rising emphasis on cost-effective and convenient treatment solutions for both chronic and mild infections is also contributing to macrolide antibiotics market expansion. Moreover, the increasing reach of telehealth services and remote monitoring solutions is improving patient access to macrolide-based treatments within the comfort of their homes.

Regional Analysis:

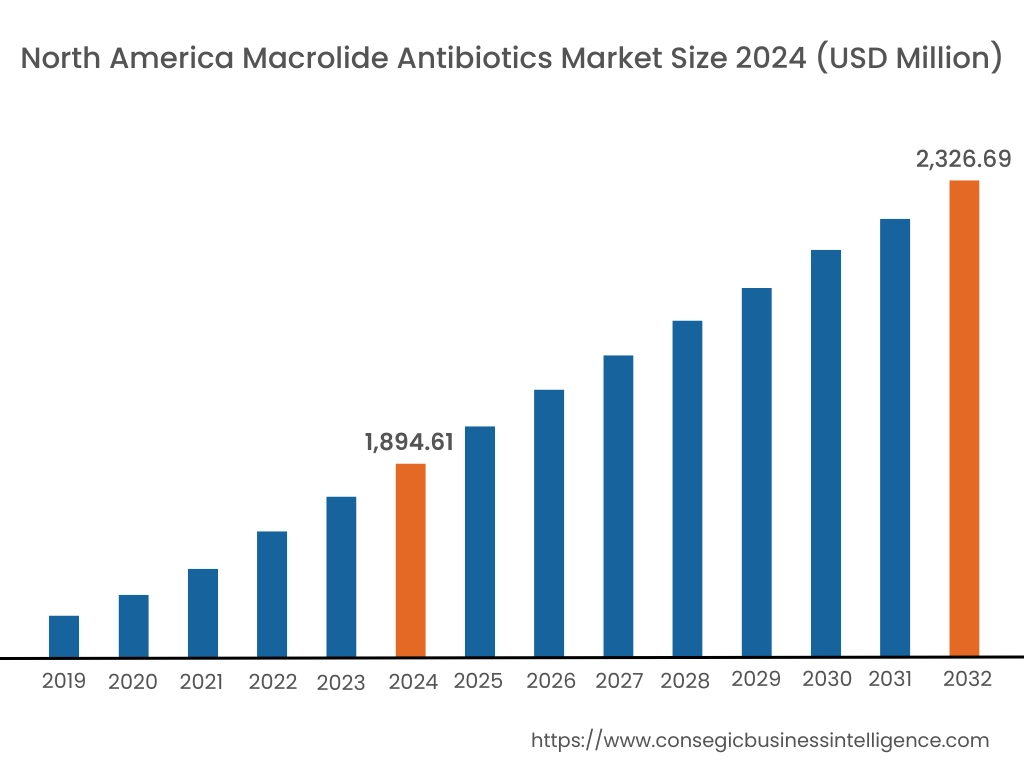

The global macrolide antibiotics market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

North America region was valued at USD 2,398.89 Million in 2024 and is expected to reach over USD 3,015.15 Million by 2032. In North America, U.S. accounted for the highest share of 73.50% during the base year of 2024. Higher healthcare expenditure translates to improved access to medical consultations, diagnostic tests, and prescribed medications, including macrolide antibiotics, for a larger segment of the population. Additionally, with greater spending, there is likely to be increased diagnosis and treatment of various infections, including respiratory tract infections, skin and soft tissue infections, and sexually transmitted infections, where macrolides are frequently used.

- For instance, S. health care spending saw a significant 7.5 percent increase in 2023, reaching a total of USD 4.9 trillion, which equates to USD 14,570 per person. This expenditure now represents 17.6% of the nation's Gross Domestic Product.

In 2024, Asia Pacific was valued at USD 1,884.84 Million and is expected to reach USD 2,369.04 Million in 2032. The macrolide antibiotics industry in China, India, and Southeast Asia is growing due to rising infectious disease cases and better healthcare infrastructure. China is the dominant player, driven by demand for community-acquired infection treatments and strong manufacturing. India's expanding healthcare sector supports widespread generic macrolide use, especially in rural regions. Japan focuses on advanced formulations and strict antibiotic stewardship. However, limited awareness of antimicrobial resistance in rural areas and over-the-counter antibiotic availability could impede proper usage in these regions.

As per the analysis, European macrolide antibiotics industry is characterized by stringent regulatory frameworks promoting responsible antibiotic use and a focus on combating antimicrobial resistance. Additionally, Latin American market sees increasing demand for macrolides due to rising infectious disease prevalence and expanding healthcare access in many countries. Moreover, Middle East and Africa regions face a growing burden of infectious diseases alongside developing healthcare infrastructure, driving increased consumption of macrolide antibiotics.

Top Key Players & Market Share Insights:

The market is highly competitive with major players providing macrolide antibiotics to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the macrolide antibiotics industry include-

- Pfizer Inc. (United States)

- Merck & Co., Inc. (United States)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sun Pharmaceutical Industries Limited (India)

- Zydus Lifesciences Limited (India)

- Alkem Laboratories Ltd. (India)

- Aurobindo Pharma (India)

- Novartis AG (Switzerland)

- GSK plc (United Kingdom)

- Abbott Laboratories (United States)

Macrolide Antibiotics Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 7,178.93 Million |

| CAGR (2025-2032) | 2.9% |

| By Drug Type |

|

| By Drugs |

|

| By Route of Administration |

|

| By Indication |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the macrolide antibiotics market? +

The macrolide antibiotics market size is estimated to reach over USD 7,178.93 Million by 2032 from a value of USD 5,711.66 Million in 2024 and is projected to grow by USD 5,775.53 Million in 2025, growing at a CAGR of 2.9% from 2025 to 2032.

What specific segmentation details are covered in the macrolide antibiotics report? +

The macrolide antibiotics report includes specific segmentation details for drug type, drug, route of administration, application, end-user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the macrolide antibiotics market, services is the fastest growing segment during the forecast period.

Who are the major players in the macrolide antibiotics market? +

The key participants in the macrolide antibiotics market are Pfizer Inc. (United States), Merck & Co., Inc. (United States), Teva Pharmaceutical Industries Ltd. (Israel), Sun Pharmaceutical Industries Limited (India), Alkem Laboratories Ltd. (India), Aurobindo Pharma (India), Novartis AG (Switzerland), GSK plc (United Kingdom), Abbott Laboratories (United States), Zydus Lifesciences Limited (India), and Others.

Which drug type dominates the Macrolide Antibiotics Market? +

The 14-membered macrolides segment, including erythromycin and clarithromycin, accounted for the largest revenue share in 2024 due to their broad-spectrum activity and widespread use in treating respiratory and skin infections.