Rosuvastatin Market Size :

Consegic Business Intelligence analyzes that the rosuvastatin market size is growing with a CAGR of 4.0% during the forecast period (2023-2031). The market accounted for USD 463.85 million in 2022 and USD 480.58 million in 2023, and the market is projected to be valued at USD 655.99 million by 2031.

Rosuvastatin Market Scope & Overview:

Rosuvastatin belongs to a class of medications known as HMG-CoA reductase inhibitors, commonly referred to as statins. The primary mechanism of action of this medication is the inhibition of an enzyme that is crucial for cholesterol synthesis within the body. As a result, the medication decreases the amount of cholesterol circulating in the bloodstream. When combined with a suitable diet and exercise regimen, the medication effectively reduces bad cholesterol and lipid levels, such as LDL and triglycerides, and enhances the levels of good cholesterol. This improvement in cholesterol levels helps to prevent the development of arterial blockages, thereby reducing the risk of serious cardiovascular conditions such as heart disease, stroke, and other complications. The medication is primarily used to treat hypercholesterolemia and mitigate the risk of cardiovascular disease.

Rosuvastatin Market Insights :

Key Drivers :

Growing incidences of cardiovascular diseases across the globe

Rosuvastatin medications are used to decrease the amount of cholesterol circulating in the bloodstream and enhance the levels of good cholesterol in the body. This improvement in cholesterol levels helps to prevent the development of arterial blockages, thereby reducing the risk of serious cardiovascular conditions. The increasing prevalence of cardiovascular diseases across the globe is driving the demand for rosuvastatin medication worldwide. Cardiovascular disease (CVD) is a class of diseases that includes aortic atherosclerosis, cerebrovascular disease (heart stroke), coronary artery disease, and peripheral artery disease. Based on the analysis, these diseases are mainly caused by a build-up of fat and cholesterol in the blood vessels and arteries. Moreover, as per the analysis, the number of people suffering from cardiovascular diseases worldwide has escalated substantially and is potentially fuelling the rosuvastatin market. According to the data published by the Centers for Disease Control and Prevention in May 2023, about 695,000 people in the United States died from heart disease in 2021—that's 1 in every 5 deaths. Moreover, one person dies every 33 seconds in the United States from cardiovascular disease and almost 2 in 5 adults in the United States have high cholesterol (total blood cholesterol ≥ 200 mg/dL). Thus, as the prevalence of cardiovascular diseases increases, so does the demand for this medication.

Rising awareness about health risks related to high cholesterol and obesity

Rosuvastatin is a statin medication used to lower cholesterol levels in the blood. It is a safe and effective medication for consumers. It is a statin medication used to lower levels of "bad" cholesterol (LDL-C), total cholesterol, and triglycerides in the blood. It is also used to prevent heart attacks, strokes, and other cardiovascular events in people with high cholesterol or a history of heart disease. The growing awareness among consumers about the health risks related to high cholesterol and the growing emphasis on health and wellness among consumers worldwide is propelling the global rosuvastatin market. Based on the analysis, a sedentary lifestyle and unhealthy eating habits are leading to a rise in the number of people with high cholesterol leading to obesity. This, in turn, increases the risk of health issues such as hyperlipidemia, hypercholesterolemia, and cardiovascular diseases. Additionally, based on the analysis, government campaigns aimed at raising awareness about reducing obesity contribute to the expansion of the global rosuvastatin market. For instance, on March 4, 2022, the Australian Government launched the National Obesity Strategy 2022-2032, a framework for action to prevent, reduce, and treat, overweight and obesity in Australia.

Key Restraints :

New alternative product launches and competitor drugs

Existing competition between statin drugs is substantially restraining the market. Multiple alternatives to statin medications are available in the market for reducing bad LDL cholesterol and high lipid levels. FDA-approved statins include atorvastatin, simvastatin, pravastatin, fluvastatin, lovastatin, and pitavastatin. Moreover, as per the analysis, owing to the side effects caused by statin medications, pharmaceutical companies are developing and launching new line therapies and products for the treatment of high cholesterol levels. For instance, on May 13, 2022, Zydus Lifesciences launched Bemdac (Bempedoic acid), an oral drug for treating patients with uncontrolled levels of LDL cholesterol (LDL-c). The drug is for patients who have tried lifestyle modifications and the maximum tolerated dose of statins. On Dec 22, 2021, the FDA approved Novartis Leqvio (inclisiran), a first-in-class siRNA (Small interfering RNA) to lower cholesterol and keep it low with two doses a year. Thus, the competition between statin drugs and new treatment therapies to reduce high LDL cholesterol is restraining the expansion of the market across the globe.

Future Opportunities :

Increasing investment in R&D and developing health care infrastructure

Cardiovascular disease (CVD) is the leading cause of death globally. The increasing prevalence of obesity across the globe and rising incidences of cardiovascular disease are driving the rosuvastatin market globally. Additionally, it is encouraging pharmaceutical companies for more investment in the research and development sector. The growing investments in pharmaceutical and biotechnology research and development activities are expected to drive the demand for this medication for the prevention of obesity and cardiovascular diseases. For instance, according to the 2021 European Union Industrial R&D Investment Scoreboard, health industries invested USD 199.24 billion in R&D in 2020, which accounted for 20.8% of total business R&D expenditure worldwide. Moreover, increasing allocations of funds by the government to the healthcare industry is expected to open new rosuvastatin market opportunities in the future. According to the data published by the India Brand Equity Foundation in August 2023, in the Union Budget 2023-24, the Indian government allocated USD 10.76 billion to the Ministry of Health and Family Welfare (MoHFW). The Indian government is planning to introduce a credit incentive program worth USD 6.8 billion to boost the country's healthcare infrastructure. Thus, a high prevalence of obesity and cardiovascular conditions and an increase in investment in Research and Development are likely to drive the rosuvastatin market growth and trends over the forecast period.

Rosuvastatin Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 655.99 Million |

| CAGR (2023-2031) | 4.0% |

| By Application | Obesity, Dyslipidemia, Atherosclerosis, Heart stroke, and Others |

| By Dosage Form | Capsules and Tablets |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies and Drug Stores, Online Pharmacies, and Others. |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Glenmark Pharmaceuticals U.S. Inc., USA, AstraZeneca, AdvaCare Pharma, Niksan Pharmaceutical, Teva Pharmaceutical Industries, MANUS AKTTEVA BIOPHARMA LLP, Nextwell Pharmaceutical, Schwitz Biotech, XENON PHARMA PVT LTD, Saheb Pharmaceuticals LLP, MSN Laboratories, Shanghai Pharma Holdings Co., Ltd, Lunan Pharmaceutical Group, JB Pharma and Grünenthal. |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Rosuvastatin Market Segmental Analysis :

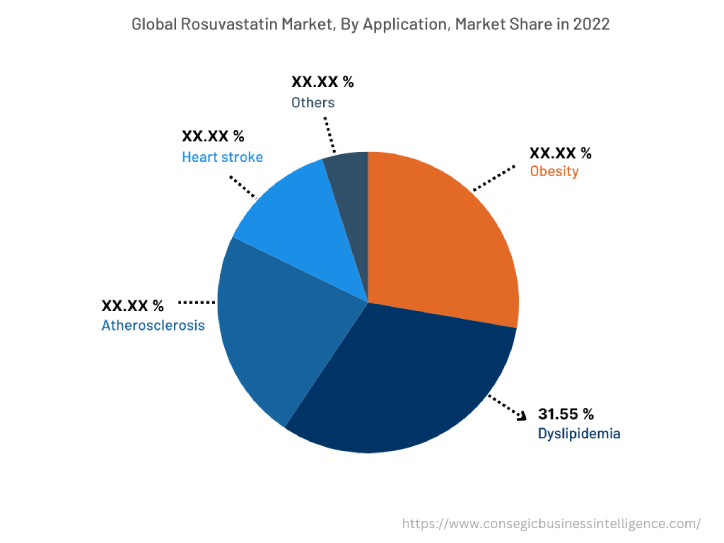

By Application :

The application segment is categorized into obesity, dyslipidemia, atherosclerosis, heart stroke, and others. In 2022, the dyslipidemia segments accounted for the highest market share of 31.55% in the overall rosuvastatin market. It is a statin medication that is used to lower cholesterol levels and reduce the risk of cardiovascular events, such as heart attack and stroke. It is one of the most effective statins available, and its use has been increasing in recent years. For instance, according to a study published in May 2023, more than 85% of the urban and sub-urban population in India have dyslipidemia. This is compared to 78.5% of rural residents. The prevalence of dyslipidemia is higher in urban residents with diabetes and hypertension. Thus, the growing prevalence of dyslipidemia is driving the rosuvastatin market demand and trends across the globe.

Moreover, the obesity segment is expected to hold the highest CAGR over the forecast period. High obesity increases the risk of coronary artery disease, stroke, and cardiovascular death. The increasing occurrences of both obesity and cardiovascular disorders are expected to propel the segment's growth and trends in the future.

By Dosage Form :

By dosage form, the rosuvastatin market is categorized into capsules and tablets. In 2022, the capsules segment for the highest market revenue in the overall rosuvastatin market, and it is expected to hold the highest CAGR over the forecast period. These capsules are indicated for use in adults in combination with a healthy diet to reduce levels of low-density lipoprotein (LDL) cholesterol and triglycerides in the blood. These capsules are available for oral administration and can be administered either alone or in conjunction with soft food. The medication sprinkle capsule is formulated as extended-release-coated pellets that are sprinkled over soft food. In circumstances where nasogastric administration is required, the capsules are opened, and their contents are emptied into a 60 ml catheter-tipped syringe. As a result, based on the analysis, the above-mentioned benefits of the capsule form of this compound are leading to an increased demand for the capsule form of this drug, which in turn, propelling the market growth and trends in the following years.

By Distribution Channel :

The distribution channel segment is categorized into hospital pharmacies, retail pharmacies and drug stores, online pharmacies, and others. In 2022, the retail pharmacies and drug stores segment accounted for the highest market revenue in the overall rosuvastatin market. Retail pharmacies play an important role in helping patients with obesity and cardiovascular issues to manage their condition. By providing convenient, affordable, and accessible access to this drug, retail pharmacies help patients live healthier and more fulfilling lives. Additionally, retail pharmacy stores are easy to access, offer competitive prices on this drug, and can provide patients with information and support on how to use this capsules and tablets safely and effectively. The high benefits and easy availability of these capsules and tablets across retail pharmacy stores are driving the segment growth worldwide.

Moreover, the online pharmacies segment is expected to hold the highest CAGR over the forecast period. Based on the rosuvastatin market analysis, the increasing sale of pharmaceutical products through e-commerce platforms is expected to provide lucrative growth opportunities for online pharmacies over the forecast period. For instance, according to the report by India Brand Equity Foundation in July 2023, the Indian e-pharmacy market is predicted to increase at a compounded annual rate of 44% to USD 4.5 billion by 2025. Thus, the growing e-pharmacy sales are providing lucrative growth opportunities and trends for segment growth over the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

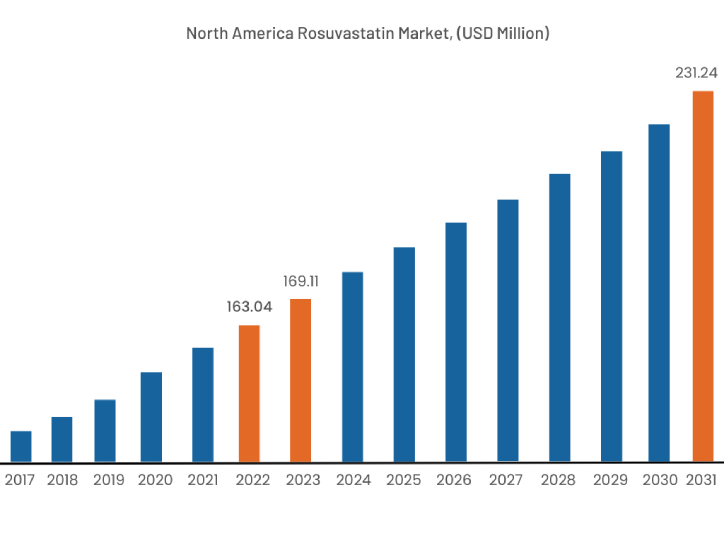

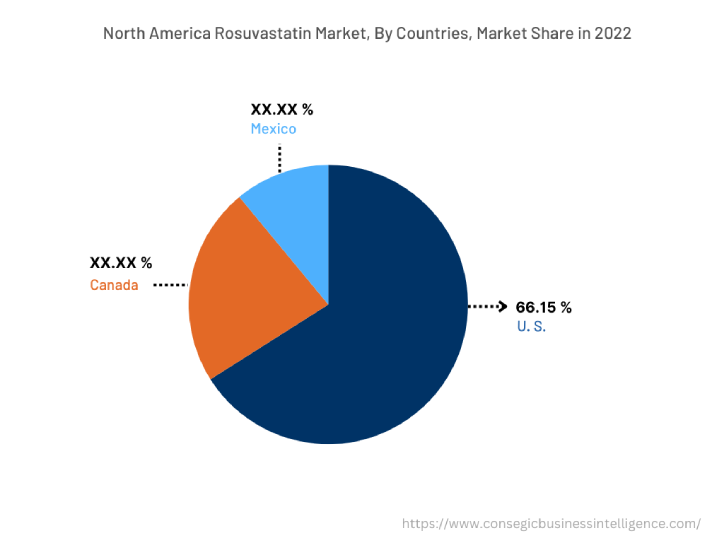

In 2022, North America accounted for the highest market share at 35.15% valued at USD 163.04 Million in 2022 and USD 169.11 Million in 2023, it is expected to reach USD 231.24 Million in 2031. In North America, the U.S. accounted for the highest rosuvastatin market share of 66.15% in the base year 2022. North America has a well-established healthcare infrastructure, with a high number of hospitals, clinics, and pharmacies. This makes it easy for people with hyperlipidemia and severe cardiovascular conditions to access these capsules. Moreover, the high incidences of cardiovascular diseases across the region are driving the demand for rosuvastatin market across the region. For instance, According to the data published by the Centers for Disease Control and Prevention in May 2023, one person dies every 33 seconds in the United States from cardiovascular disease and almost 2 in 5 adults in the United States have high cholesterol (total blood cholesterol ≥ 200 mg/dL). Thus, the incidences of cardiovascular disease across the region are driving the demand and trends for rosuvastatin industry across North America.

Furthermore, Asia Pacific is expected to witness significant growth over the forecast period, growing at a CAGR of 4.4% during 2023-2031. This is due to the high population in the region, the large patient population, and the developing medical infrastructure in this region. Additionally, an array of initiatives taken by the government and leading healthcare agencies to reduce the burden of cardiovascular diseases across the region is expected to drive the market. For instance, on September 29, 2022, the World Health Organization called for a united effort to reduce mortality from cardiovascular diseases, a leading cause of death in the Southeast Asia Region with 3.6 million lives lost every year. To reduce deaths from cardiovascular diseases (CVDs) by one-third by 2030, WHO South-East Asia Region plans to scale-up and integrate ongoing initiatives through SEA HEARTS, the ‘WHO South-East Asia HEARTS initiative. Thus, the aforementioned factors are driving the development and rosuvastatin market trends of the market.

Top Key Players & Market Share Insights:

The market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development trends and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Glenmark Pharmaceuticals U.S. Inc., USA

- AstraZeneca

- MSN Laboratories

- Shanghai Pharma Holdings Co., Ltd

- Lunan Pharmaceutical Group

- JB Pharma.

- Grünenthal

- AdvaCare Pharma

- Niksan Pharmaceutical

- Teva Pharmaceutical Industries

- MANUS AKTTEVA BIOPHARMA LLP

- Nextwell Pharmaceutical

- Schwitz Biotech

- XENON PHARMA PVT LTD

- Saheb Pharmaceuticals LLP

Recent Industry Developments :

- On Dec 14, 2022, JB Pharma, a Mumbai-based company, agreed to buy the Razel (Rosuvastatin) franchise from Glenmark Pharmaceuticals for USD 37.71 million. The agreement covers the India and Nepal region. The acquisition was funded through internal accruals and long-term debt.

Key Questions Answered in the Report

What was the market size of the Rosuvastatin market in 2022? +

In 2022, the market size of Rosuvastatin was USD 463.85 million.

What will be the potential market valuation for the rosuvastatin industry by 2031? +

In 2031, the market size of Rosuvastatin will be expected to reach USD 655.99 million.

What are the key factors driving the growth of the rosuvastatin market? +

Increasing incidences of cardiovascular diseases are the factors driving the market growth across the globe.

What is the dominant segment in the rosuvastatin market for the application? +

In 2022, dyslipidemia segment accounted for the highest market share of 31.55% in the overall rosuvastatin market.

Based on current market trends and future predictions, which geographical region is the dominating region in the rosuvastatin market? +

North America accounted for the highest market share in the overall market.