Spherical Tungsten Powder Market Size:

The Spherical Tungsten Powder Market size is growing with a CAGR of 6.4% during the forecast period (2025-2032), and the market is projected to be valued at USD 1.22 Billion by 2032 from USD 0.75 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 0.79 Billion.

Spherical Tungsten Powder Market Scope & Overview:

Spherical tungsten powder is a refined form of tungsten metal characterized by its high purity, uniform and spherical particle shape. This distinct morphology achieved through advanced atomization processes, grants the powder superior flowability and high packing density compared to irregularly shaped tungsten. These properties are crucial for advanced manufacturing techniques such as additive manufacturing, metal injection molding, and thermal spraying, enabling the creation of components with enhanced mechanical properties, reduced porosity, and precise geometries. With tungsten's inherently high density, melting point, and excellent conductivity, this powder serves as a high-performance material for demanding applications across aerospace, defense, electronics, and medical industries among others.

How is AI Transforming the Spherical Tungsten Powder Market?

AI is influencing the spherical tungsten powder market by improving production efficiency, quality control, and application performance. Manufacturing spherical tungsten powder requires precise particle size and uniformity, and AI-driven process optimization ensures better consistency during atomization and classification. Machine learning models analyze production data to predict defects, reduce energy use, and minimize material waste. In applications such as additive manufacturing, coatings, and electronics, AI helps tailor powder characteristics to specific performance needs, enhancing strength, conductivity, and durability. Also, predictive analytics supports equipment maintenance, ensuring continuous, high-quality output. As demand for advanced materials grows, AI is driving the development of more reliable and cost-effective spherical tungsten powder solutions for global industries.

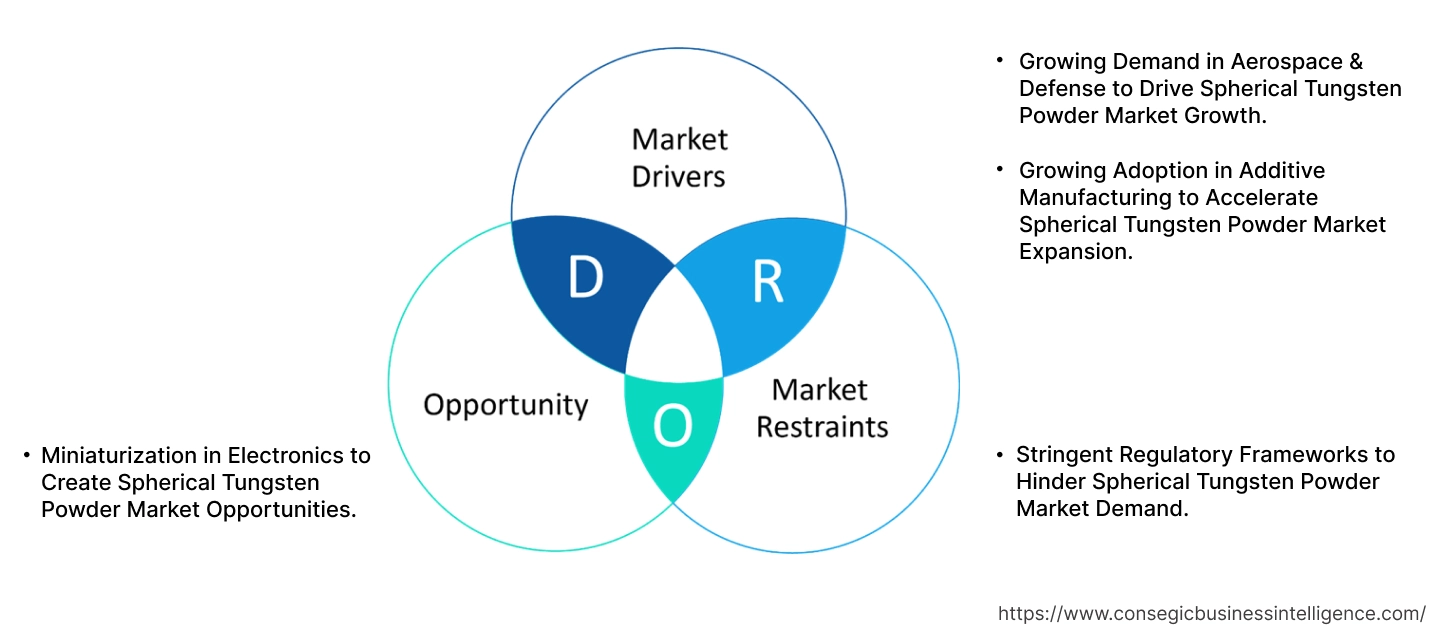

Spherical Tungsten Powder Market Dynamics - (DRO) :

Key Drivers:

Growing Demand in Aerospace & Defense to Drive Spherical Tungsten Powder Market Growth.

The escalating demand from the aerospace and defense sectors is a key driver for the market as these sectors require materials with exceptional properties like high density, superior strength-to-weight ratio, wear resistance, and the ability to withstand extreme temperatures and harsh environments. Spherical tungsten powder, particularly when utilized in additive manufacturing and thermal spray coatings, enables the production of lightweight yet robust aircraft components, high-density counterweights, radiation shielding for satellites, and specialized ballistic materials. As global defense budgets increase and aerospace innovations continue, the necessity for such high-performance materials is supporting the market.

- For instance, in 2024, GE Aerospace announced plans to invest over USD 70 million into its European manufacturing facilities. This strategic investment aims to bolster the production of more efficient commercial engines and critical military engines.

Thus, the market for these films in consumer electronics is witnessing significant growth.

Growing Adoption in Additive Manufacturing to Accelerate Spherical Tungsten Powder Market Expansion.

The burgeoning adoption of additive manufacturing technologies is one of the prominent factors as its exceptional flowability and high packing density make spherical tungsten powder suitable for 3D printing processes. 3D printing techniques including Selective Laser Melting (SLM) and Electron Beam Melting (EBM) enable the creation of complex, high-density, and intricate tungsten components with superior mechanical properties. As several various sectors leverage 3D printing for rapid prototyping and the production of specialized parts, the need for high-quality tungsten powder feedstock is experiencing significant rise.

- For instance, as per surveys PROTOLABSindicate that 71% of businesses increased their use of 3D printing in 2022 compared to 2021.

Thus, significant rise in EV production is impacting positively on the spherical tungsten powder market demand.

Key Restraints:

Stringent Regulatory Frameworks to Hinder Spherical Tungsten Powder Market Demand.

The market faces a significant impediment due to stringent regulatory frameworks for spherical powder of tungsten. The production and handling of fine metal powders, including spherical tungsten, are subject to rigorous health, safety, and environmental regulations globally. These mandates cover aspects such as dust control, ventilation requirements, waste disposal, and transportation, leading to increased operational complexities and compliance costs for manufacturers. Furthermore, specific applications, particularly in defense or medical fields, often involve additional certifications and approvals, extending lead times and development expenses. Such stringent oversight, while crucial for safety, impedes market entry for new players and slow the adoption of these advanced materials due to the associated financial and logistical burdens.

Future Opportunities :

Miniaturization in Electronics to Create Spherical Tungsten Powder Market Opportunities.

As electronic devices become smaller, more powerful, and increasingly integrated, there's a heightened need for materials that deliver high performance in compact forms. The spherical form of tungsten powder, with its excellent electrical and thermal conductivity, combined with its high density and precise formability through advanced powder metallurgy techniques is suitable for creating micro-components, efficient heat sinks, and advanced interconnects. This trend fuels the need for high-purity, fine tungsten powders to support the intricate designs and stringent performance requirements of next-generation electronic devices.

- For instance, according to Quantum Zeitgeist, the size of transistors is expected to decrease to 3-5 nanometers by 2029, allowing for increased computing power and reduced energy consumption.

Henceforth, the proliferation of aforementioned technologies is creating lucrative spherical tungsten powder market opportunities over the forecast period.

Spherical Tungsten Powder Market Segmental Analysis :

By Particle Size:

Based on particle size, the market is categorized into fine powder, medium powder, and coarse powder.

Trends in Particle Size:

- There is a growing trend of using fine powders in conductive inks, thick film pastes, and miniaturized components, where high surface area and density are crucial.

- The usage of coarse powder in thermal spraying for wear-resistant coatings in industrial and automotive sectors is also a rising trend.

The fine powder segment accounted for the largest spherical tungsten powder market share in 2024.

- Fine powders are small and in spherical shape. They have the ability to pack very densely. This leads to components with higher final densities and reduced porosity after sintering

- Smaller particles have a larger surface area-to-volume ratio. It promotes more efficient sintering. This results in stronger, denser, and more uniform final products.

- Moreover, parts made from fine powders generally exhibit a much smoother surface finish. This reduces the need for post-processing.

- Additionally, their small size is beneficial in the fabrication of miniaturized components with high precision. All these factors have contributed to its increased usage, thus driving segment.

- Overall, as per the market analysis, the aforementioned factors are driving segments in the spherical tungsten powder market growth.

The coarse powder segment is expected to grow at the fastest CAGR over the forecast period.

- Coarse tungsten powder offers excellent flowability. This is crucial for efficient feeding in various industrial processes.

- Moreover, it also provides superior wear resistance and thermal conductivity in finished components.

- Its larger particle size contributes to higher deposition rates in coating applications. Additionally, it finds use in welding materials and certain abrasive products.

- It is used in thermal spraying applications across sectors such as aerospace, heavy machinery, and automotive. Rapid increase in these sectors is driving the adoption of these powders.

- For instance, according to European Automobile Manufacturers Association, Brazil's car production increased by 6.3% in 2024.

- According to market analysis, coarse powder providing high flow and wear resistance boosts properties in sectors such as automotive will drive the segmental for the upcoming years.

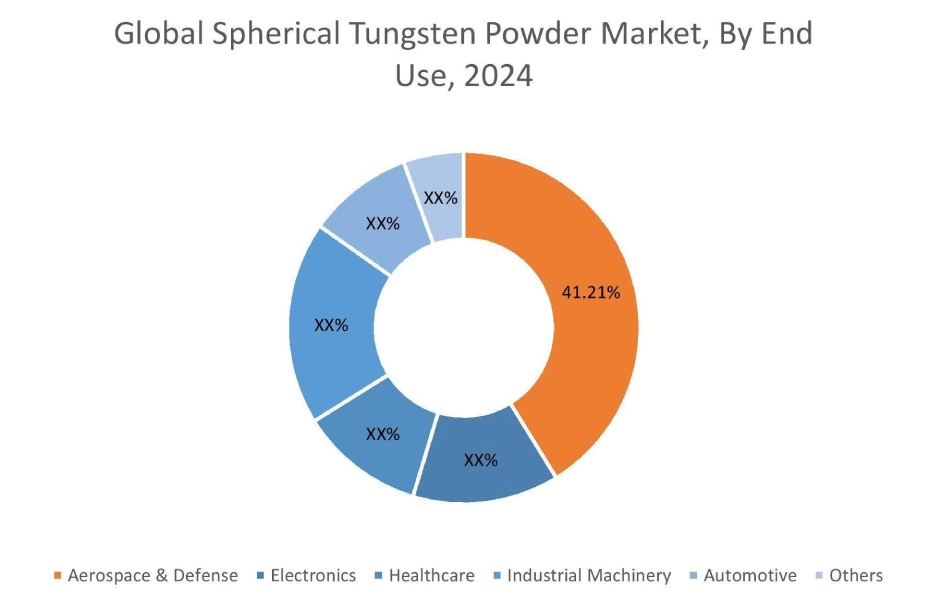

By End Use:

Based on the end use, the market is categorized into aerospace & defense, electronics, healthcare, industrial machinery, automotive, and others.

Trends in the End Use:

- Growing demand for radiation shielding solutions in satellite and spacecraft applications utilizing high-density spherical tungsten is a key trend.

- Accelerated use in micro-components and advanced packaging due to the miniaturization trend in electronic devices.

The aerospace & defense segment accounted for the spherical tungsten powder market share of 41.21% in 2024.

- The aerospace & defense sector presently stands as the dominant end-use segment owing to the stringent and highly demanding requirements inherent in aerospace and defense applications.

- The necessity for components featuring exceptional density, effective radiation shielding, precise counterweights, and the capacity to endure extreme temperatures and harsh operational environments makes spherical form of tungsten powder crucial material.

- Its application in advanced manufacturing techniques, such as 3D printing and thermal spraying, facilitates the creation of critical aerospace & defense parts.

- For instance, in Aerospace Industries Association, the U.S. aerospace and defense sector recorded over USD 955 billion in sales in 2023. This figure represents a notable 7.1% increase compared to the sales generated in 2022.

- Thus, as per the spherical tungsten powder market analysis, the consumer electronics segment holds a dominating share in the market.

The electronics segment is expected to grow at the fastest CAGR over the forecast period.

- Electronics encompasses critical applications in components such as heat sinks, electrical contacts, and conductive pastes, as well as in targets for thin-film deposition used in sophisticated products such as smartphones, tablets, and advanced semiconductors.

- Spherical tungsten powder is crucial here due to its exceptional electrical and thermal conductivity.

- Continuous push towards miniaturization, greater integration, and the escalating requirement for high-performance electronic devices are creating significant potential for the adoption of this tungsten powder in electronics.

- Overall, the aforementioned factors are expected to fuel healthcare segment turnover in spherical tungsten powder market trend.

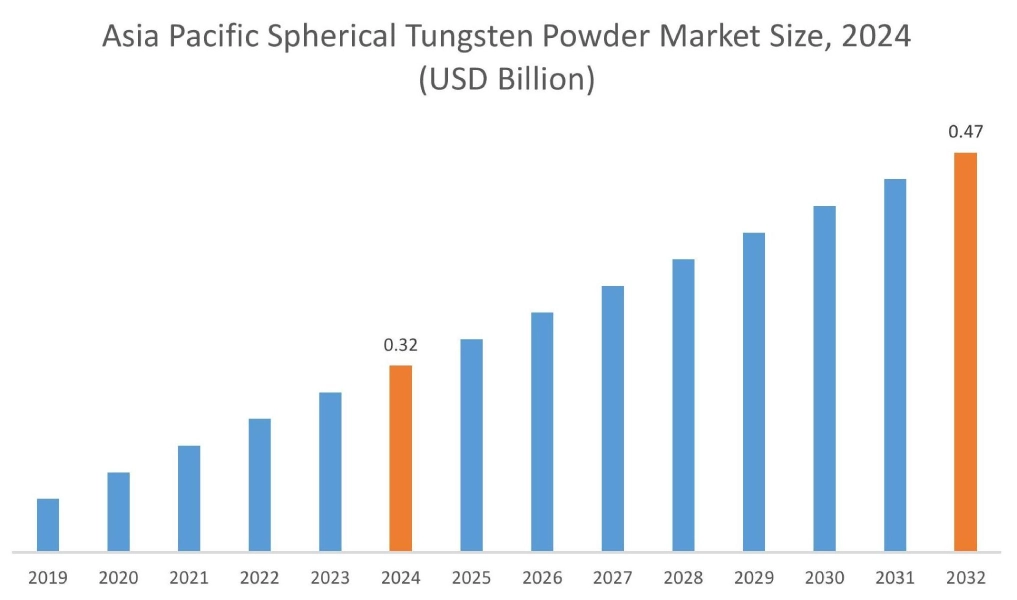

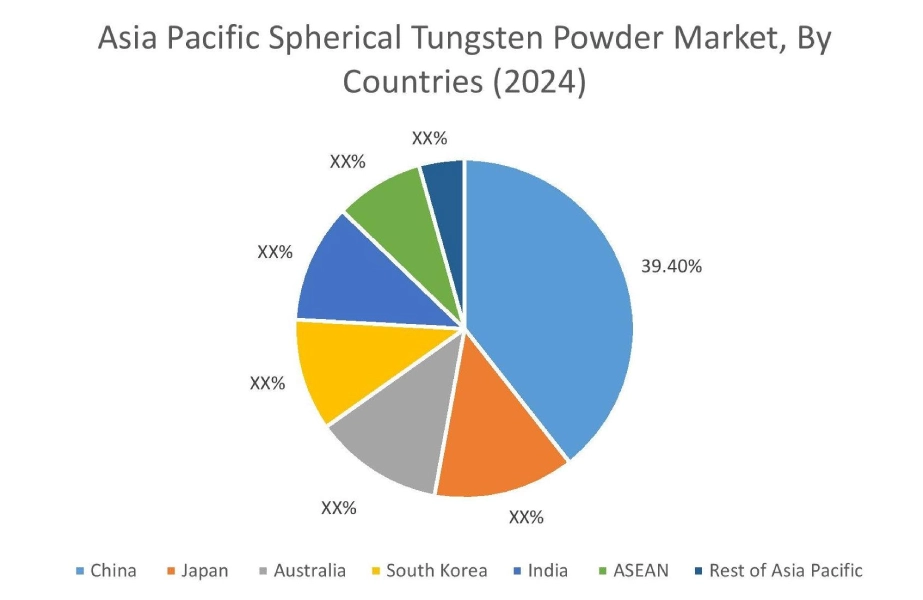

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, Asia Pacific accounted for the highest market share at 42.34% and was valued at USD 0.32 Billion and is expected to reach USD 0.47 Billion in 2032. In Asia Pacific, China accounted for a market share of 39.40% during the base year of 2024. The dominance of Asia Pacific in the global spherical tungsten powder market is substantial investments in advanced manufacturing technologies. Countries like China, Japan, and South Korea are heavily adopting 3D printing, electronics manufacturing, and sophisticated thermal spraying processes. This, coupled with robust growth in automotive and defense sectors, and an increasing focus on high-quality and sustainable production practices, supports market revenue across the region.

- For instance, the according to China Briefing, total mobile production volume in China amounted to 1.67 billion units in 2024, representing a 7.8% increase.

Thus, as per analysis, these factors collectively position Asia-Pacific as a key region for the market.

In Europe, the spherical tungsten powder industry is experiencing the fastest growth with a CAGR of 8.5% over the forecast period owing to the advancements within the electronics and semiconductor sectors. Europe is heavily investing in these sectors, with several initiatives aiming to boost domestic semiconductor production and reduce reliance on external supply chains. This strategic push drives the requirement for spherical tungsten powder, which is essential for creating high-performance components in microelectronics, such as advanced electrical contacts, heat sinks, and deposition targets for thin films. The ongoing miniaturization of electronic devices, coupled with the rising integration of 5G, IoT, and AI technologies in Europe, makes tungsten powder a crucial material for next-generation electronic innovations. Hence, as per analysis, these factors collectively present a positive impact on the European spherical tungsten powder market trends.

The North American market growth benefits from accelerating aerospace and defense sectors. These sectors, characterized by substantial investments in advanced technologies and an ongoing need for high-performance materials, are increasingly leveraging spherical tungsten powder. Its superior flowability and high density are critical for sophisticated manufacturing processes for intricate components and thermal spray coatings for enhanced durability. With continuous defense budget allocations and relentless innovation in aircraft and military systems, the demand for tungsten powder in North America is set to expand significantly. This escalating requirement from a rapidly evolving aerospace and defense landscape is therefore a major driver for the North America spherical tungsten powder market analysis.

The spherical tungsten powder market expansion in Latin America is defined by increased investments in healthcare infrastructure and a rising requirement for advanced medical technologies. This includes sophisticated diagnostic equipment, surgical tools, and especially radiation shielding components. Tungsten powder's high density and excellent radiation shielding properties make it ideal for use in X-ray targets, collimators, and other radiation-protective devices in medical imaging and radiotherapy. As Latin America continues to modernize its healthcare systems and adopt advanced medical devices, the demand for this specialized powder to create high-performance, compact, and effective medical solutions will continue to accelerate market revenue.

The market growth in Middle East and Africa is characterized by increasing investments in infrastructure projects across the region, particularly in sectors requiring high-performance materials. The expanding oil and gas sector within MEA, along with emerging defense sectors, contributes to the necessity for materials such powder for wear-resistant coatings, high-density components, and specialized applications. Furthermore, a gradual adoption of advanced manufacturing technologies, including 3D printing, in certain parts of the region is expected to accelerate the market's expansion in the coming years.

Top Key Players and Market Share Insights:

The Global Spherical Tungsten Powder Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Spherical Tungsten Powder market. Key players in the Spherical Tungsten Powder industry include

- Tekna (Canada)

- Advanced Engineering Materials Limited (China)

- Elmet Technologies (U.S.)

- Anhui Fitech Materials Co.,Ltd (China)

- ATT Advanced elemental materials Co., Ltd. (U.S.)

- Stanford Advanced Materials (U.S.)

- Shanghai Greenearth Chemicals Co.,Ltd. (China)

- Heeger Materials Inc. (U.S.)

Spherical Tungsten Powder Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1.22 Billion |

| CAGR (2025-2032) | 6.4% |

| By Particle Size |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Spherical Tungsten Powder market? +

In 2024, the Spherical Tungsten Powder market is USD 0.75 Billion.

Which is the fastest-growing region in the Spherical Tungsten Powder market? +

Europe is the fastest-growing region in the Spherical Tungsten Powder market.

What specific segmentation details are covered in the Spherical Tungsten Powder market? +

By Particle Size and End Use segmentation details are covered in the Spherical Tungsten Powder market.

Who are the major players in the Spherical Tungsten Powder market? +

Tekna (Canada), Advanced Engineering Materials Limited (China), ATT Advanced elemental materials Co., Ltd. (U.S.) are some of the major players in the market.