Truck Trailer Landing Gear Market Size:

Truck Trailer Landing Gear Market Size is estimated to reach over USD 1,363.02 Million by 2032 from a value of USD 900.68 Million in 2024 and is projected to grow by USD 935.00 Million in 2025, growing at a CAGR of 4.8% from 2025 to 2032.

Truck Trailer Landing Gear Market Scope & Overview:

Truck trailer landing gear is a mechanical system installed on semi-trailers. It provides stable support when the trailer is unhitched from the truck. This system typically consists of two retractable legs with adjustable heights. The legs can be operated manually or hydraulically. This ensures safe and efficient loading, unloading, and parking of trailers. Landing gear systems are designed to withstand heavy loads and are made from durable materials for reliability under challenging operational conditions.

How is AI Transforming the Truck Trailer Landing Gear Market?

AI is increasingly being used in the truck trailer landing gear market, particularly for creating smarter, automated, and more efficient landing gear systems, incorporating sensors and data analytics for predictive maintenance, remote operation, and real-time load monitoring. Moreover, AI-driven features can also detect terrain changes and adjust gear legs for safety and stability and reduce maintenance costs by predicting component fatigue. In addition, AI-powered solutions are also used during the manufacturing process, particularly in digital design and simulation, which enables more precise engineering and faster development of innovative, lightweight, and durable landing gear solutions. Therefore, the aforementioned factors are expected to positively impact the market growth in upcoming years.

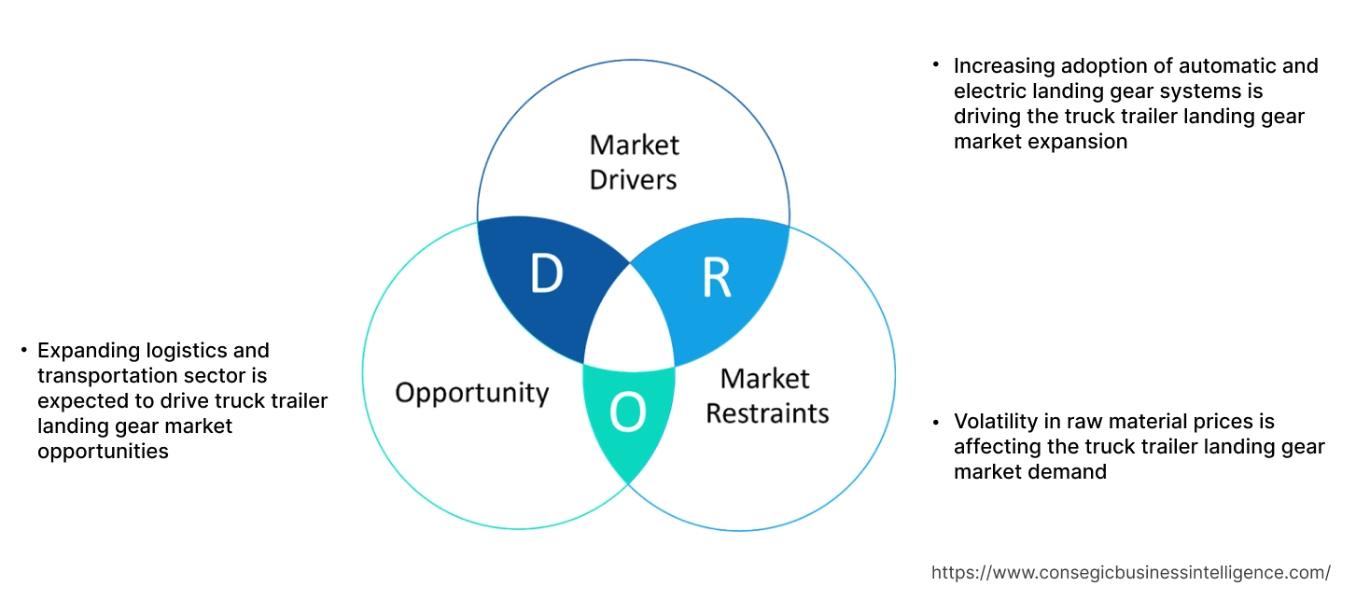

Truck Trailer Landing Gear Market Dynamics - (DRO) :

Key Drivers:

Increasing adoption of automatic and electric landing gear systems is driving the truck trailer landing gear market expansion

The growing focus on automatic and electric landing gear is transforming the global market, due to the need for better operator safety and efficiency. They significantly cut down on the manual effort needed to detach and park trailers, which in turn reduces operator fatigue and the chance of workplace injuries. These systems also offer reliable performance. Automatic landing gear systems contribute to fuel efficiency and lower emissions by reducing idle times during loading and unloading. As governments and regulatory bodies worldwide continue to tighten environmental standards, the need for technologies that promote fuel efficiency and reduce carbon footprints is expected to rise, further boosting the market for automatic truck trailer landing gear.

- For instance, Range Energy’s electric truck trailers are loaded with electric powertrains to turn any semi trailer into hybrid trailer. It is compatible with any electric or diesel-powered truck, making it ideal for fleet operations without needing any truck modifications.

Thus, according to the truck trailer landing gear market analysis, increasing adoption of automatic and electric landing gear systems is driving the truck trailer landing gear market size and trends.

Key Restraints :

Volatility in raw material prices is affecting the truck trailer landing gear market demand

One major restraint in the market is the volatility in raw material prices, which can impact the production costs and pricing strategies of manufacturers. Variations in the prices of key materials such as aluminum and steel can increase the overall production cost of truck trailer landing gear, thereby affecting the profitability of manufacturers. Additionally, the high initial costs associated with automated landing gear systems could pose a barrier to adoption for small and medium-sized enterprises, particularly in price-sensitive markets. Thus, the aforementioned factors would further impact the truck trailer landing gear market size.

Future Opportunities :

Expanding logistics and transportation sector is expected to drive truck trailer landing gear market opportunities

The rapid development of the e-commerce sector and the increasing need for efficient logistics solutions are driving the need for commercial vehicles and consequently, advanced landing gear systems. The development of logistics networks, particularly in emerging economies, is creating new prospects for market players. Manufacturers are focusing on developing innovative and high-performance truck trailer landing gear systems to cater to the evolving needs of the logistics industry. The increasing investments in infrastructure development and industrial activities are further driving the need for advanced landing gear systems, presenting significant opportunities for the market.

- For instance, in April 2021, JOST launched the innovative KKS automatic coupling system, which allows drivers to couple and uncouple semi-trailers remotely. This makes the process automatic, safer, and faster. For transportation and logistics fleet operators, the KKS-U connector offers an alternative installation option. It makes it easy to equip existing trailers with the KKS system. This connector handles all the mechanical, electrical, and air connections between the truck and trailer, removing the need for the typical, more vulnerable spiral lines for air, electrics, and ABS/EBS.

Thus, based on the above truck trailer landing gear market analysis, expanding logistics and transportation sectors are expected to drive the truck trailer landing gear market opportunities.

Truck Trailer Landing Gear Market Segmental Analysis :

By Type:

Based on type, the market is segmented into manual landing gear and automatic landing gear.

Trends in the type:

- The growing emphasis on regulatory compliance and safety standards is influencing the product type dynamics in the market.

- The development of lightweight materials and energy-efficient systems is a key area of focus for manufacturers seeking to gain a competitive edge.

- Thus, based on the above analysis, these factors are driving the truck trailer landing gear market demand.

The manual landing gear segment accounted for the largest revenue share in the year 2024.

- Manual landing gear has been the traditional choice for many trucking operations due to its cost-effectiveness and simplicity.

- These systems are widely used in regions where labor costs are relatively low and where there is a strong preference for tried-and-tested technologies.

- There is a steady demand for manual landing gears in regions with a high prevalence of older trucking fleets and less emphasis on technological upgrades.

- Thus, based on the above analysis, these factors are further driving the truck trailer landing gear market growth.

The automatic landing gear segment is anticipated to register the fastest CAGR during the forecast period.

- Automatic landing gear systems offer numerous advantages, including reduced manual labor, faster operations, and enhanced safety.

- These systems are equipped with electric or hydraulic mechanisms that allow easy and efficient raising and lowering of the landing gear at the push of a button.

- The integration of sensors and IoT (internet of things) technology further enhances the functionality of automatic landing gear systems, providing real-time monitoring and predictive maintenance capabilities.

- Fleet operators are increasingly adopting automatic landing gear systems to improve operational efficiency and reduce downtime.

- For instance, ON-Lift’s automatic pneumatic landing gear system is exceptionally fast, and can raise and lower tractor-trailer landing gear in under 10 seconds. It uses air power from the Emergency Brake System, which means no additional power source is required.

- Thus, based on the above analysis, these factors are expected to drive the truck trailer landing gear market share during the forecast period.

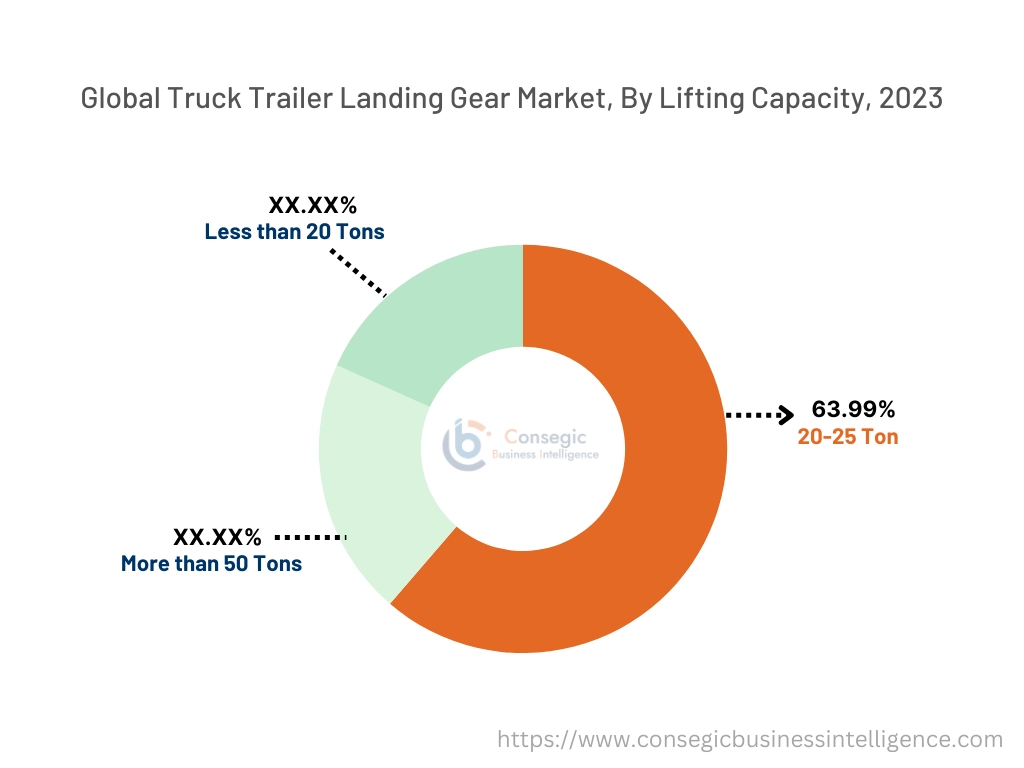

By Lifting Capacity:

Based on the lifting capacity, the truck trailer landing gear market is segmented into less than 20 tons, 20–50 tons, and more than 50 tons.

Trends in the lifting capacity:

- The exponential development of e-commerce necessitates efficient and rapid movement of goods, leading to increased demand for trailers and robust landing gear systems.

- Manufacturers are increasingly utilizing lightweight yet durable materials like aluminum alloys and advanced composites in landing gear components.

The 20–50 tons segment accounted for the largest revenue share of 64.12% in the year 2024.

- Advanced landing gear in this capacity range is increasingly incorporating sensors and IoT capabilities. This allows fleet operators to monitor the status, load, and even potential maintenance needs of the landing gear in real-time.

- The integration with fleet management systems allows remote control of coupling/uncoupling operations, further enhancing efficiency and safety, especially in large-scale logistics operations.

- Thus, based on the above analysis, these factors would further supplement the truck trailer landing gear market

The more than 50 tons segment is anticipated to register the fastest CAGR during the forecast period.

- Landing gear capable of lifting over 50 tons is essential for specialized tasks, particularly in oversized cargo transport and heavy machinery logistics.

- The segment growth can be attributed to the increasing need for high-capacity trailers in industries such as mining, oil and gas, and infrastructure development.

- The segment growth is supported by ongoing advancements in materials and structural designs, which are leading to the creation of lighter yet more robust landing gear for these heavy-duty applications.

- These factors are anticipated to further drive the truck trailer landing gear market trends during the forecast period.

By Operation:

Based on operation, the market is segmented into two-speed and single-speed.

Trends in the operation:

- The market is witnessing a trend towards customization and hybrid solutions, where features of different systems are combined to meet diverse operational needs. This flexibility and adaptability are driving the

- The development of automated systems that work seamlessly with both electric and diesel-powered trucks secure fleet investments, catering to the evolving powertrain landscape.

The two-speed segment accounted for the largest revenue share in the year 2024.

- Two-speed landing gear systems provide flexibility, allowing operators to select between high-speed (for quick adjustments) and low-speed (for precise or heavy lifting/lowering) modes.

- Their operational versatility and efficiency in managing diverse loads make them a popular choice for heavy-duty and long-haul trailers.

- Fleet operators increasingly prefer these systems to boost their performance and operational efficiency.

- Thus, based on the above analysis, these factors are driving the truck trailer landing gear market growth.

The single-speed segment is anticipated to register the fastest CAGR during the forecast period.

- Single-speed landing gear systems are ideal for simple tasks where the load does not change much, making them a great fit for small-scale logistics and light-duty trailers.

- They are also cost-effective and easy to use, appealing to operators and small fleets who value basic functionality over advanced features.

- These factors are anticipated to further drive the truck trailer landing gear market trends during the forecast period.

By Sales Channel:

Based on sales channel, the market is segmented into OEMs and aftermarket.

Trends in the sales channel:

- The increasing trend of digitalization and e-commerce has also impacted the sales channel dynamics, with many companies enhancing their online presence to reach a broader customer base.

- Stringent safety and performance standards mandated by regulatory bodies are driving the demand for high-quality landing gear systems in both OEM and aftermarket segments.

The OEMs segment accounted for the largest revenue share in the year 2024.

- The OEM segment dominates the market, driven by the increasing demand for new commercial vehicles and the preference for factory-installed landing gear systems.

- OEMs are focusing on integrating advanced landing gear systems into their vehicles to enhance their performance, safety, and compliance with regulatory standards.

- The growing adoption of automation and IoT technology in landing gear systems is further driving the demand for OEM-installed systems, as fleet operators seek to leverage these advanced features to improve their operational efficiency and reduce maintenance costs.

- Therefore, based on the above analysis, these factors are driving the global market.

The aftermarket segment is anticipated to register the fastest CAGR during the forecast period.

- Aftermarket sales channels are also witnessing substantial growth, driven by the need to upgrade and retrofit existing truck fleets with automatic landing gear systems.

- Fleet operators seeking to improve efficiency and reduce operational costs are increasingly turning to aftermarket solutions.

- The availability of a wide range of products and the flexibility to upgrade existing systems without the need for significant modifications are key factors driving the development of the aftermarket segment.

- The above factors are anticipated to further drive the global market trends during the forecast period.

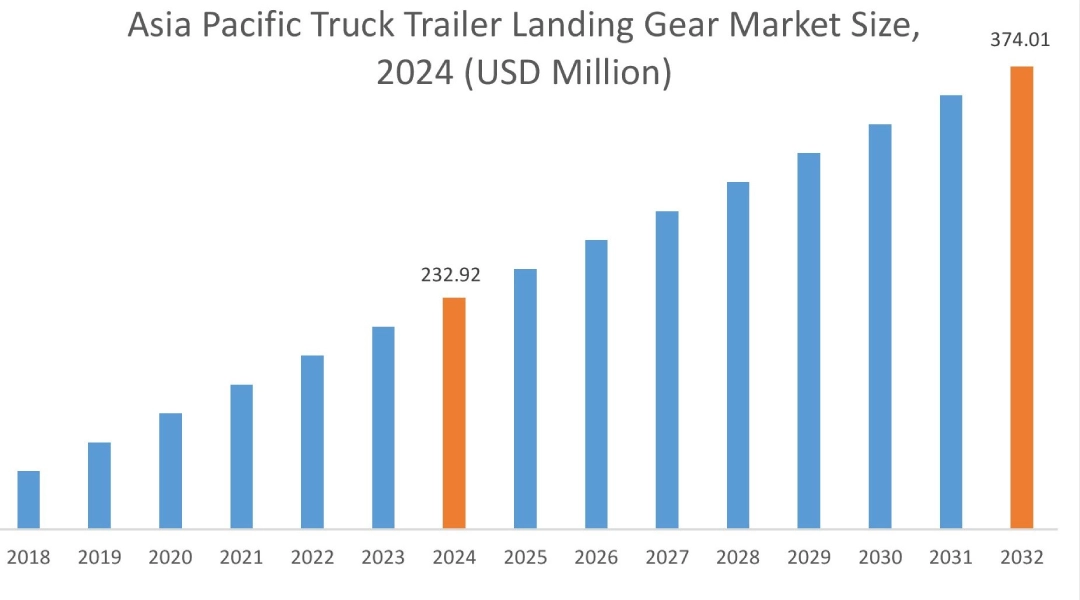

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

Asia Pacific truck trailer landing gear market expansion is estimated to reach over USD 374.01 million by 2032 from a value of USD 232.92 million in 2024 and is projected to grow by USD 243.02 million in 2025. Out of this, the China market accounted for the maximum revenue split of 32.21%. The regional growth is driven by rapid industrialization, urbanization, and the development of the e-commerce sector. Countries in the region are investing heavily in infrastructure development and logistics improvements, creating a favorable environment for the adoption of advanced truck landing gear systems. Further, the region's growing automotive truck trailer landing gear market and increasing focus on operational efficiency are key factors contributing to the market development. The above factors would further drive the regional truck trailer landing gear market during the forecast period.

- For instance, in November 2024, Tata Motors introduced its first truck with an automated manual transmission (AMT), the Tata Prima 4440.S AMT. This new truck leverages Tata Motors' global expertise to deliver exceptional reliability and performance. It features a powerful engine and transmission, durable components, and a comfortable driver's cabin.

The North American market is estimated to reach over USD 466.43 million by 2032 from a value of USD 310.86 million in 2024 and is projected to grow by USD 322.48 million in 2025. The region's well-established logistics and transportation infrastructure, coupled with the presence of major trucking companies, drives the need for advanced landing gear systems. Further, the adoption of automation and smart technologies is high in North America, which is further propelling market growth. The aforementioned factors would further drive the market in North America.

According to the truck trailer landing gear market, the truck trailer landing gear industry in Europe is expected to witness significant development during the forecast period. The region's focus on technological advancements and regulatory compliance is driving the need for high-quality and advanced landing gear systems. Additionally, the increasing emphasis on sustainability and fuel efficiency is influencing market growth in Latin America, with manufacturers developing lightweight and durable landing gear systems to meet these requirements. Further, the increasing investments in infrastructure development and the expansion of logistics networks in the Middle East & Africa region are creating lucrative prospects for market players.

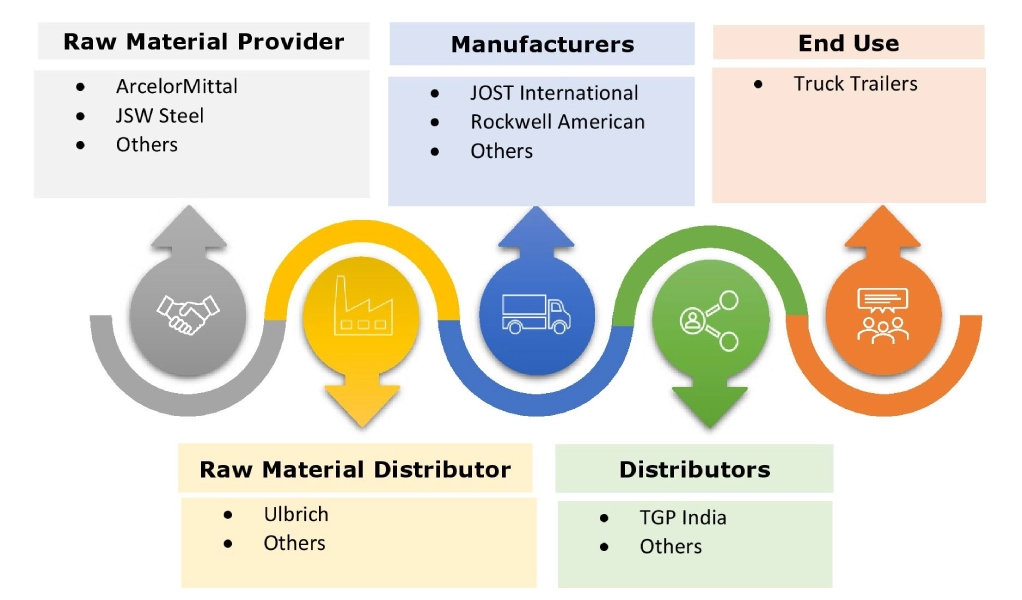

Top Key Players & Market Share Insights:

The global truck trailer landing gear market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the truck trailer landing gear industry include-

- JOST International (U.S.)

- SAF-HOLLAND (Germany)

- Penz Products Inc. (U.S.)

- Transwest Trailer, LLC (U.S.)

- Butler Products Corporation (U.S.)

- Standen's Limited (Canada)

- Tata Motors (India)

- Horizon Global Americas (U.S.)

- Rockwell American (U.S.)

- Buffers USA (U.S.)

- Fleet Engineers (U.S.)

Recent Industry Developments :

Product Launch:

- In August 2021, Airman Products launched the NR DART (Dynamic Automated Repair Test) system, a new way to automate the testing and maintenance of landing gear. This system boosts operational efficiency by reducing the need for manual checks, cutting down on errors, and speeding up repair times.

Truck Trailer Landing Gear Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 1,363.02 Million |

| CAGR (2024-2031) | 4.8% |

| By Type |

|

| By Lifting Capacity |

|

| By Operation |

|

| By Sales Channel |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Truck Trailer Landing Gear Market? +

Truck Trailer Landing Gear market size is estimated to reach over USD 1,363.02 Million by 2032 from a value of USD 900.68 Million in 2024 and is projected to grow by USD 935.00 Million in 2025, growing at a CAGR of 4.8% from 2025 to 2032.

Which is the fastest-growing region in the Truck Trailer Landing Gear Market? +

Asia-Pacific region is experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Truck Trailer Landing Gear report? +

The truck trailer landing gear report includes specific segmentation details for type, lifting capacity, operation, sales channel, and region.

Who are the major players in the Truck Trailer Landing Gear Market? +

The key participants in the market are JOST International (U.S.), SAF-HOLLAND (Germany), Tata Motors (India), Horizon Global Americas (U.S.), Rockwell American (U.S.), Buffers USA (U.S.), Fleet Engineers (U.S.), Penz Products Inc. (U.S.), Transwest Trailer, LLC (U.S.), Butler Products Corporation (U.S.), Standen's Limited (Canada), and others.