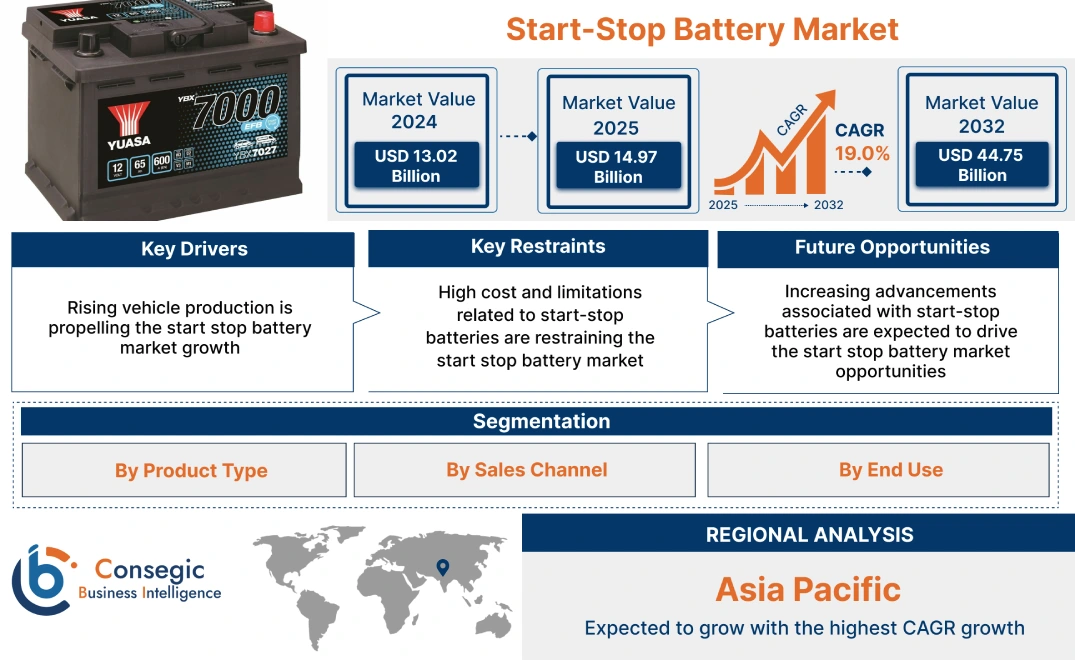

Start Stop Battery Market Size:

Start Stop Battery Market size is estimated to reach over USD 44.75 Billion by 2032 from a value of USD 13.02 Billion in 2024 and is projected to grow by USD 14.97 Billion in 2025, growing at a CAGR of 19.0% from 2025 to 2032.

Start Stop Battery Market Scope & Overview:

Start stop battery is designed for handling frequent engine starts and stops, in turn providing a higher cycle life in comparison to normal batteries. Start-stop batteries capable of withstanding several deep discharge and recharge cycles without experiencing substantial degradation in performance. Moreover, start stop battery offer a broad range of benefits including enhanced fuel efficiency, reduced carbon emissions, improved energy efficiency, and cost efficiency among others.

How is AI Transforming the Start Stop Battery Market?

AI is being increasingly used in the start stop battery market. AI-powered solutions are being used for several applications, including predictive maintenance to forecast battery failure, optimizing battery design through faster material discovery, enhancing manufacturing quality control for improved product consistency, and improving battery management systems (BMS) for longer life and better performance. Moreover, AI-powered systems can improve precision, reduce errors in automated assembly lines, and enhance defect detection accuracy, which ensures consistent product quality. Thus, the above factors are projected to drive the market growth during the forecast period.

Key Drivers:

Rising vehicle production is propelling the start stop battery market growth

Start stop battery is primarily used in modern vehicles equipped with start-stop systems, which helps in automatically shutting off the engine when the vehicle is stationary and restarting it when the driver presses the accelerator. Moreover, the use of start-stop batteries in modern vehicles can help improve fuel efficiency and reduce emissions. In addition, start-stop batteries are capable of handling high volumes of charge-discharge cycles, in turn providing durability and improved performance. As a result, the rising vehicle production is driving the market.

- For instance, according to the International Organization of Motor Vehicle Manufacturers, the total passenger car production worldwide reached up to 68.02 million in 2023, representing an increase of nearly 11% from 61.55 million in 2022.

Therefore, the rising vehicle production is increasing the adoption of start-stop batteries in modern vehicles, in turn proliferating the start stop battery market size.

Key Restraints:

High cost and limitations related to start-stop batteries are restraining the start stop battery market

The deployment of start-stop batteries is often associated with high cost and certain operational limitations, which are among the key factors restraining the market. For instance, start-stop batteries are typically more expensive in comparison to traditional batteries since they are developed to meet the particular demands of start-stop systems and are manufactured with more advanced technologies.

Additionally, start-stop systems often put additional demands on the battery, which may lead to premature failure. This necessitates car owners to replace their start-stop battery more frequently as compared to a traditional battery. Thus, the high cost and limitations related to start-stop batteries are limiting the start stop battery market expansion.

Future Opportunities :

Increasing advancements associated with start-stop batteries are expected to drive the start stop battery market opportunities

Start stop battery manufacturers are frequently investing in the development of new technologies associated with start-stop batteries to ensure its safe and effective utilization in passenger cars and commercial vehicles. As a result, battery manufacturers are launching new products with updated feature, which in turn is providing lucrative aspects for market growth.

- For instance, in November 2024, Exide Technologies announced the launch of its new absorbed glass mat (AGM) start-stop battery range. The new AGM batteries are equipped with standard and thin taper terminals that comply with Japanese Industrial Standard (JIS) and European Norm (EN) respectively while facilitating greater compatibility across a broader range of vehicles in Japan and Europe.

Thus, as per the analysis, rising advancements associated with start-stop batteries are projected to drive the start stop battery market opportunities during the forecast period.

Start Stop Battery Market Segmental Analysis :

By Product type:

Based on product type, the market is segmented into absorbent glass mat (AGM) battery, enhanced flooded battery (EFB), and lithium start-stop battery.

Trends in the product type:

- Increasing trend in adoption of AGM batteries due to its faster recharge rates, high power output, durability, and longer lifespan.

- There is a rising trend towards utilization of enhanced flooded battery (EFB) in vehicle start-stop system, attributing to its good cycling capabilities for delivering constant power, faster recharge, and improved cycle life.

The absorbent glass mat (AGM) battery segment accounted for a substantial revenue share in the total start stop battery market share in 2024.

- AGM battery refers to a type of advanced lead-acid battery that uses a fiberglass mat for absorbing the electrolyte, making it spill-proof and more vibration-resistant.

- AGM battery is also capable of delivering improved cycle life and superior cycling capabilities while providing high cranking power even when the state of charge is low.

- Moreover, AGM batteries offer several benefits such as minimal maintenance requirement, excellent charging acceptance, durability, and higher power output in comparison to flooded battery.

- For instance, East Penn offers an extensive line of AGM batteries for vehicle start-stop system in its product offerings. The company’s AGM batteries deliver superior performance and prolonged shelf-life among others.

- According to the start stop battery market analysis, the rising advancements associated with AGM batteries are driving the start stop battery market trends.

Enhanced flooded battery (EFB) segment is anticipated to register significant CAGR growth during the forecast period.

- Enhanced flooded battery is an improved version of traditional flooded lead-acid batteries.

- It features enhanced design, which offers the ability to provide constant power to all car electrical loads, even when the vehicle is idle.

- Enhanced flooded battery also has good cycling capabilities for delivering improved cycle life, constant power, and faster recharge.

- For instance, Exide Technologies offer a broad range of enhanced flooded batteries (EFB) in its product offerings. Exide enhanced flooded batteries support all vehicles with start-stop systems that have high cycling requirements.

- Therefore, the increasing developments related to enhanced flooded batteries are projected to drive the start stop battery market growth during the forecast period.

By Sales Channel:

Based on sales channel, the market is segmented into original equipment manufacturer (OEM) and aftermarket.

Trends in the sales channel:

- Factors including the availability of targeted advertising, competitive pricing, ease of use, and reliable shipping and return policies are among the key prospects driving the OEM channel segment.

- Factors including the rising automotive MRO (maintenance, repair, and operation) activities, availability of economical products in comparison to OEM products, higher accessibility to a variety of products, and higher flexibility are primary determinants for boosting the aftermarket segment.

Original equipment manufacturer (OEM) segment accounted for a significant revenue in the overall market in 2024.

- In the start-stop battery sector, an OEM (original equipment manufacturer) refers to companies whose start-stop battery is utilized as components in the products of another company, which then sells the finished item to respective end users.

- OEM sales agreements enable a company to sell its products to another company by relabelling the products and selling them as its own. The process enables a manufacturer to quickly leverage existing marketing and sales infrastructure without the need of building their own infrastructure.

- Moreover, purchasing start-stop batteries from an OEM offers various benefits including faster response time, higher product quality, competitive pricing, excellent support and warranty, faster production, and higher return on investments among others.

- Therefore, the above benefits OEM channels are primary determinants for driving the OEM segment.

Aftermarket segment is anticipated to register the fastest CAGR growth during the forecast period.

- The aftermarket channel involves the sale of spare parts, components, and accessories for maintaining or improving an original product.

- The aftermarket channel for start-stop batteries offers opportunities for the distribution of additional goods for upgrading or replacing the existing start-stop batteries after the initial purchase.

- Moreover, aftermarket sales channel provides numerous benefits including wider reach, increased customer convenience, enhanced product visibility, and others. The above benefits of aftermarket sales channel are vital aspects for increasing the distribution of start-stop batteries from aftermarket sales channels.

- For instance, Robert Bosch GmbH offers a broad range of start-stop batteries including absorbent glass mat (AGM) battery and enhanced flooded battery (EFB) in its aftermarket product offerings.

- Hence, the increasing availability of start-stop batteries in aftermarket sales channels, attributing to its aforementioned benefits, is a key factor projected to drive the aftermarket segment during the forecast period.

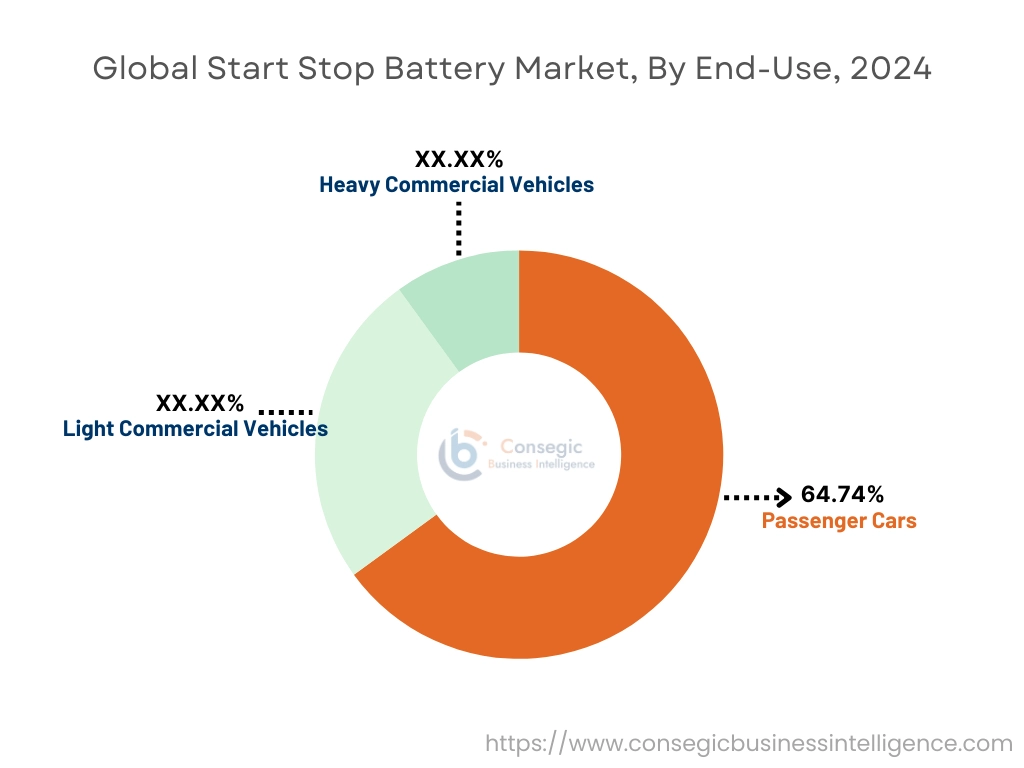

By End Use:

Based on the end-use, the market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles.

Trends in the end-use:

- Factors including the rising disposable income, growing popularity of luxury cars, and progressions in autonomous driving systems are key trends propelling the growth of the passenger cars segment.

- Factors including the rising sales of heavy-duty vehicles, growing investments in commercial vehicles, and increasing need for economical modes of transportation and logistics are primary determinants for driving the commercial vehicles segment.

Passenger cars segment accounted for the largest revenue share of 64.74% in the overall start stop battery market share in 2024, and it is anticipated to register substantial CAGR growth during the forecast period.

- Start stop battery is primarily used in modern passenger cars equipped with start-stop systems, which helps in automatically shutting off the engine when the vehicle is stationary and restarting it when the driver presses the accelerator.

- Moreover, the use of start-stop batteries in passenger cars can help improve fuel efficiency and lower carbon dioxide (CO2) emissions.

- For instance, according to the International Organization of Motor Vehicle Manufacturers, the total production of passenger cars in Europe reached up to 15,449,729 units in 2023, representing an increase of nearly 13% in comparison to 2022.

- According to the analysis, the rising passenger car production is driving the adoption of start-stop batteries, in turn propelling the start stop battery market size.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

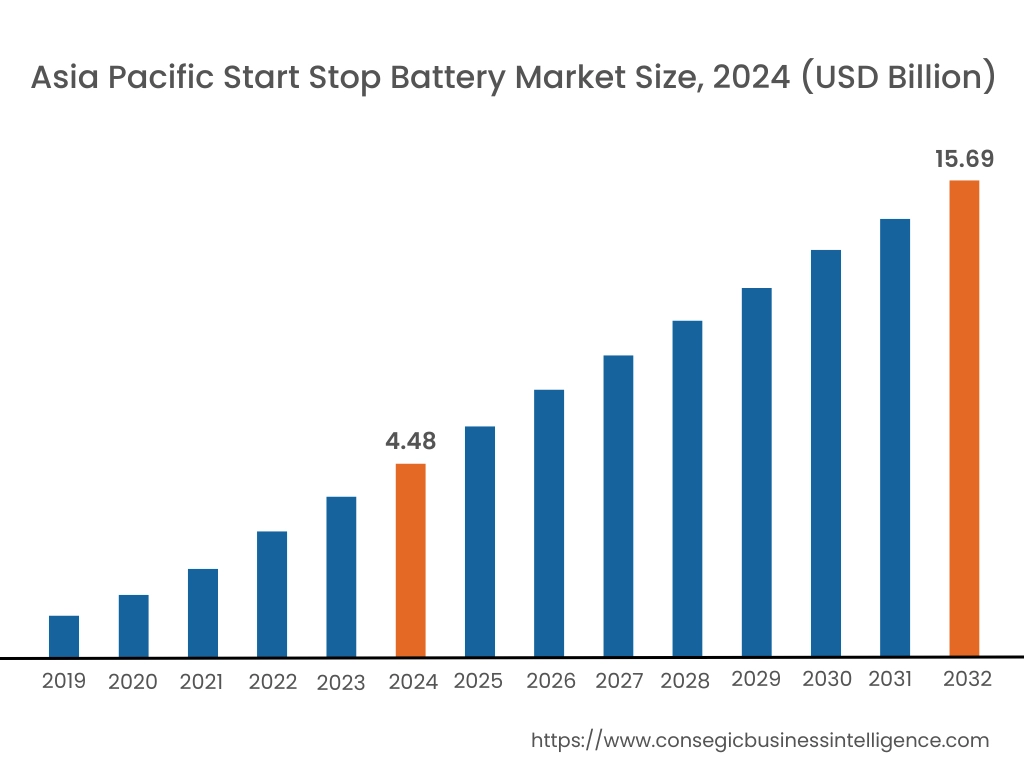

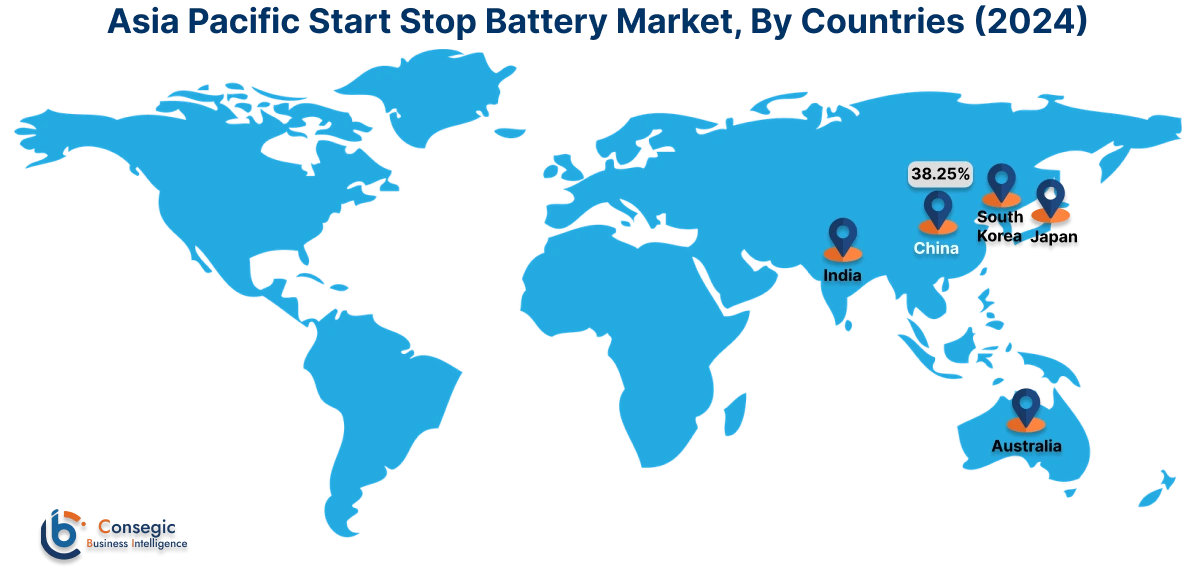

Asia Pacific region was valued at USD 4.48 Billion in 2024. Moreover, it is projected to grow by USD 5.16 Billion in 2025 and reach over USD 15.69 Billion by 2032. Out of this, China accounted for the maximum revenue share of 38.25%. As per the start stop battery market analysis, the adoption of start-stop batteries in the Asia-Pacific region is primarily driven by increasing government investments in automotive industry, rising automobile production, and increasing adoption of hybrid vehicles. Additionally, the rising advancements associated with passenger cars and increasing integration of start-stop system in modern vehicles are further accelerating the start stop battery market expansion.

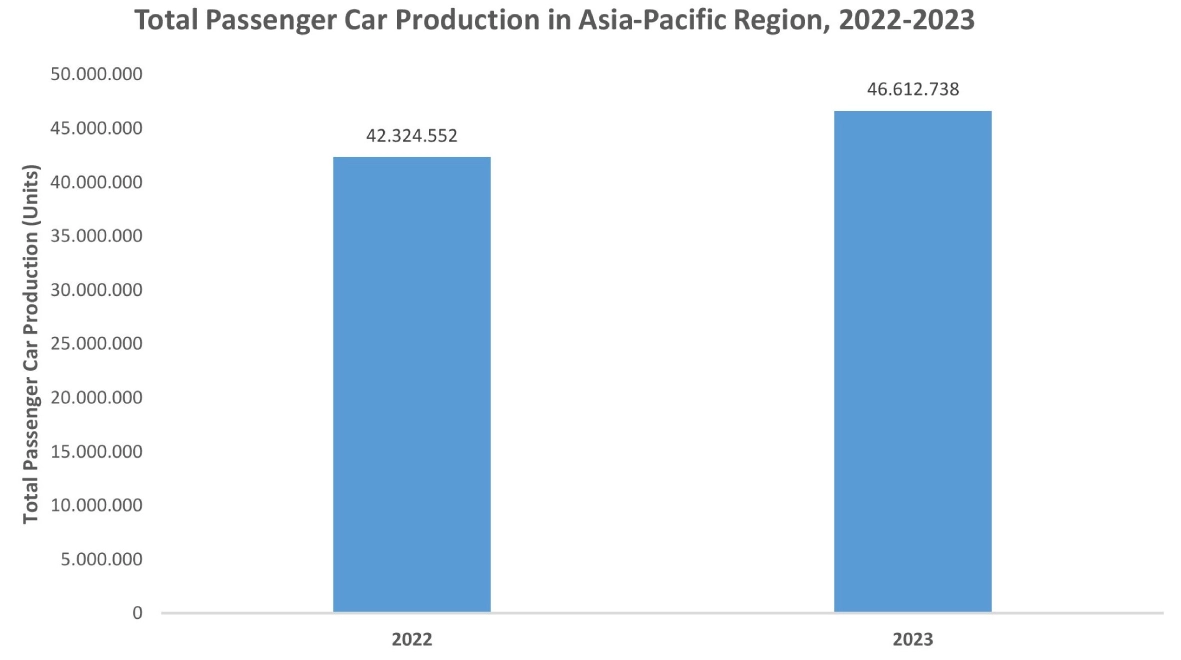

- For instance, according to the International Organization of Motor Vehicle Manufacturers, the total production of passenger cars in Asia-Pacific region reached up to 46,612,738 units in 2023, depicting an incline of nearly 10% in comparison to 42,324,552 units in 2022. The above factors are further propelling the market demand in the Asia-Pacific region.

North America is estimated to reach over USD 13.46 Billion by 2032 from a value of USD 3.93 Billion in 2024 and is projected to grow by USD 4.51 Billion in 2025. In North America, the growth of start stop battery industry is driven rising vehicle production and growing adoption of hybrid vehicles and electric vehicles in the region. Similarly, rising need for improved fuel efficiency in modern vehicles is further contributing to the start stop battery market demand.

- For instance, according to the International Organization of Motor Vehicle Manufacturers, the total automotive production in the United States reached up to 10,611,555 units in 2023, witnessing an increase of 6% as compared to 2022. The aforementioned actors are driving the start stop battery market trends in North America.

In addition, the regional analysis depicts that the increasing automotive production, advent of electro mobility, and stringent government measures for reducing vehicle emissions are propelling the start stop battery market demand in Europe. Further, according to the analysis, the market demand in Latin America, Middle East, and African regions is projected to grow at a substantial rate due to factors such as growing automotive sector, increasing investments in electric vehicles, and rising integration of start-stop systems in modern vehicles among others.

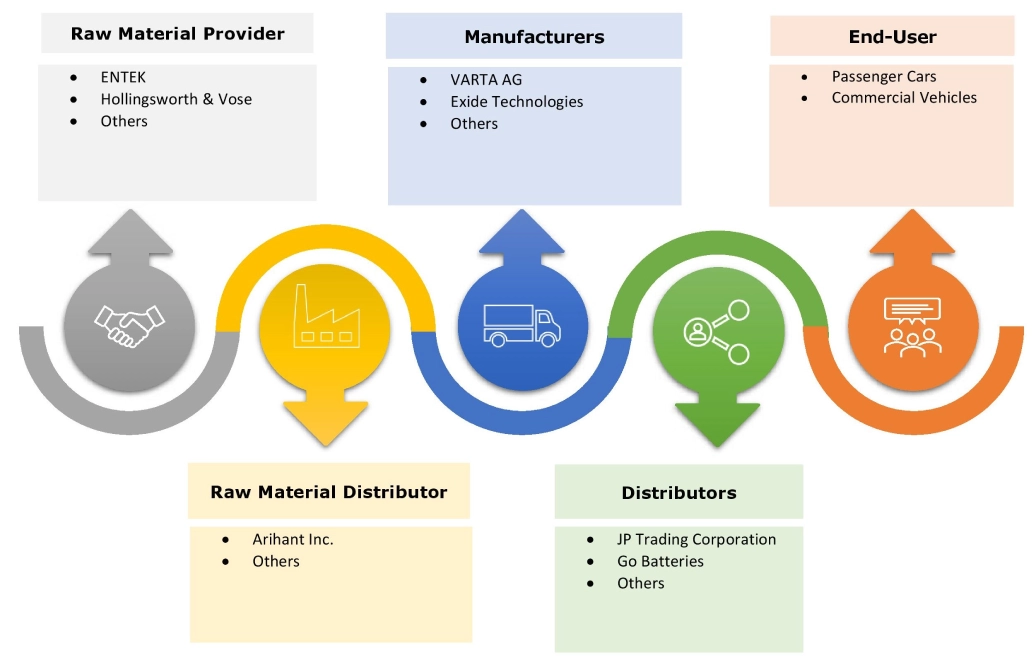

Top Key Players and Market Share Insights:

The global start stop battery market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the start stop battery market. Key players in the start stop battery industry include-

- VARTA AG (Germany)

- Exide Technologies (France)

- Clarios (U.S)

- GS Yuasa Corporation (Japan)

- Banner Batteries (United Kingdom)

- Robert Bosch GmbH (Germany)

- Leoch International Technology Limited (Singapore)

- East Penn Manufacturing Company (U.S)

- Panasonic Corporation (Japan)

- EnerSys (U.S)

Recent Industry Developments :

Product Launch:

- In September 2024, VARTA Automotive launched its updated battery product portfolio. The new battery line-up includes EFB and AGM batteries, which is intended to better support start-stop, hybrid and electric vehicles.

Start Stop Battery Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 44.75 Billion |

| CAGR (2025-2032) | 19.0% |

| By Product Type |

|

| By Sales Channel |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the start stop battery market? +

The start stop battery market was valued at USD 13.02 Billion in 2024 and is projected to grow to USD 44.75 Billion by 2032.

Which is the fastest-growing region in the start stop battery market? +

Asia-Pacific is the region experiencing the most rapid growth in the start stop battery market.

What specific segmentation details are covered in the start stop battery report? +

The start stop battery report includes specific segmentation details for product type, sales channel, end-use, and region.

Who are the major players in the start stop battery market? +

The key participants in the start stop battery market are VARTA AG (Germany), Exide Technologies (France), Robert Bosch GmbH (Germany), Leoch International Technology Limited (Singapore), East Penn Manufacturing Company (U.S), Panasonic Corporation (Japan), EnerSys (U.S), Clarios (U.S), GS Yuasa Corporation (Japan), Banner Batteries (United Kingdom), and others.