Naloxone Market Size :

Consegic Business Intelligence analyzes that the naloxone market size is growing with a CAGR of 11.1% during the forecast period (2023-2031). The market accounted for USD 850.07 million in 2022 and USD 940.54 million in 2023, and the market is projected to be valued at USD 2,178.75 Million by 2031.

Naloxone Market Scope & Overview:

Naloxone is a type of medication that is used to reverse the effects of opioid overdose including heroin, fentanyl, and prescription opioid medications when given in time. It is also known as Narcan. Naloxone works by blocking the effects of opioids on the brain, which can restore normal breathing and consciousness. Naloxone is safe and effective, and it has no potential for abuse.

Naloxone is available in various forms nasal spray, oral, and injectable. Naloxone is often distributed by community-based organizations, health departments, and pharmacies. Naloxone is commercialized in many pharmacies, and it is often distributed by community-based organizations and health departments. This has made it easier for people to get naloxone, which has increased demand.

Naloxone Market Insights :

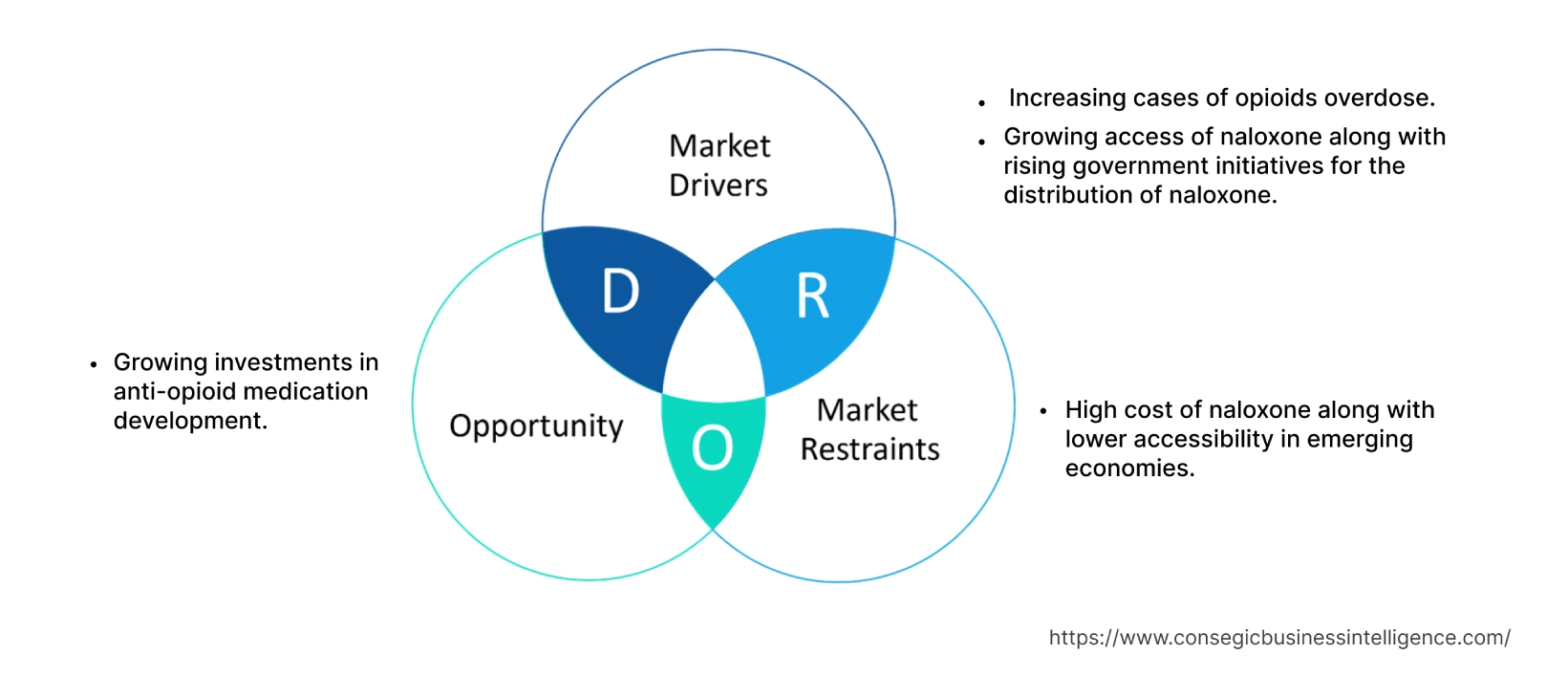

Naloxone Market Dynamics - (DRO) :

Key Drivers :

Increasing cases of opioids overdose

Naloxone is a life-saving medication that can reverse an opioid overdose. It is an opioid antagonist, meaning that it binds to opioid receptors and blocks the effects of other opioids, such as morphine, and oxycodone. The opioid epidemic has led to a record number of overdose deaths in the United States. According to the report by the National Institute of Health, in 2021, over 100,000 people died from drug overdoses, the vast majority of which were from opioids. This has created a strong demand for naloxone, as it is the only medication that can reverse an opioid overdose.

Furthermore, the rise of fentanyl has made the opioid epidemic even more deadly. Fentanyl is a powerful synthetic opioid that is often mixed with other drugs, such as heroin and prescription opioids. It is much more potent than heroin or morphine, and it can lead to overdoses more easily. This has increased the need for naloxone, as multiple doses may be needed to reverse a fentanyl overdose. Thus, the increasing number of cases of opioid overdose is leading to the increasing demand for naloxone across the globe.

For instance, according to the report by the Center for Disease Control and Prevention in August 2023, in 2021, there were 106,699 drug overdose deaths in the United States. The age-adjusted rate of overdose deaths increased by 14% from 2020 (28.3 per 100,000) to 2021 (32.4 per 100,000). The significant growth in the number of deaths due to opioid overdose is driving the market for naloxone across the globe.

Growing access of naloxone along with rising government initiatives for the distribution of naloxone

The access of naloxone is increasing rapidly across the globe, naloxone is now more widely available through various distribution channels. It is available in many pharmacies without a prescription, and it is often distributed by community-based organizations and health departments. This has made it easier for people to get naloxone, which has increased demand. Governments of various countries worldwide are taking initiatives to improve the distribution network of naloxone to make it available for populations across their countries. Such as rising government initiatives for the distribution of naloxone is driving the market for naloxone globally. For instance, in August 2023, the California Department of Healthcare Services announced the launch of the Naloxone Distribution Project (NDP) with a funding of USD 15 million, which is aimed at reducing opioid overdose deaths. The NDP provides naloxone kits to opioid users, their families and friends, and others who may be able to save someone at risk of an opioid overdose. Thus, the growing access of naloxone and rising government initiatives for its distribution are providing access to the people with the medication and driving the market growth.

Key Restraints :

High cost of naloxone along with lower accessibility in emerging economies

The high cost of naloxone can be a barrier to access for people who need it most. This is especially concerning given the opioid epidemic, which is disproportionately impacting low-income and marginalized communities. The limited competition along with the high manufacturing cost of naloxone substantially improves the final cost of naloxone across the various parts of the globe. There are only a few companies that manufacture naloxone. This lack of competition can drive up prices. Furthermore, Naloxone is a complex medication to manufacture, and the manufacturing process is subject to strict regulatory requirements, which also improves the final cost of the product.

Moreover, there are some regulatory barriers in the emerging economies regarding the availability of naloxone and the limited supply of the product in these regions. In some emerging economies, there are regulatory barriers to accessing naloxone. For example, naloxone may require a prescription from a doctor. This can make it difficult for people to get the medication when they need it. The supply of naloxone may be limited in some emerging economies. This can make it difficult for people to find naloxone, even if they are aware of it and can afford it. Thus, the high cost of naloxone along with the challenges associated with naloxone limits the accessibility of naloxone in emerging economies that are restraining the growth of the naloxone market across the globe.

Future Opportunities :

Growing investments in anti-opioid medication development

Increased investment in anti-opioid medication development is leading to the development of new naloxone formulations that are easier to use and more effective. For example, new nasal sprays and injectable formulations of naloxone have been developed that are more convenient and easier to administer than traditional injectable formulations. Furthermore, the increased investment in anti-opioid medication development is also helping to raise awareness of naloxone and its availability. This is leading to more people seeking out naloxone, either for themselves or for others. Various government bodies across the globe are actively investing in the development of anti-opioid medications to combat the problem of drug overdose. For instance, in July 2021, the Pritzker Administration, which is the administration of the Illinois governor, announced an investment of USD 13 million to expand access to life-saving medication in the opioid crisis fight. The investment was aimed at fighting the opioid epidemic by expanding access to naloxone.

Thus, increasing investments in anti-opioid medication development is expected to create lucrative growth opportunities for the growth of the global naloxone market over the forecast period.

Naloxone Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 2,178.75 Million |

| CAGR (2023-2031) | 11.1% |

| By Strength | 2.0 mg/0.1 ml and 4.0 mg/ml, 1 mg/ml, 0.4 mg/ml, and Others |

| By Route of Administration | Injectables (Intramuscular or Subcutaneous and Intravenous), Nasal, and Oral |

| By Distribution Channel | Hospital Pharmacies, Retail Stores, Online Pharmacies, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Amphastar Pharmaceuticals, Inc., Emergent BioSolutions Inc., Hikama Pharmaceuticals PLC, Indivior Plc., Kaleo, Inc., Kern Pharma, S.L., Mundipharma International Limited, Novartis AG (Sandoz US), Pfizer, Inc., Viatris Inc., and Padagis LLC |

Naloxone Market Segmental Analysis :

By Strength :

The strength is categorized into 2.0 mg/0.1 ml and 4.0 mg/ml, 1 mg/ml, 0.4 mg/ml, and others. In 2022, the 2.0 mg/0.1 ml and 4.0 mg/ml segment accounted for the highest market share in the naloxone market. The 2.0 mg/0.1 ml and 4.0 mg/ml strengths of naloxone are largely used because they are the most effective and widely available formulations of this life-saving medication. The 2.0 mg/0.1 ml strength is typically used in nasal spray formulations, while the 4.0 mg/ml strength is typically used in injectable formulations. Both formulations are effective in reversing opioid overdoses, but the injectable formulation is more rapid-acting and may be preferred in critical situations. Both the 2.0 mg/0.1 ml and 4.0 mg/ml strengths of naloxone are safe and effective, and they have no potential for abuse. They are also relatively inexpensive, which makes them accessible to a wide range of people. Thus, the high accessibility and high benefits of these strengths are driving the segment growth across the globe.

Moreover, the 0.4 mg/ml segment is expected to hold the highest CAGR over the forecast period. The 0.4 mg/ml injectable solution is the most widely available form of naloxone, and it is also the most used form in clinical settings. It can be administered intramuscularly, subcutaneously, or intravenously. Moreover, the 0.4 mg/ml injectable solution is a safe and effective way to reverse an opioid overdose. It is also relatively inexpensive and easy to use. These factors are expected to contribute to the rapid growth of the market for this formulation of naloxone over the forecast period.

By Route of Administration :

The end-user industry segment is categorized into injectables nasal, and oral. In 2022, the injectables segment accounted for the highest market share in the overall naloxone market. The injectables segment is further categorized into intramuscular or subcutaneous and intravenous. Injectables are the dominant route of administration for naloxone because they are the most effective and rapid-acting way to deliver the medication. Injectable naloxone can be administered intramuscularly, subcutaneously, or intravenously. All three routes of administration are effective, but intravenous administration is the fastest act. The increasing launch of injectable naloxone medications is driving the segment growth across the globe. For instance, in January 2023, Hikma, a multinational pharmaceutical company, has launched Naloxone Hydrochloride Injection, USP, 2mg/2mL, in prefilled syringe (PFS) form in the US. This is the third PFS product launched by Hikma. The drug is used for the emergency treatment of a known or suspected opioid overdose. Thus, the high benefits of injectable naloxone along with the increasing product innovations is driving the segment growth worldwide.

Moreover, the nasal segment is expected to hold the highest CAGR over the forecast period. Nasal naloxone is a widely available form of naloxone that is easy to administer and does not require medical training. The increasing acceptance of the nasal route of administration of naloxone is expected to provide lucrative growth opportunities for the nasal route of administration over the forecast period. For instance, in March 2023, Amneal Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration (FDA) has accepted for review its Abbreviated New Drug Application (ANDA) for naloxone hydrochloride nasal spray, USP, 4mg, the generic version of Narcan®. Naloxone is used to treat known or suspected opioid overdose emergencies. The growing acceptance of the nasal route of administration of naloxone is creating lucrative growth opportunities for segment growth over the forecast period.

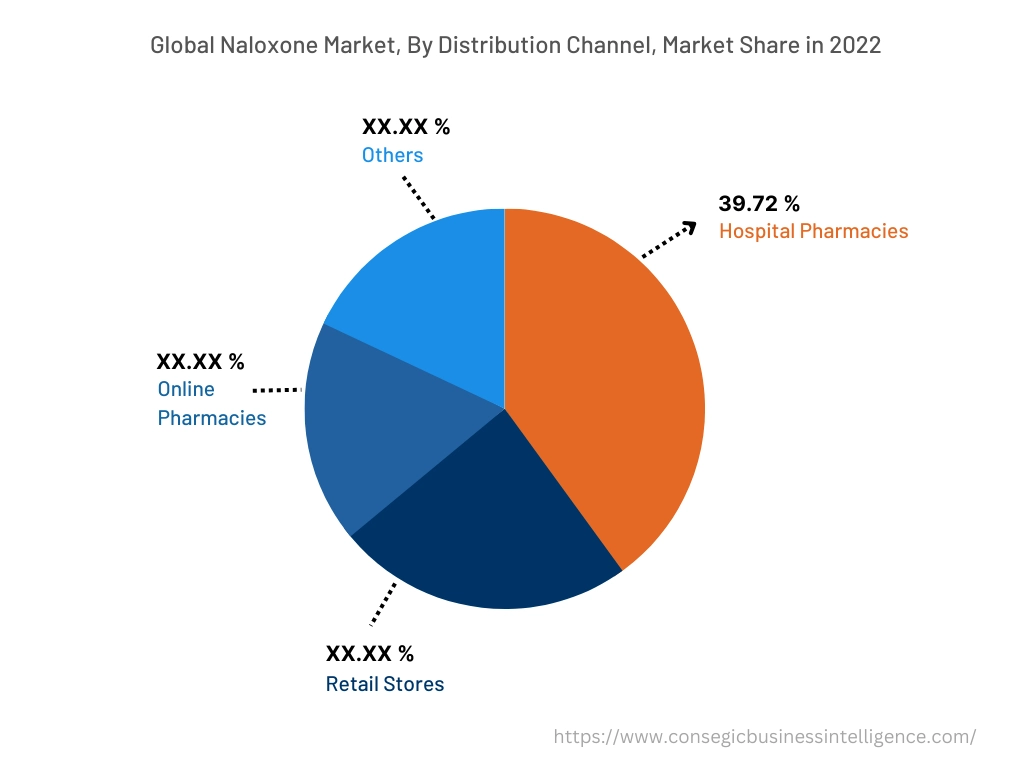

By Distribution Channel :

The distribution channel segment is categorized into hospital pharmacies, retail stores, online pharmacies, and others. In 2022, the hospital pharmacies segment accounted for the highest market share of 39.72% in the overall naloxone market, and it is also expected to hold the highest CAGR over the forecast period. Hospitals are the primary setting where opioid overdoses are treated. Hospital pharmacies are responsible for dispensing naloxone to medical professionals to use in treating these overdoses. In the United States, the Joint Commission on Accreditation of Healthcare Organizations (JCAHO) requires all hospitals to stock naloxone. This requirement is intended to ensure that naloxone is readily available to treat opioid overdoses in the hospital setting. Hospital pharmacies play an important role in the distribution of naloxone which is a key factor driving the segment growth across the globe.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

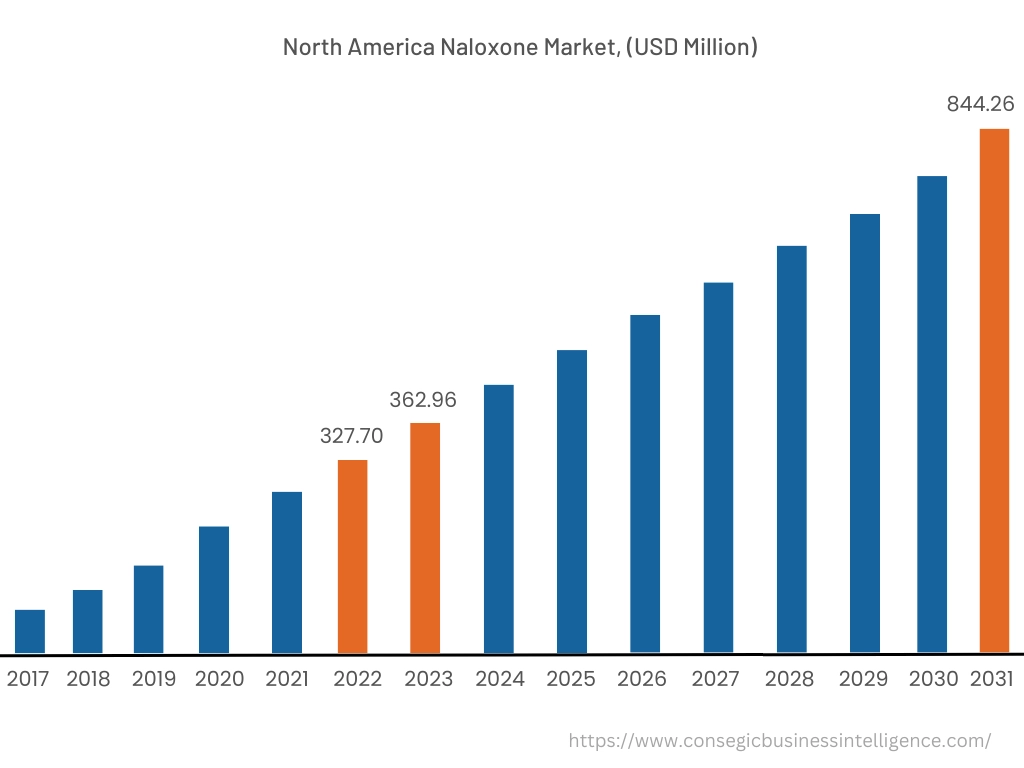

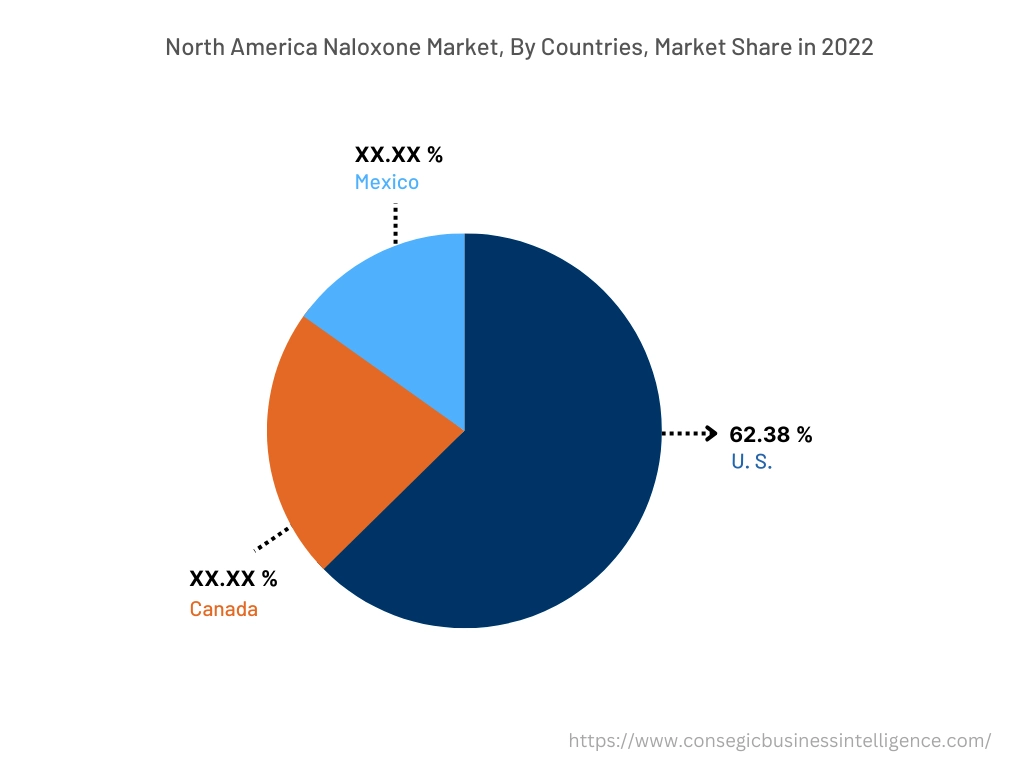

In 2022, North America accounted for the highest market share at 38.55% valued at USD 327.70 Million in 2022 and USD 362.96 Million in 2023, it is expected to reach USD 844.26 Million in 2031. In North America, the U.S. accounted for the highest market share of 62.38% during the base year of 2022. The increasing cases of opioids involved overdose cases across the region is the key factor driving the market growth across North America. For instance, according to the report by the National Institute on Drug Abuse in April 2023, opioid-involved overdose deaths in the United States rose from 21,089 in 2010 to 47,600 in 2017. The number of deaths remained steady through 2019. In 2020, there were 68,630 reported deaths, and in 2021, there were 80,411 reported deaths. Thus, the increase in opioid-involved overdose deaths is driving the demand for naloxone across North America region.

Furthermore, Asia Pacific is expected to witness significant growth over the forecast period, growing at a CAGR of 11.7% during 2023-2023. The significant growth in the pharmaceutical and drug industry across the region is providing lucrative growth opportunities for the naloxone market growth over the forecast period. For instance, according to the report by the National Investment Promotion and Facilitation Agency in April 2023, India's API industry is the third largest in the world. It contributes about 35% of the global pharmaceutical market. API stands for Active Pharmaceutical Ingredient, which is the biologically active component of a drug that causes an intended medical effect. All these above-mentioned factors are collectively boosting the market for naloxone across the Asia Pacific region and creating lucrative growth opportunities for the naloxone market in the Asia Pacific region.

Top Key Players & Market Share Insights:

The naloxone market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Amphastar Pharmaceuticals, Inc.

- Emergent BioSolutions Inc.

- Novartis AG (Sandoz US)

- Pfizer, Inc.

- Viatris Inc.

- Padagis LLC

- Hikama Pharmaceuticals PLC

- Indivior Plc.

- Kaleo, Inc.

- Kern Pharma, S.L.

- Mundipharma International Limited

Recent Industry Developments :

- In August 2023, Padagis LLC, a leading provider of specialty pharmaceuticals, has launched the country's first over the counter (OTC) Naloxone HCl Nasal Spray. Naloxone is a medication that is designed to rapidly reverse the effects of opioid overdose.

- In March 2023, the FDA approved Amphastar Pharmaceuticals' New Drug Application (NDA) for naloxone hydrochloride nasal spray 4mg. The spray is used to treat known or suspected opioid overdoses in adult and pediatric patients. It's delivered using Amphastar's proprietary nasal delivery device.

- In December 2021, Sandoz US a subsidiary of Novartis AG announced the launch of an authorized generic of Narcan® (naloxone hydrochloride) Nasal Spray 4mg. Narcan is used to reverse opioid overdoses.

Key Questions Answered in the Report

What was the market size of the naloxone market in 2022? +

In 2022, the market size of naloxone was USD 850.07 million.

What will be the potential market valuation for the naloxone industry by 2031? +

In 2031, the market size of naloxone will be expected to reach USD 2,178.75 million.

What are the key factors driving the growth of the naloxone market? +

Increasing cases of opioids overdose across the globe is fueling market growth at the global level.

What is the dominant segment in the naloxone market for the distribution channel? +

In 2022, the hospital pharmacies segment accounted for the highest market share of 39.72% in the overall naloxone market.

Based on current market trends and future predictions, which geographical region is the dominating region in the naloxone market? +

North America accounted for the highest market share in the overall market.