3D Sensor Market Size:

3D Sensor Market size is estimated to reach over USD 27.33 Billion by 2032 from a value of USD 6.05 Billion in 2024 and is projected to grow by USD 7.18 Billion in 2025, growing at a CAGR of 18.2% from 2025 to 2032.

3D Sensor Market Scope & Overview:

3D sensor (three-dimensional sensor) refers to devices that capture three-dimensional information regarding an object or environment, providing data about its depth, shape, and position in space. Moreover, three-dimensional sensors offer several benefits across various industries due to their ability to capture depth information and create detailed 3D models of objects and environments. Additionally, these sensors are primarily used in consumer electronics, automotive, aerospace & defense, healthcare, retail & e-commerce, robotics, logistics, and other industries.

How is AI Impacting the 3D Sensor Market?

The integration of AI is significantly influencing the 3D sensor market growth. The integration of AI can enhance the sensor's capabilities and offer improved real-time object recognition, enhanced depth sensing, faster data processing, and improved automation and efficiency. Moreover, the integration of AI in three-dimensional sensors enables faster, more accurate, and more efficient 3D sensing applications across various industries, including consumer electronics, robotics, automotive, healthcare, and others.

AI integration in three-dimensional sensors can significantly improve applications such as facial recognition in smartphones, advanced robotics, and more accurate 3D mapping. Additionally, AI facilitates faster data processing, which further enables quicker decision-making and automation in real-time scenarios. Hence, the aforementioned factors are expected to positively impact the market growth in upcoming years.

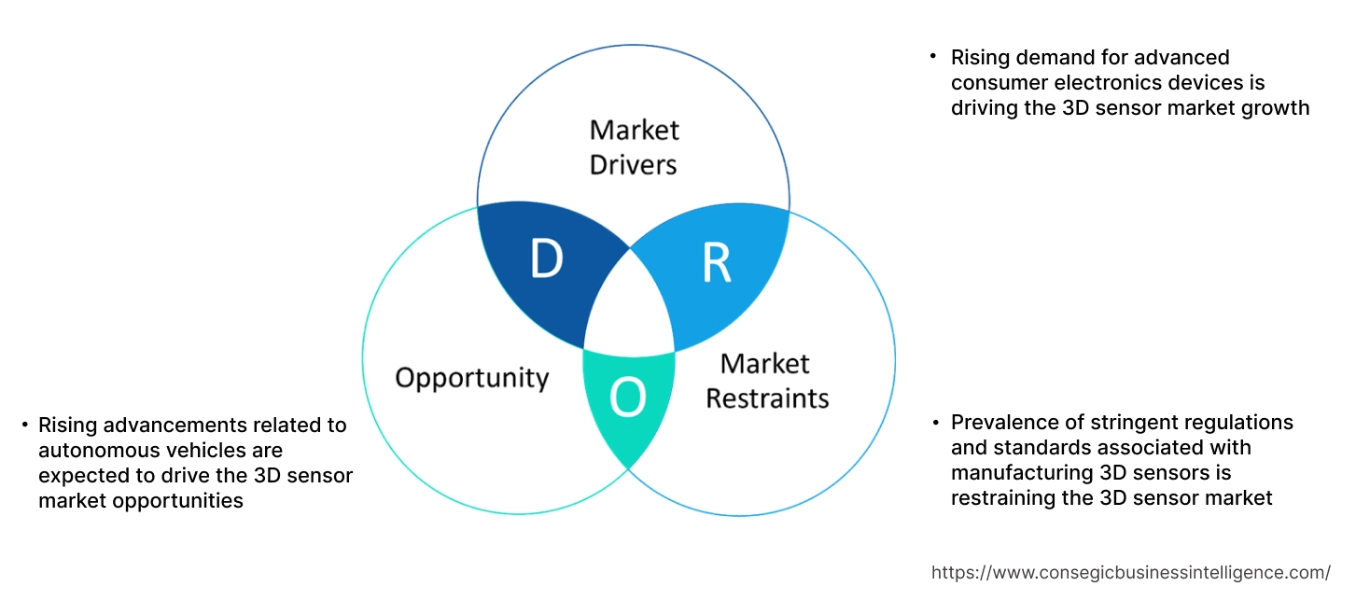

Key Drivers:

Rising demand for advanced consumer electronics devices is driving the 3D sensor market growth

3D sensors are primarily used in the consumer electronics sector, particularly for improving user experiences through features such as facial recognition, gesture control, and augmented reality (AR). Moreover, three-dimensional sensors, which measure depth and spatial information, are typically used in smartphones, gaming consoles, AR devices, and smart home devices, among others. Additionally, the integration of these sensors in consumer electronics devices offers several benefits, including enhanced user interaction, improved device functionality, and others.

- For instance, according to Canalys, the global smartphone shipments reached 1,223.1 million units in 2024, representing an increase of 7% in comparison to 1,141.9 million units in 2023.

Thus, the rising demand for advanced consumer electronics devices, including smartphones and others, is increasing the adoption of three-dimensional sensors, in turn driving the 3D sensor market size.

Key Restraints:

Prevalence of stringent regulations and standards associated with manufacturing 3D sensors is restraining the 3D sensor market

The manufacturers of 3D sensors have to comply with several stringent standards such as ISO (International Organization for Standardization) Standard - ISO 9001, CE (Conformite Européenne), Restriction of Hazardous Substances (RoHS) Directive, and others, which are among the primary factors limiting the market growth.

For instance, ISO 9001 standard specifies particular requirements for a quality management system. Three-dimensional sensor manufacturers must comply with the ISO standard for demonstrating the ability to consistently provide products and services that meet regulatory and customer requirements.

CE certification ensures that the sensor manufacturer takes responsibility for the compliance of a product, confirming that it is applicable to European health, performance safety, and environmental requirements. Thus, the prevalence of above regulations and standards related to manufacturing three-dimensional sensors is hindering the 3D sensor market expansion.

Future Opportunities :

Rising advancements related to autonomous vehicles are expected to drive the 3D sensor market opportunities

Autonomous vehicles are gaining significant popularity in recent years, attributed to its ability to enhance driving experience, facilitate safer commuting, and improve traffic flow among others. Additionally, three-dimensional sensors play a crucial role in autonomous vehicles for providing detailed surrounding perception. They create a 3D representation of the surroundings, which enables the vehicle to detect objects, navigate safely, and make informed decisions.

- For instance, in July 2023, Volkswagen Group commenced its first autonomous vehicle test program in Austin, United States. The program includes the rollout of a batch of 10 all-electric vehicles integrated with an autonomous driving technology platform. Volkswagen Group also intends in increasing its test fleet in Austin and expanding its testing operations to four more cities in the U.S. Additionally, the company plans to launch its autonomous driving vehicles in Austin by 2026.

Hence, as per the analysis, the increasing advancements related to autonomous vehicles are projected to increase the adoption of three-dimensional sensors for providing detailed surrounding perception. The above factors are expected to boost the 3D sensor market opportunities during the forecast period.

3D Sensor Market Segmental Analysis :

By Product Type:

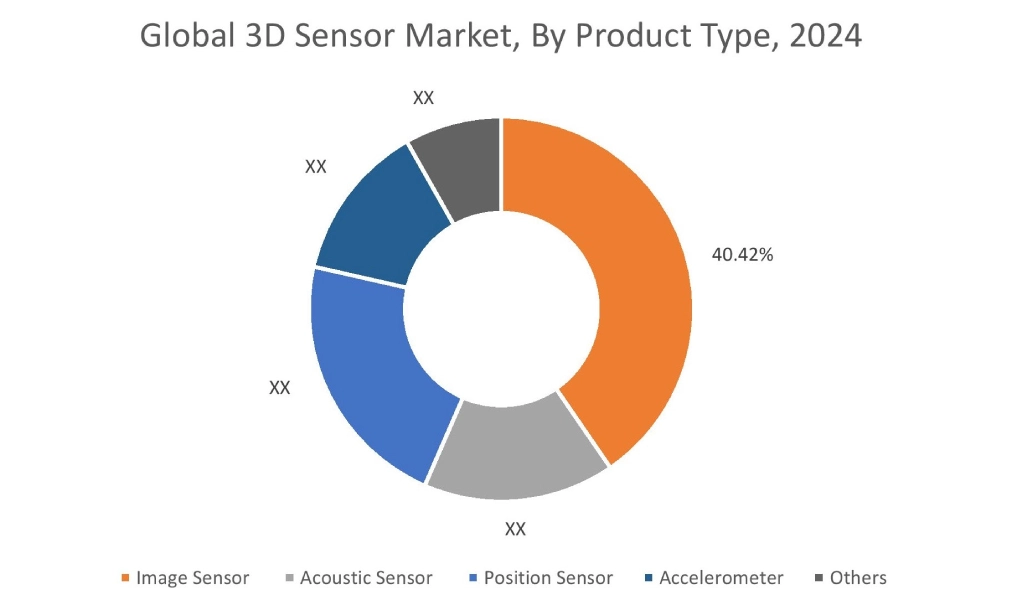

Based on product type, the market is segmented into image sensor, acoustic sensor, position sensor, accelerometer, and others.

Trends in the product type:

- Increasing trend towards adoption of 3D image sensors in applications involving robotics, AR/VR, and industrial automation for facilitating devices to understand their surroundings in 3D is driving the market.

- Rising advancements associated with 3D position sensors with advanced features to enable precise tracking and control of objects or movements are propelling the segment growth.

The image sensor segment accounted for the largest revenue share of 40.42% in the 3D sensor market share in 2024.

- 3D image sensors capture spatial depth information, which enables devices to perceive distances and dimensions, unlike traditional 2D image sensors that perceive shapes and colors only.

- Moreover, 3D image sensors play a crucial role in applications involving robotics, AR/VR, and industrial automation for facilitating devices to understand their surroundings in 3D.

- Additionally, 3D image sensors enable more accurate object detection, distance measurement, and scene understanding, which makes them ideal for use in the aforementioned applications.

- For instance, Teledyne offers Hydra3D+ model of 3D image sensors in its product offerings. It is a time-of-flight (ToF) CMOS image sensor that is designed for versatile 3D detection and measurement within all distance ranges and in all light conditions.

- According to the 3D sensor market analysis, the rising advancements associated with 3D image sensors are driving the market.

The position sensor segment is anticipated to register the fastest CAGR during the forecast period.

- A 3D position sensor refers to a device that detects and measures the position of an object in three-dimensional space, typically along the x, y, and z axes, providing information about its location and orientation.

- 3D position sensors are used in various applications, including robotics, automation, automotive, virtual reality, and others, to enable precise tracking and control of objects or movements.

- For instance, in June 2024, TDK Corporation launched its new HAL/HAR 3936 model of 3D position sensor. The 3D position sensor is designed for use in modern automotive and industrial applications.

- Therefore, the increasing innovations related to 3D position sensors are anticipated to boost the 3D sensor market size during the forecast period.

By Technology:

Based on technology, the market is segmented into time-of-flight (ToF), structured light, stereo vision, and others.

Trends in the technology:

- There is an increasing trend towards adoption of 3D ToF sensors in robotics, consumer electronics, automotive, healthcare, and other sectors, due to its benefits such as compact design, accurate & precise depth sensing, lower power consumption, and others.

- Rising integration of stereo vision technology in three-dimensional sensors, due to its numerous benefits, including highly accurate depth perception, improved object recognition and tracking, along with the ability to detect smaller objects from longer distances.

The time-of-flight (ToF) segment accounted for the largest revenue in the overall 3D sensor market share in 2024, and it is anticipated to register the fastest CAGR during the forecast period.

- 3D time-of-flight (ToF) technology is used to create three-dimensional images by measuring the time it takes for light to travel to an object and back to the sensor.

- ToF technology utilizes a light source, typically infrared, to illuminate a scene, and a sensor that captures the reflected light to determine the distance to various points in the scene. 3D ToF sensors can generate depth information for each pixel by calculating the time difference, in turn creating a 3D representation of the environment.

- Additionally, 3D ToF sensors are compact, energy-efficient, and offer high-speed, accurate distance measurement, which makes it ideal for various applications including robotics, consumer electronics, automotive, healthcare, and others.

- For instance, Infineon Technologies AG offers REAL3 model of 3D image sensor based on time-of flight (ToF) technology in its product portfolio. The ToF-based 3D image sensors offer several features such as accurate & precise depth sensing, high resolution, long range, lower power consumption, and others. The sensors are designed for both consumer and industrial applications.

- Therefore, the rising developments associated with 3D ToF sensors are driving the 3D sensor market trends.

By Sales Channel:

Based on sales channel, the market is segmented into direct sales and distributor sales.

Trends in the sales channel:

- Factors including the availability of excellent support and warranty, higher product quality, and reliable shipping and return policies are key prospects driving the direct sales channel segment.

- Factors such as higher accessibility to a variety of products, higher flexibility, and expanded reach are major determinants for driving the distributor sales channel segment.

The direct sales segment accounted for a significant revenue in the overall three-dimensional sensor market share in 2024.

- In direct sales channel, three-dimensional sensors are sold directly to customers through numerous physical outlets, including company outlets, among others.

- Moreover, the direct sales channel also consists of an online mode, wherein the manufacturers sell the sensors through its own company websites.

- Additionally, purchasing three-dimensional sensors from direct sales channel offers numerous benefits, including faster response time, higher product quality, higher return on investments, competitive pricing, and others, which are key determinants for increasing the purchase of these sensors from direct sales channel.

- For instance, Teledyne is a three-dimensional sensor manufacturer that offers a broad range of three-dimensional sensors for direct purchase through the company website.

- Therefore, the increasing availability of three-dimensional sensors in direct sales channels is driving the market.

The distributor sales segment is anticipated to register the fastest CAGR during the forecast period.

- The distributor sales channel involves an indirect distribution of three-dimensional sensors, wherein the sensors are purchased from several regional distributors operating in multiple regions worldwide.

- Moreover, distributor sales channels provide several benefits, including increased market reach, reduced capital expenditure, increased cost efficiency, and others. The above benefits of distributor sales channels are further increasing its utilization for sales of three-dimensional sensors.

- For instance, Mouser Electronics Inc., DigiKey Corporation, Arrow Electronics, Premier Farnell Limited, and others are few of the distributors of three-dimensional sensors.

- Hence, the increasing availability of three-dimensional sensors in distributor sales channels is anticipated to boost the market during the forecast period.

By End User:

Based on the end user, the market is segmented into consumer electronics, automotive, aerospace & defense, healthcare, retail & e-commerce, robotics, transportation & logistics, and others.

Trends in the end user:

- Factors including the increasing production of automobiles, rising adoption of electric vehicles (EVs), progressions in autonomous driving systems, and growing integration of enhanced automobile sensors and safety solutions are primary aspects driving the automotive segment.

- Factors such as rising penetration of smartphones, laptops, and other consumer devices integrated with advanced features, increasing popularity of wearable devices, and rising advancements in consumer electronics, including IoT and AI, are key trends driving the consumer electronics segment.

The consumer electronics segment accounted for the largest revenue share in the market in 2024.

- Three-dimensional sensors are primarily used in the consumer electronics industry, specifically in smartphones, gaming consoles, AR devices, and smart home devices, among others.

- These sensors are used for improving user experiences through features such as facial recognition, gesture control, and augmented reality (AR).

- Moreover, the integration of these sensors in consumer electronics devices offers several benefits, including enhanced user interaction, improved device functionality, and others.

- For instance, according to the India Brand Equity Foundation (IBEF), the overall smartphone production in India observed a substantial growth, and the smartphone sector was valued at USD 49.55 billion in FY2023-24.

- According to the analysis, the growing consumer electronics sector is increasing the adoption of three-dimensional sensors, thereby driving the market.

The automotive segment is anticipated to register a significant CAGR during the forecast period.

- Three-dimensional sensors are being increasingly used in the automotive industry, particularly in the development of advanced driver-assistance systems (ADAS) and autonomous vehicles.

- These sensors are crucial for enhancing safety, improving driving automation, and providing a more convenient and comfortable driving experience.

- Moreover, three-dimensional sensors enable features such as lane departure warnings, adaptive cruise control, and emergency braking by providing real-time environment mapping and object detection.

- Further, self-driving or autonomous cars heavily rely on 3D sensors to perceive their surroundings to enable safe navigation and intelligent decision-making.

- For instance, according to the International Organization of Motor Vehicle Manufacturers, the total production of passenger cars in Europe reached up to 15,449,729 units in 2023, representing an increase of nearly 13% as compared to 2022.

- Consequently, the increasing automotive production and rising integration of ADAS in modern vehicles are expected to drive the market growth during the forecast period.

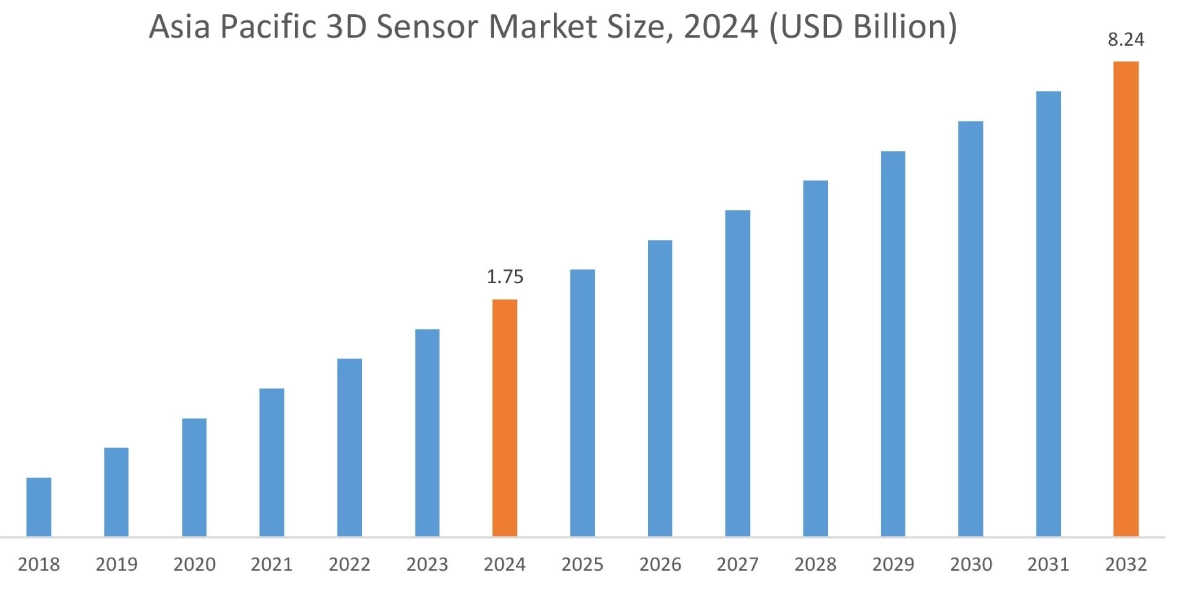

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

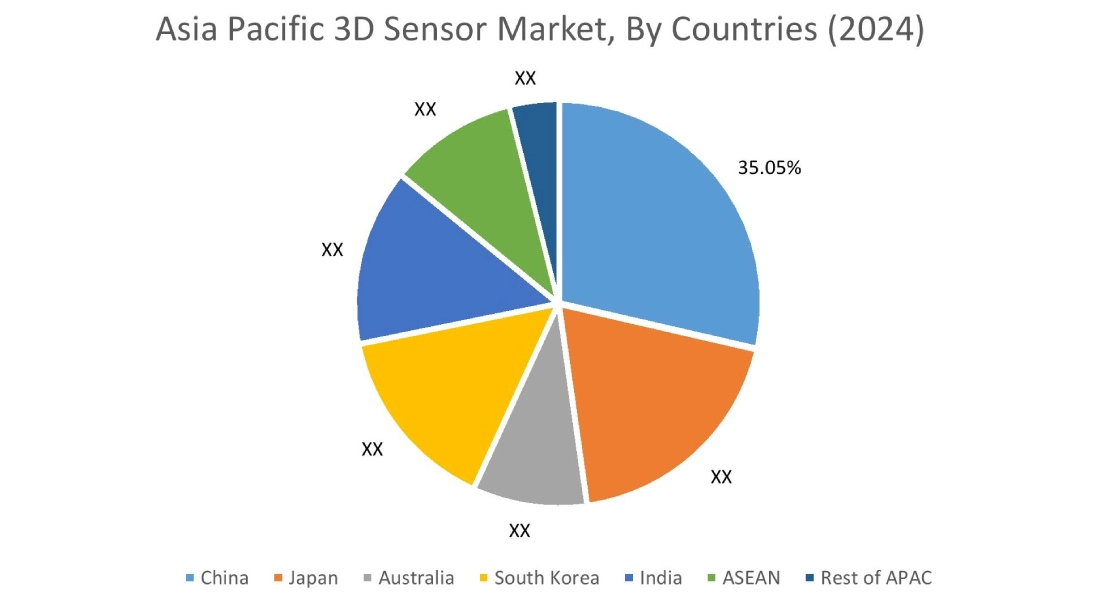

Asia Pacific region was valued at USD 1.75 Billion in 2024. Moreover, it is projected to grow by USD 2.09 Billion in 2025 and reach over USD 8.24 Billion by 2032. Out of this, China accounted for the maximum revenue share of 35.05%. As per the 3D sensor market analysis, the adoption of three-dimensional sensors in the Asia-Pacific region is primarily driven by growing consumer electronics, automotive, robotics, and logistics sectors, among others. Additionally, the rising production of consumer electronic devices and increasing integration of advanced sensing solutions in consumer devices are further accelerating the 3D sensor market expansion.

- For instance, according to the India Brand Equity Foundation, the value of consumer electronics and appliances sector in India reached up to USD 9.84 billion in 2021, and it is estimated to grow at a substantial rate to reach USD 21.18 billion by 2025. Consequently, the above factors are further driving the market in the Asia-Pacific region.

North America is estimated to reach over USD 10.30 Billion by 2032 from a value of USD 2.30 Billion in 2024 and is projected to grow by USD 2.73 Billion in 2025. In North America, the growth of the 3D sensor industry is driven by the rising adoption of three-dimensional sensors in aerospace & defense, automotive, healthcare, and other industrial sectors. Similarly, rising advancements associated with autonomous vehicles are contributing to the 3D sensor market demand.

- For instance, in October 2024, Tesla introduced the Cybercab, the company’s robotaxi, and also announced plans to commence autonomous driving of its Model 3 and Model Y cars in U.S. states including California and Texas in 2025. The above factors are expected to propel the 3D sensor market trends in North America during the forecast period.

Meanwhile, the regional analysis depicts that favorable government measures for industrial automation, rising investments in electric vehicle manufacturing, increasing aircraft production, and significant advancements in medical devices are driving the 3D sensor market demand in Europe. Furthermore, according to the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as growing logistics sector, along with rising consumer electronics production, and increasing investments in advanced automobile technologies, among others.

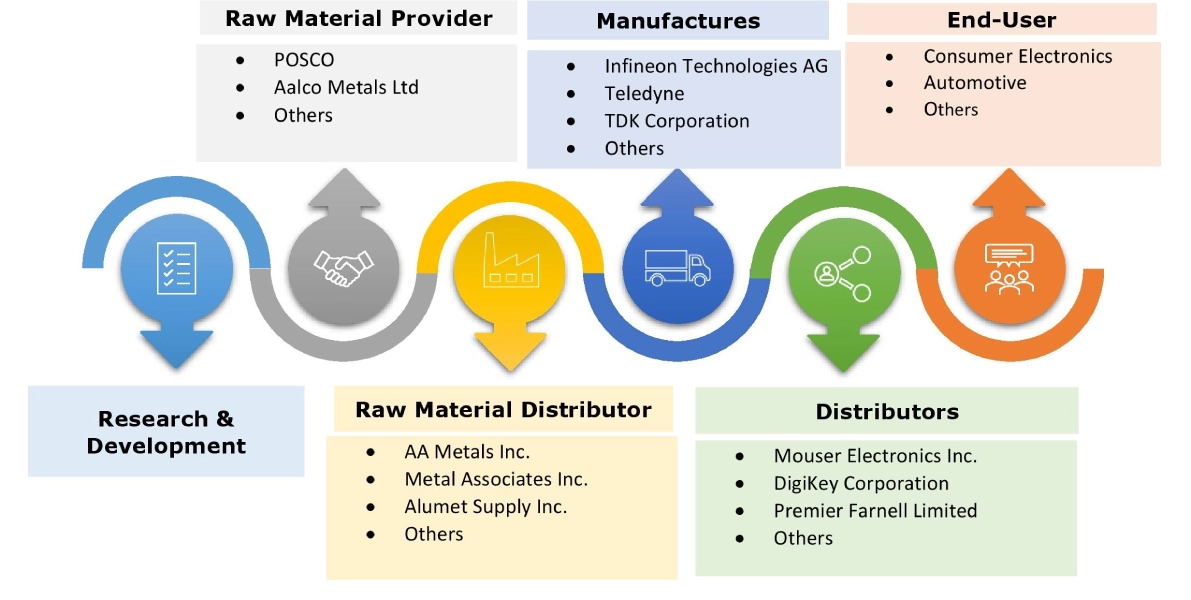

Top Key Players and Market Share Insights:

The global 3D sensor market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the 3D sensor market. Key players in the 3D sensor industry include-

- Infineon Technologies AG (Germany)

- Teledyne (USA)

- IFM Electronic (Germany)

- Texas Instruments Incorporated (USA)

- Microchip Technology Inc. (USA)

- TOPPAN Holdings Inc. (Japan)

- TDK Corporation (Japan)

- Samsung (South Korea)

- Sony Corporation (Japan)

- Qualcomm Technologies Inc. (USA)

- STMicroelectronics (Switzerland)

Recent Industry Developments :

Product launches

- In November 2024, TOPPAN Holdings Inc. announced that it has improved its first-generation 3D ToF sensor model, with a more compact design and relatively lower power consumption. This new and upgraded 3D ToF sensor features higher 3D sensing accuracy for use in robotics and spatial mapping, in turn expanding its potential application range.

- In February 2024, STMicroelectronics expanded its 3D depth sensing portfolio with the launch of its new 3D time-of-flight (ToF) sensors. The 3D ToF sensors are designed for applications including virtual reality, camera assist, robotics, 3D webcam, and smart buildings, among others.

3D Sensor Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 27.33 Billion |

| CAGR (2025-2032) | 18.2% |

| By Product Type |

|

| By Technology |

|

| By Sales Channel |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the 3D sensor market? +

The 3D sensor market was valued at USD 6.05 Billion in 2024 and is projected to grow to USD 27.33 Billion by 2032.

Which is the fastest-growing region in the 3D sensor market? +

Asia-Pacific is the region experiencing the most rapid growth in the 3D sensor market.

What specific segmentation details are covered in the 3D sensor report? +

The 3D sensor report includes specific segmentation details for product type, technology, sales channel, end user, and region.

Who are the major players in the 3D sensor market? +

The key participants in the 3D sensor market are Infineon Technologies AG (Germany), Teledyne (USA), TDK Corporation (Japan), Samsung (South Korea), Sony Corporation (Japan), Qualcomm Technologies Inc. (USA), STMicroelectronics (Switzerland), IFM Electronic (Germany), Texas Instruments Incorporated (USA), Microchip Technology Inc. (USA), TOPPAN Holdings Inc. (Japan), and others.