Cryptocurrency Mining Market Size:

Cryptocurrency Mining Market Size is estimated to reach over USD 4.56 Billion by 2032 from a value of USD 2.07 Billion in 2024 and is projected to grow by USD 2.25 Billion in 2025, growing at a CAGR of 11.6% from 2025 to 2032.

Cryptocurrency Mining Market Scope & Overview:

Cryptocurrency mining is the process by which new units of cryptocurrency are created, and transactions are verified and added to the blockchain, a public digital ledger. Miners use powerful computers to solve complex cryptographic puzzles, and the first miner to find the solution gets to add a new block of verified transactions to the blockchain and is typically rewarded with newly minted cryptocurrency and transaction fees. This process is essential for the operation and security of many cryptocurrencies, ensuring the integrity of the network and preventing double-spending.

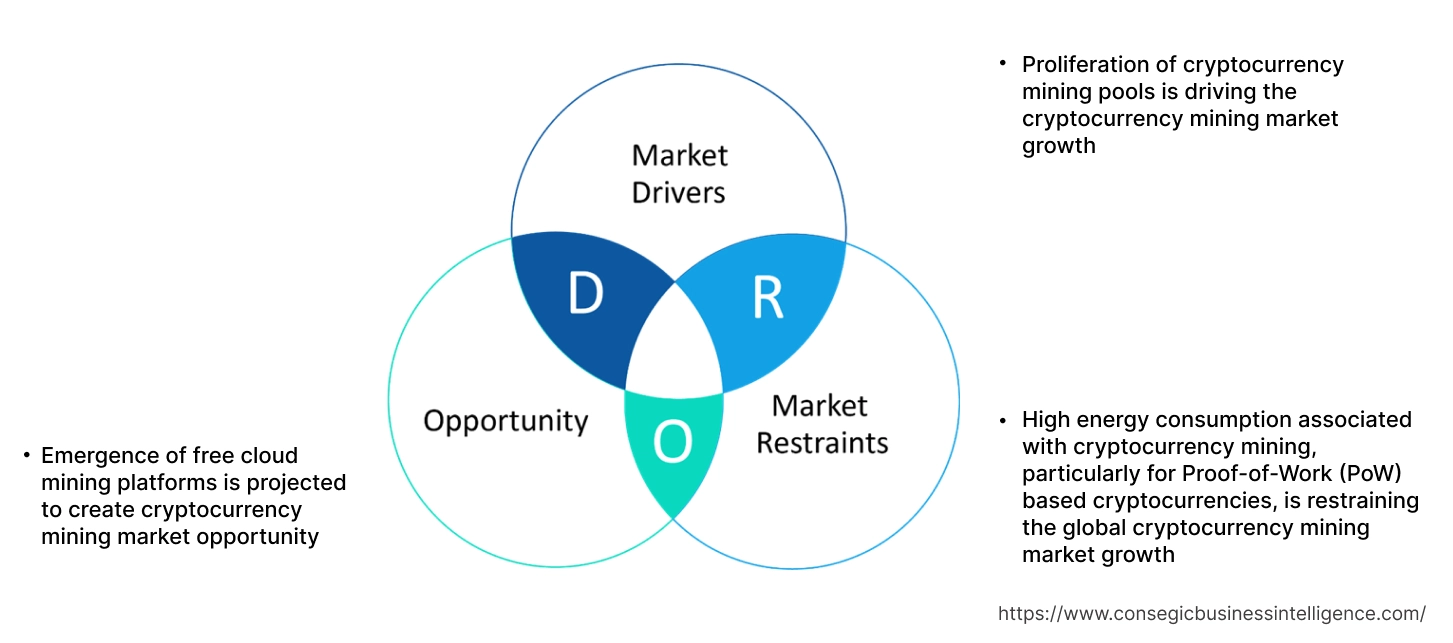

Cryptocurrency Mining Market Dynamics - (DRO) :

Key Drivers:

Proliferation of cryptocurrency mining pools is driving the cryptocurrency mining market growth

Solo mining for popular cryptocurrencies is becoming difficult and requires substantial investment in specialized hardware (like ASICs) and significant electricity consumption. Mining pools allow individuals with less powerful hardware to combine their computational resources with others. This collective effort increases their chances of earning rewards, making mining accessible to a broader range of participants. Additionally, mining pools have optimized infrastructure and achieve economies of scale in terms of electricity procurement and cooling solutions. By joining a pool, miners can indirectly benefit from these efficiencies, potentially reducing their individual operational costs, consequently driving the cryptocurrency mining market size.

- For instance, in Dec 2024, BitFuFu Inc. launched its own Bitcoin mining pool, "BitFuFu Pool,", offering very low commission rates starting at 0.4%. Available to BitFuFu app users buying cloud mining or miner services, the pool will initially focus on Bitcoin, with plans for future expansion to other cryptocurrencies.

Consequently, proliferation of cryptocurrency mining pools is driving the cryptocurrency mining market growth.

Key Restraints:

High energy consumption associated with cryptocurrency mining, particularly for Proof-of-Work (PoW) based cryptocurrencies, is restraining the global cryptocurrency mining market growth

Cryptocurrency mining, especially Bitcoin, consumes vast amounts of electricity, often generated from fossil fuels, leading to significant carbon dioxide emissions, contributing to climate change. For instance, Bitcoin mining's annual electricity consumption is comparable to that of entire countries like Poland. Its carbon emissions are estimated to be equivalent to those of countries such as Greece or Oman. Additionally, growing public awareness of the environmental consequences of crypto mining negatively impacts its image. Investors and institutions are increasingly focusing on Environmental, Social, and Governance (ESG) factors, making energy-intensive cryptocurrencies less attractive, limiting investment in mining infrastructure.

Therefore, as per the analysis, these combined factors are significantly hindering cryptocurrency mining market share.

Future Opportunities :

Emergence of free cloud mining platforms is projected to create cryptocurrency mining market opportunity

Traditional crypto mining requires significant investment in hardware, cooling systems, and infrastructure. Free cloud mining eliminates these initial capital expenditures, allowing individuals with limited funds to participate in mining. Additionally, free cloud mining platforms handle all the technical complexities, making it accessible to individuals without any prior mining experience. Users can start earning simply by signing up and choosing a mining plan, hence boosting cryptocurrency mining market demand.

- For instance, in Apr 2025, ZA Miner launched a free cloud mining platform, allowing Bitcoin (BTC) and Dogecoin (DOGE) fans globally to mine cryptocurrencies without initial costs or hardware.

Hence, based on the analysis, emergence of free cloud mining platforms is expected to create cryptocurrency mining market opportunities.

Cryptocurrency Mining Market Segmental Analysis :

By Offering:

Based on the Offering, the market is categorized into Hardware and Software.

Trends in the Offering:

- Increasing trend towards the adoption of Application-Specific Integrated Circuits (ASICs) designed for specific algorithms and cryptocurrencies.

- Mining pool software is evolving to offer better user interfaces, more detailed statistics, improved payout systems, and enhanced security features.

Hardware accounted for the largest revenue share in the market in 2024.

- Manufacturers are innovating advanced ASICs to reduce power consumption per unit of hash rate (J/TH) to significantly improve energy efficiency.

- Additionally, increasing trend towards creating more compact and densely packed mining hardware to maximize hash rate within a limited space, especially for large-scale mining operations.

- Moreover, advanced cooling solutions like immersion cooling and efficient air-cooling systems are gaining traction to improve hardware longevity and performance, further boosting the cryptocurrency mining market size.

- For instance, in Mar 2025, Auradine introduced Teraflux AH3880 Bitcoin miner, a hydro-cooled, rack-mounted unit boasting an impressive 600 TH/s hash rate and an industry-leading efficiency of 14.5 J/TH in normal mode. This next-generation miner sets new standards for speed, reliability, and energy efficiency, while also offering a viable solution for operators looking to integrate Bitcoin mining with liquid-cooled AI data centers within the same infrastructure.

- Thus, as per the cryptocurrency mining market analysis, the aforementioned factors are driving hardware segment.

Software is projected to register the fastest CAGR during the forecast period.

- Mining software offers remote management capabilities, allowing miners to monitor and control their rigs remotely. Features include real-time statistics on hash rate, temperature, and fan speed, as well as remote rebooting and configuration.

- Some mining software is integrating seamlessly with cryptocurrency wallets and exchanges to streamline the process of receiving and trading mined coins.

- Software that automatically switches between different cryptocurrencies or mining algorithms based on real-time profitability is becoming increasingly popular, allowing miners to maximize their earnings.

- For instance, Awesome Miner is a comprehensive Windows-based software application designed for managing and monitoring cryptocurrency mining operations. It caters to both small-scale individual miners and large-scale mining farms, offering a centralized platform to control.

- Therefore, as per analysis, the above-mentioned factors are projected to drive the growth of software segment during the upcoming years.

By Process:

Based on the Process, the market is classified into Mining and Transaction.

Trends in the Process:

- Increased trend towards the adoption of the Proof-of-Stake (PoS) consensus mechanism and its variants, which require significantly less energy than PoW.

- Advancements and increased adoption of Layer-2 solutions (like Ethereum's rollups and Bitcoin's Lightning Network) to enhance transaction speed and reduce fees on main blockchains.

Transaction accounted for the largest revenue share in 2024 and is predicted to register the fastest CAGR during the forecast period.

- Growing focus on solutions that enable different blockchain networks to communicate and exchange value seamlessly (e.g., cross-chain bridges, protocols like IBC used by Cosmos, and projects like Polkadot).

- Development and implementation of privacy-preserving technologies like zero-knowledge proofs (ZKPs) and fully homomorphic encryption (FHE) to enable confidential transactions is also driving the cryptocurrency mining market demand.

- Continued growth and maturation of Decentralized Finance (DeFi) platforms, offering a wider range of financial services without traditional intermediaries is driving the market trend.

- Thus, as per the cryptocurrency mining market analysis, the aforementioned factors are driving transaction segment growth.

By Type:

Based on the Type, the market is categorized into Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dash, and Others.

Trends in the Type:

- Increasing trend of Ethereum (ETH) following the transition to Proof-of-Stake (PoS) to secure the network and earn rewards.

- Bitcoin Cash positions itself as a peer-to-peer electronic cash system with fast payments and low fees, aiming for wider adoption as a medium of exchange.

Bitcoin accounted for the largest revenue share in 2024 and is also predicted to register the fastest CAGR.

- Bitcoin mining companies are exploring diversification into AI and high-performance computing (HPC) to leverage their infrastructure, hence driving the market trend.

- Miners are looking for regions with cheaper and more abundant energy, including those with access to renewable sources, which in turn, is boosting market size.

- For instance, in Apr 2025, DN Miner enhanced its cloud mining platform with the latest generation of mining hardware, improved cooling, and stronger security. This major infrastructure upgrade positions DN Miner as a leading provider, aiming to make Bitcoin mining more accessible and efficient for both new and seasoned cryptocurrency enthusiasts.

- In conclusion, the above-mentioned reasons are contributing notably in spurring the market demand.

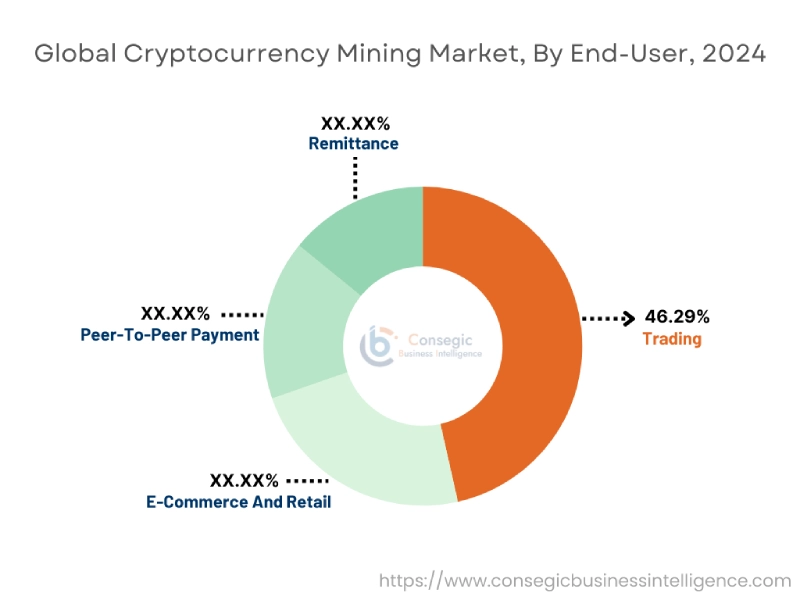

By End-User:

Based on the End-User, the market is categorized into Trading, E-commerce and Retail, Peer-to-Peer Payment, and Remittance.

Trends in the End-User:

- Cryptocurrencies offer the potential for significantly lower transaction fees compared to traditional payment gateways, benefiting merchants.

- Stablecoins like USDT and USDC are gaining traction for P2P payments due to their price stability.

Trading accounted for the largest revenue share of 46.29% in 2024 and is predicted to register the fastest CAGR during the forecast period.

- Cryptocurrencies like Ripple (XRP) and Solana (SOL) are experiencing increased trading volumes, indicating growing interest in alternative digital assets, hence driving the market demand.

- Newer assets like PEPE and POPCAT are attracting speculative trading activity, highlighting a segment focused on high-risk, high-reward investments.

- Traders increasingly rely on technical analysis, chart patterns, and indicators to make informed decisions.

- Decentralized Finance (DeFi) platforms are becoming integral to trading strategies, offering lending, borrowing, and yield farming opportunities.

- For instance, in Apr 2025, Interactive Brokers expanded its cryptocurrency offerings by listing Chainlink (LINK), Avalanche (AVAX), and Sui (SUI) for trading. These new additions, accessible via accounts at Zero Hash LLC, join a wide selection of popular cryptocurrencies already available on the platform, including Bitcoin, Ethereum, and Ripple. This move provides investors with even broader access to the digital asset market.

- In conclusion, the aforementioned factors are contributing to the global cryptocurrency mining market expansion.

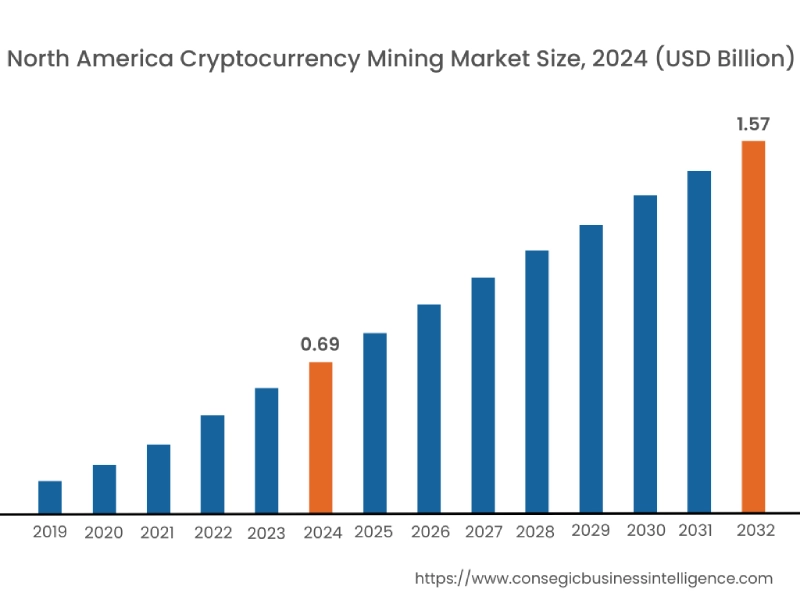

Regional Analysis:

The global cryptocurrency mining market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

North America region was valued at USD 0.69 Billion in 2024. Moreover, it is projected to grow by USD 0.75 Billion in 2025 and reach over USD 1.57 Billion by 2032. Out of these, U.S. accounted for the largest revenue share of 63.60% in 2024. North America boasts a well-established and advanced technological infrastructure, which is crucial for efficient cryptocurrency mining operations. Additionally, increasing acceptance and investment in cryptocurrencies by major institutions have promoted the market and fueled growth. Moreover, the presence of key players in the region is also contributing notably in driving the market demand.

- For instance, Soluna Holdings, Inc. recently signed a two-year hosting agreement with Blockware. Under this agreement, Blockware will deploy approximately 1,500 of its next-generation S21+ mining units at Soluna's Project Dorothy 2 data center in Texas.

Asia Pacific was valued at USD 0.54 Billion in 2024. Moreover, it is projected to grow by USD 0.59 Billion in 2025 and reach over USD 1.19 Billion by 2032. Asia Pacific remains a crucial hub for the manufacturing of cryptocurrency mining hardware, with companies like Bitmain playing a significant role in the global supply chain. Additionally, increasing technological adoption, and growing demand for digital assets continue to contribute to the development of its cryptocurrency mining sector.

As per the cryptocurrency mining market analysis, Europe is witnessing a growing interest in cryptocurrency mining, driven by technological advancements and increasing acceptance of digital currencies. However, the region faces challenges related to high electricity costs and diverse regulatory landscapes. Latin America presents a landscape for cryptocurrency mining, with countries like Argentina and Venezuela offering low electricity costs. The region's potential is supported by a growing interest in cryptocurrencies as a hedge against economic instability. Middle East and Africa demonstrate a growing interest in cryptocurrency mining, driven by increasing digital adoption and, in some areas, access to cheap energy sources.

Top Key Players and Market Share Insights:

The market is highly competitive with major players providing cryptocurrency mining to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the cryptocurrency mining industry include-

- Marathon Digital Holdings (United States)

- Riot Platforms (United States)

- Iris Energy Limited (Australia)

- Canaan Inc. (China)

- Bit Digital, Inc. (United States)

- HIVE Digital Technologies (Canada)

- Argo Blockchain (United Kingdom)

- BitFuFu Inc. (Singapore)

- Cipher Mining (United States)

- CleanSpark (United States)

- Hut 8 Corp (Canada)

- Bitfarms Ltd. (Canada)

- Core Scientific (United States)

- Bitdeer Technologies Group (Singapore)

- TeraWulf Inc. (United States)

Recent Industry Developments :

Expansion:

- In Apr 2025, Soluna Holdings announced plans for "Project Ellen," a new 100MW green data center in South Texas that will be powered by a co-located 145MW wind farm. This initiative aims to support intensive computing applications like Bitcoin mining and AI, leveraging renewable energy for sustainable operations.

- In Apr 2025, PayPal has expanded its cryptocurrency offerings, now allowing users on both PayPal and Venmo to directly buy, hold, sell, and transfer Chainlink (LINK) and Solana (SOL).

Agreement:

- In Mar 2025, Trump Media and Technology Group, through its Truth.Fi brand, has announced a preliminary agreement with Crypto.com to develop and launch a series of exchange-traded funds (ETFs) and exchange-traded products.

Cryptocurrency Mining Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 4.56 Billion |

| CAGR (2025-2032) | 11.6% |

| By Offering |

|

| By Process |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the cryptocurrency mining market? +

The cryptocurrency mining market size is estimated to reach over USD 4.56 Billion by 2032 from a value of USD 2.07 Billion in 2024 and is projected to grow by USD 2.25 Billion in 2025, growing at a CAGR of 11.6% from 2025 to 2032.

What specific segmentation details are covered in the cryptocurrency mining report? +

The cryptocurrency mining report includes specific segmentation details for offering, process, type, end-user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the cryptocurrency mining market, software is the fastest-growing segment during the forecast period.

Who are the major players in the Cryptocurrency Mining market? +

The key participants in the Cryptocurrency Mining market are Marathon Digital Holdings (United States), Riot Platforms (United States), Cipher Mining (United States), CleanSpark (United States), Hut 8 Corp (Canada), Bitfarms Ltd. (Canada), Core Scientific (United States), Bitdeer Technologies Group (Singapore), TeraWulf Inc. (United States), Iris Energy Limited (Australia), Canaan Inc. (China), Bit Digital, Inc. (United States), HIVE Digital Technologies (Canada), Argo Blockchain (United Kingdom), BitFuFu Inc. (Singapore) and Others.