Safety Prefilled Syringe System Market Introduction :

Consegic Business Intelligence analyzes that the safety prefilled syringe system market is growing with a healthy CAGR of 11.2% during the forecast period (2023-2030), and the market is projected to be valued at USD 15,173.58 Million by 2030 from USD 6,531.84 Million in 2022.

Safety Prefilled Syringe System Market Definition & Overview:

The safety prefilled syringe system is a single-dose solution of vaccines with a fixed needle. SPSs are typically used for the administration of medications that are hazardous to the user, such as insulin or chemotherapy drugs. The safety prefilled syringe system has a superior level of accuracy, which makes the product safer to use. The two prominent types of safety prefilled syringe systems include disposable prefilled syringes and reusable prefilled syringes. These products eliminate the overfill of expensive drug products. Moreover, a safety prefilled syringe system eradicates dosage errors as the exact amount of a deliverable dose is contained in the syringe. As a result, due to the above-mentioned benefits, safety prefilled syringe system products are ideal solutions for applications such as anaphylaxis, rheumatoid arthritis, diabetes, and others.

Safety Prefilled Syringe System Market Insights :

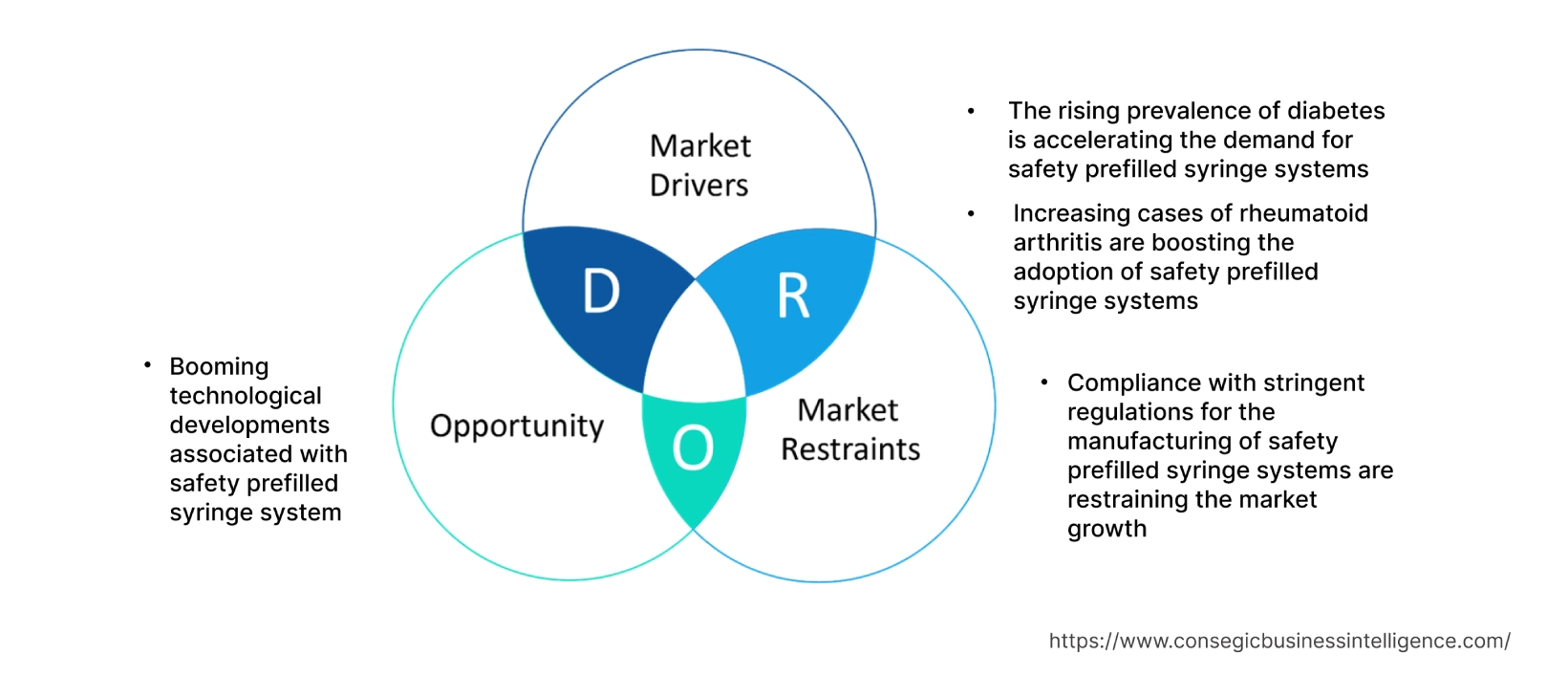

Safety Prefilled Syringe System Market Dynamics - (DRO) :

Key Drivers :

The rising prevalence of diabetes is accelerating the demand for safety prefilled syringe systems

Safety prefilled syringe systems are utilized in diabetes treatment to administer the process of drug products. This ensures safer, quicker, and easier doses of diabetes medication for nurses and patients. The prime factors such as genetics, increasing cases of type 2 diabetes, and others are fostering the prevalence of diabetes at the global level. For instance, according to the National Diabetes Statistics Report for 2022 published by the Centers for Disease Control (CDC), approximately 37.3 million, which is 11.3% of the population in the United States are suffering from diabetes. Furthermore, about 1.45 million people in the United States are suffering from type 1 diabetes, which is 3.75% of all diabetes cases in diabetes. Hence, the increasing prevalence of diabetes is boosting the demand for safety prefilled syringe systems to ensure accurate dosages of medication. This prominent factor is boosting the market growth.

Increasing cases of rheumatoid arthritis are boosting the adoption of safety prefilled syringe systems

Safety prefilled syringe system helps in reducing the loss of strength during the transfer of rheumatoid arthritis disease biopharmaceuticals to different containers. Safety prefilled syringe systems (SPSs) are becoming increasingly popular for the administration of injectable RA medications. SPSs offer several benefits over traditional syringes including, it increases safety for patients, and improving usability, among others. According to recent data from the World Health Organization (WHO), the global prevalence of rheumatoid arthritis disease was 18 million in 2019. Additionally, about 55% of the total rheumatoid arthritis disease patients are above 55 years and 70% of people living with rheumatoid arthritis are women. Also, 13 million people are suffering from severe rheumatoid arthritis. Therefore, the rising prevalence of rheumatoid arthritis is fueling the demand for safety prefilled syringe systems to ensure efficient treatment of rheumatoid arthritis disease. This, in turn, is driving the market growth.

Key Restraints :

Compliance with stringent regulations for the manufacturing of safety prefilled syringe systems are restraining the market growth

Safety prefilled syringe systems are utilized in various applications such as anaphylaxis, rheumatoid arthritis, diabetes, and others to ensure superior accuracy in dosing. As a result, the safety prefilled syringe systems manufacturers have to comply with stringent manufacturing quality regulations to ensure superior product performance. For instance, the manufacturing of safety prefilled syringe systems must comply with international standards such as International Standard Organization (ISO), the United States Food and Drug Administration (FDA), and others. Hence, compliance with stringent regulations for the manufacturing of safety prefilled syringe systems is posing a major bottleneck for the market growth during the projected forecast period.

Future Opportunities :

Booming technological developments associated with safety prefilled syringe system

The key players dealing in the safety prefilled syringe systems product range are substantially investing in the technological innovations of safety prefilled syringe systems, which are ideal for anaphylaxis, rheumatoid arthritis, diabetes, and others. As a result of this, safety prefilled syringe systems manufacturers are continuously leveraging their technological potential to develop new products with updated technological advancements. For instance, in September 2022, BD, a global manufacturer of safety prefilled syringe systems launched a next-generation glass prefillable syringe (PFS). The product is designed for ensuring superior reliability and efficiency. Henceforth, the launch of new products with upgraded technology will create a potential opportunity for the expansion of the global safety prefilled syringe system market in the upcoming years.

Safety Prefilled Syringe System Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 15,173.58 Million |

| CAGR (2023-2030) | 11.2% |

| By Product Type | Disposable Prefilled Syringes and Reusable Prefilled Syringes |

| By Application | Anaphylaxis, Rheumatoid Arthritis, Diabetes, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | BD, Gerresheimer, Nipro Corporation, Schott, Stevanato, Baxter BioPharma Solution, Rovi CM, Terumo, Catalent, and Taisei Kako |

Safety Prefilled Syringe System Market Segmental Analysis :

Based on the Product Type :

The product type segment is categorized into disposable prefilled syringes and reusable prefilled syringes and is projected to be the fastest-growing segment during the forecast period. In 2022, the disposable prefilled syringes segment accounted for the highest market share in the safety prefilled syringe system market. The disposable prefilled syringe is an ideal option for medical personnel to reduce the risk associated with the spreading of blood-borne diseases. In addition, the major benefits of a disposable prefilled syringe include minimizing the risk of infection, eliminating cleaning or sharpening, ensuring mass production, cost-effectiveness, being safer for the environment, and others. The international players dealing in disposable prefilled syringes products are expanding their product offerings in various countries. For instance, in October 2021, West Pharmaceutical Services, a supplier of syringe products in India introduced NovaGuard SA Pro Safety System. The single-use accessory is a prefilled ISO standard 0.5mL staked needle syringe. This product is a disposable prefilled syringe. Thus, the expansion of disposable prefilled syringe product offerings in the international market will foster the revenue growth of the safety prefilled syringe system industry during the forecast period.

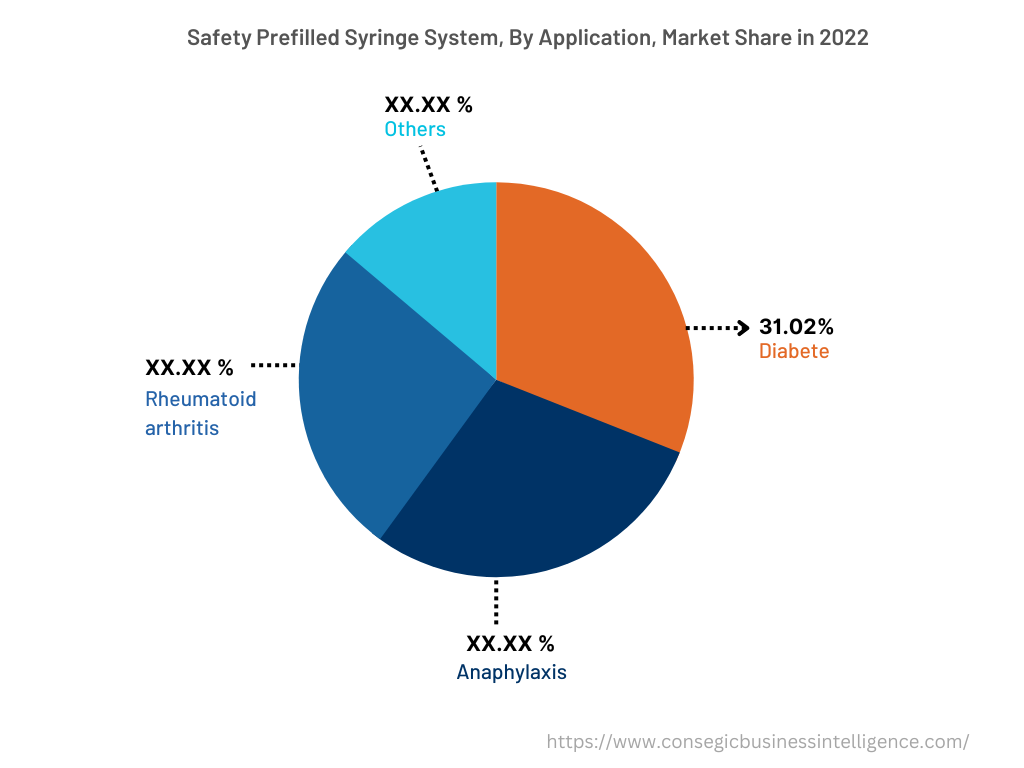

Based on the Application :

The application segment is categorized into anaphylaxis, rheumatoid arthritis, diabetes, and others. In 2022, the diabetes segment accounted for the highest market share of 31.02% in the overall safety prefilled syringe system market. The safety prefilled syringe system is frequently deployed in the treatment of diabetes to ensure ease of administration. The safety prefilled syringe system results in added convenience for healthcare personnel and patients suffering from diabetes as the syringes ensure easier self-administration and use during emergencies. Likewise, the benefits of a safety prefilled syringe system include lower costs due to fewer materials, less preparation, and easy storage & disposal. For instance, according to the recent statistics published by the International Diabetes Federation (IDF), approximately 537 million people at the global level were suffering from diabetes in 2021. Furthermore, it is projected that the prevalence of diabetes will reach 643 million in 2030 and 783 million in 2045, respectively. Therefore, the rising prevalence of diabetes is fostering the demand for safety prefilled syringe systems to reduce medical errors and misidentification, thereby driving segmental growth.

However, the anaphylaxis segment is expected to be the fastest-growing segment during the forecast period because of the development of new anaphylaxis healthcare facilities, increasing research & development, and others.

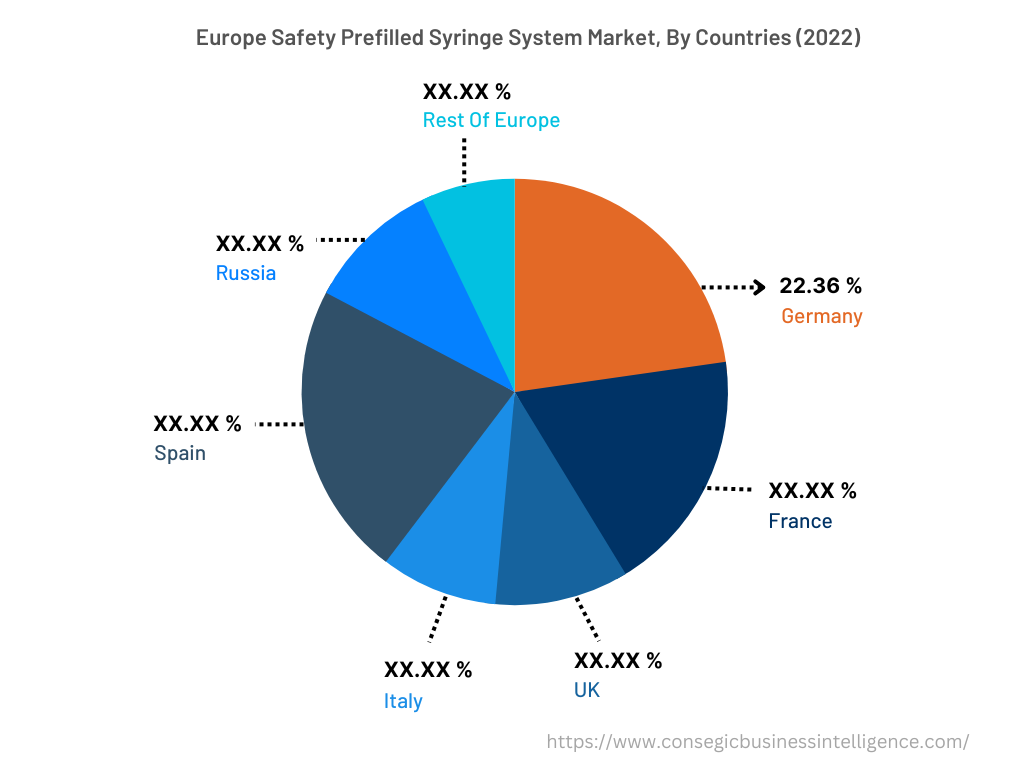

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

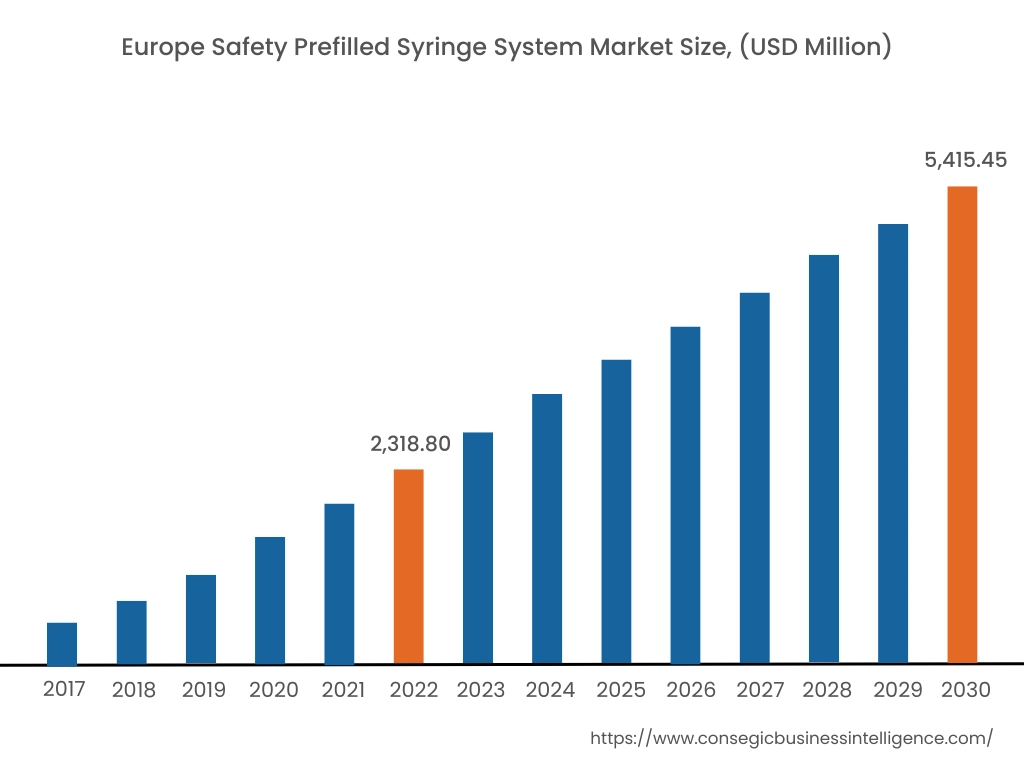

In 2022, Europe accounted for the highest market share at 35.50% and was valued at USD 2,318.80 million, and is expected to reach USD 5,415.45 million in 2030. In Europe, Germany accounted for the highest market share of 22.36% during the base year of 2022. The rise in diabetes cases in the European region is attributed to factors such as overweight, age-related concerns, genetics, and others. Increasing diabetes cases in Europe are fueling the demand for safety prefilled syringe systems to reduce dosage errors. For instance, according to the recent statistics published by the International Diabetes Federation (IDF), in 2021, approximately 61 million in the European region were suffering from diabetes, which was 9.2% of the total European population. Moreover, USD 189.3 billion was spent on the treatment of diabetes in the European region, which was 19.6% of the total spending at the global level. Also, the number of people suffering from diabetes in the European region will reach 67 million in 2030 and 69 million in 2024. Henceforth, the rising prevalence of diabetes cases in the Europe region is fostering market growth.

Furthermore, Asia Pacific is expected to witness significant growth over the forecast period, growing at a CAGR of 12.2% during 2023-20230. This is due to the increasing adoption of safety prefilled syringe systems in various applications such as anaphylaxis, rheumatoid arthritis, diabetes, and others.

Top Key Players & Market Share Insights:

The safety prefilled syringe system market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- BD

- Gerresheimer

- Terumo

- Catalent

- Taisei Kako

- Nipro Corporation

- Schott

- Stevanato

- Baxter BioPharma Solution

- Rovi CM

Recent Industry Developments :

- In May 2022, Terumo Pharmaceutical Solutions, a leading healthcare manufacturer in Belgium, introduced Luer Lock Silicone oil-free pre-fillable syringe named PLAJEX 0.5mL. The product is a type of safety prefilled syringe system for application in low doses. Hence, the launch of new products in the market will foster the overall market size growth in the upcoming years.

Key Questions Answered in the Report

What was the market size of the safety prefilled syringe system industry in 2022? +

In 2022, the market size of safety prefilled syringe system was USD 6,531.84 million.

What will be the potential market valuation for the safety prefilled syringe system industry by 2030? +

In 2030, the market size of safety prefilled syringe system will be expected to reach USD 15,173.58 million.

What are the key factors driving the growth of the safety prefilled syringe system market? +

The rising prevalence of diabetes is accelerating the demand for safety prefilled syringe systems, thereby fueling market growth at the global level.

What is the dominating segment in the safety prefilled syringe system market by application? +

In 2022, the diabetes segment accounted for the highest market share of 31.02% in the overall safety prefilled syringe system market.

Based on current market trends and future predictions, which geographical region is the dominating region in the safety prefilled syringe system market? +

Europe accounted for the highest market share in the overall safety prefilled syringe system market.