Special Motors Market Introduction :

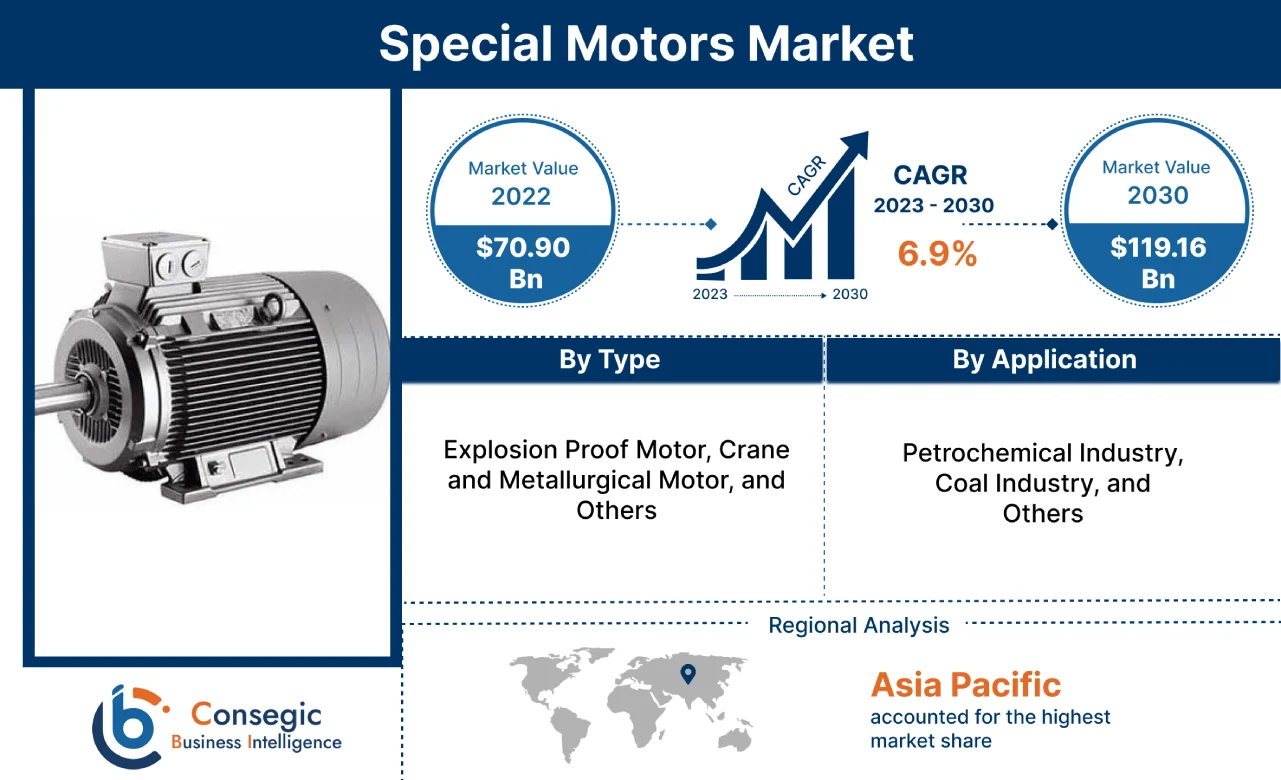

Global Special Motors Market size is estimated to reach over USD 119.16 Billion by 2030 from a value of USD 70.90 Billion in 2022, growing at a CAGR of 6.9% from 2023 to 2030.

Special Motors Market Definition & Overview:

Special motors are specifically designed and engineered for unique and specialized applications, distinct from general-purpose motors. They are tailored to meet specific requirements including high precision, high torque, specific environmental conditions, or integration with specialized systems. Additionally, they are deployed in various sectors including robotics, automotive, aerospace, and medical devices to provide customized performance and functionality.

Special Motors Market Insights :

Special Motors Market Dynamics - (DRO) :

Key Drivers :

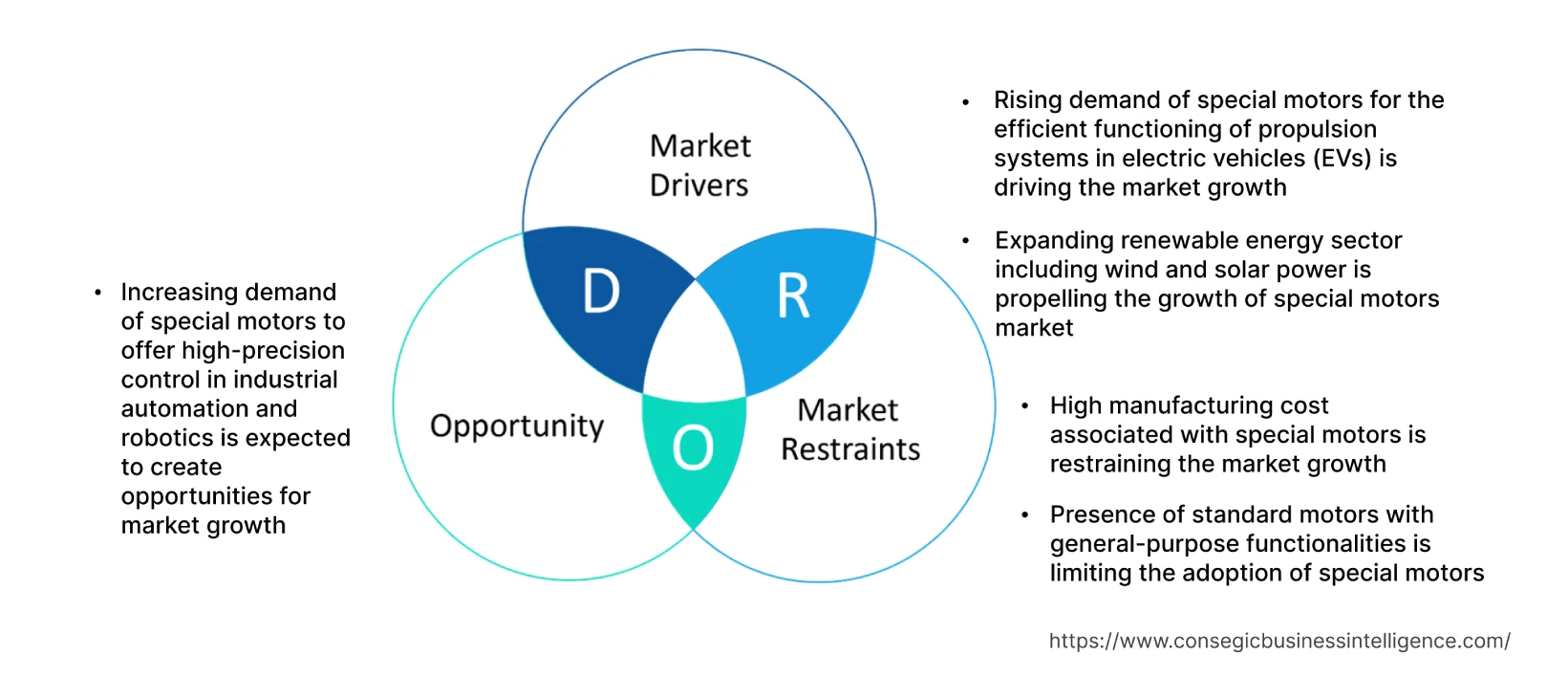

Rising demand for the efficient functioning of propulsion systems in electric vehicles (EVs)

Electric vehicles require specialized motors for the effectual functioning of propulsion systems. EVs employ electric traction motors to convert electrical energy into mechanical energy, providing the necessary power for vehicle movement. Additionally, traction motors are also utilized to deliver high torque, efficiency, and reliability to electric vehicles for maximizing energy efficiency to extend the driving range. Specialized motors are designed to minimize energy losses and maximize efficiency by incorporating additional advanced motors namely permanent magnet motors and synchronous reluctance motors to offer higher efficiency compared to traditional motors. Analysis of market trends concludes that the surge in the number of electric vehicles is increasing the requirement for special motors to optimize the performance and enhance the functioning of propulsion systems. For instance, in June 2022, according to the International Council on Clean Transportation, global electric vehicle sales accounted to 6.9 Million in 2021 with a rise of 107% in comparison to 2020. Out of the vehicles sold, 2% accounted for heavy-duty vehicles (HDVs) and 98% of the vehicles were light-duty vehicles (LDVs), thus contributing remarkably in driving the special motors market demand.

Expanding renewable energy sector including wind and solar power

Special motors are essential components of wind turbines to convert wind energy into electricity and are employed in various parts of the wind turbine system including the pitch control system, yaw control system, and generator. Additionally, they are designed to withstand harsh environmental conditions by operating efficiently and providing precise control to the wind turbine system. Moreover, they ars are also gaining applications in solar tracking systems to optimize the angle and orientation of solar panels to maximize energy generation. The motors enable the solar panels to follow the sun's movement throughout the day, maximizing the panel's exposure to sunlight, resulting in improved energy generation. Furthermore, the government is also investing heavily to expand the renewable energy sector for the generation of cleaner energy and also to confront climate change. For instance, in June 2023, The Government of Canada invested USD 650,000 in QUEST Canada to adopt Accelerating Implementation of Renewable Energy (AIRE) for the generation of cleaner energy and also to expand renewable energy initiatives. Analysis of market trends concludes that increasing investment by the government to expand the renewable energy sector is thus contributing significantly in accelerating the special motors market demand.

Key Restraints :

High manufacturing cost

The cost of production of special motors is significantly high owing to the integration of advanced materials including Cadmium and Rhodium B to offer high heat resistance, enhanced electrical conductivity, and superior magnetic characteristics. The materials are more expensive than traditional materials used in standard motors, hence contributing to higher manufacturing costs. In addition, the motors require high levels of precision in the manufacturing processes including high tolerances, specialized machining techniques, and intricate assembly procedures to ensure optimal performance and reliability. Consequently, the additional requirements increase the upfront cost, thus impeding the proliferation of the global special motors market.

Presence of standard motors with general-purpose functionalities

Standard motors, particularly AC motors with general-purpose functionalities are also capable of generating higher torque by using a more powerful current. Additionally, standard motors are produced in bulk quantities and widely available in the market and have lower production costs as compared to specialized motors. Analysis of market trends concludes that standard motors do not require high startup power and are relatively simple to install, further restraining the expansion of the special motor market. For instance, in February 2021, Portescap launched 16ECS, a high-speed brushless DC motor to provide high power and torque by running at speeds of 75,000 rpm. The 16ECS brushless DC motor is equipped with an Ultra EC coil to provide higher torque and mechanical power, thereby limiting the adoption of special motors. Consequently, the aforementioned advantages earned by standard motors over the motors are hampering the proliferation of the special motors market.

Future Opportunities :

Increasing demand to offer high-precision control in industrial automation and robotics is expected to create opportunities for market proliferation

Industrial automation and robotics rely on precise motion control to perform various tasks accurately and efficiently. Specialized motors offer high-precision control, enabling robots and automated systems to execute complex movements with accuracy and repeatability. In addition, special motors are also customized to meet the specific needs of different applications including material handling, assembly, packaging, and inspection. The customization allows for optimized motor designs, performance parameters, and integration with specialized control systems, offering tailored solutions to enhance automation performance. Analysis of market trends concludes that the increasing demand to optimize production processes and improve productivity is emerging as one of many special motors market opportunities that will drive market expansion.

Special Motors Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 119.16 Billion |

| CAGR (2023-2030) | 6.9% |

| By Type | Explosion Proof Motor, Crane and Metallurgical Motor, and Others |

| By Application | Petrochemical Industry, Coal Industry, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | ABB Ltd, Brook Crompton, Toshiba Corporation, Hyosung Corporation, Jiamusi Electric Machine Co., Ltd., Kollmorgen (Altra Industrial Motion Corp.), Nidec Corporation, Regal Beloit Corporation, Siemens, Valworx, Tsurumi (America), Inc. |

Special Motors Market Segmental Analysis :

Based on the Type :

The type segment is categorized into explosion proof motor, crane and metallurgical motor, and others. In 2022, the Crane and metallurgical motors segment accounted for the highest special motors market share owing to the increasing application in various industries including manufacturing, construction, mining, and steel production. Additionally, crane and metallurgical motors are specifically designed to handle heavy loads and operate in demanding environments. The motors are built to withstand the rigors of continuous operations to provide high torque, durability, and reliability for heavy-duty applications. Assessment of market trends indicates that the integration of advanced features including robust enclosures to protect against dust, moisture, and mechanical stress, as well as advanced control systems for precise movement and positioning is further boosting the market proliferation. For instance, SEALOCEAN launched a crane and metallurgical motor YZR series that operates at 400 C and 600 C for crane and metallurgical applications respectively. The motor series is lightweight and easy to install and is extensively used in applications including material handling, and weirs and sluices, thus contributing considerably in bolstering the growth of crane and metallurgical motor segment.

The explosion proof motor is anticipated to witness the fastest CAGR in the special motors market during the forecast period. Industries operating in hazardous environments, namely oil refineries, chemical plants, and mining operations are subject to stringent safety regulations. The regulations require the use of explosion-proof equipment, including motors, to prevent the ignition of flammable substances and ensure the safety of personnel and assets. Analysis of special motors market trends concludes that the growing awareness of the potential risks associated with hazardous environments is driving the adoption of explosion-proof motors. Industries are adopting proactive measures to mitigate the risk of explosions and to ensure the safety of workers. Explosion-proof motors are a vital component in such risk mitigation strategies, hence contributing notably in fueling the special motors market growth in the upcoming years.

Based on the Application :

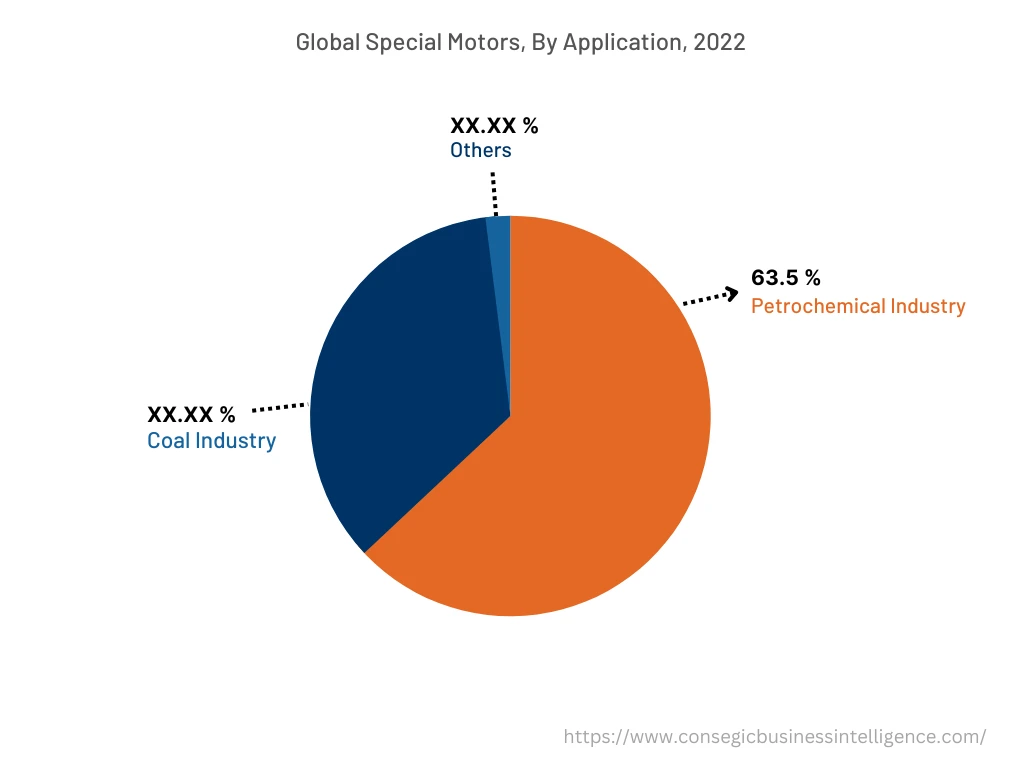

The application segment is classified into petrochemical industry, coal industry, and others. In 2022, the petrochemical industry segment accounted for the highest special motors market share of 63.5% in the market as the it encompasses a wide range of processes and applications, including refining, chemical production, polymer manufacturing, and oil and gas exploration. Each of the applications requires specialized motors to meet specific operational requirements. Additionally, petrochemical processes involve harsh environments, high temperatures, corrosive substances, and explosive atmospheres. Examination of market trends concludes that the motors designed for such challenging conditions are essential for the safe and efficient operation of petrochemical facilities, thereby contributing significantly in promoting special motors market growth.

Moreover, petrochemical plants operate on a continuous basis, with little or no downtime. The motors play a vital role in ensuring the reliable and continuous operation of various equipment, including pumps, compressors, mixers, and agitators. The motors are designed for continuous duty, high efficiency, and long service life, thus becoming indispensable in the petrochemical industry. Consequently, the expanding petrochemical industry increases the demand of the motors to function efficiently in harsh conditions and also to enhance operational efficiency. For instance, according to the Indian Department of Chemicals & Petrochemicals, the production of major chemicals and petrochemicals in India in 2022 accounted to 26,570 thousand MT, witnessing a CAGR of 4.61% from 2019 to 2022. Analysis of special motors market trends concludes that the expanding petrochemical industry is thus contributing considerably in propelling the growth of the special motors market.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

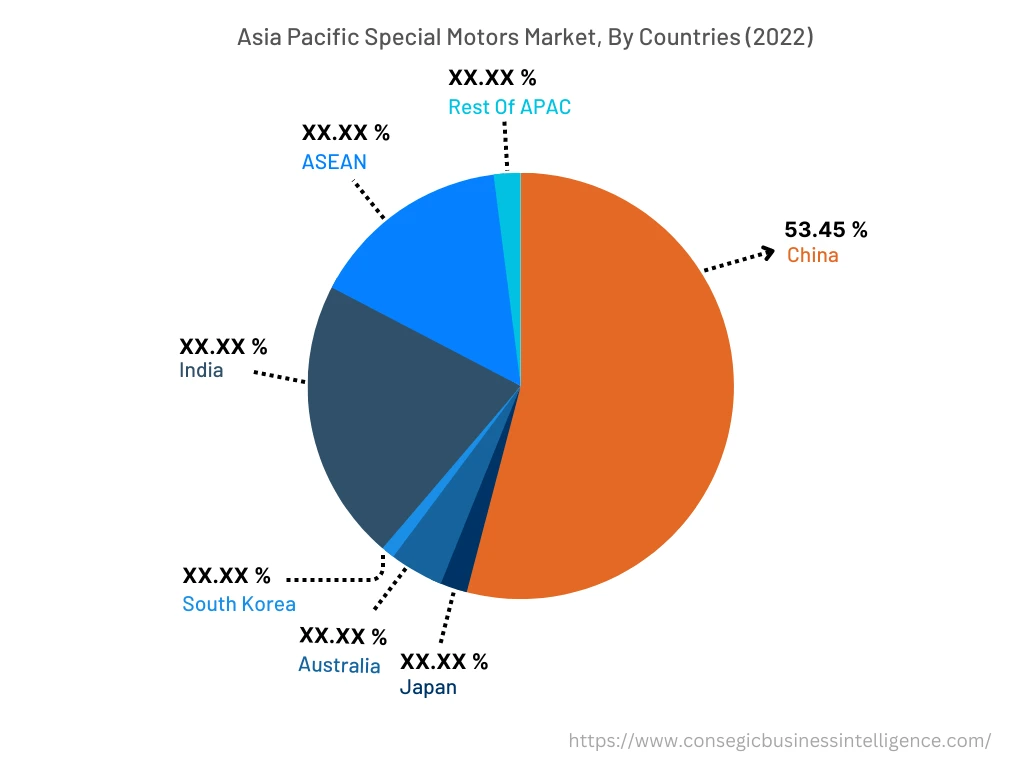

Asia Pacific accounted to USD 21.67 Billion in 2022 and is expected to register the fastest CAGR of 7.2% accounting to USD 37.12 Billion in 2030 in the special motors market. In addition, in the region, China accounted for the maximum revenue share of 53.45% in the year 2022. Asia Pacific is undergoing rapid industrialization, with several countries in the region witnessing significant growth in the manufacturing and infrastructure sectors. The special motors market analysis concluded that the expansion of industries including automotive, electronics, energy, and construction is driving the growth of the special motors market. Additionally, Asia Pacific has a strong emphasis on energy efficiency, sustainability, and reducing environmental impact. Specialized motors play a crucial role in optimizing energy consumption and meeting sustainability goals. The region's focus on energy efficiency is increasing the requirement for high-performance, energy-efficient motors, further strengthening Asia Pacific's position in the special motor market. For instance, in July 2022, the Indian Government initiated steps to promote the growth of renewable energy by laying new transmission lines and creating new sub-station capacity for the evacuation of renewable power plants.

Top Key Players & Market Share Insights:

The competitive landscape of the special motors market has been analyzed in the report, along with the detailed profiles of the major companies operating in special motors industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and application launches have accelerated the proliferation of the special motors market. Key players in the market include -

- ABB Ltd.

- Toshiba Corporation

- Regal Beloit Corporation

- Siemens

- Valworx

- Tsurumi (America), Inc.

- Jiamusi Electric Machine Co., Ltd.

- Hyosung Corporation

- Brook Crompton

- Kollmorgen (Altra Industrial Motion Corp.)

- Nidec Corporation

Recent Industry Developments :

- In September 2022, Valworx introduced explosion-proof electric actuators with a heavy-duty explosion-proof motor that provides a 70% duty cycle and is widely employed in applications to detect the presence of explosive gases.

- In October 2020, Tsurumi America Inc. launched AVANT Series with explosion-proof pumps to provide improved performance and increases cost-savings for wastewater applications. The explosion-proof pumps and motors have a closed-circuit cooling system to deliver high performance and also to withstand heavy-duty cycles.

Key Questions Answered in the Report

What is a special motor? +

A special motor is specifically designed and engineered for unique and specialized applications, distinct from general-purpose motors. The motors are tailored to meet specific requirements including high precision, high torque, specific environmental conditions, or integration with specialized systems.

What specific segmentation details are covered in the special motors market report, and how is the dominating segment impacting the market growth? +

Crane and metallurgical motors dominate the market in 2022 owing to the increasing application in various industries including manufacturing, construction, mining, and steel production. Additionally, crane and metallurgical motors are specifically designed to handle heavy loads and operate in demanding environments, further driving the growth of the market.

What specific segmentation details are covered in the special motors market report, and how is the fastest segment anticipated to impact the market growth? +

The explosion-proof motors are anticipated to have the largest impact due to the increasing safety regulations that necessitate the use of explosion-proof equipment, including motors, to prevent the ignition of flammable substances and ensure the safety of personnel and assets.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia Pacific is expected to witness the fastest CAGR during the forecast period as the region has a strong emphasis on energy efficiency, sustainability, and reducing environmental impact and special motors play a crucial role in optimizing energy consumption and meeting sustainability goals.