Hydrazine Hydrate Market Size:

Hydrazine Hydrate Market Size is estimated to reach over USD 414.21 Million by 2032 from a value of USD 250.60 Million in 2024 and is projected to grow by USD 262.40 Million in 2025, growing at a CAGR of 5.9% from 2025 to 2032.

Hydrazine Hydrate Market Scope & Overview:

Hydrazine hydrate is a colorless, flammable liquid with a pungent, ammonia-like smell. This highly reactive substance acts as both a strong base and a reducing agent, leading to violent reactions with oxidizing agents. It is used in a wide range of applications, including water treatment, agrochemicals, pharmaceuticals, chemical synthesis, and others.

Hydrazine Hydrate Market Insights:

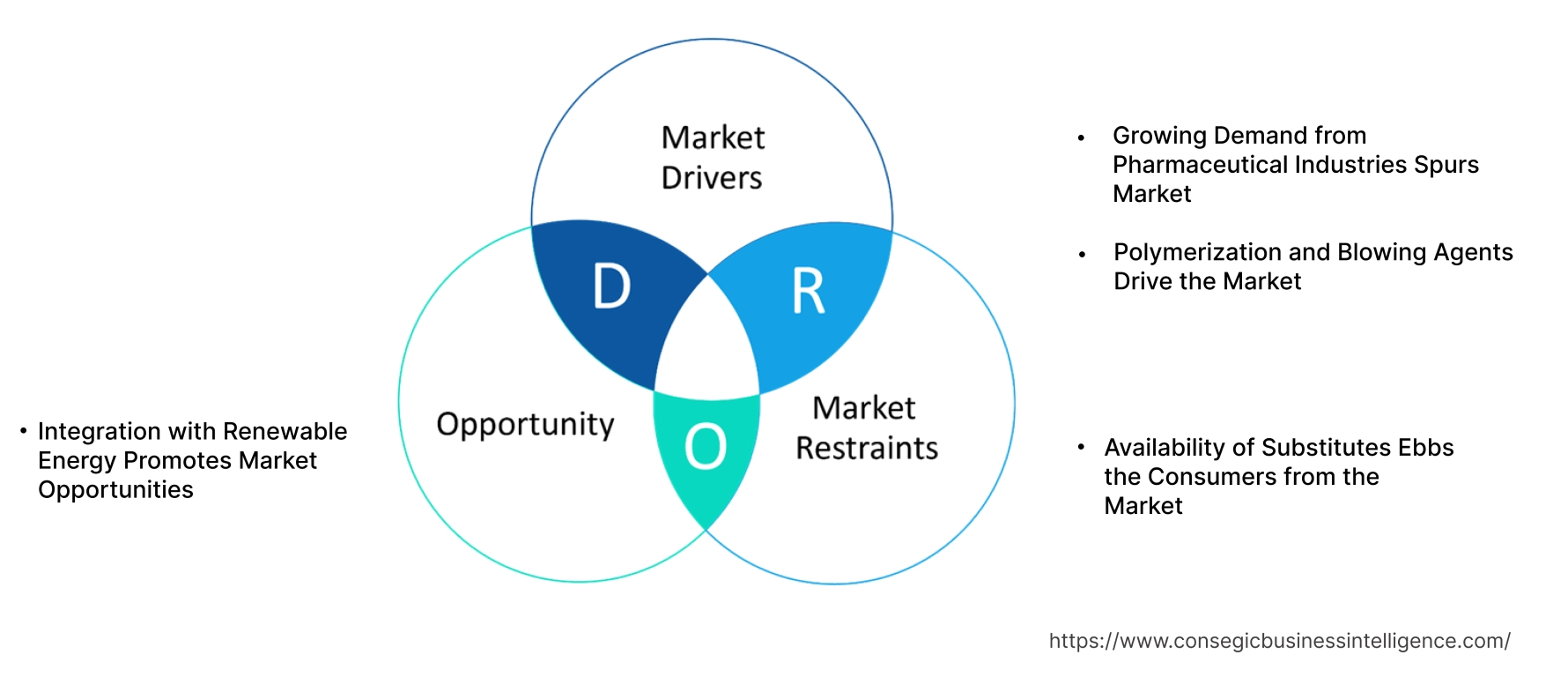

Hydrazine Hydrate Market Dynamics - (DRO) :

Key Drivers:

Extensive applications in water treatment processes are driving the hydrazine hydrate market expansion

Hydrazine hydrate is widely used as an oxygen scavenger in boilers, preventing corrosion and maintaining the efficiency of industrial water systems. With the increasing need for efficient water treatment solutions due to stringent environmental regulations and the global water scarcity issue, the need for such types of chemicals is on the rise. Additionally, the growing emphasis on sustainable and eco-friendly industrial processes is further propelling the adoption of these chemicals, as it offers an effective solution for minimizing environmental impact by enhancing the longevity and productivity of industrial equipment.

- For instance, Arkema provides water-based solutions of hydrazine hydrate and its derivatives, which are widely utilized as reducing agents, blowing agents, corrosion inhibitors, oxygen scavengers, or synthesis intermediates.

Therefore, according to the hydrazine hydrate market analysis, the extensive applications in water treatment processes are driving the hydrazine hydrate market size.

Key Restraints :

Stringent regulatory environments are affecting the hydrazine hydrate market demand

Compliance with safety regulations and environmental standards can be a significant hurdle for manufacturers and end-users, potentially impacting market growth. Further, due to its reactivity and hazardous nature, it requires specialized storage facilities with temperature control, inert atmospheres, and leak containment systems. This significantly increases capital expenditure for manufacturers and users. Moreover, the high compliance burden, significant initial investment in safety infrastructure, and ongoing operational costs can act as a substantial barrier to entry for new players in the global market. Thus, the aforementioned factors would further impact the hydrazine hydrate market size.

Future Opportunities :

Increasing demand for sustainable and eco-friendly industrial processes is expected to create potential growth for hydrazine hydrate market opportunities

As industries across the globe strive to minimize their environmental impact, the use of these chemicals in water treatment and corrosion prevention offers an effective solution for enhancing the efficiency and sustainability of industrial operations. The growing emphasis on sustainable development and rising need for efficient resource management are likely to drive the need for these chemicals in various applications while opening new prospects for market development.

Further, these chemicals are gaining traction in fuel cell technology, due to its high energy density and the ability to release hydrogen upon decomposition. This makes it a valuable element in the development of clean energy solutions. As the global need for sustainable and eco-friendly energy increases, the expanding potential of fuel cells presents a significant emerging opportunity for the market.

- For instance, in 2022, a study by Wuhan University and Anhui University of China showcased the potential of hydrazine hydrate in achieving zero-carbon energy systems. Their research involved developing an advanced electrocatalyst designed to facilitate hydrazine oxidation reactions within fuel cells, underscoring its role in clean energy solutions.

Thus, based on the above hydrazine hydrate market analysis, the increasing need for sustainable and eco-friendly industrial processes is expected to drive the hydrazine hydrate market opportunities in upcoming years.

Hydrazine Hydrate Market Segmental Analysis :

By Concentration Type:

Based on concentration type, the hydrazine hydrate market is segmented into 24%-35%, 40%-55%, 60%-85%, and 100%.

Trends in the concentration type:

- The increasing need for efficient water treatment solutions, particularly in regions with stringent environmental regulations, is propelling the market.

- The advancements in manufacturing processes and applications are leading to a shift towards higher purity concentrations.

- Thus, based on the above analysis, these factors are driving the hydrazine hydrate market demand.

The 60%-85% segment accounted for the largest revenue share in the year 2024.

- The 60%-85% concentration is used in polymerization processes and as a blowing agent in the production of plastic foams. This concentration level offers the necessary reactivity for these applications, facilitating the formation of polymers and foams with desired characteristics.

- The increasing need for lightweight and durable materials in the automotive and construction industries is driving the growth of the 60%-85% concentration segment.

- As manufacturers seek to innovate and develop advanced materials, the utilization of these chemicals in polymerization processes is anticipated to rise.

- For instance, Aerojet Rocketdyne has employed hydrate in concentrations ranging from 60% to 85% for their rocket propulsion systems. This concentration has been significantly used in their products to power high-performance rocket engines and facilitate space exploration missions.

- Thus, based on the above analysis, these factors are further driving the hydrazine hydrate market growth.

The 40%-55% segment is anticipated to register a substantial CAGR during the forecast period.

- This concentration level is used in the synthesis of pharmaceutical intermediates and active ingredients, making it crucial for drug manufacturing.

- Its role in the production of agrochemicals, such as pesticides and herbicides, also contributes to its growing need.

- With the pharmaceutical sector's expansion and the rising emphasis on agricultural productivity, the 40%-55% concentration segment is expected to witness significant growth over the forecast period.

- Thus, based on the above analysis, these factors are expected to drive the hydrazine hydrate market share during the forecast period.

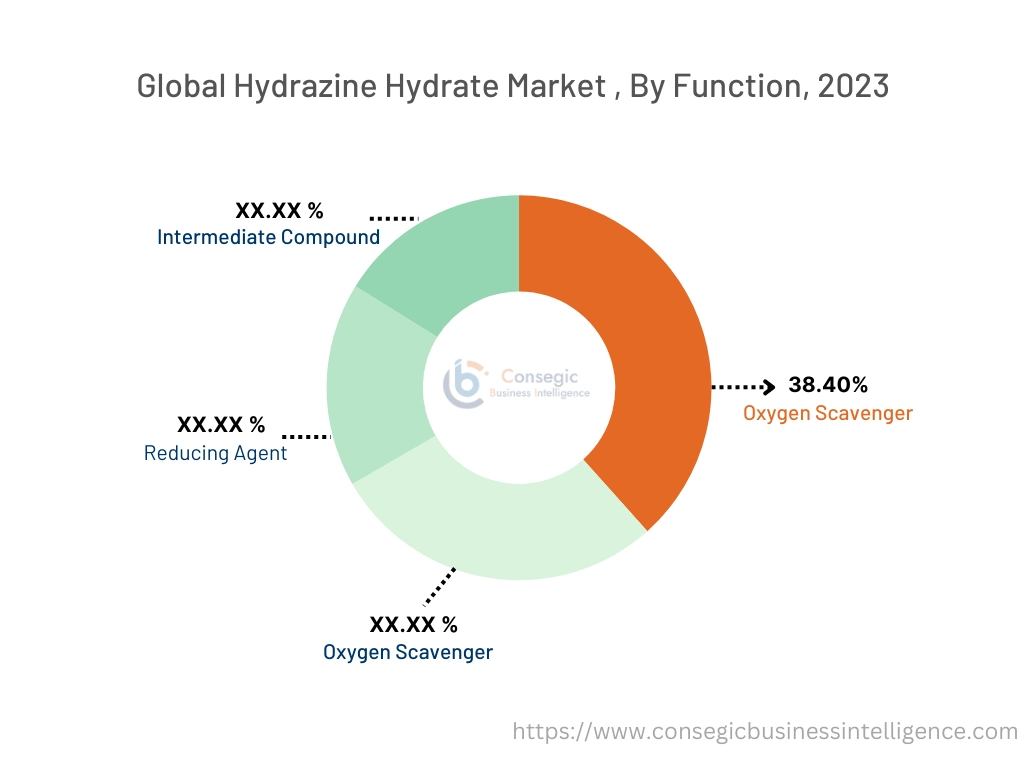

By Function:

Based on the function, the hydrazine hydrate market is segmented into oxygen scavenger, reducing agent, blowing agent, and intermediate compound.

Trends in the function:

- As manufacturers seek to develop innovative materials with enhanced performance characteristics, the role of these chemicals is anticipated to grow.

- The increasing need for lightweight and durable materials in industries such as automotive, construction, and packaging is driving the market growth.

The blowing agent segment accounted for the largest revenue share of 39.45% in the year 2024.

- The construction industry is increasingly focusing on improving the thermal efficiency of buildings to reduce energy consumption.

- Blowing agents are critical in the production of insulation materials such as polyurethane foams, which are widely used for their excellent thermal insulation properties.

- Moreover, the ongoing trend of urbanization and smart city projects is expected to boost the construction sector, thereby driving the need for blowing agents.

- Thus, based on the above analysis, these factors would further supplement the hydrazine hydrate market

The oxygen scavenger segment is anticipated to register the fastest CAGR during the forecast period.

- In water treatment sector, these chemicals are extensively used as oxygen scavengers in boiler feedwater systems, preventing corrosion and enhancing the efficiency of industrial operations.

- Moreover, the growing global emphasis on sustainable water management and rising need for efficient industrial processes are driving the need for these chemicals in this sector.

- Oxygen scavengers are extensively used in pharmaceutical packaging to maintain the integrity of active pharmaceutical ingredients (APIs) and extend the shelf life of medications. This is particularly important for biologics and other advanced therapeutics that are prone to oxidation.

- Thus, based on the above analysis, these factors are anticipated to further drive the hydrazine hydrate market trends during the forecast period.

By Form:

Based on form, the market is segmented into liquid and solid.

Trends in the form:

- The increasing investment in research and development activities for developing advanced formulations of agrochemicals is expected to create new growth prospects in the upcoming years.

- The growing need for new and innovative drugs, driven by the global increase in chronic diseases and an aging population, is fueling the requirement for different forms of hydrate.

The liquid segment accounted for the largest revenue share in the year 2024.

- Liquid hydrate has high energy density and the ability to release hydrogen upon decomposition, which makes it crucial for increasing research for clean energy solutions and zero-carbon energy systems.

- Moreover, it effectively acts as an oxygen scavenger, preventing corrosion and extending the lifespan of critical industrial equipment.

- The growing concerns regarding wastewater management and the need for effective water treatment methods are driving the need for liquid hydrate.

- Thus, the above factors are driving the hydrazine hydrate market growth and trends.

The solid segment is anticipated to register the fastest CAGR during the forecast period.

- Solid forms of hydrazine, such as hydrazine sulphate and hydrazine nitrate, are finding increasing use in specialized applications.

- These forms are valuable in areas such as pharmaceutical research and as reagents in various chemical synthesis.

- They are also applied in developing certain medicines and serve as precursors for other chemical reactions.

- These factors are anticipated to further drive the hydrazine hydrate market trends during the forecast period.

By Application:

Based on application, the market is segmented into polymerization and blowing agents, water treatment, pharmaceuticals, agrochemicals, chemical synthesis, and others.

Trends in the application:

- The expanding chemical sector, driven by the increasing need for specialty chemicals and intermediates, is a significant driver for the market.

- The industry's focus on innovative drug formulations and therapeutic compounds further necessitates the importance of these chemical compounds in pharmaceutical production.

The polymerization and blowing agents segment accounted for the largest revenue share in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- The polymerization and blowing agents segment is a significant application area for these chemicals.

- The increasing need for lightweight and durable materials in industries such as automotive, construction, and packaging is driving the development of these chemical compounds.

- Moreover, the growing need for high-performance and sustainable materials is further boosting the need for these chemical compounds in polymerization applications.

- Thus, the aforementioned factors are further expected to drive the market during the forecast period.

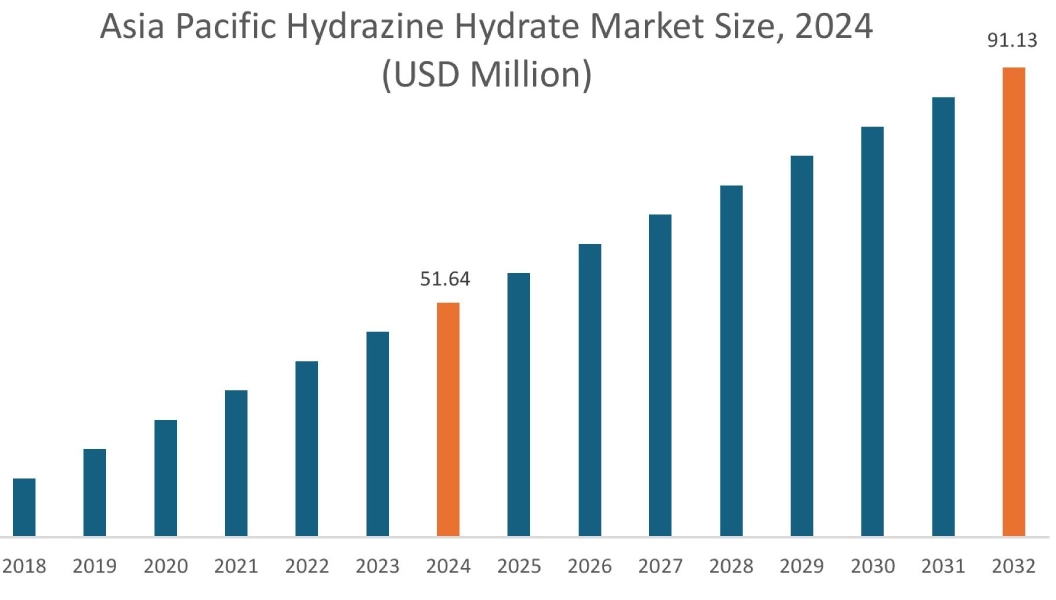

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

Asia Pacific hydrazine hydrate market expansion is estimated to reach over USD 91.13 million by 2032 from a value of USD 51.64 million in 2024 and is projected to grow by USD 54.37 million in 2025. Out of this, the China market accounted for the maximum revenue split of 34.23%. The regional development is driven by rapid industrialization and the growing need from key end-user industries such as water treatment, pharmaceuticals, and agriculture. Countries in the region are witnessing substantial development in their chemical and pharmaceutical sectors, which is contributing to the increasing need for these chemicals. Further, the region's focus on sustainable development and stringent environmental regulations are fueling the market development. These trends would further drive the regional hydrazine hydrate market during the forecast period.

- For instance, in October 2022, Gujarat Alkalies and Chemicals Ltd (GACL) commenced producing hydrazine hydrate at its new facility in Gujarat, India. This new plant marks India's first large-scale hydrazine hydrate factory and it is expected to reduce the nation's chemical imports by 60% hydrazine hydrate.

-

North America market is estimated to reach over USD 179.77 million by 2032 from a value of USD 109.10 million in 2024 and is projected to grow by USD 114.20 million in 2025. The region's focus on sustainable industrial practices and the development of advanced materials are contributing to the demand for these chemicals in various applications. In addition, the presence of key market players and ongoing research and development activities are further driving market development in North America.

According to the analysis, the hydrazine hydrate industry in Europe is anticipated to witness significant development during the forecast period. The region's stringent environmental regulations and emphasis on sustainable development are driving the demand for these chemical compounds in water treatment and other industrial applications. With rapid industrialization and urbanization across Latin American countries, there is a rising demand for effective water and wastewater treatment solutions. This drives the use of several chemical compounds as an oxygen scavenger and corrosion inhibitors in industrial boilers and water systems. Further, with a growing population and efforts to enhance food security, the agricultural sector in Middle East and Africa is expanding. This leads to an increased demand for crop protection chemicals, including pesticides, herbicides, and fungicides, in turn driving the market.

Top Key Players & Market Share Insights:

The global hydrazine hydrate market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the hydrazine hydrate industry include-

- AlzChem Group AG (Germany)

- Arkema S.A. (France)

- Sateri (China)

- Lonza Group (Switzerland)

- Mitsubishi Gas Chemical Company, Inc. (Japan)

- INEOS Group (UK)

- Olin Corporation (USA)

- Nippo Carbide Industries (Japan)

- Weifang Zhonghao Chemical Co., Ltd. (China)

- CymitQuimica S.A. (Spain)

- Huntsman Corporation (USA)

- Lanxess AG (Germany)

Recent Industry Developments :

Product launches

- In April 2023, Hubei Yihua Chemical Industry Co., Ltd. launched a new high-purity product specifically designed for advanced industrial applications and specialized agrochemical formulations.

- In August 2023, Arkema S.A. introduced a new range with enhanced stability and efficiency for use in water treatment and chemical synthesis applications.

Mergers & Acquisitions

- In April 2023, INEOS Group acquired BASF's hydrazine hydrate division to expand its market presence in Europe and North America. This acquisition strengthens INEOS's position in the hydrazine hydrate market by adding BASF's established customer base and production capabilities.

Hydrazine Hydrate Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 414.21 Million |

| CAGR (2025-2032) | 5.9% |

| By Concentration |

|

| By Function |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the hydrazine hydrate market? +

Hydrazine Hydrate Market size is estimated to reach over USD 371.95 Million by 2031 from a value of USD 240.58 Million in 2023 and is projected to grow by USD 249.76 Million in 2024, growing at a CAGR of 5.6% from 2024 to 2031.

Which is the fastest-growing region in the hydrazine hydrate market? +

North America is the region experiencing the most rapid growth in the hydrazine hydrate market.

What specific segmentation details are covered in the Hydrazine Hydrate report? +

The Hydrazine Hydrate report includes specific segmentation details for concentration, function, form, application, and region.

Who are the major players in the hydrazine hydrate market? +

The key players in the hydrazine hydrate market are AlzChem Group AG (Germany), Arkerma S.A. (France), Lanxess AG (Germany), Hubei Yihua Chemical Industry Co. Ltd. (China), Weifang Zhonghao Chemical Co., Ltd. (China), CymitQuimica S.A. (Spain), Huntsman Corporation (USA), Lonza Group (Switzerland), Mitsubishi Gas Chemical Company, Inc. (Japan), INEOS Group (UK), and Olin Corporation (USA).