Orthopedic Devices Market Size :

Orthopedic Devices Market size is estimated to reach over USD 60.76 Billion by 2032 from a value of USD 44.82 Billion in 2024 and is projected to grow by USD 45.78 Billion in 2025, growing at a CAGR of 4.1% from 2025 to 2032.

Orthopedic Devices Market Scope & Overview:

Orthopedic devices are medical tools designed to address and prevent issues affecting your musculoskeletal system, which includes your bones, joints, muscles, ligaments, tendons, and nerves. These devices help improve mobility, lessen pain, and correct deformities. There are two primary categories of orthopedic devices Implant devices and non-implant devices. The implant devices are surgically placed inside your body while non-implant devices are worn externally to support or protect your musculoskeletal system. Further, the key trends driving the orthopedic devices market include an aging global population and increasing incidence of orthopedic disorders and sports-related injuries. Furthermore, significant technological advancements including minimally invasive surgical techniques, robotics, and 3D printing, and a growing emphasis on personalized medicine and rehabilitation drives the market.

How is AI Impacting the Orthopedic Devices Market?

AI is impacting the orthopedic devices market by enabling a new era of personalized and precision medicine. AI-driven algorithms analyze patient-specific data, such as CT and MRI scans, to design and manufacture custom implants that fit a person's unique anatomy, improving surgical outcomes and implant longevity. This technology is also integrated into robotic-assisted surgical systems, which use AI for real-time navigation and precise implant placement, reducing human error and improving efficiency in the operating room. Furthermore, AI-powered predictive analytics are used to monitor post-operative recovery through smart implants and wearables, allowing for proactive intervention and personalized rehabilitation plans.

Orthopedic Devices Market Insights :

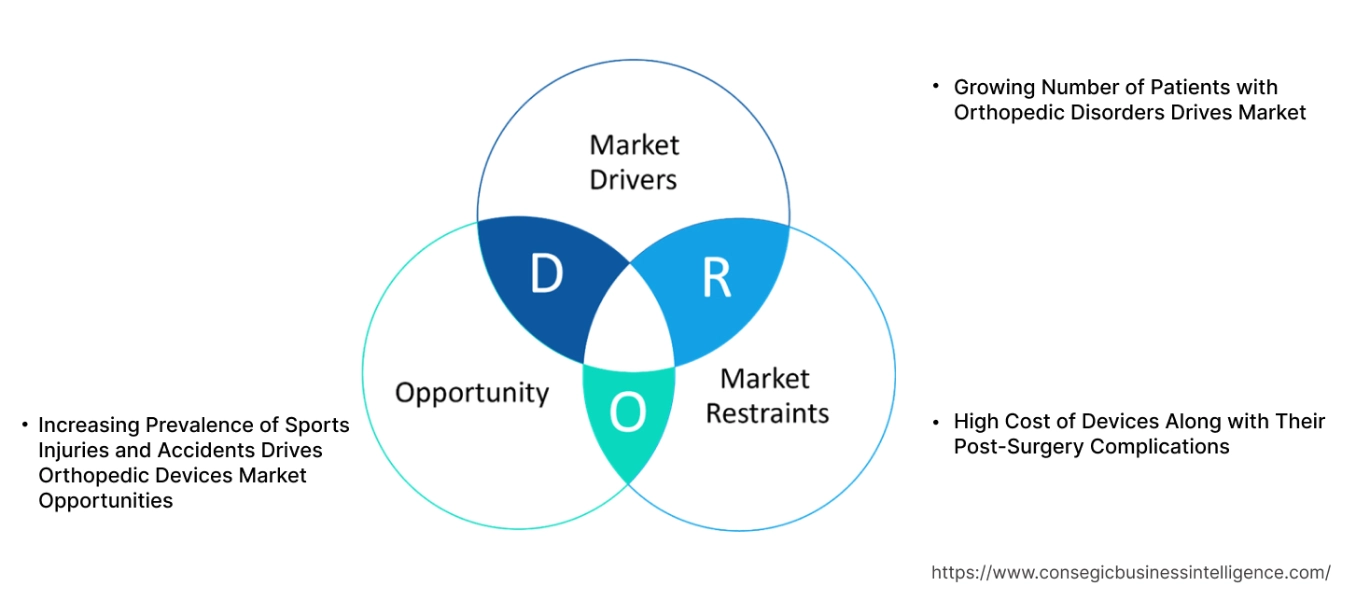

Key Drivers :

Growing Number of Patients with Orthopedic Disorders Drives Market

Orthopedic disorders are conditions that impact our musculoskeletal system which include bones, joints, muscles, ligaments, tendons, and nerves. This surge is driven by several interconnected factors including aging global population. As people live longer, they naturally experience more age-related wear and tear on their joints and bones. Alongside this, the rising prevalence of obesity places extra stress on weight-bearing joints, leading to conditions like osteoarthritis. Further, there is an increase in sports participation, which has led to a greater incidence of sports-related injuries. Furthermore, workplace injuries continue to contribute to the burden of musculoskeletal issues.

- For instance, according to a December 2021 report from the National Center for Biotechnology Information, there's a rise in orthopedic surgeries, with planned spending on these procedures jumping 44% to USD 25 billion since 2010. This indicates a significant and growing need for musculoskeletal treatments.

Thus, growing incidence of orthopedic disorders directly translates to a rise in orthopedic surgeries.

Key Restraints :

High Cost of Devices Along with Their Post-Surgery Complications

The orthopedic device market faces significant challenges due to the inherent complexity and high cost associated with these medical tools. Manufacturing orthopedic devices is intricate, demanding substantial investment in research and development from medical device companies. These R&D costs are ultimately reflected in higher prices for consumers. Further, specific devices like joint implants and spinal fusion devices are particularly expensive to produce and surgically implanted.

The overall cost is also influenced by the patient's condition and the complexity of the required surgery. Furthermore, beyond the financial burden, orthopedic devices can also lead to post surgery complications. The issues such as infection, loosening, allergic reactions, and blood clotting are potential risks that can result in severe health complications. Thus, combined factors including high manufacturing costs, significant patient expenses, and the potential for post-operative complications collectively hamper the growth of the orthopedic devices market.

Future Opportunities :

Increasing Prevalence of Sports Injuries and Accidents Drives Orthopedic Devices Market Opportunities

As sports become increasingly competitive and physically demanding, athletes face a heightened risk of injury. These sports injuries and accidents can lead to various orthopedic conditions, including fractures, ligament tears, and joint dislocations. These conditions often necessitate treatment with orthopedic devices like casts, splints, braces, and implants. Further, the rising global incidence of sports and accident-related injuries is expected to significantly drive the expansion of the global orthopedic devices market.

- For instance, a 2023 report from Johns Hopkins Medicine revealed that roughly 30 million children and teens in the US participate in organized sports, with sports-related injuries accounting for about 20%.

Moreover, according to the National Safety Council of India, sports and recreational injuries saw a 12% increase in 2022, following a 20% rise in 2021 from the previous year. Thus, increasing prevalence of sports injuries and accidents will be a key opportunity, propelling the orthopedic devices market opportunities.

Orthopedic Devices Market Segmental Analysis :

By Site :

Based on the site, the market is segmented into wrist and shoulder, hip & pelvis, knee, foot and ankle, and others.

Trends in the Site:

- The adoption of minimally invasive surgical techniques, often assisted by robotics, is transforming knee procedures, driving the orthopedic devices market demand.

- A rising prevalence of conditions like arthritis, rotator cuff tears, and fractures in the wrist and shoulder areas drives the orthopedic devices market growth.

Knee accounted for the largest revenue share in the year 2024.

- Increasing aging population and rising obesity rates are driving the prevalence of knee osteoarthritis and other degenerative conditions which in turn drives the orthopedic devices market growth.

- Further, higher rates of sports-related injuries contribute significantly to the demand for knee braces, implants, and arthroscopy devices in turn driving the orthopedic devices industry.

- Furthermore, continuous innovation is leading to the development of new and improved knee implants that are more durable, have longer lifespans, and offer better patient outcomes.

- Thus, as per orthopedic devices market analysis, technological advancement growing sports participation and aging population are driving the market.

Foot and ankle is anticipated to register the fastest CAGR during the forecast period.

- An aging population, increasing sports activities, and the growing prevalence of conditions like arthritis, diabetic foot complications, and fractures.

- Further, 3D printing technology is enabling the creation of patient-specific implants and orthotics, offering better fit and improved outcomes which propels the orthopedic devices market expansion.

- Therefore, integration of 3D printing and rising incidence of foot and ankle conditions are anticipated to boost the growth of the market during the forecast period.

By Product Type :

Based on the product type, the market is segmented into joint reconstruction devices, spinal implants and surgical devices, orthopedic fixation devices, orthopedic replacement devices, orthopedic prosthetics, orthobiologics devices, arthroscopy instruments, orthopedic braces and supports, and others.

Trends in the Product Type:

- Increasing aging population and lifestyle factors contribute to a higher incidence of degenerative disc disease, spinal deformities, and trauma, driving the orthopedic devices market trends.

- Continuous innovation in plate and screw designs, materials and locking mechanisms offers improved stability, strength, and reduced soft tissue drive orthopedic devices market size.

Joint reconstruction devices accounted for the largest revenue share in the year 2024.

- High prevalence of osteoarthritis and other degenerative joint diseases drives the demand for joint reconstruction solutions, driving the orthopedic devices market share.

- Further, increasing number of joint replacement surgeries including procedures like knee, hip, and shoulder replacements are becoming more common.

- Furthermore, the aging demographic contributes significantly to the need for joint reconstruction which in turn drives the orthopedic devices market trends.

- For instance, according to a report by the National Center for Biotechnology Information in 2021, the number of joint replacement surgeries is increasing every year in India. In 2020, there were an estimated 200,000 knee arthroplasties in India.

- Thus, as per orthopedic devices market analysis, prevalence of osteoarthritis, rise in joint pain, and increasing number of joint replacement surgeries are driving the market.

Orthobiologics devices is anticipated to register the fastest CAGR during the forecast period.

- There is a growing popularity of orthobiologics in orthopedic surgery which in turn drives the orthopedic devices market share.

- Further, ability of orthobiologics to promote healing and reduce complication risk in turn drives the orthopedic devices market demand.

- Furthermore, less invasive nature of orthobiologics compared to traditional treatments drives the market.

- Therefore, based on analysis, reduce complication risk, less invasive, and growing popularity is anticipated to boost the market during the forecast period.

By Application :

Based on the application, the market is segmented into fracture treatment and recovery, osteoarthritis and rheumatoid arthritis treatment, spine fusion, fixation, and decompression, neurological disorders, dental orthopedics, and others.

Trends in the Application:

- Increasing use of spinal cord stimulators and related devices for the management of chronic neuropathic pain, in turn, drives the orthopedic devices market expansion.

- The continued surge in popularity of clear aligners as an aesthetic and convenient alternative to traditional braces for orthodontic treatment.

Fracture treatment and recovery accounted for the largest revenue share in the year 2024.

- Continued innovation in plates, screws, rods, and external fixation systems is driving the market.

- Further, growing adoption of minimally invasive surgical techniques for fracture fixation, leading to smaller incisions, less soft tissue damage, reduced pain, and quicker patient recovery.

- Furthermore, Development of implants with bioactive coatings to promote bone growth and integration, drives the market.

- For instance, according to a report by the Centers for Disease Control and Prevention in 2022, 4.2% of men aged 50 years of age and over and 18.8% of women aged 50 years and above in the U.S. are suffering from osteoporosis of the femur neck or lumbar spine.

- Thus, based on analysis, bioactive implants and minimally invasive fracture management, drive the market.

Spine fusion, fixation, and decompression is anticipated to register the fastest CAGR during the forecast period.

- Increased utilization of bone graft substitutes and other orthobiologics to promote robust fusion and accelerate bone is driving the orthopedic devices market size.

- Further, The emergence of 3D-printed, patient-specific spinal implants for improved fit, stability, and biomechanical advantage.

- Furthermore, widespread adoption of robotic-assisted platforms and advanced intraoperative navigation systems drives the market.

- Thus, based on analysis, growth in spinal biologics, patient-specific spinal implants, and integration of robotics is driving the market.

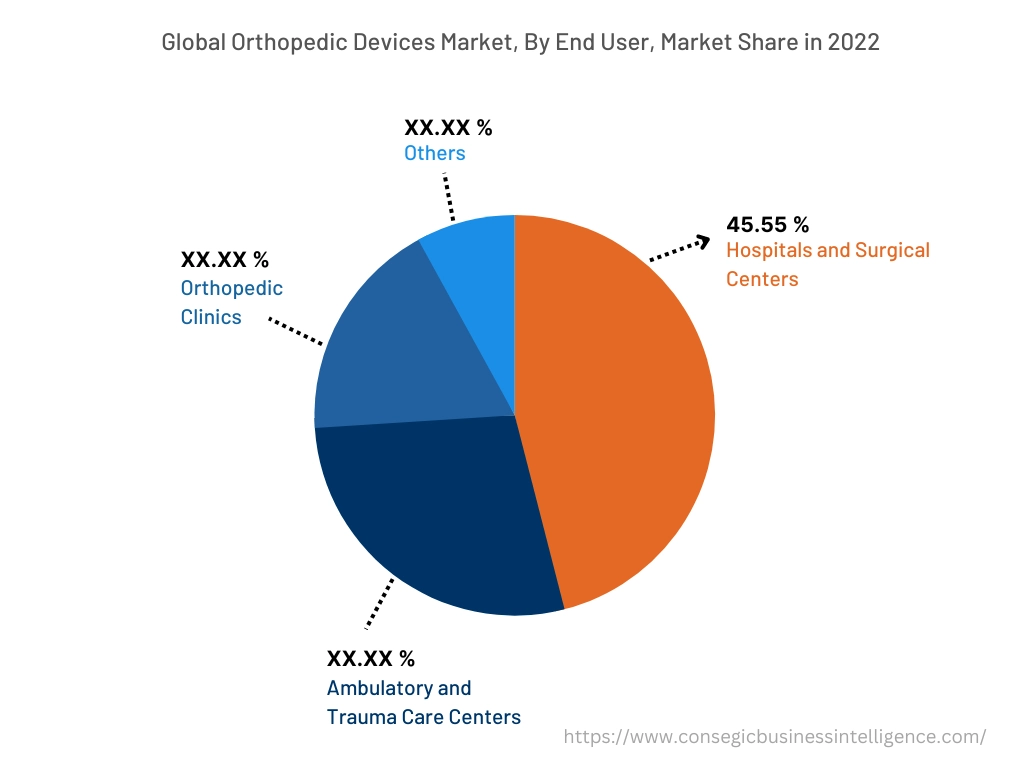

By End-User :

Based on the end-user, the market is segmented into hospitals and surgical centers, ambulatory and trauma care centers, orthopedic clinics, and others.

Trends in the End-User:

- There's a significant and accelerating trend of moving suitable orthopedic procedures, especially joint replacements and sports medicine surgeries, from traditional hospitals to Ambulatory Surgical Centers (ASCs) due to lower costs and greater convenience.

Hospitals and surgical centers accounted for the largest revenue share of 45.55% in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Hospitals and large surgical centers will remain the primary venues for complex orthopedic procedures, severe trauma, and cases requiring extensive post-operative care.

- Further, these centers are leading the adoption of cutting-edge technologies such as robotic-assisted surgery, AI-powered surgical planning, and advanced imaging systems.

- Furthermore, hospitals are investing in expanding and creating specialized orthopedic departments to cater to the growing volume and complexity of musculoskeletal conditions.

- For instance, according to a report by Invest India in 2022, the hospital industry in India accounts for 80% of the total healthcare market and is witnessing a huge investor demand from both global as well as domestic investors. The hospital industry is expected to reach around USD 132 billion by the end of 2023 from USD 61.8 billion in 2017, growing at a CAGR of 16-17%.

- Thus, based on analysis, adoption of advanced technologies and rise of orthopedic departments drives the market.

By Region :

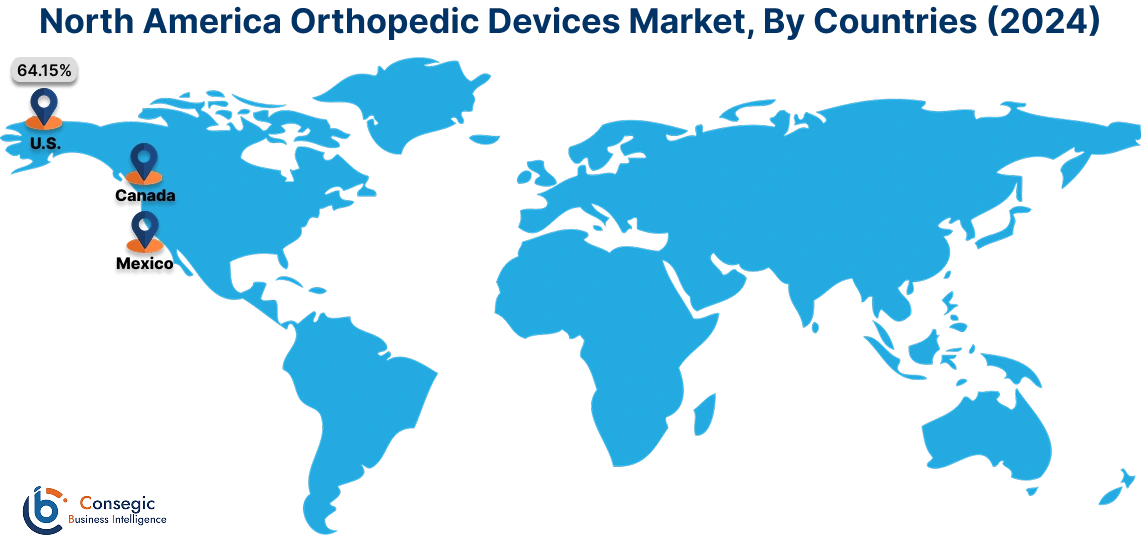

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

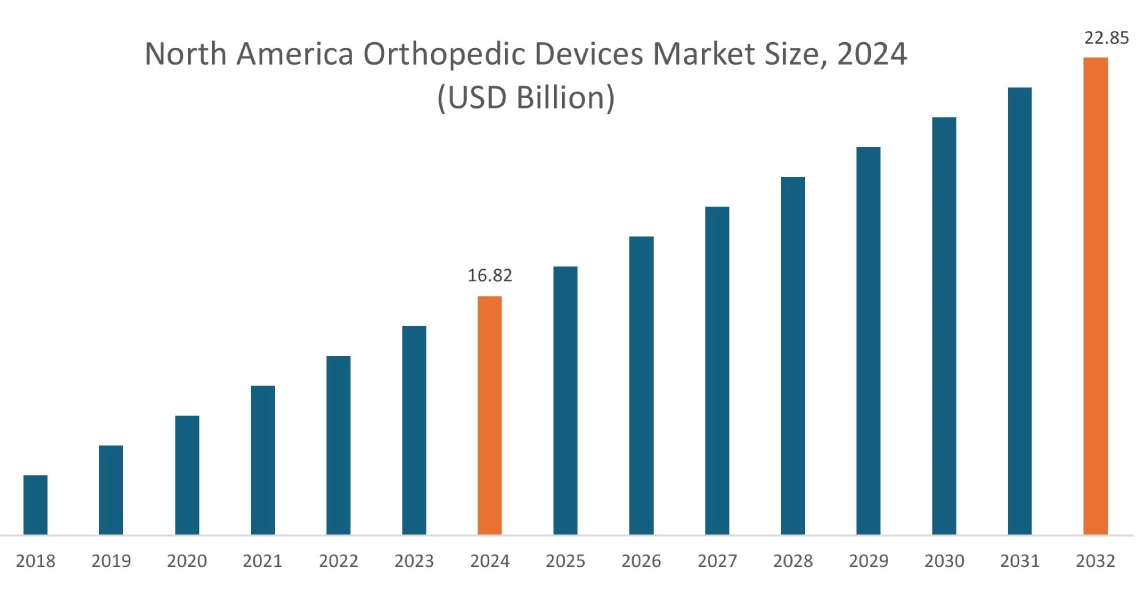

North America region was valued at 16.82 Billion in 2024. Moreover, it is projected to grow by 17.18 Billion in 2025 and reach over 22.85 Billion by 2032. Out of this, US accounted for the maximum revenue share of 64.15%. The North American market is primarily driven by increasing prevalence of orthopedic disorders in an aging population, rising rates of sports and accident-related injuries, and continuous technological advancements.

- For instance, in March 2021, The Orthopedic Devices Program in the FDA's Center for Devices and Radiological Health (CDRH) conducts research to ensure patients have access to innovative devices that are safe and effective. The significant increase in research on medical devices drives the market.

Furthermore, the Asia Pacific region is expected to witness significant growth over the forecast period, growing at a CAGR of 4.5% during 2025-2032. Analysis of market trends concludes that the rise in per capita healthcare expenditure is expected to drive market across the region over the forecast period.

- For instance, In July 2023, Smith+Nephew launched the REGENETEN Bioinductive Implant in India. The implant is used to repair rotator cuff injuries.

The regional trends analysis depicts stringent regulations, rapidly aging population, and continuous advancements in medical technology in Europe are driving the market. Additionally, the factors driving the market in the Middle East and African region are increasing government initiatives to modernize healthcare sector and rising rates of sports and road accidents. Further, growing awareness and acceptance of innovative treatment options, rising healthcare expenditure, and improving healthcare infrastructure is paving the way for the progress of market in Latin America region.

Top Key Players & Market Share Insights:

The global orthopedic devices market is highly competitive, with several large players and numerous small and medium-sized enterprises. The major companies operating in the orthopedic devices industry have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Stryker Corporation (US)

- Johnson & Johnson(US)

- Integra LifeSciences (US)

- NuVasive (US)

- Arthrex (US)

- Globus Medical Inc. (US)

- Conmed (US)

- Orthofix Medical (US)

- Zimmer Biomet (US)

- Medtronic (Ireland)

- Smith & Nephew (England)

Recent Industry Developments :

Product Launch

- In August 2024, Johnson & Johnson MedTech announced that its orthopedics company, DePuy Synthes, is launching the VELYS™ Active Robotic-Assisted System (VELYS SPINE). This proprietary system, developed in collaboration with eCential Robotics, is a dual-use platform offering both standalone navigation and active robotics.

Orthopedic Devices Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 60.76 Billion |

| CAGR (2025-2032) | 4.1% |

| By Product Type | Joint Reconstruction Devices, Spinal Implants and Surgical Devices, Orthopedic Fixation Devices, Orthopedic Replacement Devices, Orthopedic Prosthetics, Orthobiologics Devices, Arthroscopy Instruments, Orthopedic Braces and Supports, and Others |

| By Site | Wrist and Shoulder, Hip & Pelvis, Knee, Foot & Ankle, and Others |

| By Application | Fracture Treatment and Recovery, Osteoarthritis and Rheumatoid Arthritis Treatment, Spine Fusion, Fixation, and Decompression, Neurological Disorders, Dental orthopedics, and Others |

| By End User | Hospitals and Surgical Centers, Ambulatory and Trauma Care Centers, Orthopedic Clinics, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Stryker Corporation, Johnson & Johnson, Zimmer Biomet, Medtronic, Smith & Nephew, NuVasive, Arthrex, Globus Medical Inc., Integra LifeSciences, Conmed, and Orthofix Medical |

Key Questions Answered in the Report

How big is the orthopedic devices market? +

The orthopedic devices market is estimated to reach over USD 60.76 Billion by 2032 from a value of USD 44.82 Billion in 2024 and is projected to grow by USD 45.78 Billion in 2025, growing at a CAGR of 4.1% from 2025 to 2032.

What specific segmentation details are covered in the orthopedic devices report? +

The orthopedic devices report includes specific segmentation details for site, product type, application, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the orthopedic devices market, hospitals and surgical centers is the fastest-growing segment during the forecast period.

Who are the major players in the orthopedic devices market? +

The key participants in the orthopedic devices market are Stryker Corporation (US), Johnson & Johnson(US), Integra LifeSciences (US), Conmed (US), Orthofix Medical (US), Zimmer Biomet (US), Medtronic (Ireland), Smith & Nephew (England), NuVasive (US), Arthrex (US), Globus Medical Inc. (US)and others.

What are the key trends in the orthopedic devices market? +

The orthopedic devices market is being shaped by several key trends including growing number of patients with orthopedic disorders, technological advancements, and growing awareness.