PC-Based Automation Market Size:

PC-Based Automation Market Size is estimated to reach over USD 51.10 Billion by 2032 from a value of USD 33.91 Billion in 2024 and is projected to grow by USD 35.09 Billion in 2025, growing at a CAGR of 5.30% from 2025 to 2032.

PC-Based Automation Market Scope & Overview:

PC-based automation leverages standard personal computers (PCs) to manage and automate industrial operations and equipment. This approach relies on readily available commercial hardware and software to execute automation functions. These PCs are typically ruggedized to withstand challenging industrial environments and are equipped to interface with sensors for data input and to issue control signals. Furthermore, it provides numerous benefits, including flexibility, scalability, cost-effectiveness, and the capacity to integrate with various IT systems like databases, enterprise resource planning (ERP) platforms, and cloud services among others.

PC-Based Automation Market Insights:

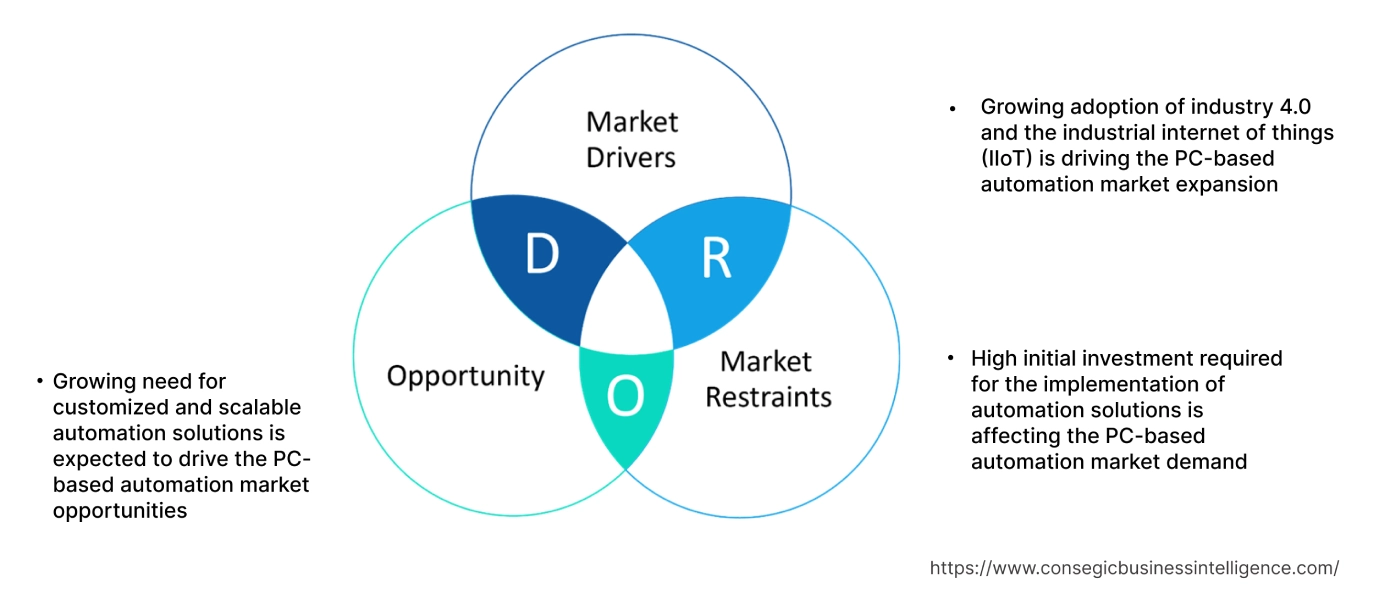

PC-Based Automation Market Dynamics - (DRO) :

Key Drivers:

Growing adoption of industry 4.0 and the industrial internet of things (IIoT) is driving the PC-based automation market expansion

Industry 4.0, also known as smart manufacturing, is revolutionizing industrial production. This transformation is fueling the need for automation solutions that are more flexible, deeply interconnected, and heavily data-driven. The convergence of IT and operational technology has led to the creation of smart factories where machines and devices are interconnected and can communicate with each other. This seamless integration facilitates predictive maintenance, real-time data analytics, and improved decision-making, thus enhancing the overall productivity and efficiency of industrial operations. Additionally, the increasing focus on digital transformation and smart manufacturing is expected to further fuel the market development.

- For instance, in November 2021, Siemens introduced a range of Edge computing devices specifically designed to enhance PC-based automation. These devices empower industrial PCs to carry out sophisticated data processing and analytics directly at the source, which is a fundamental aspect of Industry 4.0.

Thus, according to the PC-based automation market analysis, the growing adoption of Industry 4.0 and industrial internet of things is driving the PC-based automation market size.

Key Restraints :

High initial investment required for the implementation of automation solutions is affecting the PC-based automation market demand

The cost of acquiring and installing advanced automation systems, including hardware, software, and services, can be substantial. This high initial investment may discourage small and medium enterprises from adopting automation solutions.

Additionally, the complexity of integrating automation systems with existing infrastructure and the need for skilled personnel to operate and maintain these systems pose further challenges. Therefore, the aforementioned factors would further impact the PC-based automation market.

Future Opportunities :

Growing need for customized and scalable automation solutions is expected to drive the PC-based automation market opportunities

Organizations across various industries are increasingly seeking automation solutions that can be tailored to their specific requirements. The availability of flexible and scalable PC-based automation systems enables organizations to achieve their operational goals without incurring significant costs. Moreover, increasing adoption of cloud-based deployment options and growing trend of collaborative partnerships between SMEs and large enterprises are further driving the market opportunities. Further, the ability to offer customized and scalable solutions is expected to drive the global market growth.

- For instance, in October 2023, Rockwell Automation unified its FactoryTalk Optix platform with cloud capabilities, creating a comprehensive automation solution. This integration enables users to combine the precision of PC-based control with the power of cloud-based analytics and machine learning. The result is enhanced data insights and the ability to implement predictive maintenance strategies. This strategic innovation is expected to boost the growth of the PC-based automation market share.

Thus, based on the above PC-based automation market analysis, the growing need for customized and scalable automation solutions is expected to drive the PC-based automation market opportunities.

PC-Based Automation Market Segmental Analysis :

By Offering:

Based on offering, the market is segmented into hardware and software.

Trends in the offering:

- The growing need for comprehensive support services and increasing complexity of automation systems are driving the growth of the segment.

- There is a growing trend towards using application programming interfaces (APIs) to connect different software applications and automation systems. This enables more flexible and scalable solutions, while driving the PC-based automation market growth.

- Thus, the aforementioned factors are driving the PC-based automation market demand.

The hardware segment accounted for the largest revenue in the year 2024.

- The hardware segment includes various physical devices and equipment such as industrial PCs, programmable logic controllers (PLCs), and human machine interfaces (HMIs).

- The demand for robust and reliable hardware solutions is driven by the need for precise control and monitoring of industrial processes.

- Moreover, industrial PCs are widely used in automation systems due to their high processing power, durability, and ability to withstand harsh industrial environments.

- Additionally, the continuous advancements in hardware technology, such as the development of compact and energy-efficient devices, are driving the segment.

- For instance, in June 2021, Beckhoff launched the C7015 ultra-compact Industrial PC. This model is a high-performance, space-saving industrial computer built for demanding automation tasks. It highlights the growing need for compact yet powerful hardware solutions, which are crucial for modern automation systems that require significant processing power.

- Thus, based on the above analysis, these factors are further driving the PC-based automation market growth and trends.

The software segment is anticipated to register the fastest CAGR during the forecast period.

- Software solutions such as supervisory control and data acquisition (SCADA), distributed control systems (DCS), and manufacturing execution systems (MES) are essential for the efficient operation of automation systems.

- These software solutions provide real-time data analysis, process visualization, and remote monitoring capabilities, enabling industries to optimize their operations and improve decision-making.

- The increasing adoption of advanced software solutions and integration of artificial intelligence (AI) and machine learning (ML) technologies are expected to drive the growth of this segment.

- Therefore, based on the above analysis, these developments are expected to drive the PC-based automation market share and trends during the forecast period.

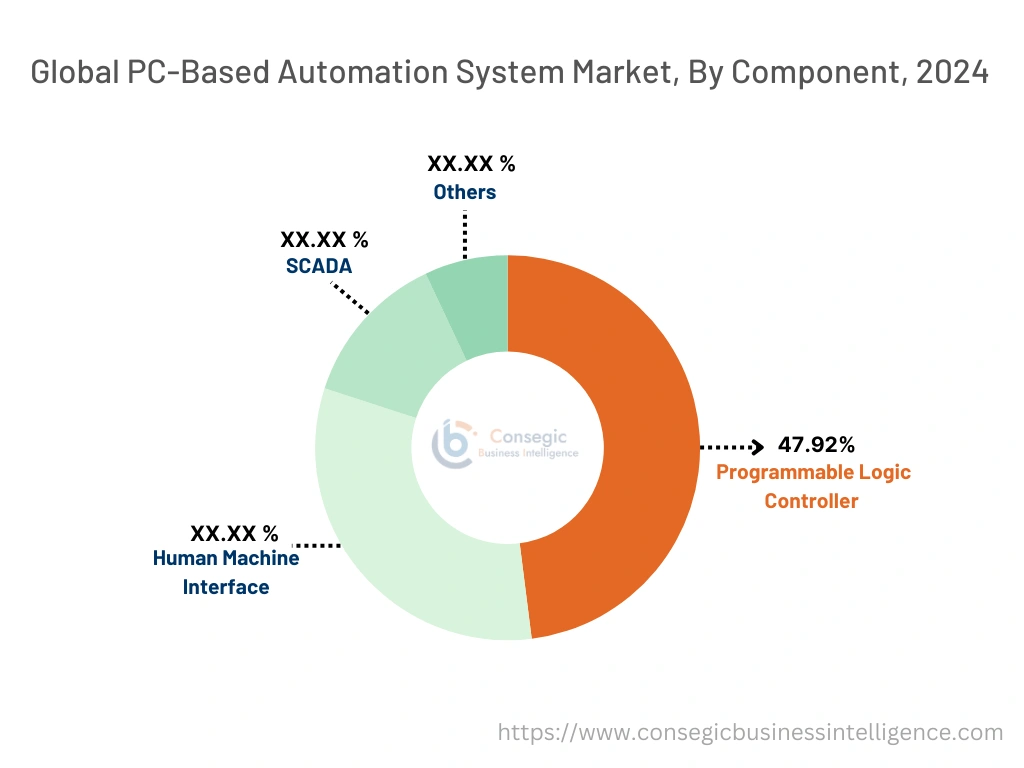

By Component:

Based on component, the market is segmented into programmable logic controller (PLC), human machine interface (HMI), SCADA, and others.

Trends in the component:

- The need for efficiency, precision, and safety in various industrial operations has propelled the adoption of PLCs and HMIs.

- The integration of advanced technologies such as the internet of things (IoT) and artificial intelligence (AI) into PLC systems also contributes to the market's expansion, enabling smarter and more connected industrial processes.

- Based on the above analysis, these factors are anticipated to further drive the PC-based automation market trends during the forecast period.

The programmable logic controller (PLC) segment accounted for the largest revenue share of 47.92% in the year 2024, and it is expected to register the highest CAGR during the forecast period.

- The capability of PLCs to integrate and manage complex automation processes makes them necessary in modern industrial settings.

- As industries continue to evolve towards digitization, the need for PLCs that can support these advanced functionalities is expected to increase, thus driving the segment development.

- For instance, in April 2023, Siemens expanded its Simatic range with the Simatic S7-1500V controller, a new offering designed to meet specific market needs, such as virtualizing PLC computing.

- Thus, based on the above analysis, these factors would further supplement the PC-based automation market trends.

By Application:

Based on application, the PC-based automation market is segmented into manufacturing, medical, retail, energy and utilities, transportation, building automation, and others.

Trends in the application:

- The increasing adoption of cloud computing, big data analytics, and IoT technologies is expected to further drive the need for PC-based automation solutions in the various end-use industries.

- The growing trend of e-commerce and increasing focus on omnichannel retailing are further driving the need for automation solutions in the retail sector. Thus, the above factors are driving the global market.

The manufacturing segment accounted for the largest revenue share in the market in the year 2024.

- The manufacturing sector is one of the largest end-users, driven by the need for efficient and precise manufacturing processes.

- Industries such as automotive, aerospace & defense, and energy & utilities are increasingly adopting PC-based automation systems to enhance their productivity, reduce operational costs, and improve product quality.

- Moreover, the integration of advanced automation technologies, such as robotics and AI, is enabling manufacturers to achieve higher levels of automation and efficiency.

- Thus, the aforementioned factors are driving the global market.

The energy and utilities segment are anticipated to register the fastest CAGR during the forecast period.

- The energy & utilities sector is driven by an increasing demand for efficiency, sustainability, and the real-time management of energy systems.

- The proliferation of IoT devices in the energy sector (smart meters, sensors on grid assets) requires strong PC-based platforms that can seamlessly collect data and control these distributed intelligent endpoints.

- As energy systems evolve with new technologies (renewables, EV charging infrastructure), PC-based solutions offer inherent flexibility to adapt to changing requirements and easily scale up or down as needed.

- Thus, the above factors are expected to drive the global

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

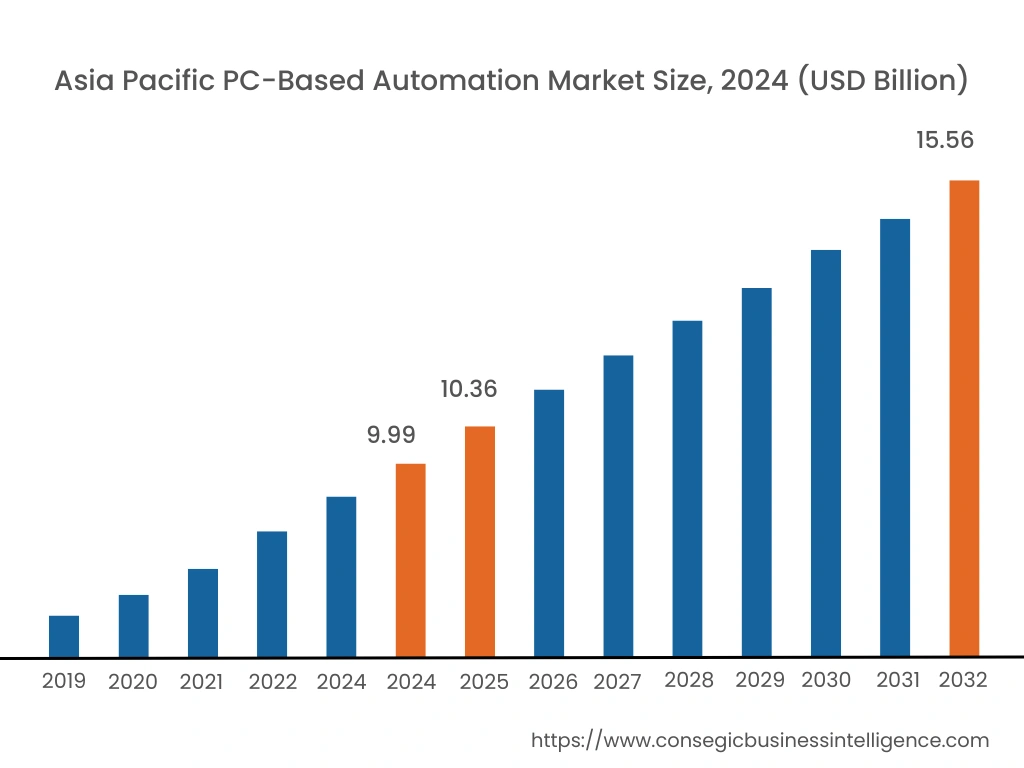

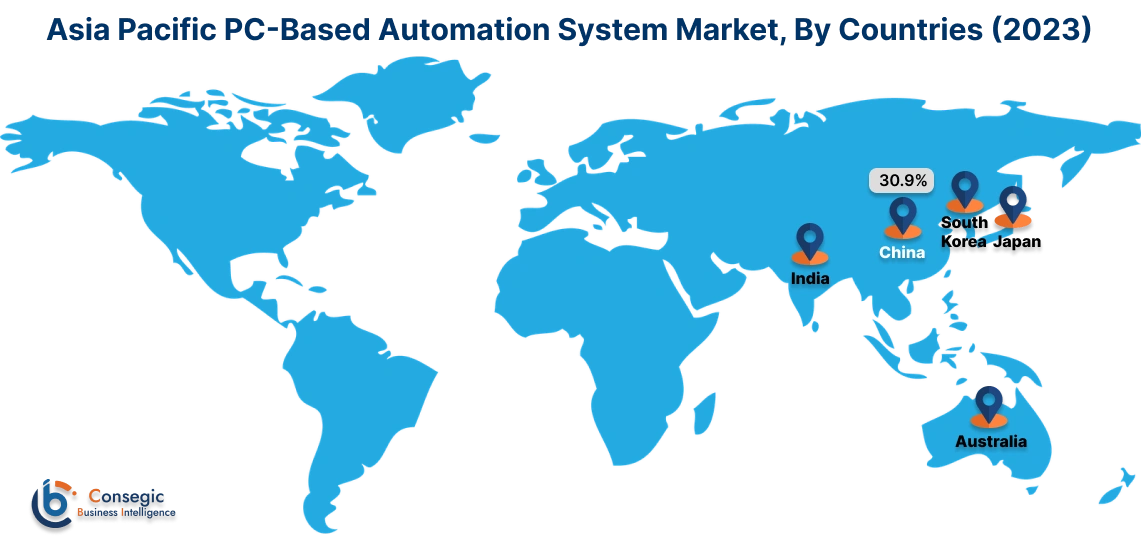

Asia Pacific PC-based automation market expansion is estimated to reach over USD 15.56 billion by 2032 from a value of USD 9.99 billion in 2024 and is projected to grow by USD 10.36 billion in 2025. Out of this, the China market accounted for the maximum revenue share of 30.90%. The regional growth can be attributed to the rapid industrialization, increasing investments in automation technologies, and growing adoption of smart manufacturing practices. Countries such as China, India, and Japan are key contributors to the market development in the Asia Pacific region. Further, the expanding manufacturing sector, coupled with government initiatives to promote industrial automation, is fueling the demand for automation solutions. These factors would further drive the regional PC-based automation market during the forecast period.

- For instance, in December 2023, Advantech launched the ARK-3533, a compact edge computer designed for kiosks and robotics. It provides intelligent control management and integrates seamlessly with other systems, offering robust performance and rugged features for various industries.

North America market is estimated to reach over USD 16.56 billion by 2032 from a value of USD 11.25 billion in 2024 and is projected to grow by USD 11.62 billion in 2025. The strong industrial base, coupled with the increasing investments in automation technologies, is propelling the demand for automation solutions in the region. Further, the rising focus on digital transformation and integration of smart manufacturing practices are driving the market prospects. These factors would further drive the regional market during the forecast period.

Additionally, according to the analysis, the PC-based automation industry in Europe is expected to witness significant development during the forecast period. The need for efficient and precise manufacturing processes is driving the adoption of PC-based automation solutions in this region. Additionally, the increasing focus on digitalization, coupled with the integration of advanced automation technologies, is expected to further drive the Latin American market. Further, as countries across the Middle East and African regions push for diversification of their economies and develop robust manufacturing sectors, there is an increased need for efficient and modernized production processes. These factors are driving the regional PC-based automation market size and share.

Top Key Players & Market Share Insights:

The global PC-based automation market is highly competitive with major players providing solutions and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the PC-based automation industry include-

- Beckhoff Automation (Germany)

- Honeywell International, Inc (US)

- Yokogawa Electric (Japan)

- Schneider Electric (France)

- IDEC Corporation (Japan)

- Siemens (Germany)

- Advantech Co, LTD (Taiwan)

- Rockwell Automation (US)

- Mitsubishi Electric Corporation (Japan)

- Omron Corporation (Japan)

Recent Industry Developments :

Product Launch:

- In June 2024, NVIDIA unveiled Project G-Assist, an AI assistant powered by their RTX GPUs, designed to provide personalized help for PC users. The NVIDIA RTX AI Toolkit equips developers with new tools and software development kits (SDKs) to optimize and deploy large generative AI models directly on Windows PCs.

PC-Based Automation Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 51.1 Billion |

| CAGR (2025-2032) | 5.3% |

| By Offering |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

What is PC-based automation? +

PC-Based Automation refers to a method of using personal computers (PCs) to control and automate industrial processes and machinery. It uses commercial off-the-shelf (COTS) hardware and software to perform automation tasks.

How big is the PC-based automation market? +

PC-Based Automation Market size is estimated to reach over USD 51.1 Billion by 2032 from a value of USD 33.91 Billion in 2024 and is projected to grow by USD 35.09 Billion in 2025, growing at a CAGR of 5.30% from 2025 to 2032.

What is the key market trend? +

Industrial PC hardware is increasingly incorporating edge computing functionalities, enabling real-time data processing and analytics, crucial for IoT applications and industry 4.0.

Who are the major players in the PC-based automation market? +

Key players in the PC-based automation market are Beckhoff Automation (Germany), Honeywell International, Inc (US), ABB Ltd (Switzerland), Siemens (Germany), Advantech Co, LTD (Taiwan), Rockwell Automation (US), Mitsubishi Electric Corporation (Japan), Omron Corporation (Japan), Yokogawa Electric (Japan), Schneider Electric (France), IDEC Corporation (Japan) and others.