Management System Certification Market Size:

Management System Certification Market size is growing with a CAGR of 4.4% during the forecast period (2025-2032), and the market is projected to be valued at USD 49.47 Billion by 2032 from USD 35.08 Billion in 2024. Additionally, the market value for the 2025 attributes to USD 36.51 Billion.

Management System Certification Market Scope & Overview:

Management system certification is a third-party audit process. An independent certification body is involved in the verification of another organization's management system. It evaluates whether a respective organization complies with the requirements of a specific international standard. It is a voluntary process for organizations to prove they are committed to best practices. It also improves operational efficiency and consistency. Moreover, it demonstrates commitment to quality, safety, and sustainability. It also provides a competitive advantage and is helpful in opening new market potential.

Management System Certification Market Dynamics - (DRO) :

Key Drivers:

Increasing Regulatory Compliance and Legal Mandates is Accelerating Management System Certification Market Expansion.

Data breaches, inadequate quality in food products, quality comprise in pharmaceuticals, fraud, exploitation, unfair trade practices are increasing day by day. To control all these factors, governments and international bodies worldwide are introducing strict regulations across diverse sectors. These regulations are also helpful in reducing systemic risks and preventing crises. These certifications ensure the stability of critical infrastructure and services. It includes environmental protection laws, data privacy acts, and quality standards for industries such as automotive and medical devices.

For instance,

- In 2024, Europe introduced a new standard EN ISO 20916:2024 which defines good study practice for conducting clinical performance studies of in vitro diagnostic medical devices using human specimens, thus positively impacting management system certification market trends.

Overall, increasing regulatory compliance & legal mandates is significantly boosting the management system certification market expansion.

Key Restraints:

High Cost of Certifications is Hampering the Management System Certification Market Demand.

The high cost of acquiring certifications is posing a significant barrier to the market. Achieving standards such as ISO 9001 and ISO 27001 is not a simplified task. It involves internal assessments, staff training, and hiring consultants. It also requires implementation of new systems and performing recurrent surveillance audits. For smaller businesses, these expenses are quite high and run into thousands of dollars. This is a considerable burden with companies having tight operating budgets. Even large companies hesitate when implementing multiple certifications are required in different departments. Beyond cost, it involves dedicated time and disruption to daily operations. Moreover, the need to dedicate internal resources adds to more burden. Additionally, in emerging markets, there is an absence of certificate bodies. It further adds travel consultant cost. This makes certification more inaccessible. Hence, the high cost of certifications is hampering the management system certification market demand.

Future Opportunities :

Rise in Sector-Specific Certifications is Expected to Increase Management System Certification Market Opportunities.

There are universal standards such as ISO 9001, which already provide an established framework. However, industries are increasingly required tailored certifications. This to address their unique risks, regulatory demands, and operational intricacies, as general standards do not have granularity which is needed for highly specialized sectors. New fields such as artificial intelligence are prompting standards such as ISO 42001, thus positively influencing management system certification market trends.

For instance,

- In 2024, Integral Ad Science became one of the first companies globally to achieve accredited ISO 42001:2023, which is AI management system certification.

Overall, a rise in sector-specific certifications is expected to increase the management system certification market opportunities.

Management System Certification Market Segmental Analysis :

By Service Type:

Based on service type, the market is categorized into certification & auditing, training & education, consulting, and others.

Trends in Service Type:

- There is a growing trend of certification bodies increasingly adopting remote auditing models. This is to reduce travel costs and improve efficiency worldwide.

- Growing cyber threats and stringent data protection regulations have led to increased demand for consulting services for maintaining ISO 27001, which is for information security.

The certification & auditing segment accounted for the largest market share in 2024.

- It involves the process where an independent certification body evaluates an organization's management system against the multiple requirements of a specific international standard.

- This provides proof of adherence to international standards. It enhances reputation and builds trust with customers.

- It is a prerequisite for entering new markets. This helps in differentiating the organization from non-certified competitors.

- The audit process itself identifies non-conformities. It provides potential for improvement. This leads to more consistent and effective operations.

- Moreover, it is helpful in identifying and managing risks systematically. This reduces potential for errors and incidents. It also protects us from legal liabilities. All these benefits are driving its increased usage in multiple industries.

- Overall, as per the market analysis, the aforementioned factors are driving a segment in the management system certification market growth.

The training & education segment is expected to grow at the fastest CAGR over the forecast period.

- This segment is emerging, and it provides the knowledge and skills necessary to understand audit management systems.

- It also helps with implementation and making the maintenance organization. This includes a range of services such as awareness training, implementation training, internal auditor training, and lead auditor training among others.

- This leads to genuine process improvement and sustained compliance. Moreover, training reduces the need for external consultants long-term. Increasing launches of training programs is driving the segment.

- For instance, in 2025, QIIN, in collaboration with Cademy Ltd, launched its first online QMS ISO 9001:2015 certification training. The training was delivered live via Google Meet. This aimed to replicate an interactive, classroom-like experience.

- According to market analysis, the aforementioned factors will drive the segmental share in the management system certification market growth.

By Certification Type:

Based on certification type, the market is categorized into quality management systems, environmental management systems, occupational health & safety management systems, food safety management systems, energy management systems, and others.

Trends in Certification Type

- Increasing consumer demand for ethical products is driving the need for environmental certification such as ISO 14001 and ISO 50001.

- Rising consumer awareness of foodborne illnesses is driving the need for robust food safety certifications to ensure product integrity.

The quality management systems segment accounted for the largest market share in 2024

- Quality management system (QMS) is a formalized system that documents processes for achieving quality objectives.

- The most widely recognized QMS standard is ISO 9001. It provides a framework for organizations. This is to ensure they consistently deliver products and services that meet customer and regulatory requirements.

- Moreover, achieving QMS helps companies in streamlining the internal procedures and reducing waste.

- Additionally, a commitment to quality attracts more customers and stakeholders.

- Furthermore, it helps in identifying potential issues before they become costly problems.

- All these multiple benefits are driving their increased adoption in different industries worldwide.

- Overall, the aforementioned factors are driving a segment in the market.

The food safety management systems segment is expected to grow at the fastest CAGR over the forecast period.

- Food safety certifications ensure that all the edibles consumed by humans are safe and do not impact health negatively. This enhances consumer trust and confidence.

- They also help in preventing foodborne illnesses and reduce product recalls. By demonstrating adherence to international standards, organizations are improving their reputation with customers and marketability, thus driving segment.

- For instance, in 2024, Sunsho Pharmaceutical's acquired the FSSC 22000 Certification, a global food safety management system standard.

- Overall, as per the market analysis, the aforementioned factors will drive segmental growth in the management system certification industry.

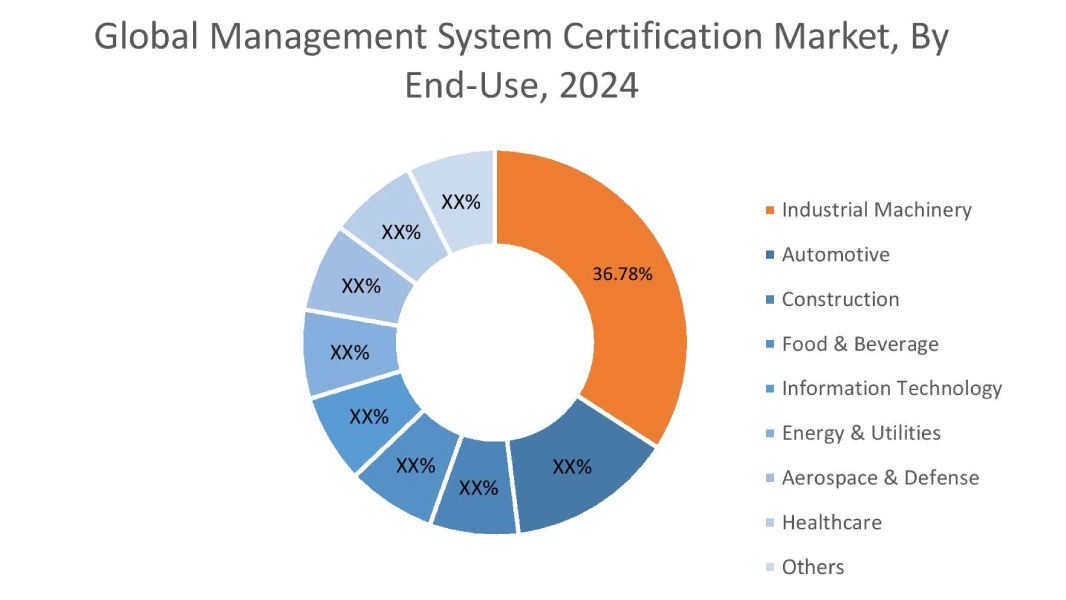

By End Use:

Based on end-use, the market is categorized into industrial machinery, automotive, construction, food & beverage, information technology, energy & utilities, aerospace & defense, healthcare, and others.

Trends in End-Use

- The electrification of vehicles is leading to increased demand for IATF 16949 quality certification.

- Due to growing pressure for sustainability, there is a growing trend of adopting ISO 14001 which is for environmental.

The industrial machinery segment accounted for the largest market share of 36.78% in 2024.

- Industrial machinery segment involves companies involved in the manufacturing and sale of equipment which are used across various industries.

- This includes heavy machinery for construction, mining, and agriculture, as well as production machinery for factories such as automation systems, robotics, packaging equipment, and textile machinery among others.

- Quality assuranceensures the reliability, precision, and longevity of complex machinery.

- Occupational health & safety certification demonstrates a commitment to worker safety and aims to reduce accidents.

- Additionally, environmental certification helps manufacturers to optimize resource use in the machinery and reduce their environmental footprint. These advantages companies achieve through certifications drive the need in the sector.

- Overall, as per the management system certification market analysis, the aforementioned factors are driving the segment in the market.

The construction segment is expected to grow at the fastest CAGR over the forecast period.

- In the construction industry, quality assurance is needed to ensure consistent quality in builds and reduce errors.

- Moreover, occupational certification helps minimize accidents and improves worker well-being.

- Additionally, environmental certification is required to demonstrate sustainability commitment.

- Growing stringent regulations and legal mandates for construction is creating potential for the market.

- For instance, in 2024, the American Concrete Institute (ACI) released ACI CODE-323-24:Low-Carbon Concrete Code requirements and commentary. This is a code for concrete aiming to reduce global warming potential.

- Thus, according to market analysis, the aforementioned factors will drive segmental growth for the forecasted years.

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

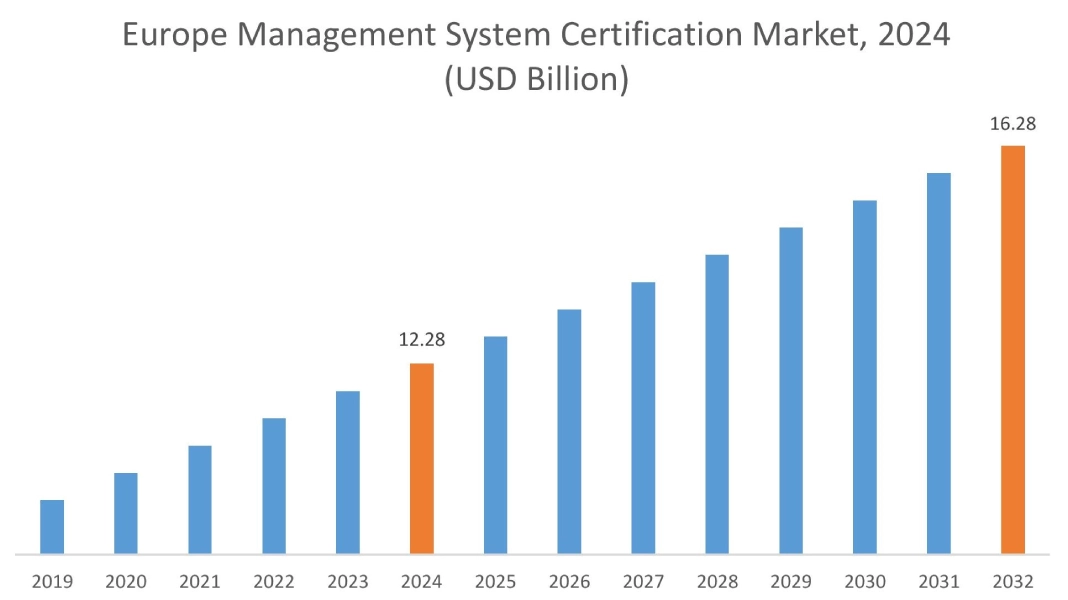

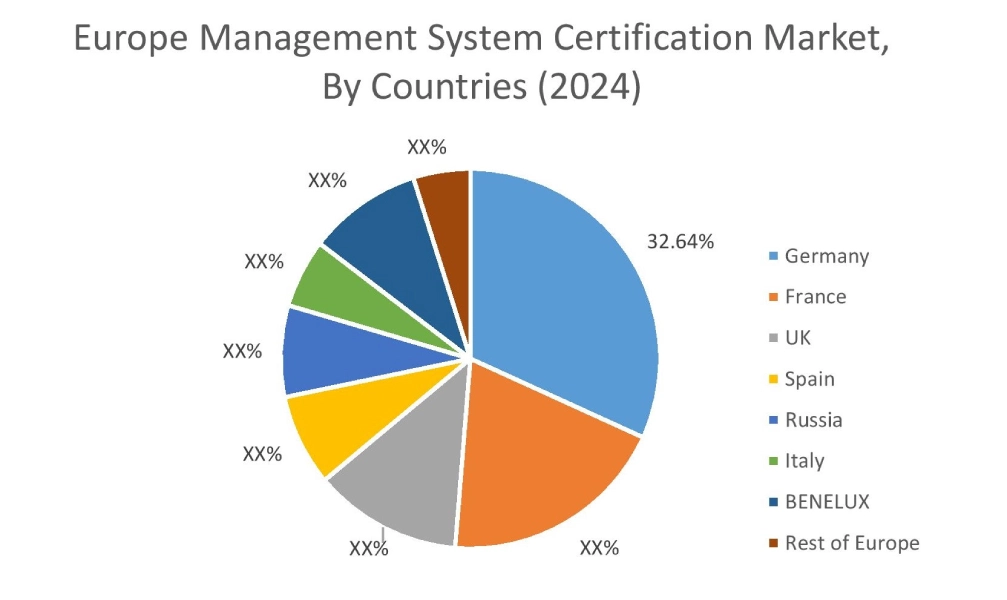

In 2024, Europe accounted for the highest management system certification market share at 35.12% and was valued at USD 12.28 Billion and is expected to reach USD 16.28 Billion in 2032. In Europe, the Germany accounted for the management system certification market share of 32.64% during the base year of 2024. There are growing stringent regulations in the region. EU has strict directives on emissions, waste management, deforestation-free supply chains, and the circular economy. This is pushing companies to adopt ISO 14001 and other management systems. It helps them prove compliance. Moreover, the EU Ecolabel's increased legislative recognition also supports this.

For instance,

- In 2024, the European Union adopted a ban on bisphenol A (BPA) in food contact materials. This further demonstrates their commitment to stringent product safety and required compliance with these regulations.

Additionally, occupational health and safety laws are pushing companies to implement ISO 45001 to ensure worker safety. Overall, the growing stringent regulations are driving the market in the region.

In Asia Pacific, the management system certification market is experiencing the fastest growth with a CAGR of 5.3% over the forecast period. The healthcare sector is rapidly expanding in the region. This growth is fueled by aging populations, rising prevalence of chronic diseases, and increasing healthcare expenditures. Healthcare providers are increasingly adopting ISO 9001 to ensure quality service delivery. This improves patient outcomes and enhances safety. Moreover, medical device manufacturing, ISO 13485 certification, is crucial. It demonstrates product safety and helps in accessing global markets.

The North America management system certification market analysis indicates that several key trends are contributing to its growth in the region. The automotive production is increasing. The industry heavily relies on management system certification. This certification is mandatory for suppliers to major OEMs. This ensures defect prevention, waste reduction, and continuous improvement throughout the complex supply chain. Moreover, the rapid transition to electric vehicles and autonomous driving features demands new levels of safety. Certifications ensure performance and safety of electronic systems.

Middle East and Africa (MEA) market analysis indicates that the information technology sector is rapidly growing in the region. This expansion is fueled by government digital transformation initiatives such as Saudi Vision 2030, increasing cloud adoption, and smart city developments. Organizations are increasingly seeking ISO 27001 certification. This is to establish robust information security management systems. It protects against breaches and builds trust with clients. Moreover, ISO 22301 ensures the resilience of IT operations against disruptions.

Latin America's region creates potential for the market. Consumer goods production is increasing in the region. This is propelled by an expanding middle class, increasing disposable incomes, rapid urbanization, and burgeoning e-commerce. Companies are seeking quality management system certification to ensure product consistency and optimize production processes. Moreover, these certifications help in gaining consumer confidence, as they help in demonstrating high product quality, transparency, and ethical practices. Countries such as Brazil, Colombia, and Argentina leads the market.

Top Key Players and Market Share Insights:

The Management System Certification market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Management System Certification market. Key players in The Management System Certification industry include-

- SGS SA (Switzerland)

- Bureau Veritas (France)

- Lloyd's Register (United Kingdom)

- DEKRA (Germany)

- UL LLC (United States)

- Intertek Group Plc (United Kingdom)

- TUV SUD (Germany)

- TUV Rheinland (Germany)

- Det Norske Veritas (Norway)

- British Standards Institution (United Kingdom)

Management System Certification Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 49.47 Billion |

| CAGR (2025-2032) | 4.4% |

| By Service Type |

|

| By Certification Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Management System Certification market? +

In 2024, the Management System Certification market is USD 35.08 Billion.

Which is the fastest-growing region in the Management System Certification market? +

Asia Pacific is the fastest-growing region in the Management System Certification market.

What specific segmentation details are covered in the Management System Certification market? +

Service Type, Certification Type and End-Use segmentation details are covered in the Management System Certification market

Who are the major players in the Management System Certification market? +

SGS SA (Switzerland), Bureau Veritas (France), Intertek Group Plc (United Kingdom), TUV SUD (Germany), TUV Rheinland (Germany), and Det Norske Veritas (Norway) are some major players in the market.