Digital Subscriber Line (DSL) Chipsets Market Size:

Digital Subscriber Line (DSL) Chipsets Market size is estimated to reach over USD 2,154.89 Million by 2032 from a value of USD 1,248.60 Million in 2024 and is projected to grow by USD 1,314.50 Million in 2025, growing at a CAGR of 6.4% from 2025 to 2032.

Digital Subscriber Line (DSL) Chipsets Market Scope & Overview:

DSL (Digital Subscriber Line) chipsets are specialized semiconductor components that enable high-speed data transmission over existing copper telephone lines. They are crucial for DSL modems, allowing broadband internet access without requiring new infrastructure. These chipsets use advanced modulation techniques to facilitate simultaneous voice and data transmission, making them a cost-effective solution for enhancing internet connectivity, particularly in areas where fiber-optic deployment is limited. They are essential for enabling DSL technology, which provides broadband internet access using existing telephone lines.

How is AI Transforming the Digital Subscriber Line (DSL) Chipsets Market?

AI is reshaping the digital subscriber line (DSL) chipsets market by enhancing network efficiency, stability, and user experience. DSL technology, widely used for broadband connections, faces challenges like noise interference and bandwidth limitations. AI-driven algorithms further optimize signal processing, dynamically adjusting to reduce latency and improve data transmission speeds. Moreover, Real-time monitoring powered by AI helps detect faults, predict line failures, and enable faster troubleshooting, minimizing service disruptions. Additionally, AI enhances energy efficiency by optimizing power usage in chipsets during varying traffic loads. As demand for reliable internet connectivity grows, AI integration is enabling DSL chipsets to deliver smarter, faster, and more stable broadband performance, strengthening their role in global communication networks.

Digital Subscriber Line (DSL) Chipsets Market Dynamics - (DRO) :

Key Drivers:

Rising adoption of DSL chipsets in the industrial sector is boosting the market growth

DSL chipsets are semiconductor components that enable high-speed data transmission over existing copper telephone lines. In industrial settings, they are used for applications like remote monitoring, process automation, and data analytics, providing reliable internet connections over long distances and in challenging environments. DSL technology offers a cost-effective solution for enhancing connectivity in areas where fiber-optic infrastructure is limited. The robustness of DSL in providing stable internet connections over long distances and in challenging environments makes it suitable for various industrial applications.

Thus, the market analysis shows that the aforementioned factors are boosting the adoption of DSL chipsets in turn driving the digital subscriber line (DSL) chipsets market growth.

Key Restraints:

The availability of alternative solutions is hindering the market growth

The proliferation of wireless broadband, including 5G, provides high-speed internet access without the need for fixed-line connections, further diminishing DSL's adoption, particularly in urban areas with robust wireless coverage. Moreover, fiber-optic solutions offer faster speeds and higher reliability, making them more attractive to consumers and businesses.

Thus, the market trends analysis shows that the availability of alternative solutions is restraining the digital subscriber line (DSL) chipsets market demand.

Future Opportunities :

Integration of DSL chipsets with smart home devices creates new market opportunities

DSL chipsets are integrated with smart home devices to enable high-speed internet access, facilitating various smart home functions like remote control, security, and entertainment. DSL technology, using existing phone lines, provides broadband connectivity for devices within a smart home. The internet connection provided by DSL enables various smart home features, including remote control of home automation systems, such as lights, thermostats, and appliances, from anywhere.

Thus, the above advancements are projected to drive digital subscriber line (DSL) chipsets market opportunities during the forecast period.

Digital Subscriber Line (DSL) Chipsets Market Segmental Analysis :

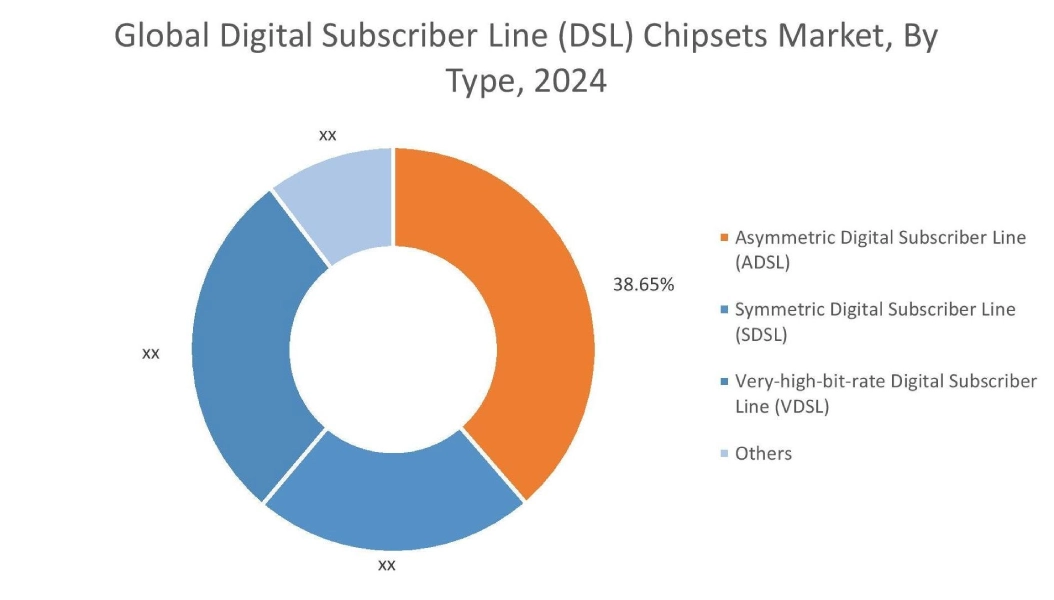

By Type:

Based on the type, the market is segmented into asymmetric digital subscriber line (ADSL), symmetric digital subscriber line (SDSL), very-high-bit-rate digital subscriber line (VDSL), and others.

Trends in the Type:

- Rising adoption of SDSL for small businesses or in situations where uploading and downloading large files is crucial.

- Increasing adoption of VDSL for faster internet and download speeds is boosting the digital subscriber line (DSL) chipsets market size.

The asymmetric digital subscriber line (ADSL) segment accounted for the largest revenue share of 38.65% in the market in 2024.

- Asymmetric digital subscriber line (ADSL) is a technology that uses existing copper telephone lines to provide high-speed internet access.

- It offers faster download speeds than upload speeds, reflecting the common user preference for downloading more data than uploading.

- ADSL is a form of digital subscriber line (DSL) technology that uses frequency division to create separate bandwidths for downstream and upstream data.

- ADSL offers a constant internet connection, unlike dial-up, which requires a phone call to establish a connection.

- Therefore, the aforementioned factors are boosting the digital subscriber line (DSL) chipsets market growth.

The very-high-bit-rate digital subscriber line (VDSL) segment is expected to register the fastest CAGR during the forecast period.

- VDSL (Very High-bit-rate Digital Subscriber Line) is a DSL technology that offers significantly higher bandwidth than ADSL, delivering data over existing copper phone lines.

- VDSL can achieve download speeds up to 52 Mbps and upload speeds up to 16 Mbps. It is designed for short-distance connections, typically between 1,000 and 4,500 feet, and uses a variety of modulation techniques like DMT or QAM.

- VDSL leverages existing copper telephone lines, making it a cost-effective solution for upgrading internet connectivity.

- VDSL can be configured with asymmetric speeds (faster downloads than uploads) or symmetrical speeds (equal upload and download speeds).

- Thus, the aforementioned factors are expected to boost the digital subscriber line (DSL) chipsets market trends during the forecast period.

By Product Type:

Based on the product type, the market is segmented into integrated chipsets, standalone chipsets, system-on-chip (SoC), and others.

Trends in the Product Type:

- Rising adoption of DSL SoC provides a compact, efficient, and cost-effective solution for implementing DSL technology in various devices boosting the market demand.

- Increasing trend in the adoption of standalone chipsets to achieve simultaneous voice and data transmission, making them a cost-effective solution for improving internet connectivity.

The integrated chipsets segment accounted for the largest revenue share in the digital subscriber line (DSL) chipsets market share in 2024.

- A DSL-integrated chipset allows simultaneous voice and data transmission over existing phone lines, enabling high-speed internet access.

- This technology offers benefits like high-speed internet, simultaneous phone and internet use, and cost-effectiveness, particularly in areas where fiber-optic deployment is limited.

- DSL chipsets enable users to make and receive phone calls while simultaneously using the internet.

- DSL is a more affordable option than fiber-optic internet, particularly for individuals and small businesses.

- Therefore, the aforementioned factors are boosting the digital subscriber line (DSL) chipsets market

The system-on-chip (SoC) segment is expected to register the fastest CAGR during the forecast period.

- A DSL system-on-chip (SoC) is a specialized integrated circuit that implements all the essential components of a DSL modem or other DSL devices on a single chip.

- It is a cost-effective and efficient way to achieve DSL functionality in a compact form factor.

- By integrating all the components onto a single chip, DSL SoCs significantly reduce the physical size and cost of DSL devices.

- Integrated designs often achieve higher speeds and more efficient power consumption as compared to separate component implementations.

- Thus, the aforementioned factors are expected to boost the digital subscriber line (DSL) chipsets market trends during the forecast period.

By Technology:

Based on the technology, the market is segmented into frequency division multiplexing (FDM), discrete multitone modulation (DMT), multi-carrier modulation, packet switching, and circuit switching.

Trends in the Technology:

- Rising adoption of multi-carrier modulation to overcome the limitations of traditional single-carrier systems and achieve high-speed internet access over telephone lines.

The frequency division multiplexing (FDM) segment accounted for the largest revenue share in the digital subscriber line (DSL) chipsets market share in 2024.

- In DSL technology, frequency division multiplexing (FDM) is used to combine multiple signals onto a single transmission line, allowing simultaneous transmission of voice and data.

- FDM works by assigning different frequency bands (subchannels) to different signals, ensuring they do not interfere with each other.

- FDM allows simultaneous transmission of voice and data over a single line, which is crucial for providing high-speed internet access while retaining the ability to make and receive phone calls.

- FDM utilizes the available bandwidth efficiently by assigning different frequency bands to different signals.

- Therefore, the aforementioned factors are boosting the digital subscriber line (DSL) chipsets market

The multi-carrier modulation segment is expected to register the fastest CAGR during the forecast period.

- Digital subscriber line (DSL) technologies, such as ADSL and VDSL, widely utilize multi-carrier modulation (MCM) for efficient data transmission.

- MCM, specifically discrete multi-tone (DMT) modulation, splits the data stream into multiple, parallel sub-channels, each carrying a lower data rate.

- This approach allows better performance in environments with inter-symbol interference and can help avoid single-frequency interference.

- Thus, the aforementioned factors are expected to boost the digital subscriber line (DSL) chipsets market opportunities during the forecast period.

By End Use:

Based on the end use, the market is segmented into residential, commercial, and industrial.

Trends in the End Use:

- Rising adoption of DSL in industrial settings for data transmission, remote access, and network connectivity is boosting the digital subscriber line (DSL) chipsets market

The residential segment accounted for the largest revenue share in the market in 2024.

- Digital subscriber line (DSL) is a type of broadband internet connection that uses existing telephone lines to transmit data, making it suitable for residential use.

- DSL is a popular choice for residential internet access as it is widely available, relatively inexpensive, and does not require additional wiring.

- DSL uses the existing telephone lines to transmit data by utilizing higher frequencies than those used for traditional voice communications, allowing both voice and data transmission simultaneously.

- Therefore, the digital subscriber line (DSL) chipsets market analysis shows that the aforementioned factors are boosting the market growth.

The commercial segment is expected to register the fastest CAGR during the forecast period.

- DSL uses existing telephone lines to transmit data, offering simultaneous voice and data transmission.

- It is used in commercial settings, particularly for small businesses needing reliable internet connectivity.

- DSL provides a cost-effective way for small to medium-sized businesses to access reliable internet without the need for expensive dedicated lines.

- DSL allows businesses to use their phone lines for both voice calls and internet access simultaneously.

- Thus, the digital subscriber line (DSL) chipsets market analysis shows that the aforementioned factors are expected to boost the market opportunities during the forecast period.

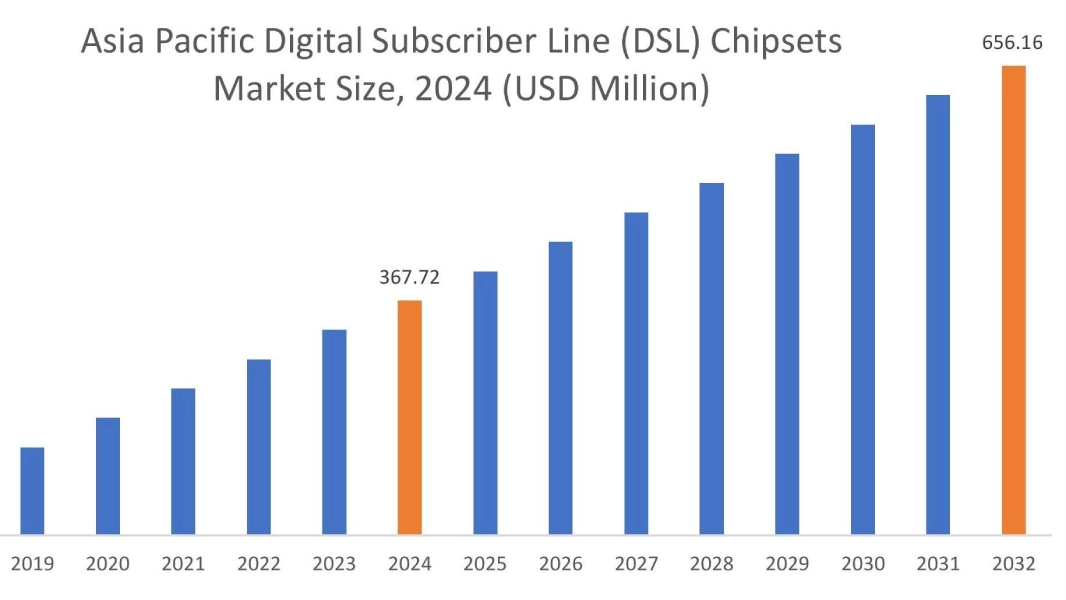

Regional Analysis:

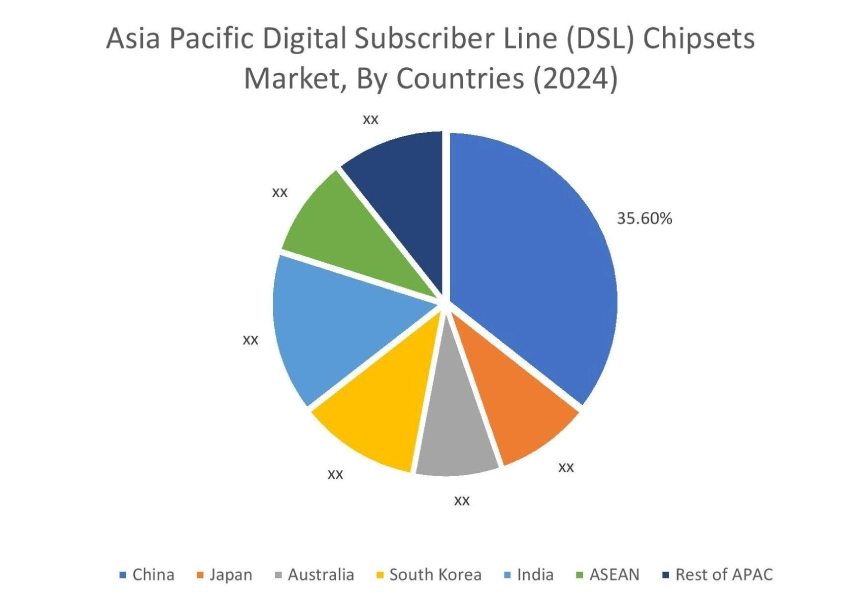

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 367.72 Million in 2024. Moreover, it is projected to grow by USD 388.23 Million in 2025 and reach over USD 656.16 Million by 2032. Out of this, China accounted for the maximum revenue share of 35.60%. The market in the region is growing due to expanding broadband infrastructure, rising internet penetration, and the need for reliable and affordable internet access in both urban and rural areas. Furthermore, the increasing number of small and medium-sized enterprises (SMEs) in the region rely on DSL for affordable internet connectivity, thereby boosting the digital subscriber line (DSL) chipsets market expansion.

- For instance, SME Finance Forum states that in Asia-Pacific region comprises more than 98% of small and medium-size enterprises.

North America is estimated to reach over USD 698.40 Million by 2032 from a value of USD 414.17 Million in 2024 and is projected to grow by USD 435.20 Million in 2025. The market in North America is primarily driven by the proliferation of digital services and smart devices. Moreover, the rise of streaming services and e-commerce has contributed to the need for higher bandwidth, which is another factor driving the market demand.

In Europe, the market is growing due to digital infrastructure development and affordable and reliable high-speed internet access to a large and growing population among others. In Latin America, the Middle East, and Africa, the market is growing due to factors including rising investment in digital infrastructure and increasing need for reliable internet access for various residential and business applications boosting the market demand.

Top Key Players and Market Share Insights:

The digital subscriber line (DSL) chipsets industry is highly competitive with major players providing solutions and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global digital subscriber line (DSL) chipsets market. Key players in the digital subscriber line (DSL) chipsets industry include -

- Broadcom Inc. (USA)

- MediaTek Inc. (Taiwan)

- Texas Instruments Incorporated (USA)

- Marvell Technology Group Ltd. (USA)

- Sagemcom Broadband SAS (France)

- Intel Corporation (USA)

- Qualcomm Technologies, Inc. (USA)

- Infineon Technologies AG (Germany)

- STMicroelectronics N.V. (Switzerland)

- NXP Semiconductors N.V. (Netherlands)

Digital Subscriber Line (DSL) Chipsets Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2,154.89 Million |

| CAGR (2025-2032) | 6.4% |

| By Type |

|

| By Product Type |

|

| By Technology |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the digital subscriber line (DSL) chipsets market? +

Digital Subscriber Line (DSL) Chipsets Market size is estimated to reach over USD 2,154.89 Million by 2032 from a value of USD 1,248.60 Million in 2024 and is projected to grow by USD 1,314.50 Million in 2025, growing at a CAGR of 6.4% from 2025 to 2032.

What are the major segments covered in the digital subscriber line (DSL) chipsets market report? +

The segments covered in the report are type, product type, technology, end use, and region.

Which region holds the largest revenue share in 2024 in the digital subscriber line (DSL) chipsets market? +

North America holds the largest revenue share in the digital subscriber line (DSL) chipsets market in 2024.

Who are the major key players in the digital subscriber line (DSL) chipsets market? +

The major key players in the market are Broadcom Inc. (USA), MediaTek Inc. (Taiwan), Intel Corporation (USA), Qualcomm Technologies, Inc. (USA), Infineon Technologies AG (Germany), STMicroelectronics N.V. (Switzerland), NXP Semiconductors N.V. (Netherlands), Texas Instruments Incorporated (USA), Marvell Technology Group Ltd. (USA), Sagemcom Broadband SAS (France).