Drone Sensor Market Size:

Drone Sensor Market size is estimated to reach over USD 3.55 Billion by 2032 from a value of USD 1.55 Billion in 2024 and is projected to grow by USD 1.70 Billion in 2025, growing at a CAGR of 12.3% from 2025 to 2032.

Drone Sensor Market Scope & Overview:

Drone sensors are electronic devices that collect data about the drone's environment and its movement. The key advantages of sensors including enhanced data collection, improved safety in hazardous environments, cost-effectiveness, and others are boosting the drone sensor market growth. Additionally, the sensors are utilized to perform diverse applications, including navigation, obstacle avoidance, aerial imaging, and environmental monitoring. Further, the expansion of drone applications in agriculture, defense, infrastructure, and emergency services is boosting the drone sensor market demand.

How AI is impacting the Drone Sensor Market?

The sensors are critical components that enable drones to observe their environment and gather data. Additionally, the integration of AI with sensors enables real time sensor data analysis, allowing drones to make immediate decisions based on environmental changes. Also, AI enhances the precision of data captured leading to clearer images and more accurate measurements. Moreover, AI-powered drones have the ability to navigate complex environments without human intervention to forecast crop yields based on plant health and growth patterns. Further, the advancement helps in search and rescue operations, wildlife monitoring, and infrastructure inspection.

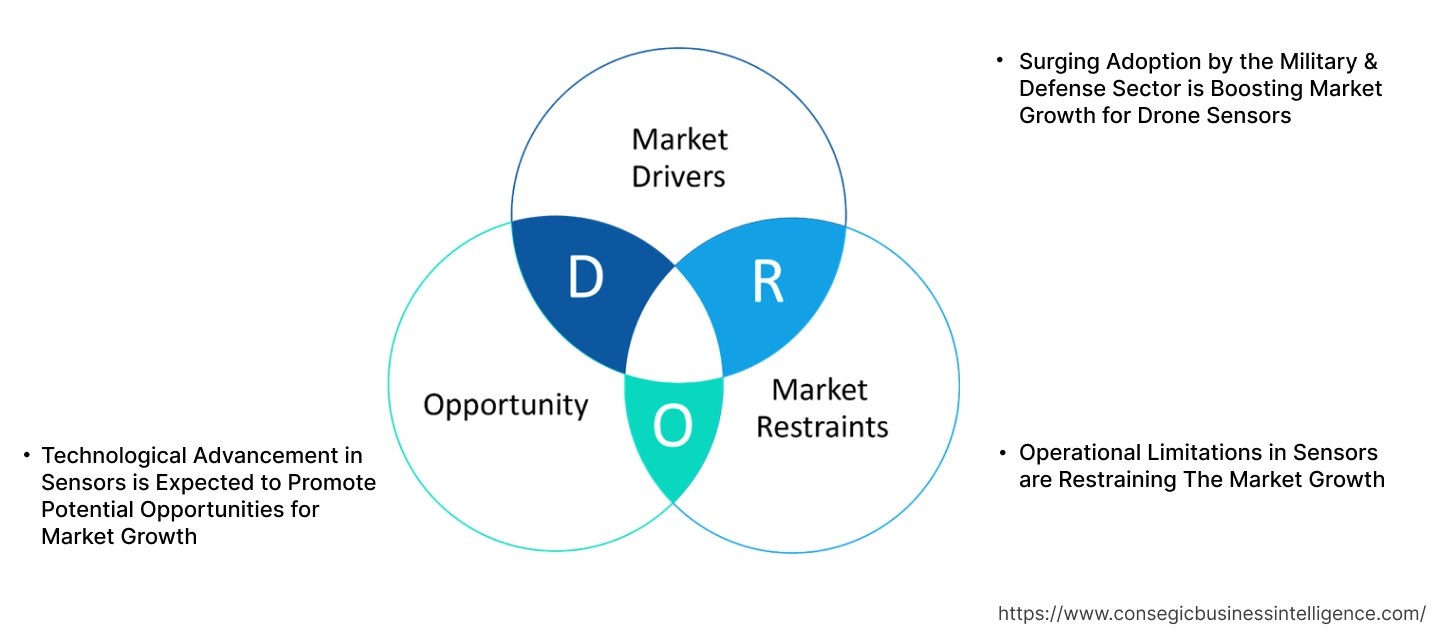

Key Drivers:

Surging Adoption by the Military & Defense Sector is Boosting Market Growth for Drone Sensors

The increasing adoption of drones by the military and defense sector due to rising demand for advanced surveillance, reconnaissance, and targeting capabilities in modern warfare is boosting the drone sensor market demand. Additionally, the military drones, equipped with sophisticated sensors, provide real-time intelligence and situational awareness, enabling better decision-making in combat zones in turn is driving the drone sensor market growth. Further, the integration of advanced sensors such as high-definition cameras, lidar, and multispectral sensors is driving the drone sensor industry.

- For instance, in July 2025, Polus Tech launched a new drone-mounted sensor that captures signals from mobile phones. The sensor is designed to enhance surveillance capabilities in various fields, from military applications to security operations.

Therefore, the rising adoption by the military & defense sector is driving the demand for sensors, in turn proliferating the growth of the market.

Key Restraints:

Operational Limitations in Sensors are Restraining The Market Growth

The sensors from drone utilizes lot of power, leading to limited flight time and applicability for tasks requiring longer flights, such as surveillance or mapping, which in turn is hindering the drone sensor market expansion. Additionally, the sensors such as cameras and GPS are easily affected by moisture and strong winds, impacting drone stability and performance which is creating a barrier for market adoption. Further, high-end sensors such as LiDAR and hyperspectral imaging are expensive, making them less accessible for smaller commercial and consumer drone users is restraining the market progress.

Therefore, the aforementioned operational limitations is hindering the drone sensor market expansion.

Future Opportunities :

Technological Advancement in Sensors is Expected to Promote Potential Opportunities for Market Growth

The increased adoption of drones across various industries is creating numerous prospects for market evolution. Also, innovations such as miniaturization, improved accuracy, and enhanced reliability, are making drones more versatile and efficient which in turn is paving the way for drone sensor market opportunities. Further, AI-powered drone sensors have the ability to perform tasks such as object recognition, data analysis, and autonomous navigation, further enhancing their capabilities is boosting the market progress.

- For instance, in February 2025, The Korea Aerospace Administration (KASA) announced the launch of DNA+ drone technology. The features include integrated data, 5G networks, and Artificial Intelligence (AI) technologies. Additionally, the technology is designed for enabling seamless 5G airspace communication, 4K drone mission video live streaming, and real-time AI analysis.

Hence, the rising integration of advancement sensor technology is anticipated to increase the utilization of sensors for drones in turn promoting prospects for drone sensor market opportunities during the forecast period.

Drone Sensor Market Segmental Analysis :

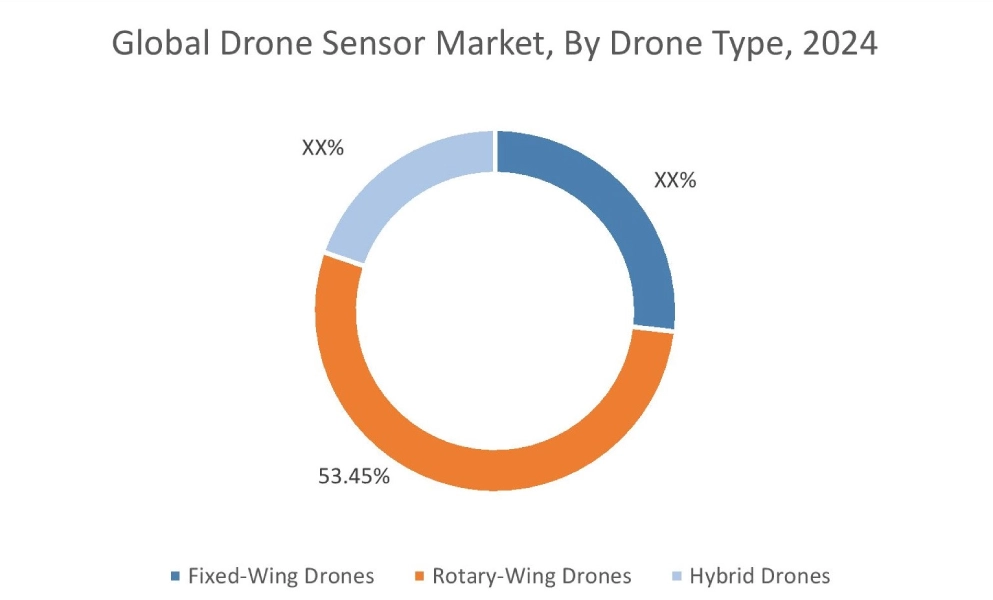

By Drone Type:

Based on drone type, the market is segmented into fixed-wing drones, rotary-wing drones, and hybrid drones.

Trends in the drone type:

- Increasing trend in utilization of rotary-wing drones, due to its ability to fly vertically, hover over a fixed position at a given height, and take off and land in a very small space, is driving the market development.

- Factors including rising adoption of drones for long-haul and heavy-lift applications, military ISR, mapping and surveying, and cargo delivery applications are further driving the market progress.

The rotary-wing drones segment accounted for the largest revenue share of 53.45% in the drone sensor market share in 2024.

- Rotary-wing drone is a type of drone that is completely or partly sustained in the air by lifting rotors revolving around a vertical axis.

- Rotary-wing drones typically consist of rotors that provide lift throughout the entire flight.

- Moreover, the key benefits of rotary-wing drones include its ability to fly vertically, hover over a fixed position at a given height, and take off and land in a very small space.

- Additionally, rotary-wing drones are primarily used in various applications, including aerial photography, surveying, inspection, and others.

- For instance, in May 2025, Cyberlux Corporation introduced its new Group 1 rotary wing drone, which is specifically tailored for the U.S. Special Operations community. The drone is designed to carry heavier payloads for longer durations, while maintaining optimum performance in dense electronic warfare environments.

- Hence, as per the drone sensor market analysis, the rising advancements associated with rotary-wing drones are propelling the market progress.

The hybrid drones segment is anticipated to register the fastest CAGR during the forecast period.

- Hybrid drones combine features of multi-rotor and fixed-wing drones, in turn offering extended flight times, versatile take-off and landing capabilities.

- Moreover, hybrid drones provide several benefits, including greater endurance, ability to cover longer distances, faster speeds, extended flight time, and others.

- Additionally, hybrid drones are capable of providing extended hover, greater manoeuvrability at lower airspeeds, improved energy efficiency, and relatively quicker take-off and landing capabilities.

- For instance, DJI offers DJI FPV model of hybrid drones in its product offerings. DJI FPV hybrid drone includes high-performance motors and can reach a maximum speed of 140 kilometres per hour. The drone consists of three flight modes, including normal mode, manual mode, and sports mode.

- Hence, as per the drone sensor market analysis, the increasing developments related to hybrid drones are expected to drive the market during the forecast period.

By Sensor Type:

Based on sensor type, the market is segmented into image sensor, speed & distance sensor, pressure sensor, position sensor, light sensor, and others.

Trends in the sensor type:

- Increasing focus on integration of image sensors in drones for several applications, involving surveillance, aerial imaging, mapping, precision agriculture, and others, is driving the market progress.

- There is a rising trend towards integration of position sensors in drones to navigate, maintain stability, avoid obstacles, and facilitate accurate data collection, which is expected to drive the market progress.

Image sensor segment accounted for the largest revenue share in the overall drone sensor market share in 2024.

- Image sensors are designed to capture and convert light into electrical signals, which then creates digital images.

- Drone image sensors are crucial components in drones for facilitating various applications, including aerial photography, surveillance, and mapping among others.

- These sensors are available in different types, including RGB, multispectral, and thermal sensors, each featuring unique characteristics and capabilities.

- For instance, Canon offers CMOS image sensors in its product offerings, which are specifically designed for use in drones. The CMOS sensors offer superior resolution, speed, sensitivity, and lower power consumption to maximize drone capabilities. The sensors can be used for several applications, involving surveillance, aerial imaging, mapping, precision agriculture, and others.

- Thus, the rising adoption of image sensors in drones is propelling the drone sensor market trends.

The position sensor segment is anticipated to register the fastest CAGR during the forecast period.

- A position sensor is used to provide information regarding the drone's location and orientation.

- Moreover, position sensors enable the drones to navigate, maintain stability, avoid obstacles, and facilitate accurate data collection.

- Position sensors also enable drones to fly autonomously along predetermined routes, maintain stable flight, and gather precise information for various applications, such as mapping, surveying, and inspections, among others.

- Additionally, the integration of position sensors in drones offers several benefits, including enhanced safety, improved operational efficiency, and others.

- Consequently, the above benefits of position sensors are further increasing its adoption in drones, in turn boosting the drone sensor market size during the forecast period.

By Application:

Based on the application, the market is segmented into navigation and positioning, collision avoidance, aerial mapping and surveying, environmental and atmospheric monitoring, payload handling and delivery assistance, and others.

Trends in the Application:

- The trend towards the increasing use of drones in GIS platforms is driving the market adoption in aerial mapping and surveying applications.

- The trend towards rising adoption of technologies such as ultra-wideband for precise indoor navigation and drone swarm control is driving the market adoption in navigation and positioning applications.

Navigation and Positioning accounted for the largest revenue share in the year 2024.

- Drones are becoming increasingly autonomous, with advancements in sensor technology, AI, and machine learning enabling them to navigate complex environments.

- Additionally, the integration of AI and machine learning are being integrated into drone systems for real-time decision-making, predictive maintenance, and improved navigation and control.

- Further, the demand for higher-resolution sensors designed for applications requiring detailed data acquisition.

- Furthermore, the advancements in 5G and other high-speed communication technologies are facilitating faster data transfer and enabling real-time data analysis and control.

- Thus, the integration of AI and machine learning is driving the market progress.

Payload Handling and Delivery Assistance is anticipated to register the fastest CAGR during the forecast period.

- Drones are evolving to handle larger payloads for efficient delivery solutions which is driven by retail and e-commerce needs.

- Additionally, the advancements in drone technology and the demand for broader geographic coverage is driving the adoption of drones for payload handling and delivery assistance applications.

- Further, the proliferation of LiDAR technology enables accurate 3D mapping and obstacle avoidance, which in turn is critical for safe and precise navigation and landing in drones is boosting the market progress.

- Therefore, the advancements in drone technology are anticipated to boost the market during the forecast period.

By End User:

Based on end user, the market is segmented into defense and security, construction and mining, agriculture and forestry, energy and utilities, consumer, logistics and warehousing, media and entertainment, and others.

Trends in the end user:

- Factors including rising investments in military and defense systems along with growing adoption of drones for efficient target acquisition, search and rescue, surveillance, and other military operations are among the key prospects driving the defense and security segment.

- Factors including increasing investments in agricultural sector and rising advancements in precision agriculture, and growing adoption of modern technologies in agriculture sector for improved crop yield are among the vital aspects driving the agriculture and forestry segment.

The defense and security segment accounted for the largest revenue in the overall market in 2024.

- Drone sensors are often used in military & defense drones for applications involving intelligence, target acquisition, search and rescue, surveillance, and reconnaissance applications.

- They are often used in security and surveillance applications for providing real-time insight into security and emergency situations to facilitate improved control, comprehensive situational awareness, accurate intelligence gathering, and more informed decision making.

- Moreover, drone sensors offer a range of benefits including compact design, resistance to extreme weather, low weight with high power, and increased flexibility in operations, which are key determinants for increasing its utilization in defense and security industry.

- For instance, Airbus offers a complete range of target drones in its product offerings, which offer realistic and cost-effective training for naval air defense, including naval targets, direct airborne targets, towed airborne targets, and surface targets.

- Consequently, as per the market analysis, the rising developments related to defense and security drones are proliferating the drone sensor market size.

The agriculture and forestry segment is anticipated to register the fastest CAGR during the forecast period.

- Sensors for drones are often used in agriculture drones to facilitate a broad range of applications, including crop mapping, soil analysis, monitoring of irrigation systems, and pest management, among others.

- Moreover, the use of drones integrated with advanced sensors in agriculture industry provides numerous benefits, including remote monitoring of crop health, improved monitoring of field conditions, optimized pesticide spraying, and increased productivity, among others.

- For instance, in July 2025, DJI launched its new DJI Agras T70P,DJI Agras T100, and DJI Agras T25P models of agriculture spray drones. These drones are capable of carrying heavier payloads while supporting multiple application scenarios with improved operational efficiency. The drones also offer intelligent features for completely automated operations.

- Therefore, the increasing adoption of drones in agriculture and forestry sector is anticipated to boost the drone sensor market trends during the forecast period.

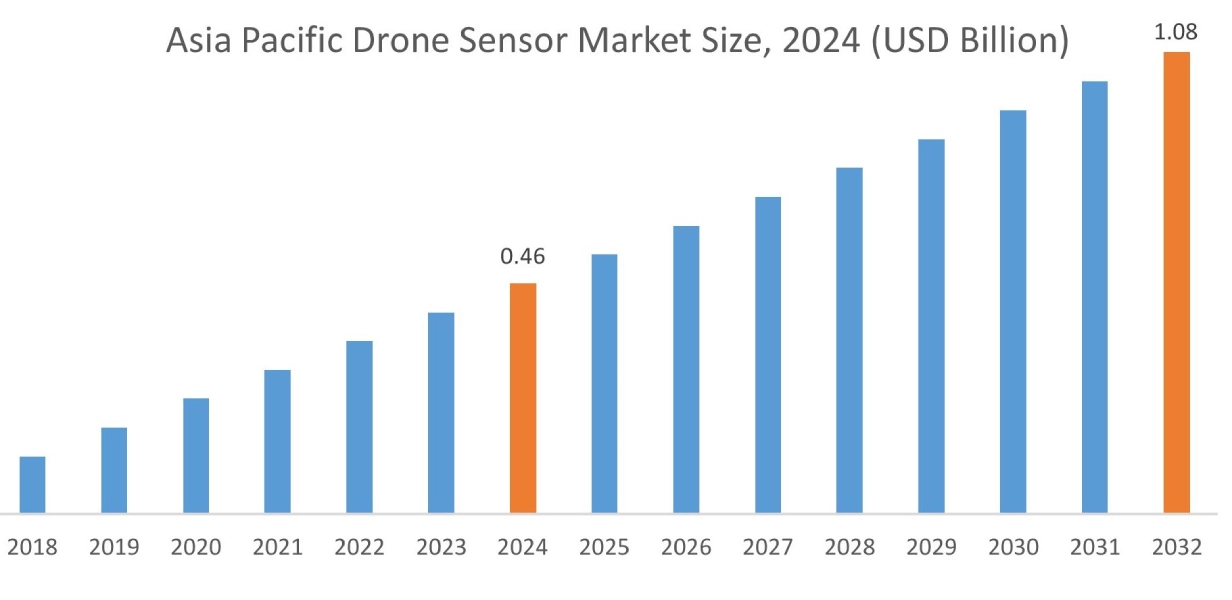

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

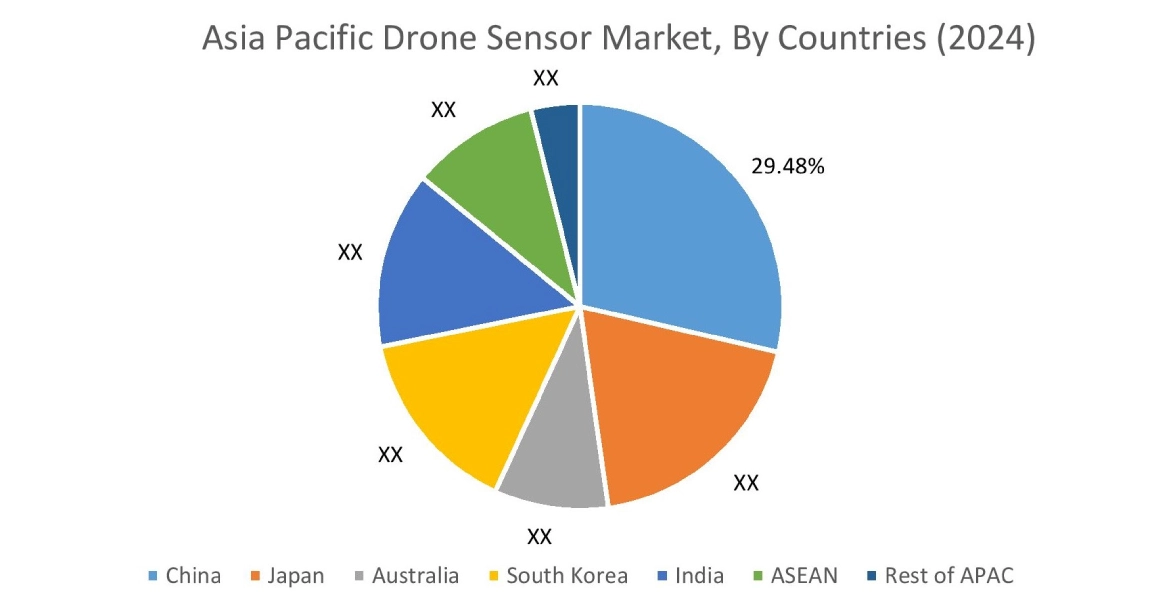

Asia Pacific region was valued at USD 0.46 Billion in 2024. Moreover, it is projected to grow by USD 0.50 Billion in 2025 and reach over USD 1.08 Billion by 2032. Out of this, China accounted for the maximum revenue share of 29.48%. The market progress is mainly driven by increasing adoption of drones across diverse sectors like precision agriculture, construction surveillance, and defense. Furthermore, significant government investments in drone technology are projected to drive the market progress in the Asia Pacific region during the forecast period.

- For instance, in May 2022, Parrot Drone announced partnership with UAVIA with the aim of developing 4G autonomous drones by integrating the Parrot Anafi Ai drone with UAVIA robotics platform. The increasing number of collaboration and partnerships is likely to drive the market in near future.

North America is estimated to reach over USD 1.21 Billion by 2032 from a value of USD 0.53 Billion in 2024 and is projected to grow by USD 0.58 Billion in 2025. North American region's growing focus on commercial adoption of drones drone offers lucrative growth prospects for the market. Additionally, significant investment in drone technology is driving the market's progress.

- For instance, in June 2025 Walmart announced development in its drone delivery service in major metropolitan areas like Atlanta, Charlotte, Houston, Orlando, and Tampa. The development in retail sector is expected to drive the sensor market.

The regional study depicts that the presence of key players in the region and consistent regulatory frameworks is driving the market in Europe. Additionally, increasing adoption of drones for surveillance and security is propelling the market adoption in the Middle East and African region. Further, growing commercial applications in sectors like construction and agriculture is paving the way for the progress of the market in the Latin American region.

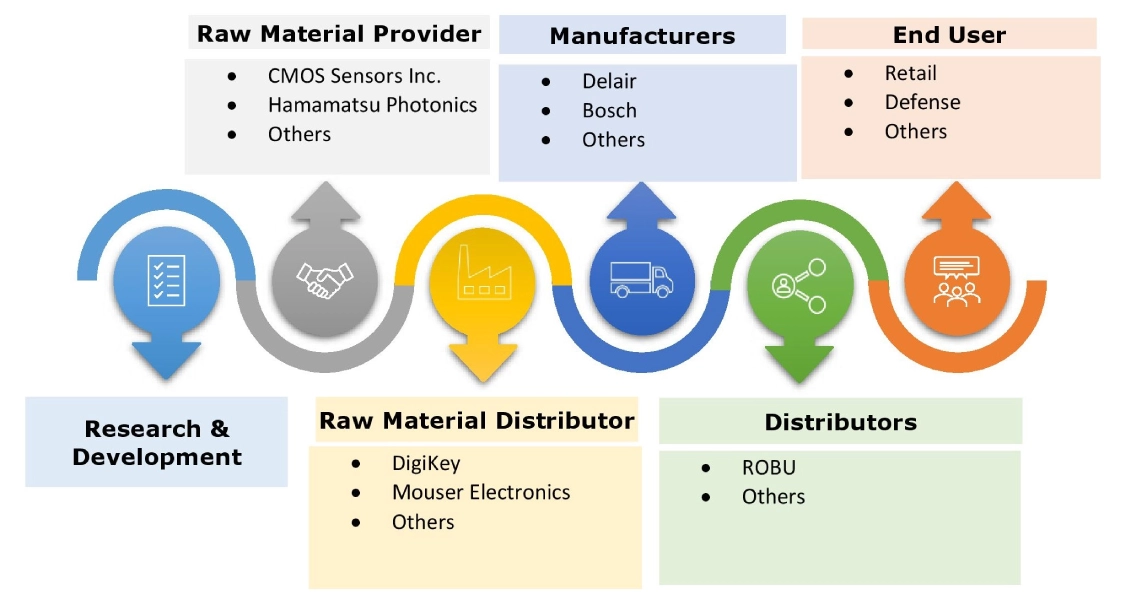

Top Key Players and Market Share Insights:

The global drone sensor market is highly competitive with major players providing sensor to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in the drone sensor industry. Key players in the drone sensor market include-

- Sony Semiconductor Solutions Corporation (Japan)

- Ouster, Inc. (USA)

- Raytheon (USA)

- Sparton NavEx (USA)

- Ams AG (Austria)

- Bosch Sensortec GmbH (Robert Bosch GmbH) (Germany)

- TE Connectivity Corporation (USA)

- Delair (France)

- Trimble Inc. (USA)

- TDK InvenSense (USA)

Recent Industry Developments :

Product launches

- In March 2025, Voliro, an aerial robotics leader, partnered with Sixpec to launch the world's first drone-based Pulsed Eddy Current (PEC) sensor. This sensor is specifically integrated into a payload for the Voliro T drone, enabling the collection of PEC data for corrosion monitoring.

Drone Sensor Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 3.55 Billion |

| CAGR (2025-2032) | 12.3% |

| By Drone Type |

|

| By Sensor Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the drone sensor market? +

The drone sensor market size is estimated to reach over USD 3.55 Billion by 2032 from a value of USD 1.55 Billion in 2024 and is projected to grow by USD 1.70 Billion in 2025, growing at a CAGR of 12.3% from 2025 to 2032.

Which segmentation details are covered in the drone sensor report? +

The drone sensor report includes specific segmentation details for drone type, sensor type, application, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the drone sensor market, the payload handling and delivery assistance is the fastest-growing segment during the forecast period due to the proliferation of LiDAR technology as well as the advancements in drone technology.

Who are the major players in the drone sensor market? +

The key participants in the drone sensor market are Sony Semiconductor Solutions Corporation (Japan), Ouster, Inc. (USA), Bosch Sensortec GmbH (Robert Bosch GmbH) (Germany), TE Connectivity Corporation (USA), Delair (France), Trimble Inc. (USA), TDK InvenSense (USA), Raytheon (USA), Sparton NavEx (USA), Ams AG (Austria) and others.

What are the key trends in the drone sensor market? +

The drone sensor market is being shaped by several key trends including the increasing use of drones in GIS platforms as well as integration of position sensors in drones to navigate, maintain stability, avoid obstacles, and facilitate accurate data collection, and other.