Wire Bonder Equipment Market Introduction:

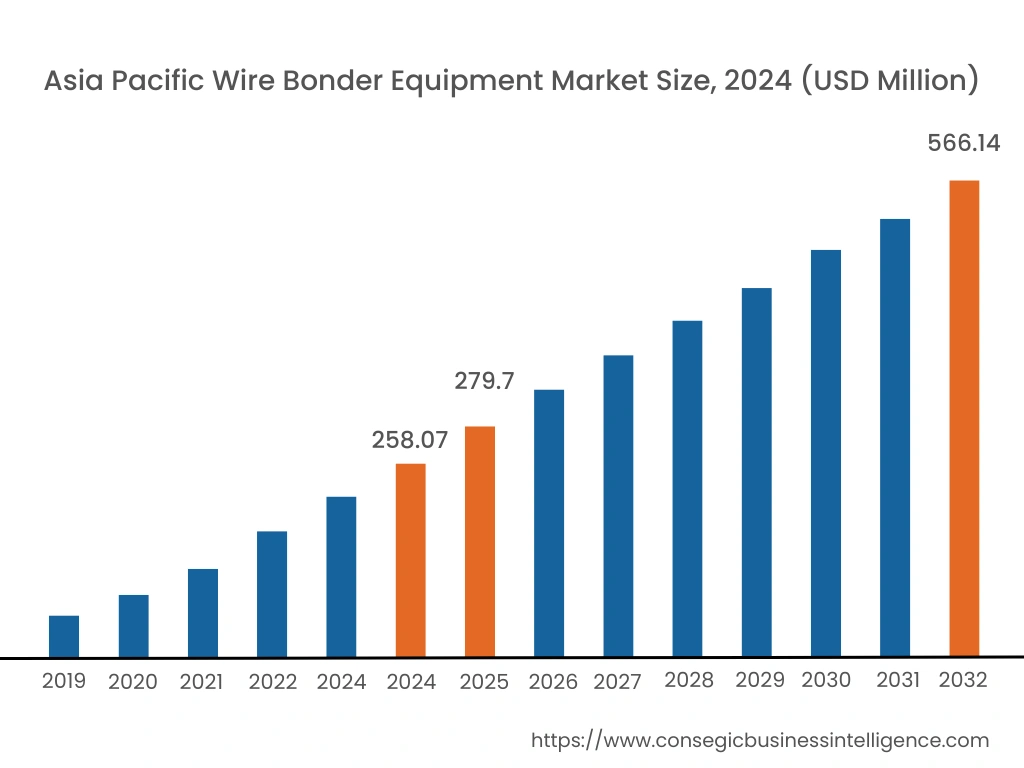

Wire Bonder Equipment Market size is estimated to reach over USD 1,859.26 Million by 2032 from a value of USD 876.26 Million in 2024 and is projected to grow by USD 947.05 Million in 2025, growing at a CAGR of 9.9% from 2025 to 2032.

Wire Bonder Equipment Market Definition & Overview :

Wire bonding is defined as a method to create a stable electrical connection using a thin wire usually made of aluminum, silver, copper, or gold along with several other parameters namely heat, pressure, and ultrasonic waves. Based on the analysis, this equipment is employed to create a stable and reliable electrical connection between the components of electronic devices. In addition, wire bonding is extensively used in various sectors including semiconductor, aerospace, microelectronics, solar cells, and EV battery industries to improve the bonder productivity and reduce the programing time.

Wire Bonder Equipment Market Insights :

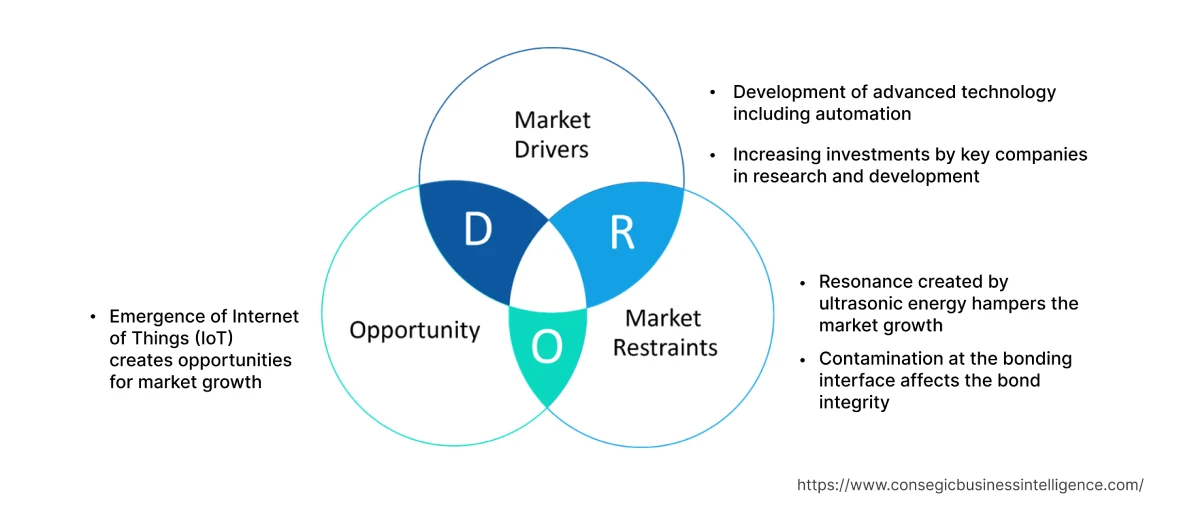

Wire Bonder Equipment Market Dynamics - (DRO) :

Key Drivers :

Development of advanced technology including automation Boosts the Market Progress

The emergence of advanced technologies such as automation serves as the primary factor for the growth of the wire bonder equipment market. The advent of such advanced technologies improves the overall bonder productivity and reduces programming time. In addition, automation facilitates quick process development that reduces the time for production, calibration, maintenance, and process set-ups. Moreover, automation simplifies the process of creation by offering offline programming to import data from CAD designs. Subsequently, the development of advanced technologies to accelerate the production process and reduce the programming time is contributing significantly in driving the growth of the global wire bonder equipment market. For instance, in September 2021, Palomar Technologies launched 3880 II Die Bonder to offer flexibility including tracking, sorting, and inspection to scale up the automation process. The product is designed to reduce programming time by 95% and enhance productivity, hence, contributing considerably in accelerating the market growth and trend.

Increasing investments by key companies in research and development Fuels the Market Progress

The increasing investments by key players to develop advanced wire bonder equipment is one of the key factors driving the growth of the market. Major market players are spending heavily on research and development to develop advanced wire bonders suitable for ribbon bonding of hybrid circuits, sensors, automotive power modules, semiconductor devices, and battery packs. In addition, several companies are launching advanced training courses and establishing process development laboratories to develop and optimize the processes including machine setup and bond quality control to improve productivity. In conclusion, the increasing investment by key players to build advanced wire bonding equipment for various applications is contributing significantly in bolstering the growth of the market. For instance, in October 2021, Inseto invested in the development of a new laboratory for Wedge Bonder and also introduced two bonder operation training courses. The heavy investments by key companies in research and development thus contribute considerably in propelling the market growth.

Key Restraints :

Resonance created by ultrasonic energy hampers the market

The major restraint for the growth of the wire bonder equipment market is the resonance created by ultrasonic energy with the substrate surface. Excessive vibration produced by the substrate surface negatively interacts with the bond formation leading to weak or no-stick bonds. According to the analysis, the formation of weak bonds between the components of an electrical system interferes with the functioning of the system thus, impeding the expansion of the wire bonder equipment industry.

Contamination at the bonding interface affects the bond integrity

Another major factor restraining the development of the market is the contamination at the bonding interface, particularly for organic materials including hydrocarbons. The contamination, namely polymer residues highly affect the prototyping stage leading to weak bond formation. The formation of weak bonds lowers the efficiency of wire bonder in an electrical system thus restraining the market.

Future Opportunities :

Emergence of Internet of Things (IoT) creates opportunities for market

The emergence of the Internet of Things (IoT) is anticipated to create wire bonder equipment market opportunities and trends for the market. Wire bonding technology is critical for connecting microchips to printed circuit boards (PCBs) in IoT devices. Consequently, with the increasing number of connected devices the demand for wire bonding equipment is also expected to increase to meet the growing need for reliable and efficient connectivity.

Wire Bonder Equipment Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 (USD Million) | USD 1,859.26 Million |

| CAGR (2025-2032) | 9.8% |

| Based on the Type | Manual, Semi-Automatic, and Automatic |

| Based on the Product | Ball Bonder, Wedge Bonder, Stud-Bump Bonder, Ultrasonic Bonder, Thermocompression Bonder, and Thermosonic Bonder |

| Based on the Material | Gold Wire, Copper Wire, Aluminum Wire, and Silver Wire |

| Based on the End-User | Outsourced Semiconductor Assembly and Testing (OSAT) and Integrated Device Manufacturers (IDM) |

| Based on the Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Palomar Technologies, Amkor Technology, Inc., ASM Pacific Technology, BE Semiconductor Industries N.V., DIAS Automation (HK) Ltd., F & S BONDTEC Semiconductor GmbH, F&K Delvotec Bondetechnik, Hesse GmBH, Promex Industries Inc., Q&P Technologies LLC |

Wire Bonder Equipment Market Segmental Analysis :

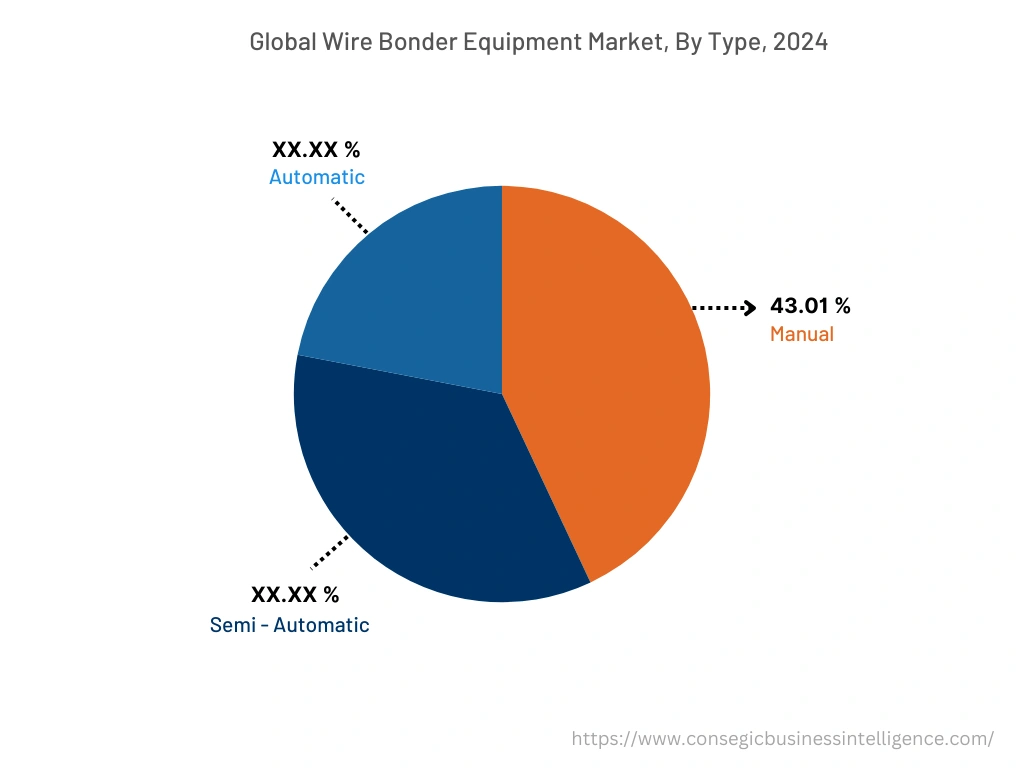

Based on the Type :

The type segment is trifurcated into manual, semi-automatic, and automatic. Manual wire bonders accounted for the largest wire bonder equipment market share of 43.01% in 2024 as manual bonders enable the mounting of the sample in any orientation programmable radiant tool heat. In addition, wire bonders with manual operation are widely deployed for the process development and production of microelectronic devices. Moreover, manual bonders offer optimum bond quality, ease of use, and reliability, is driving the development of the market. Furthermore, as per the analysis, the ability of manually operated wire bonders to provide individual bond parameter control, touch-screen interface, program storage, and the competency to handle a vast range of wire diameters is contributing significantly in propelling the rise of the manual segment.

Automatic wire bonders are anticipated to witness the fastest CAGR during the forecast period owing to the advancements in motion control technology offering higher quality and reliability. In addition, the emergence of new software facilitates the process of transferring and maintaining programs across multiple systems and is widely adopted in automotive assemblies. Moreover, automatic wire bonders are gaining applications in many fields including fine-pitch devices, multi-chip modules (MCMs), chip-on-board (COB), and optoelectronic packaging. Consequently, the aforementioned reasons including the advancements in technology, software, and the increasing adoption in various sectors is expected to fuel the demand for automatic wire bonders in upcoming years. For instance, in September 2020, Palomar Technologies introduced a fully automatic Palomar 8100 Wire Bonder capable of customizing looping profiles and ball bumping. The product is equipped with the latest SMART MOTION technology to cater to all operators and also to increase operator efficiency, among other trends.

Based on the Product :

The product segment is classified into ball bonder, wedge bonder, stud-bump bonder, ultrasonic bonder, thermocompression bonder, and thermosonic bonder. Wedge bonders accounted for the largest market share in 2024 owing to the ability to deliver improved performance and reliability for compact hybrids and MCM power connections. In addition, the advancements in technology including voice-coil technology offer improved wire tension, shorter wire feed path, and better process control. Moreover, wedge bonders allow bonding with a vast variety of ribbon and wire materials namely aluminum and gold thus, considered an ideal bonding choice for high mix environments. Subsequently, as per the analysis, the advancements in technology and improved flexibility offered by wedge bonder serves as the primary factor for the development of the wire bonder equipment market trend. For instance, in August 2022, Palomar Technologies announced to supply Palomar 9000 Wedge Bonder to Bay Photonics. The product is equipped with the latest voice-coil technology and is useful for numerous photonic applications including high-end nuclear power station solutions and unique secure space communications, thus, boosting the wedge bonders segment.

Ball bonders are predicted to witness the fastest CAGR during the forecast period as ball bonding is the fastest form of wire bonding. The bonders offer a speed of about 5 to 12+ wires/second and are the fastest in comparison to any other wire bonder. In addition, the bonder is considered ideal for fine pitch applications along with other applications namely MCM hybrids, BGA, and wafer level bumping. Consequently, the increasing adoption of bonders in various applications and trends owing to the high speed is expected to fuel the demand for ball bonders, among other trends during the forecast period.

Based on the Material :

The material segment is categorized into gold wire, copper wire, aluminum wire, and silver wire. Copper wire bonding accounted for the largest market share in 2024 as copper offers better heat conductivity and more mechanical stability in comparison to other wire bonder materials. In addition, copper wires are less expensive as compared to gold wires, further promoting the market. Moreover, copper wires offer less resistance to current and allow high power flow and are also less probable to break by fatigue or stress cracking within the thermo-mechanical load. Consequently, the ability of copper wires to offer better heat capacity, low electric resistance, and cost-effectiveness are contributing significantly in driving the development of the market trend. For instance, in December 2021, TANAKA Denshi Kogyo announced to establish a new plant in Taiwan for the production of copper bonding wires. The construction of the new plant is expected to increase the production capacity of copper wires by approximately 1.5-fold by 2025, hence, promoting the expansion of copper wires in the semiconductor industry.

Gold wires are anticipated to register the fastest CAGR during the forecast period in the wire bonder equipment market. Based on the analysis, the predominant material in the wire is a gold alloy (> 90% Au) that offers high electrical conductivity and better corrosion resistance properties. In addition, the additives in gold alloy namely beryllium aid in optimizing loop height, temperature strength, elongation at break, and tensile strength. Moreover, the emergence of thermosonic bonding enables gold wires to be bonded conveniently by applying pressure and ultrasonic energy. In conclusion, the above-mentioned factors are primarily responsible for accelerating the surge of gold wires for bonding during the forecast period.

Based on the End-use Industry :

The end-user segment is bifurcated into Outsourced Semiconductor Assembly and Testing (OSAT) and Integrated Device Manufacturers (IDM). Outsourced semiconductor assembly and testing accounted for the largest share in 2024 and is also predicted to register the fastest CAGR during the forecast period. The development of OSAT is attributed to the increasing adoption of wedge bonder wires for cutting-edge chip manufacture and the growing demand for premium packaging solutions. In addition, as per the analysis, the rising dependence of small and medium chip makers on OSAT firms due to the lack of technological knowledge and resources is also contributing significantly in promoting the market during the forecast period. For instance, in March 2023, Amkor Technology, an outsourced semiconductor assembly and test provider, invested in silicon carbide (SC) processing technologies to supply heavy gauge wire bonding to automotive industries for electrification. The supply of wire bonders by OSAT providers is thus, projected to drive the market during the forecast period.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2024 valued at USD 290.66 Million and is projected to grow at a CAGR of 9.8% during the forecast period. The development is attributed to the increasing wire bonder equipment market demand from cutting-edge manufacturers in the region. In addition, the early adoption of advanced technologies in the region enhances the accuracy, productivity, and flexibility of wires to be used in medical, biotechnology, and automotive settings. Moreover, key players in the region are constantly applying innovations and strategic decisions to expand the market portfolio in the region. For instance, in October 2022, Promex Industries installed 2200 evo plus die bonders including three additional Besi systems. The newly designed bonders are equipped with fourth-generation technology and have the ability to deliver flip-chip, die-attach, and multi-chip capability in a single unit.

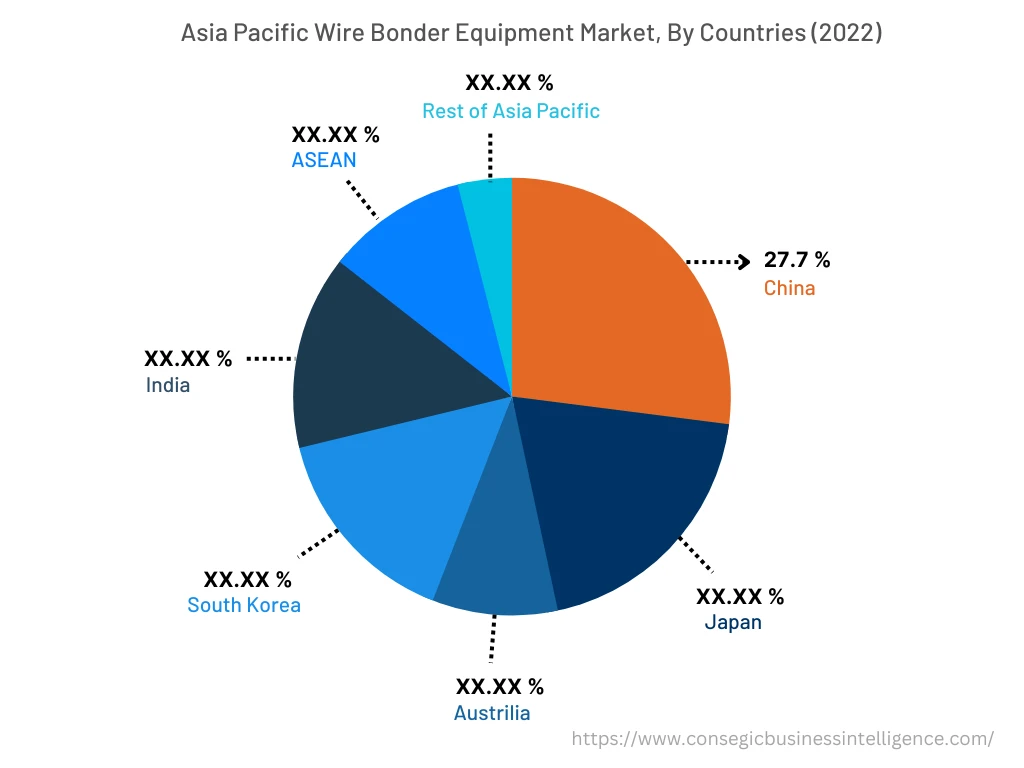

Asia Pacific is predicted to register the fastest CAGR of 10.4% in the wire bonder equipment market during the forecast period. In addition, in the region, China accounted for the maximum revenue share of 27.7% in the year 2024. The expansion of the market is attributed to the increasing production of electronic items including cell phones and wearable devices in countries namely India, China, and Japan. The growing demand for consumer electronics in the region is projected to increase the demand for semiconductor equipment and packaging, including bonder equipment. Consequently, based on the wire bonder equipment market analysis, the growing adoption of consumer electronic devices is contributing significantly in increasing the demand for wire bonding equipment which in turn is expected to drive wire bonder equipment market growth in upcoming years.

Top Key Players & Market Share Insights :

The landscape of the wire bonder equipment market is highly competitive. The key players in the market are adopting strategies for acquisitions and mergers, and product innovations to stay competitive in the wire bonder equipment industry. Following are the major market players that comprise the latest market concentration: –

- Palomar Technologies

- Amkor Technology Inc.

- Hesse GmBH

- Promex Industries Inc.

- Q&P Technologies LLC

- BE Semiconductor Industries N.V.

- Palomar Technologies

- DIAS Automation (HK) Ltd

- F & S BONDTEC Semiconductor GmbH

- F&K Delvotec Bondetechnik

Recent Industry Developments :

- In July 2022, MRSI launched the MRSI-H-HPLD+ wire bonder to improve accuracy, flexibility, and precision particularly, for high-power laser manufacturers.

- In August 2021, QP Technologies installed two new ultrasonic wire bonders for power (GaN), radio frequency (RF), and mil-spec/aerospace (mil-aero) devices. The new wire bonders are useful in several applications including compact battery modules used in automotive applications.

Key Questions Answered in the Report

What is wire bonder equipment? +

A wire bonder equipment is used to attach extremely fine wires from one point to another in order to complete the electrical connection in an electronic device.

What specific segmentation details are covered in the wire bonder equipment market report, and how is the dominating segment impacting the market growth? +

The report consists of segments including type, product, material, and end-user. Each segment has a key dominating sub-segment being driven by industry trends and market dynamics. For instance, the product segment has witnessed wedge bonders as the dominating segment in the year 2024. The growth is attributed to the ability of wedge bonders to deliver improved performance and reliability for compact hybrids and MCM power connections.

What specific segmentation details are covered in the medium voltage switchgear market report, and how is the fastest segment anticipated to impact the market growth? +

The report consists of segments including type, product, material, and end-user. Each segment is projected to have the fastest-growing sub-segment fuelled by industry trends and drivers. For instance, in the type segment, automatic wire bonders is anticipated to witness the fastest CAGR growth during the forecast period. The growth is attributed to the increasing adoption of automatic wire bonders in many fields including fine-pitch devices, multi-chip modules (MCMs), chip-on-board (COB), and optoelectronic packaging.

What specific segmentation details are covered in the Wire Bonder Equipment Market report, and how does each dominating segment is influencing the demand globally? +

As aforementioned, each dominating segment is influencing the demand globally due to growing industrial needs. Moreover, fluctuation in demand being witnessed from different sectors is responsible for driving the wire bonder equipment market.