Adhesion Barrier Market Size:

Adhesion Barrier Market size is estimated to reach over USD 1,526.36 Million by 2032 from a value of USD 825.18 Million in 2024 and is projected to grow by USD 873.87 Million in 2025, growing at a CAGR of 7.2% from 2025 to 2032.

Adhesion Barrier Market Scope & Overview:

An adhesion barrier, also known as an adhesion prevention barrier, refers to materials that are used during surgery for physically separating internal tissues and organs, which prevents them from abnormally sticking together while they heal. The barrier helps in creating a temporary protective layer while facilitating healthy tissue to recover without sticking to other structures, and further degrades and is absorbed by the body after a few days. Moreover, these barriers are typically composed of materials such as films, gels, and others, which form a temporary physical barrier, in turn decreasing the risk of complications such as chronic pain, bowel obstruction, and other issues often caused by post-operative adhesions.

How is AI Transforming the Adhesion Barrier Market?

The integration of AI is significantly transforming the adhesion barrier market. AI integration helps in accelerating new material development for adhesion prevention barrier, improving surgical planning for personalized barrier application, along with optimizing manufacturing processes through automation and quality control, among others. Moreover, AI-powered automated systems can be used for precise layering and packaging of barriers, which ensures consistent product quality and decreases manual errors.

Additionally, AI-driven systems help in optimizing manufacturing processes, in turn increasing efficiency as well as scalability for production of adhesion prevention barrier. The aforementioned applications contribute to more efficient, precise, as well as personalized adhesion prevention solutions, thereby improving patient outcomes and reducing costs. Hence, the above factors are expected to positively impact the market growth in the upcoming years.

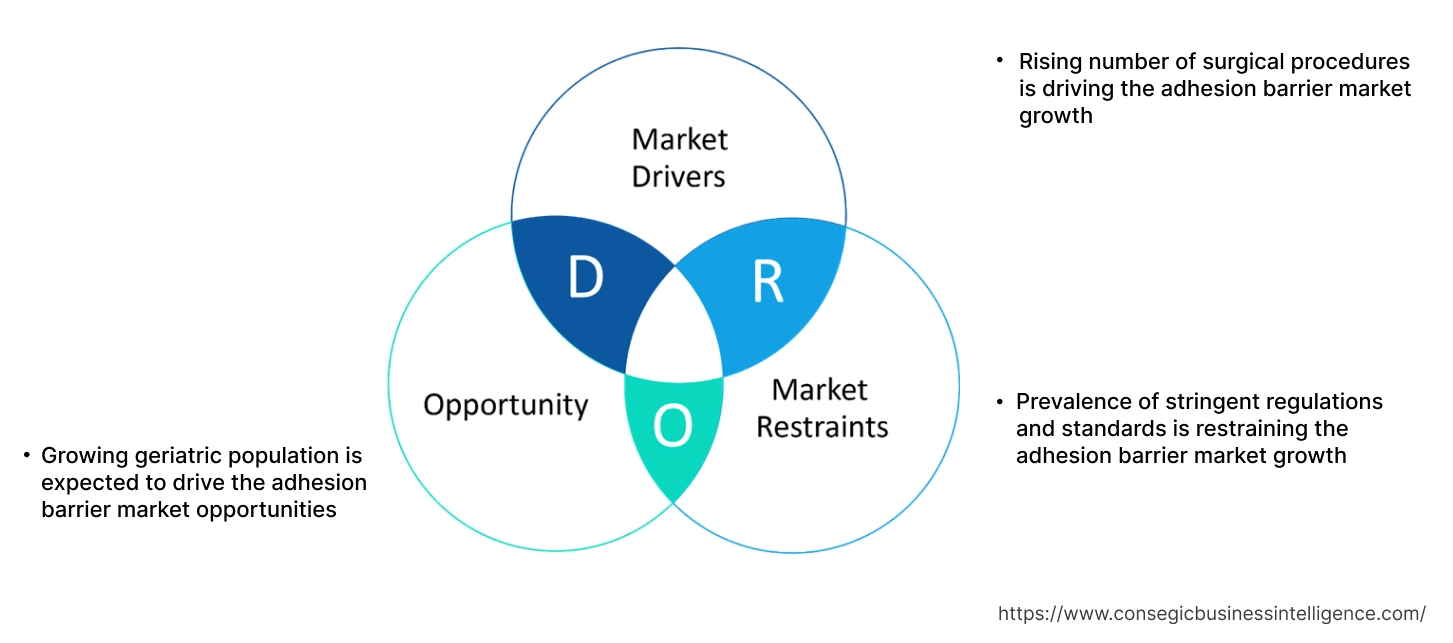

Adhesion Barrier Market Dynamics - (DRO) :

Key Drivers:

Rising number of surgical procedures is driving the adhesion barrier market growth

The increasing prevalence of chronic diseases, growing geriatric population, along with advancements in surgical methods are among the key factors driving the growth of surgical procedures. Moreover, adhesion barriers are mainly used for preventing the formation of post-surgical scar tissue, which may also result in complications such as chronic pain, organ dysfunction, and others. Additionally, the rise in number of surgical procedures, specifically in areas such as abdominal surgery, gynecology, and orthopedic procedures, also increases the risk of adhesions, in turn driving the demand for effective adhesion prevention barrier solutions.

- For instance, according to the International Society of Aesthetic Plastic Surgery (ISAPS), over 17.4 million surgical procedures were performed by plastic surgeons in the year 2024.

Consequently, the rising number of surgical procedures along with increasing need for effective adhesion prevention barrier solutions are driving the adhesion barrier market size.

Key Restraints :

Prevalence of stringent regulations and standards is restraining the adhesion barrier market growth

Adhesion prevention barrier manufacturers have to comply with numerous stringent standards associated with adhesion prevention barriers, which is a prime factor restricting the market growth. For instance, adhesion prevention barrier manufacturers have to comply with various standards from the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), CE (Conformité Européenne), and others.

Moreover, adhesion barriers are subject to stringent guidelines from agencies such as the FDA and EMA, mostly requiring extensive preclinical and clinical testing for proving safety and efficiency, including biocompatibility, proper degradation, and prevention of negative outcomes such as inflammation or infection. Compliance also involves adhering to these guidelines, investing in thorough testing and validation, and making sure products meet specific criteria.

Additionally, CE marking signifies compliance of adhesion prevention barriers with European Union safety, health, and environmental protection standards. Thus, the prevalence of the aforementioned standards associated with adhesion prevention barriers is hindering the adhesion barrier market expansion.

Future Opportunities :

Growing geriatric population is expected to drive the adhesion barrier market opportunities

The growing geriatric population worldwide is expected to offer lucrative aspects for market growth, as older adults usually need to undergo more surgical procedures due to certain age-related conditions. Moreover, the elderly population is highly prone to bone and joint disorders, which leads to a rise in joint replacements, spinal surgeries, and other trauma-related procedures. Similarly, the incidence of heart-related diseases also increases considerably with age, in turn driving the need for cardiovascular surgeries. The above factors are expected to contribute to higher demand for adhesion prevention solutions for avoiding post-surgical complications, thereby boosting the market.

- For instance, according to the U.S. Census Bureau, the total number of Americans aged 65 and older is estimated to increase from 58 million in 2022 to 82 million by 2050. Likewise, the share of 65 and older age group in the U.S. is anticipated to increase from 17% to 23% of the total population.

Hence, according to the analysis, the growing geriatric population is projected to boost the adhesion barrier market opportunities during the forecast period.

Adhesion Barrier Market Segmental Analysis :

By Type:

Based on type, the market is segmented into synthetic and natural.

Trends in the type:

- Increasing trend in adoption of synthetic adhesion prevention barriers due to its several benefits, such as ease of use and application, consistent performance, cost-effectiveness, and versatility, is driving the market.

- Rising application of synthetic adhesion prevention barriers in surgical procedures, including abdominal, cardiovascular, gynaecological, and other procedures for preventing post-operative adhesions, is propelling the market.

The synthetic segment accounted for the largest revenue share in the adhesion barrier market share in 2024, and it is anticipated to register a significant CAGR during the forecast period.

- A synthetic adhesion prevention barrier refers to a material, primarily a gel or film, which is used in surgery for preventing post-operative adhesions.

- Moreover, synthetic barriers are composed of synthetic polymers, and they are also designed to be biocompatible, biodegradable, and can be easily absorbed by the body after serving their purpose.

- Additionally, the primary benefits of synthetic adhesion prevention barriers include consistent and predictable performance, ease of use and application, cost-effectiveness, bioresorbability, along with versatility across various surgical procedures, including abdominal, gynaecological, cardiovascular, and other procedures.

- For instance, Fziomed Inc. offers synthetic adhesion barriers in its product offering, which featuresproprietary dual-polymer technology that offers several clinical benefits such as improved safety, adhesion reduction, improved tissue adherence, ease of use, and versatility among others.

- According to the adhesion barrier market analysis, the increasing advancements associated with synthetic adhesion prevention barriers are further driving the adhesion barrier market size.

By Application:

Based on application, the market is segmented into general/abdominal surgeries, gynaecological surgeries, cardiovascular surgeries, neurological surgeries, orthopedic surgeries, reconstructive surgeries, and others.

Trends in the application:

- Factors including anincreasing incidence of chronic diseases, rising prevalence of conditions such as hernias and appendicitis , along with growing number of surgical procedures are key aspects driving the general/abdominal surgeries segment.

- Factors including rising prevalence of conditions such as uterine, ovarian, and cervical cancers, along with other gynaecological disorders, combined with advancements in minimally invasive surgical techniques like laparoscopy, are driving the gynaecological surgeries segment.

The general/abdominal surgeries segment accounted for a significant revenue in the overall market in 2024.

- General/abdominal surgeries refer to procedures that are performed within the abdomen along with areas between chest and pelvis for treating a range of conditions including appendicitis, gallstones , and hernias, among others.

- Common types of general/abdominal surgeries mainly include appendectomy, cystectomy , and hernia repair. These surgeries can be done through large incisions or smaller ones using a camera and instruments, also known as laparoscopy.

- Moreover, adhesion prevention barriers are mainly used in general/abdominal surgeries for creating a temporary physical barrier between tissues in order to prevent them from sticking together and forming scar tissue bands during the healing process.

- For instance, according to Fziomed Inc.,post-operative adhesions are common across a broad range of surgical areas, mostly occurring in 93% of cases following abdominal or pelvic surgery.

- Therefore, increasing adoption of adhesion prevention barriers for preventing tissue adhesion and complications after general/abdominal surgeries is driving the market.

The gynaecological surgeries segment is anticipated to register a substantial CAGR during the forecast period.

- Gynaecological surgery includes procedures on reproductive organs for conditions such as fibroids, ovarian cysts, endometriosis, cancers, and abnormal bleeding among others.

- Common types of gynaecological procedures include hysterectomy, myomectomy, and others. Moreover, several procedures are performed minimally invasively by using small incisions for improved patient outcomes as well as quicker recovery.

- Additionally, adhesion prevention barriers are often used in gynaecological surgeries for preventing formation of post-operative adhesions, which can lead to complications such as pain or infertility.

- For instance, Johnson & Johnson offers Gynecare Interceed, which is an absorbable adhesion prevention barrier that is specifically designed for use in gynaecological procedures such as myomectomy, ovarian surgery, tubal surgery, surgical treatment of endometriosis, and other related procedures.

- According to the analysis, the increasing application of adhesion prevention solutions in gynaecological surgeries is projected to boost the market during the forecast period.

By Formulation:

Based on formulation, the market is segmented into film, gel, liquid, and others.

Trends in the formulation:

- Rising adoption of adhesion prevention barrier films in various surgical procedures for decreasing post-surgical complications such as chronic pain, subfertility, and others is driving the market.

- Increasing advancements related to anti-adhesion gels for reducing post-operative adhesion formation, decreasing severity, and improving surgical outcomes and healing are propelling the market.

Film segment accounted for the largest revenue in the overall adhesion barrier market share in 2024.

- An adhesion prevention barrier film is usually applied to traumatized tissue surfaces during or after surgery for preventing them from sticking together as they heal.

- It acts as a temporary physical separation by creating a barrier that is absorbed by the body once the tissues have healed, usually within a few days.

- These films are primarily composed of bioresorbable materials such as hyaluronic acid and carboxymethylcellulose. It is used in various surgical procedures for decreasing complications such as chronic pain, subfertility, and others that are often caused by post-surgical adhesions.

- For instance, Baxter offers Seprafilm adhesion barrier in its product portfolio, which is a film-based adhesion prevention barrier that is capable of significantly reducing the incidence, extent, as well as severity of adhesions following abdominopelvic laparotomy surgeries.

- Therefore, increasing advancements related to adhesion prevention barrier films are driving the adhesion barrier market trends.

The gel segment is anticipated to register the fastest CAGR during the forecast period.

- Anti-adhesion gels refer to medical materials that are applied to surgical sites for preventing the formation of internal scar tissue, or adhesions, which can cause chronic pain and complications.

- Moreover, anti-adhesion gels create a temporary physical barrier that separates tissues, which are further absorbed into the body over time.

- Additionally, these gels are composed of materials such as hyaluronic acid, polyethylene oxide, carboxymethylcellulose, and others, and they are often used in a wide range of surgical procedures.

- For instance, Anika Therapeutics Inc.offers Hyalobarrier Gel/Hyalobarrier Gel Endo in its product offerings, which are sterile and transparent anti-adhesion gels designed to form a barrier for preventing or decreasing post-surgical adhesions in the abdomino-pelvic area.

- Hence, the increasing developments associated with anti-adhesion gels for preventing or decreasing post-surgical adhesions areprojected to boost the market during the forecast period.

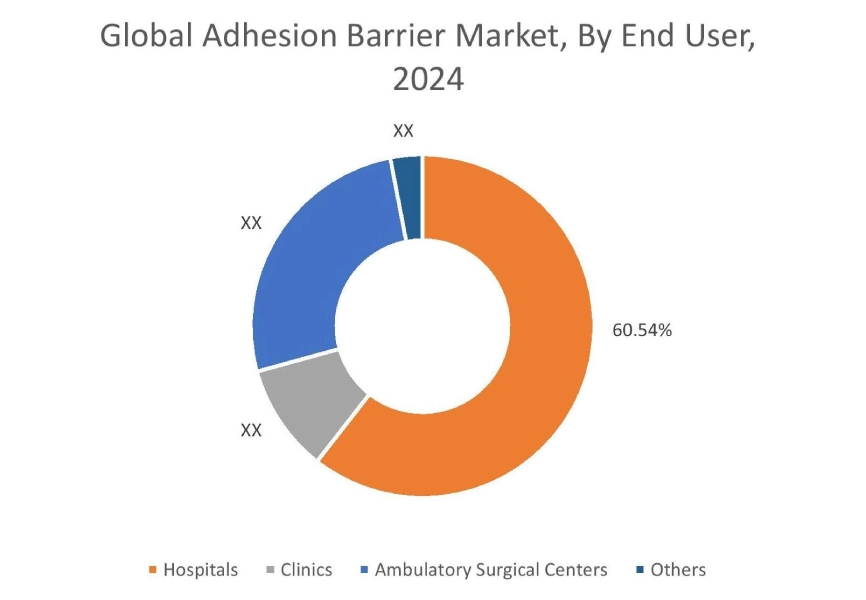

By End User:

Based on the end user, the market is segmented into hospitals, clinics, ambulatory surgical centers, and others.

Trends in the end user:

- There is a rising trend towards the adoption of adhesion prevention barriers in hospitals and clinics during surgical procedures for preventing any formation of post-operative tissue adhesion and reducing risk of complications associated with it.

- Factors such as increasing government spending on healthcare infrastructure, advancements in medical technology and surgical services, along with growing need for quality and accessible healthcare services are further driving the segment development.

The hospitals segment accounted for the largest revenue share of 60.54% in the market in 2024, and it is anticipated to register a substantial CAGR during the forecast period.

- In hospitals, adhesion prevention barriers are mainly used in several surgeries for physically separating tissues for preventing any formation of tissue adhesion, which can result in various complications such as chronic pain, bowel obstruction, infertility, and others.

- Moreover, these barriers are primarily composed of films, gels, or other bioresorbable materials, and are applied after surgery, acting as a temporary physical separation while tissues heal over several days.

- In addition, factors such as increasing government spending on healthcare infrastructure, rise of chronic and lifestyle-related diseases, advancements in medical technology and surgical services, along with growing need for quality and accessible healthcare services are key prospects driving the hospitals segment.

- Hence, the rising development of hospitals and increasing number of surgical procedures aredriving the market growth.

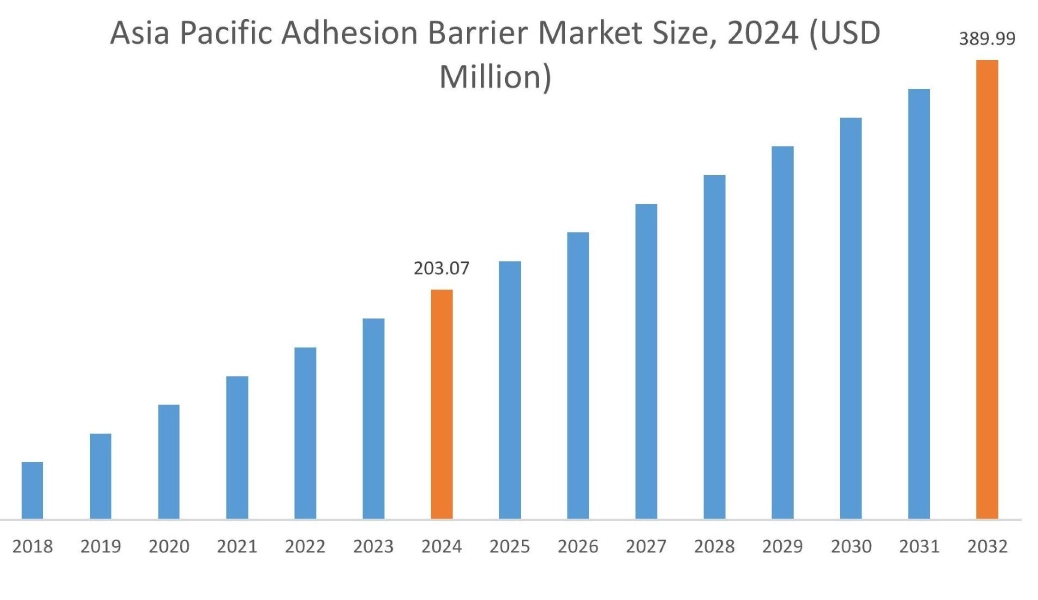

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

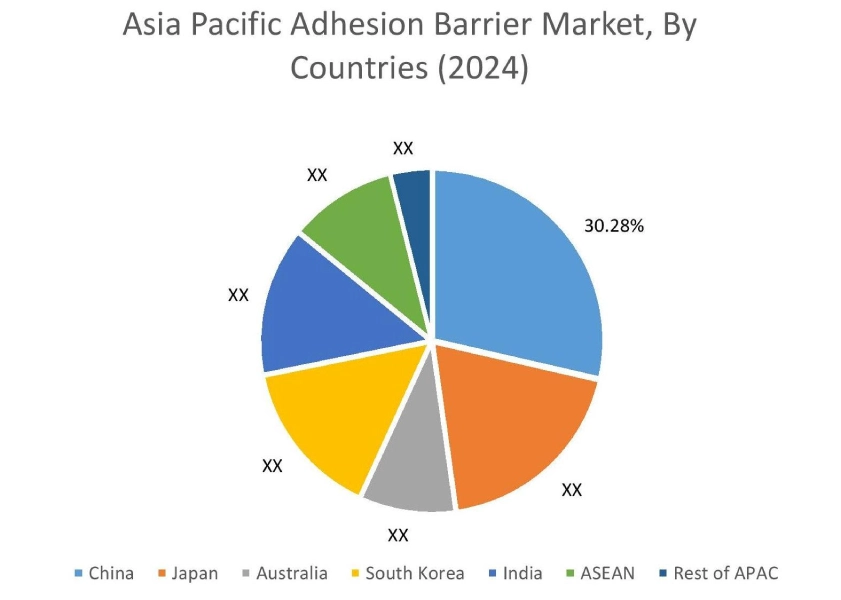

Asia Pacific region was valued at USD 203.07 Million in 2024. Moreover, it is projected to grow by USD 215.73 Million in 2025 and reach over USD 389.99 Million by 2032. Out of this, China accounted for the maximum revenue share of 30.28%. As per the adhesion barrier market analysis, the adoption of adhesion prevention barriers in the Asia-Pacific region is primarily driven by the rising prevalence of chronic diseases along with increasing investments in healthcare facilities among others. Similarly, the rising development of hospitals, growing geriatric population, and increasing number of surgical procedures are further accelerating the adhesion barrier market expansion.

- For instance, approximately 30 million surgical procedures are carried out in India every year, among which 85% of surgeries take place in smaller and medium-sized hospitals and nearly 15% of surgeries are conducted in corporate hospitals.The above factors are increasing the need for adhesion prevention solutions, in turn driving the market in the Asia-Pacific region.

North America is estimated to reach over USD 537.28 Million by 2032 from a value of USD 290.12 Million in 2024 and is projected to grow by USD 307.26 Million in 2025. In North America, the growth of the adhesion barrier industry is driven by the increasing prevalence of chronic diseases, along with rising cases of cardiovascular diseases, caused by factors such as urbanization, changing lifestyles, and rising obesity rates. Additionally, increasing government expenditure on improving healthcare infrastructure and services along with high volume of surgeries are further contributing to the adhesion barrier market demand.

- For instance, according to the American Hospital Association, there are approximately 6,093 hospitals across the United States, which mainly include community hospitals, federal government hospitals, and others. The above factors are expected to propel the adhesion barrier market trends in North America during the forecast period.

Meanwhile, according to the regional analysis, factors including the prevalence of elderly population, growing healthcare industry, and robust healthcare infrastructure are driving the adhesion barrier market demand in Europe. Furthermore, according to the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as increasing prevalence of cardiovascular diseases, and other chronic conditions, combined with the growing number of surgical procedures and rising need for post-operative tissue adhesion prevention solutions, among others.

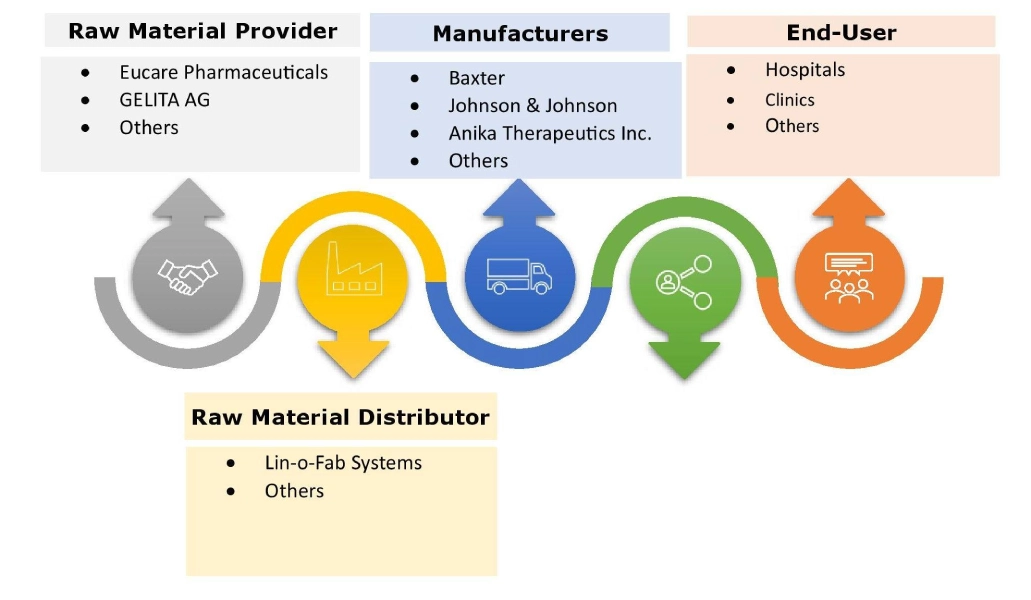

Top Key Players & Market Share Insights:

The global adhesion barrier market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the adhesion barrier market. Key players in the adhesion barrier industry include-

- Baxter (USA)

- Johnson & Johnson (USA)

- Medtronic (Ireland)

- Betatech Medical (Turkey)

- GUNZE Limited (Japan)

- Anika Therapeutics Inc. (USA)

- FzioMed Inc. (USA)

- Integra LifeSciences (USA)

- MAST Biosurgery USA Inc. (USA)

- Terumo Corporation (Japan)

Recent Industry Developments :

Product Launch:

- In 2022, Gunze Limited announced the launch of TENALEAF, which is its sheet-type absorbable adhesion barrier that is made in Japan. The product offers surgeons with a new option during open surgery as well as minimally invasive surgery, which offers several features such as easy manipulation, modest adhesive strength for repositioning as well as conformable placement.

Adhesion Barrier Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1,526.36 Million |

| CAGR (2025-2032) | 7.2% |

| By Type |

|

| By Formulation |

|

| By Application |

|

| By End-user |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the adhesion barrier market? +

The adhesion barrier market was valued at USD 825.18 Million in 2024 and is projected to grow to USD 1,526.36 Million by 2032.

Which is the fastest-growing region in the adhesion barrier market? +

Asia-Pacific is the region experiencing the most rapid growth in the adhesion barrier market.

What specific segmentation details are covered in the adhesion barrier report? +

The adhesion barrier report includes specific segmentation details for type, formulation, application, end user, and region.

Who are the major players in the adhesion barrier market? +

The key participants in the adhesion barrier market are Baxter (USA), Johnson & Johnson (USA), Anika Therapeutics Inc. (USA), FzioMed Inc. (USA), Integra LifeSciences (USA), MAST Biosurgery USA Inc. (USA), Terumo Corporation (Japan), Medtronic (Ireland), Betatech Medical (Turkey), GUNZE Limited (Japan), and others.

Which region leads the adhesion barrier market? +

North America holds the largest market share due to advanced healthcare infrastructure and a high number of surgical procedures.