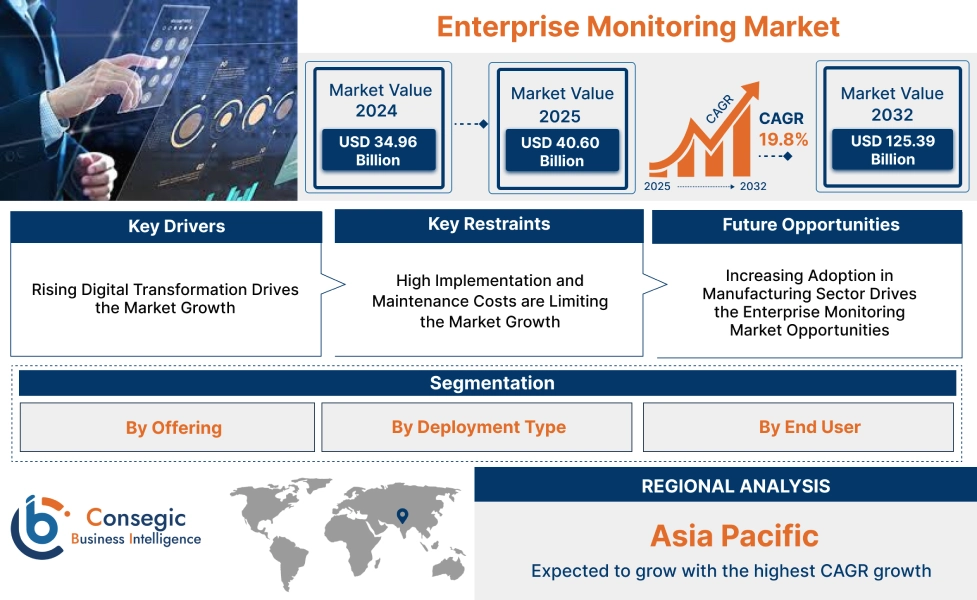

Enterprise Monitoring Market Size:

Enterprise Monitoring Market is estimated to reach over USD 125.39 Billion by 2032 from a value of USD 34.96 Billion in 2024 and is projected to grow by USD 40.60 Billion in 2025, growing at a CAGR of 19.8% from 2025 to 2032.

Enterprise Monitoring Market Scope & Overview:

Enterprise monitoring refers to the comprehensive practice of continuously observing and analyzing the performance, health, and security of an organization's entire IT infrastructure and applications. The benefits of monitoring platform include enhanced operational efficiency, downtime prevention, improved security posture & compliance adherence, optimized resource utilization, and better digital experience. Further key trends driving the market include widespread adoption of AIOps for proactive issue identification, increasing focus on end-to-end observability across complex hybrid and multi-cloud environments, and growing demand for robust security monitoring solutions.

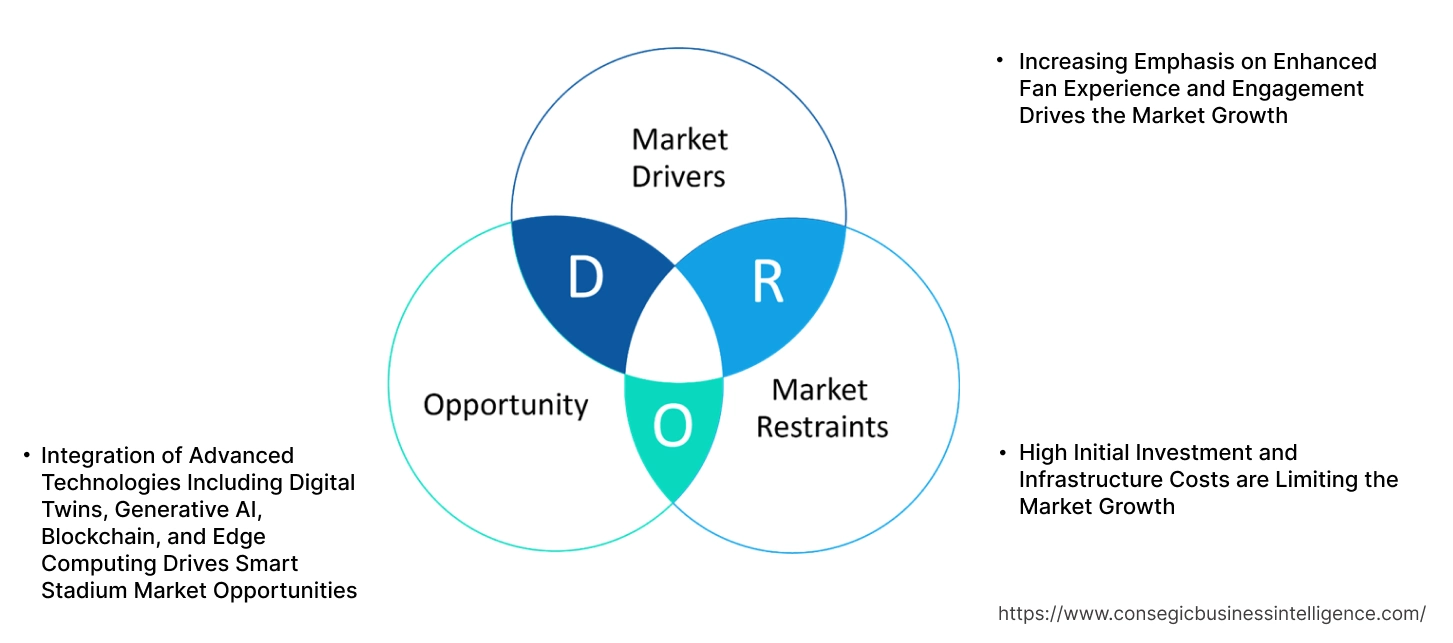

Enterprise Monitoring Market Dynamics - (DRO) :

Key Drivers:

Rising Digital Transformation Drives the Market Growth

The persistent wave of digital transformation initiatives across industries is a primary catalyst for the monitoring platform’s robust growth. As businesses increasingly digitize core operations, customer interactions, and internal processes, their reliance on complex IT infrastructures intensifies. This necessitates comprehensive monitoring solutions to ensure the continuous availability, optimal performance, and security of critical digital assets. Further, from cloud migrations and microservices adoption to the deployment of AI-driven applications, every side of digital transformation introduces new layers of complexity that demand real-time visibility and proactive management. Organizations are investing heavily in monitoring tools to maintain seamless operations and enhance user experiences, directly fueling market expansion.

- For instance, in May 2024, Seeq launched its Industrial Enterprise Monitoring Suite at the Conneqt 2024 conference. This suite aims to address challenges in industrial operations by providing a comprehensive, automated view of historical and real-time performance. The platform combines industrial analytics and AI capabilities to enhance decision-making and drive continuous improvement across complex industrial environments.

Thus, increasing adoption of digital technologies contributes significantly to the enterprise monitoring market size.

Key Restraints:

High Implementation and Maintenance Costs are Limiting the Market Growth

The benefits of robust enterprise monitoring are undeniable, however significant implementation and maintenance costs often act as a considerable barrier, particularly for small and medium-sized enterprises (SMEs). The deployment of comprehensive monitoring solutions typically involves substantial upfront investments in software licenses, specialized hardware, and the necessary infrastructure. Further, beyond initial setup, ongoing expenses for regular software updates, system maintenance, and the employment of skilled IT professionals to manage these complex tools can cumulatively strain budgets. This financial burden, coupled with the complexities of integrating new monitoring systems with existing legacy infrastructure, can deter organizations from adopting advanced solutions, thereby limiting overall market penetration and growth.

Future Opportunities :

Increasing Adoption in Manufacturing Sector Drives the Enterprise Monitoring Market Opportunities

The escalating adoption of cutting-edge technologies within the manufacturing sector is a powerful driver for opportunities in the enterprise monitoring market. As manufacturers embrace Industry 4.0 concepts, incorporating IoT, automation, AI, and big data analytics into their operations, the complexity of their IT and operational technology (OT) environments skyrockets. This digital transformation creates an urgent need for comprehensive monitoring solutions capable of providing real-time visibility into machine health, production line efficiency, supply chain performance, and predictive maintenance needs. Further, seamless, secure, and optimized factory operations, from the shop floor to the cloud, directly translates into increased requirement for advanced enterprise monitoring platforms.

- For instance, in July 2024, Xiaomi launched its completely automated smart factory in Beijing, China. The automated factory spans across 860,000 square feet and it is developed to manufacture approximately 10 million smartphones each year without any human intervention. The growing development of smart factories plays a crucial role in driving the market.

Thus, growing adoption of the platform in manufacturing sector drives the enterprise monitoring market opportunities.

Enterprise Monitoring Market Segmental Analysis :

By Offering:

Based on the offering, the market is segmented into solutions and services.

Trends in the Offering:

- Increasing adoption of platforms to protect IT infrastructure from cyber threats which in turn drives the enterprise monitoring market trends.

- Increasing need for professional services which include consulting, implementation, and customization services in turn driving the enterprise monitoring market size.

Solutions accounted for the largest revenue share in the year 2024.

- Increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities to automate anomaly detection and predict potential issues is driving the enterprise monitoring market share.

- Further, enterprises are moving towards unified observability platforms which integrate metrics, logs, traces, and user experience data.

- Furthermore, increasing trends of cloud-native and serverless monitoring drives the enterprise monitoring market trends.

- For instance, ManageEngine offers OpManager which is a comprehensive remote network monitoring software that provides centralized management for a wide array of networking devices and can analyze traffic, manage configurations, and oversee performance across large, dynamic networks.

- Thus, based on enterprise monitoring market analysis, factors including increased AI/ML integration and unified observability platforms are driving the market growth.

Services is anticipated to register the fastest CAGR during the forecast period.

- Many organizations lack in-house expertise or resources to effectively manage complex platforms which in turn drives the need for manages services.

- Further, service providers are offering specialized consulting and implementation services to help organizations design, deploy, and optimize AIOps strategies which in turn propels the enterprise monitoring market expansion.

- Furthermore, there's a growing need for services that help design and implement effective cloud monitoring strategies, driving the market.

- Therefore, based on analysis, aforementioned factors are anticipated to boost the market during the forecast period.

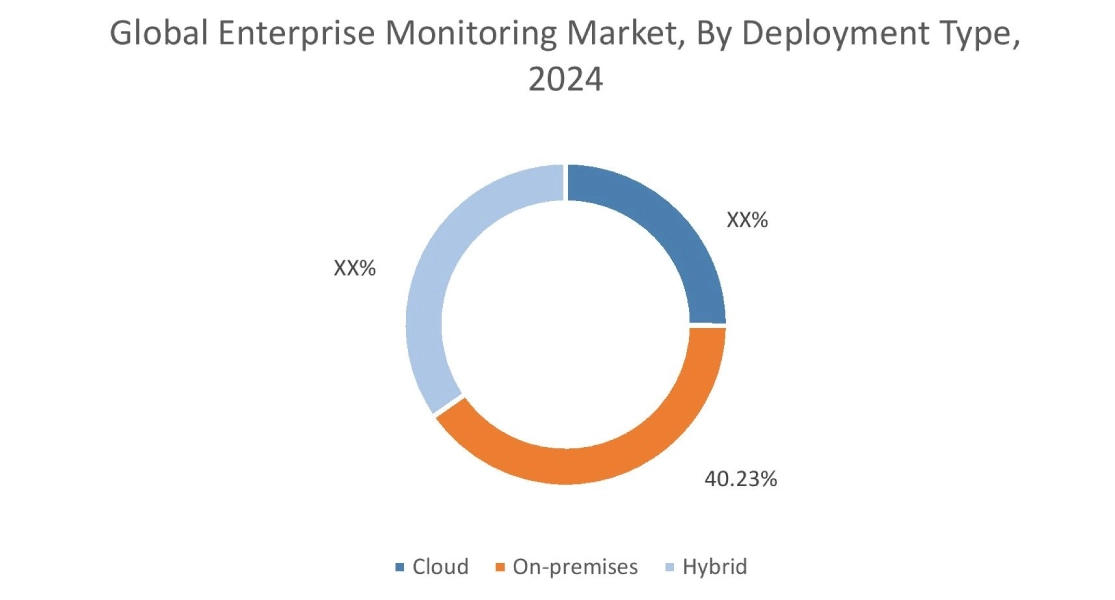

By Deployment:

Based on the deployment, the market is segmented into cloud, on-premises, and hybrid.

Trends in the Deployment:

- Growing need for cloud monitoring platforms that can seamlessly monitor workloads and resources across multiple public cloud providers drives the enterprise monitoring market demand.

- Hybrid monitoring solutions are focusing on automating the collection of metrics, logs, and traces from diverse sources in turn driving the enterprise monitoring market share.

On-premises accounted for the largest revenue share of 40.23% in the year 2024.

- Continuous need from highly regulated industries that require data to remain within their own data centers due to strict data residency laws and enhanced security requirements.

- Further, persistent need for specialized on-premises tools to monitor specific legacy hardware, software, and applications that are not easily migrated to the cloud which in turn drives the enterprise monitoring industry.

- Furthermore, on-premises monitoring solutions are adopting AIOps capabilities to provide advanced analytics, predictive insights, and automated troubleshooting for traditional IT infrastructure.

- Thus, as per enterprise monitoring market analysis, aforementioned factors are driving the market.

Cloud is anticipated to register the fastest CAGR during the forecast period.

- Strong shift towards monitoring solutions designed specifically for dynamic cloud-native environments propels the enterprise monitoring market expansion.

- Further, cloud deployment offers advanced security measures for businesses and provides easy access to sales teams.

- Additionally, the advantages including scalability, accessibility, security, and cost- effectiveness are driving the market.

- For instance, in January 2024, Dynatrace announced acquisition of Runecast, an AI-powered security and compliance solutions provider. This strategic move aims to bolster the Dynatrace unified observability and security platform, enhancing its capabilities in automated security posture management and compliance monitoring across hybrid and multicloud environments.

- Therefore, based on analysis, scalability, advanced security, and cloud-native observability is anticipated to boost the market during the forecast period.

By End User:

Based on the end user, the market is segmented into BFSI, IT and telecommunication, healthcare & life sciences, manufacturing, government retail & e-commerce, transportation & logistics, and others.

Trends in the End User:

- Extensive use of monitoring for Industrial IoT (IIoT) sensors, smart factory equipment, and interconnected production lines drives the market.

- Increasing use of the platform in transportation for monitoring the real-time location, performance, and health of vehicles, ships, and other assets.

BFSI accounted for the largest revenue share in the year 2024.

- Heightened focus on advanced security monitoring to detect and prevent sophisticated cyber threats and financial fraud in real time.

- Further, there is a strong demand for robust monitoring to meet stringent regulatory requirements which in turn drives enterprise monitoring market growth.

- Furthermore, continuous monitoring of core banking applications and infrastructure to ensure high availability, prevent downtime, and maintain operational resilience.

- Thus, as per analysis, real-time fraud detection and regulatory compliance are driving the enterprise monitoring market demand.

Healthcare & life sciences is anticipated to register the fastest CAGR during the forecast period.

- Growing need to monitor the performance, security, and data flow from a rapidly expanding ecosystem of medical IoT devices.

- Further, growing adoption of platforms for ensuring the reliability and performance of telehealth platforms and other digital health services.

- Furthermore, intense demand for robust security monitoring and compliance reporting to protect highly sensitive patient data.

- Therefore, based on analysis, medical IoT, data security & privacy compliance, and digital health platform optimizations are anticipated to boost the market during the forecast period.

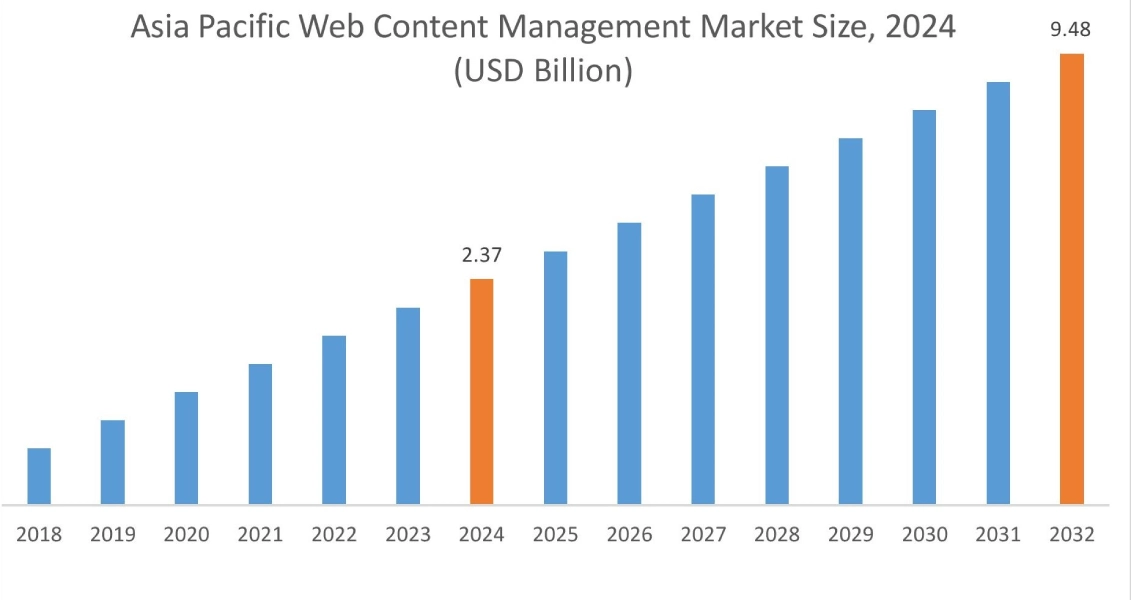

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

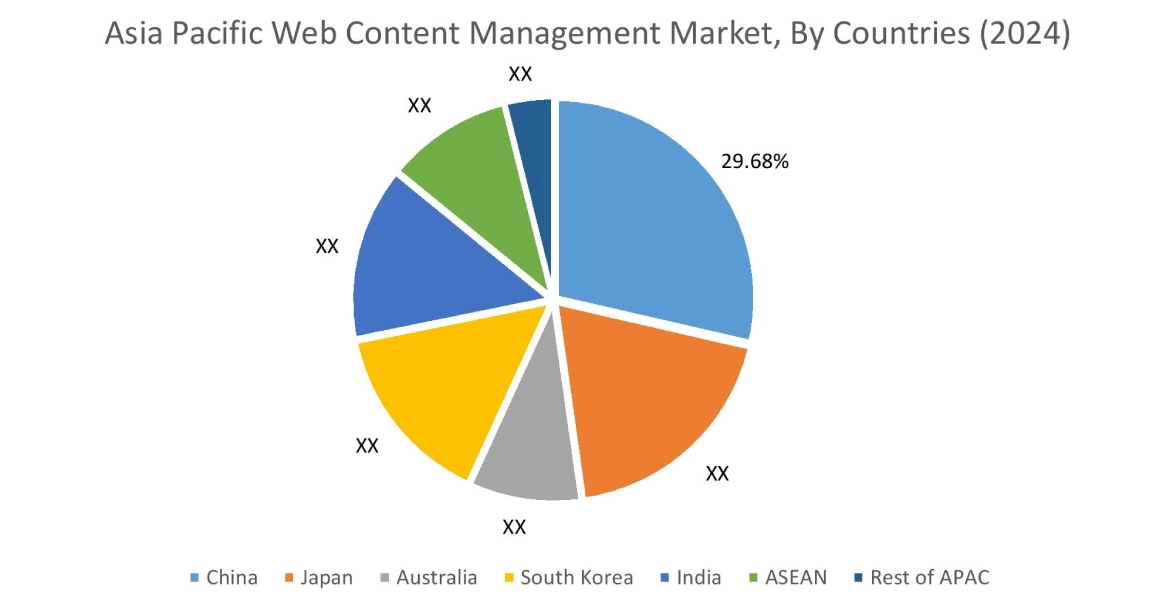

Asia Pacific region was valued at USD 9.64 Billion in 2024. Moreover, it is projected to grow by USD 11.22 Billion in 2025 and reach over USD 35.76 Billion by 2032. Out of this, China accounted for the maximum revenue share of 28.92%. The market for enterprise monitoring is mainly driven by rapid digital transformation initiatives across industries and the increasing complexity of IT environments. Furthermore, the growing emphasis on real-time visibility, proactive issue resolution, and adherence to evolving regulatory and security compliance mandates further fuels the enterprise monitoring market growth.

- For instance, according to International Trade Administration, India is projected to have the fastest retail e-commerce rise globally among major 20 countries between 2023 and 2027, boasting a CAGR of 14.1%. The growing e-commerce industry is expected to drive the need for monitoring platforms.

North America is estimated to reach over USD 41.74 Billion by 2032 from a value of USD 11.60 Billion in 2024 and is projected to grow by USD 13.47 Billion in 2025. The North American market is primarily driven by adoption of advanced technologies like cloud computing, AI, and hybrid IT environments. Also, strong emphasis on cybersecurity and compliance, and increasing complexity of IT infrastructures drives the market growth.

- In May 2022, New Relic announced a strategic multi-year partnership with Microsoft Azure, allowing Azure customers to use New Relic as their native observability platform directly within the Azure Portal. This integration simplifies cloud migration, enables Azure customers to allocate their committed Azure spend towards New Relic, and provides a unified view for monitoring all workloads.

The regional analysis depicts stringent regulatory frameworks like GDPR and DORA coupled with a strong push for digital transformation across industries in Europe is driving the market. Additionally, the factors driving the market in the Middle East and African region are substantial investments in data center infrastructure and a growing imperative for cybersecurity and regulatory compliance. Further, accelerating digital transformation, increasing investments in cloud adoption, and a growing emphasis on optimizing digital experiences is paving the way for the progress of market trends in Latin America region.

Top Key Players and Market Share Insights:

The global enterprise monitoring market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the enterprise monitoring industry. Key players in the global enterprise monitoring market include-

- SolarWinds (US)

- Dynatrace (US)

- Datadog (US)

- New Relic (US)

- LogicMonitor (US)

- ManageEngine (US)

- Splunk (US)

- IBM (US)

- Paessler (Germany)

- Atatus (India)

- Microsoft (US)

- Cisco Systems (US)

Recent Industry Developments :

Acquisition

In March 2024, Cisco completed its USD 28 billion acquisition of Splunk, aiming to become one of the world's largest software companies. This merger unites Cisco's networking strength with Splunk's security and observability expertise, providing unparalleled end-to-end visibility and insights across IT environments.

Enterprise Monitoring Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 125.39 Billion |

| CAGR (2025-2032) | 19.8% |

| By Offering |

|

| By Deployment Type |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the enterprise monitoring market? +

The enterprise monitoring market is estimated to reach over USD 125.39 Billion by 2032 from a value of USD 34.96 Billion in 2024 and is projected to grow by USD 40.60 Billion in 2025, growing at a CAGR of 19.8% from 2025 to 2032.

What specific segmentation details are covered in the enterprise monitoring report? +

The enterprise monitoring report includes specific segmentation details for offering, deployment type, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the enterprise monitoring market, cloud is the fastest-growing segment during the forecast period.

Who are the major players in the enterprise monitoring market? +

The key participants in the Enterprise Monitoring market are SolarWinds (US), Splunk (US), IBM (US), Paessler (Germany), Atatus (India), Microsoft (US), Cisco Systems (US), Dynatrace (US), Datadog (US), New Relic (US), LogicMonitor (US), ManageEngine (US) and others.

What are the key trends in the enterprise monitoring market? +

The enterprise monitoring market is being shaped by several key trends including widespread adoption of AIOps and growing demand for robust security monitoring solutions.