Hydrogen Sulfide H2S Scavenger Market Size :

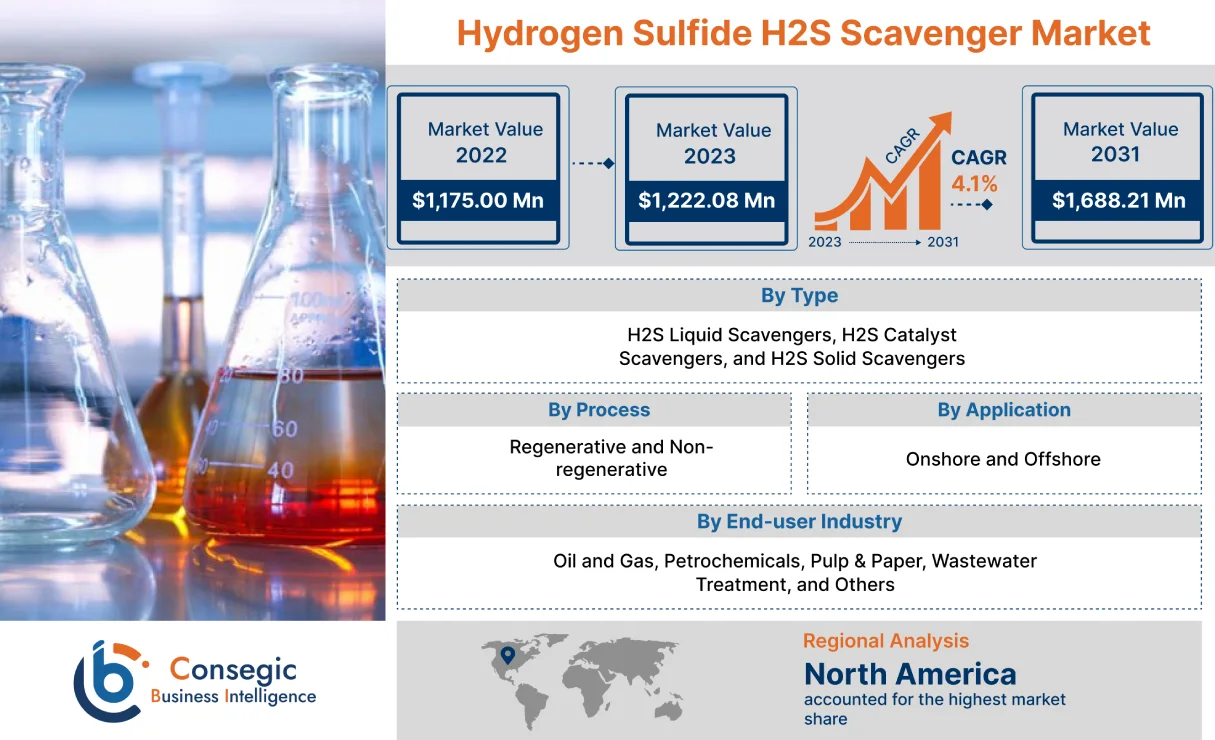

Hydrogen Sulfide H2S Scavenger Market size is estimated to reach over USD 1,709.35 Million by 2032 from a value of USD 1,243.32 Million in 2024 and is projected to grow by USD 1,271.65 Million in 2025, growing at a CAGR of 4.10% from 2025 to 2032.

Hydrogen Sulfide H2S Scavenger Market Scope & Overview :

A hydrogen sulfide scavenger is a chemical additive that reacts with hydrogen sulfide (H2S) to convert it into a less harmful compound. It is a colorless, flammable, and toxic gas that is commonly found in oil and gas production. It is a major health and safety hazard for workers in the oil and gas sector, and it can also cause corrosion of equipment and pipelines.

H2S scavengers are widely used in the oil and gas sector to protect workers and equipment, and to ensure that oil and gas products meet sales specifications. Hydrogen sulfide H2S scavenger are available in a variety of formulations to meet the specific needs of different oil and gas applications. They can be injected into fluids using a variety of methods, including downhole injection, surface injection, and batch treatment.

Hydrogen Sulfide H2S Scavenger Market Insights :

Key Drivers :

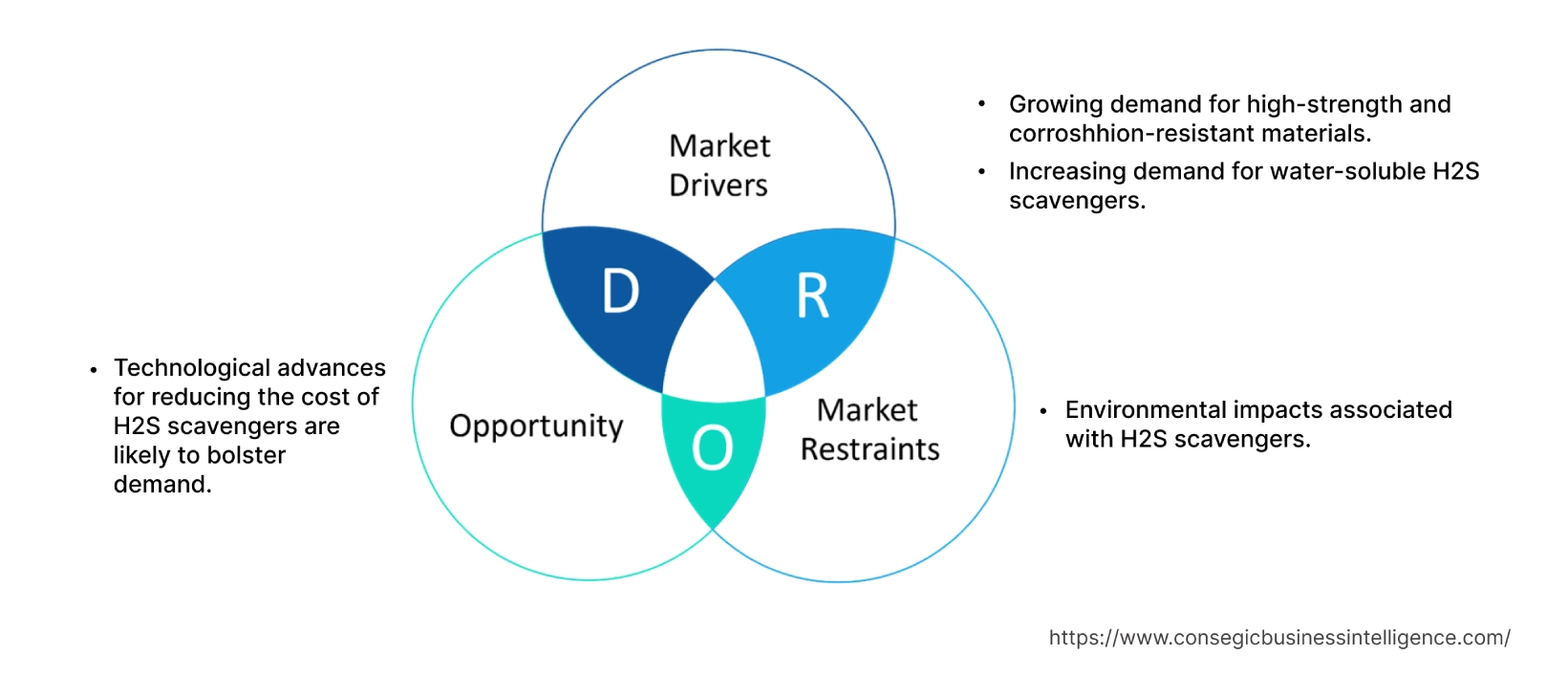

Growing demand for high-strength and corroshhion-resistant materials

H2S scavengers are used in many industries such as oil and gas, wastewater treatment, pulp and paper, mining, and others. They absorb H2S gas and prevent it from getting released into the air. These types of scavengers are used in the mining sector to remove H2S deposits from drilling mud. Furthermore, these compounds are also used in the oil and gas sector to guarantee oil specifications and eliminate odor emissions. As a result, the growing oil and gas sector will significantly increase the trend for hydrogen sulfide H2S scavengers. Based on the analysis, H2S scavengers are widely used in the oil and gas sector to protect workers and equipment and to ensure that oil and gas products meet sales specifications. The increasing launch of new oil and gas projects is driving the requirement for hydrogen sulfide for various applications. For instance, in June 2023, The Amiral petrochemical complex is a USD 11 billion project in Saudi Arabia that is being developed by the SATORP joint venture. The joint venture is owned by Saudi Aramco (62.5%) and TotalEnergies (37.5%). The project is expected to begin construction in 2023 and start commercial operation in 2027. Thus, the growing oil and gas activities across the globe is increasing the demand for hydrogen sulfide for various activities and driving the market.

Increasing demand for water-soluble H2S scavengers

H2S emissions are high in process manufacturing industries where water streams are involved either for waste removal or cooling. Water-soluble H2S can be directly injected into water streams eliminating the need for mixing and dilution equipment. Moreover, they are typically less toxic to the environment compared to organic scavengers that can accumulate near water bodies. Also, these scavengers are less likely to leave scales or deposits on pipes reducing the cost of maintenance. Water-soluble scavengers are being used to remove H2S from natural gas before it is transported to power plants and other consumers. This helps to reduce emissions of H2S and other pollutants into the atmosphere. The increasing amount of H2S content in the atmosphere and wastewater is driving the demand water soluble H2S scavenger. For instance, according to the report by the National Institute of Health in December 2020, the increase in temperature from 5 to 35 has increased the emission of H2S from 22 to 27%. Furthermore, water-soluble hydrogen sulfide H2S scavenger are less likely to make flammable bio-products because of their aqueous nature. Hence, these numerous benefits are boosting the market. Thus, the growing demand for water-soluble H2S scavenger is driving the market for hydrogen sulphide H2S scavenger globally.

Key Restraints :

Environmental impacts associated with H2S scavengers

Hydrogen sulfide scavengers are chemicals that are used to remove H2S from gas streams and wastewater. H2S is a toxic and corrosive gas that is commonly found in oil and gas production, as well as in geothermal and wastewater streams. It is also produced by the decomposition of organic matter. H2S scavengers are an important tool for protecting workers and the environment from exposure to H2S. However, some H2S scavengers can have negative environmental impacts. For example, some H2S scavengers can be toxic to aquatic life and can contribute to the formation of smog. Furthermore, Some H2S scavengers, such as triazine-based scavengers, can be toxic to aquatic life. This is a concern because H2S scavengers are often used in oil and gas production, which takes place in both marine and freshwater environments. Thus, the environmental impacts associated with hydrogen sulfide H2S scavenger are restraining the H2S scavenger market across the globe.

Future Opportunities :

Technological advances for reducing the cost of H2S scavengers are likely to bolster demand

Technological advances for reducing the cost are creating lucrative hydrogen sulfide H2S scavenger market opportunities and trends in the upcoming years. H2S scavengers are typically expensive due to their complex manufacturing process and storage requirements. Recent technological advances such as the use of nanotechnology, improved bed reactors, and additives are improving the manufacturing efficiency of these scavengers. Also, based on the analysis, key manufacturers are working towards technological advances to reduce the cost of these scavengers. For instance, In March 2021, Merichem announced the launch of EcoTreat, a revolutionary modular treatment system that completely removes H2S from sour gas streams using a sulfur-catalyst scavenger and produces water as a medium in the absorber. In contrast to traditional systems, the spent treatment solution is oxidized by sparging, which regenerates the scavenger for reuse.

Furthermore, the requirement for water-soluble H2S scavengers is increasing due to reduced toxicology and cheaper prices. The growing innovations and technological advances are expected to shape the market. Thus, increasing innovation in hydrogen sulfide is expected to create lucrative opportunities for the development and trend of the global hydrogen sulfide H2S scavenger market growth over the forecast period.

Hydrogen Sulfide H2S Scavenger Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1,709.35 Million |

| CAGR (2025-2032) | 4.1% |

| By Type | H2S Liquid Scavengers, H2S Catalyst Scavengers, and H2S Solid Scavengers |

| By Process | Regenerative and Non-regenerative |

| By Application | Onshore and Offshore |

| By End-user Industry | Oil and Gas, Petrochemicals, Pulp & Paper, Wastewater Treatment, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Schlumberger Limited, Haliburton, Baker Hughes, Nalco Champion, Hexion, Arkema S.A., Lonza, SUEZ, AkzoNobel N.V., Axalta Coating Systems, Dow, BASF SE, and Dorf Ketal |

Hydrogen Sulfide H2S Scavenger Market Segmental Analysis :

By Type :

The type is categorized into H2S liquid scavengers, H2S catalyst scavengers, and H2S solid scavengers. In 2024, the H2S liquid scavenger segment accounted for the highest market share in the hydrogen sulfide H2S scavenger market, and it is also expected to grow at the highest CAGR over the forecast period. Liquid H2S scavengers are being used to remove H2S from natural gas before it is transported to power plants and other consumers. As per the analysis, this helps to reduce emissions of H2S and other pollutants into the atmosphere. Liquid H2S scavengers are also being used to remove H2S from wastewater produced by oil and gas companies. This helps to protect the environment and reduce the risk of contamination of water resources. Furthermore, based on the analysis, liquid H2S scavengers are being used to remove H2S from biofuels, such as biodiesel and biogas. The expansion of oil and gas production is driving the requirement for liquid hydrogen sulfide across the globe. For instance, in August 2023, Chevron is expanding production across the U.S., including a 16% increase in the Permian Basin in 2022. The Permian Basin is a vast oil and gas region that spans parts of west Texas and southeastern New Mexico. Thus, the growing focus on the oil and gas field expansion is driving the segment growth across the globe.

By Process :

The process is categorized into regenerative and non-regenerative. In 2024, the non-regenerative segment accounted for the highest market share in the hydrogen sulfide H2S scavenger market, and it is also expected to grow at the highest CAGR over the forecast period. A non-regenerative hydrogen sulfide process is a process in which the H2S scavenger is consumed during the reaction with H2S. This is the simplest and most common type of H2S scavenger process. Non-regenerative H2S processes are relatively simple and easy to use. This makes them ideal for a wide range of applications, including oil and gas production, wastewater treatment, and chemical processing. As per the analysis, governments around the world are implementing stricter environmental regulations to reduce emissions of H2S and other pollutants. Non-regenerative H2S scavengers can help oil and gas companies comply with these regulations by removing H2S from their waste streams. For instance, The Occupational Safety and Health Administration (OSHA) has set an acceptable ceiling limit of 20 parts per million (ppm) for hydrogen sulfide in workplace air. This limit is a 15-minute time-weighted average that cannot be exceeded at any time during the working day. Thus, the stringent government regulations related to the emission of H2S are driving the segment growth across the globe.

By Application :

The application segment is categorized into onshore and offshore. In 2024, the onshore application segment accounted for the highest market revenue in the overall hydrogen sulfide H2S scavenger market, and it is also expected to hold the highest CAGR over the forecast period. The onshore application of hydrogen sulfide H2S scavenger includes application in oil and gas production, wastewater treatment, chemical processing, mining, food processing, and others.

Increasing government initiatives for the launch of wastewater treatment facilities across the globe are driving the segment growth. For instance, in January 2023, the Indian government laid the foundation stone for seven sewage treatment plants (STPs) in Mumbai. The plants will have a combined capacity of around 2,460 MLD. Each plant will have the capacity to treat 2,464 million liters of sewage per day. Thus, the growing onshore activities are driving the segment expansion worldwide.

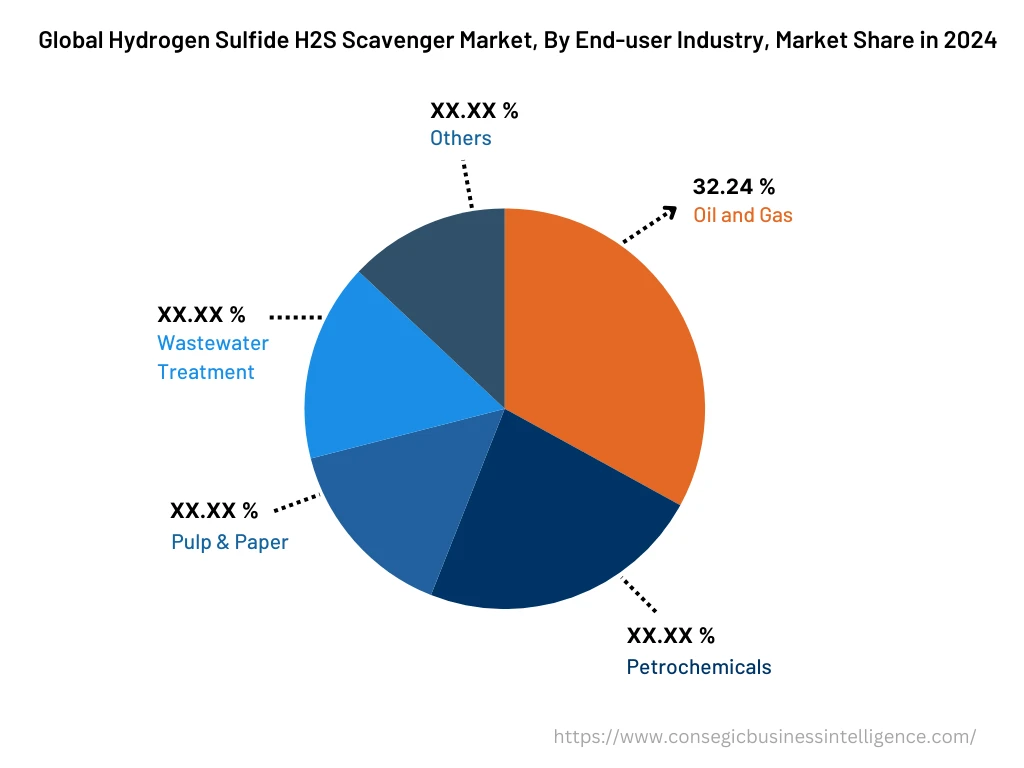

By End-user Industry :

The end-user industry segment is categorized into oil and gas, steel sector, chemicals, and petrochemicals, automotive, aerospace and defense, electrical and electronics, energy and power, mining, and others. In 2024, the oil and gas segment accounted for the highest hydrogen sulfide H2S scavenger market share of 33.24% in the overall hydrogen sulfide H2S scavenger market. In the oil and gas sector, H2S scavengers are being used to remove H2S from natural gas before it is transported to power plants and other consumers. This helps to reduce emissions of H2S and other pollutants into the atmosphere. As per the analysis, the significant rise in oil and gas production across the globe is driving the requirement for H2S scavenger from the oil and gas sector. For instance, according to the report by the National Investment Promotion and Facilitation Agency, Crude oil processing increased by 9% from 221.77 MMT in 2020-21 to 241.7 MMT in 2021-22. The production of petroleum products stood at 254.3 MMT in FY 2021-22. Thus, the growing oil and gas sector is driving the segment growth and trend across the globe.

Moreover, the wastewater treatment segment is expected to hold the highest CAGR over the forecast period. H2S scavengers are used in both primary and secondary wastewater treatment. In primary wastewater treatment, H2S scavengers can be used to remove H2S from raw wastewater before it enters the clarifier. This helps to reduce the amount of H2S that is released into the atmosphere from the clarifier. The growing application of hydrogen sulfide H2S scavenger in wastewater treatment is driving the segment growth and trend over the forecast period.

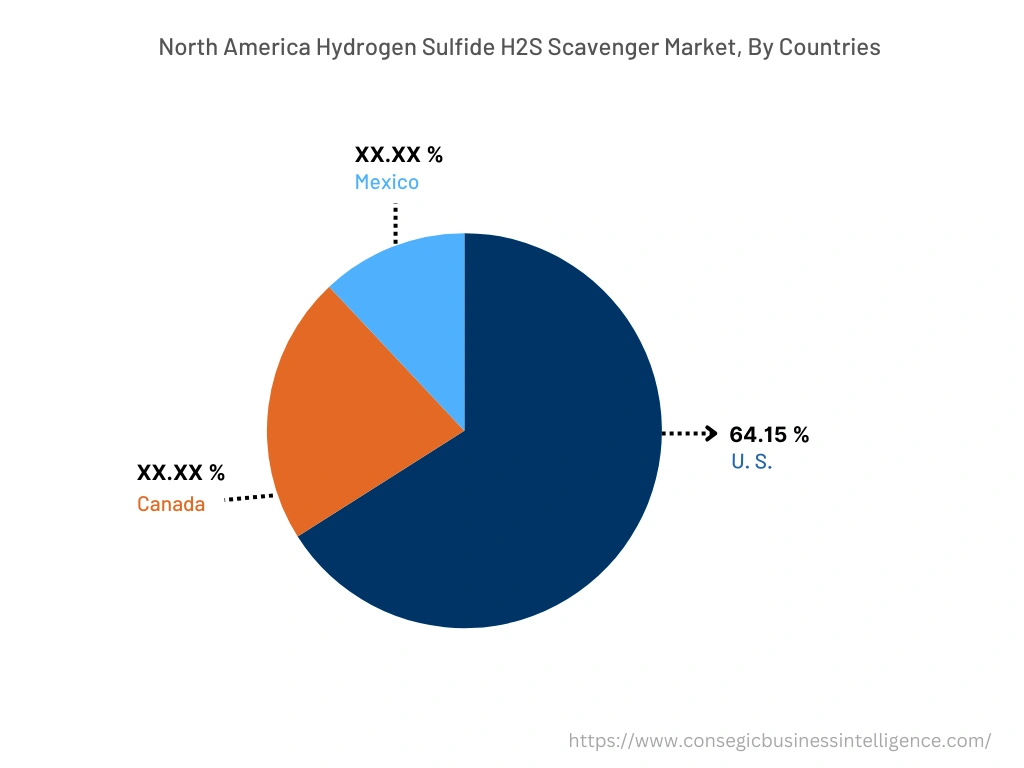

By Region :

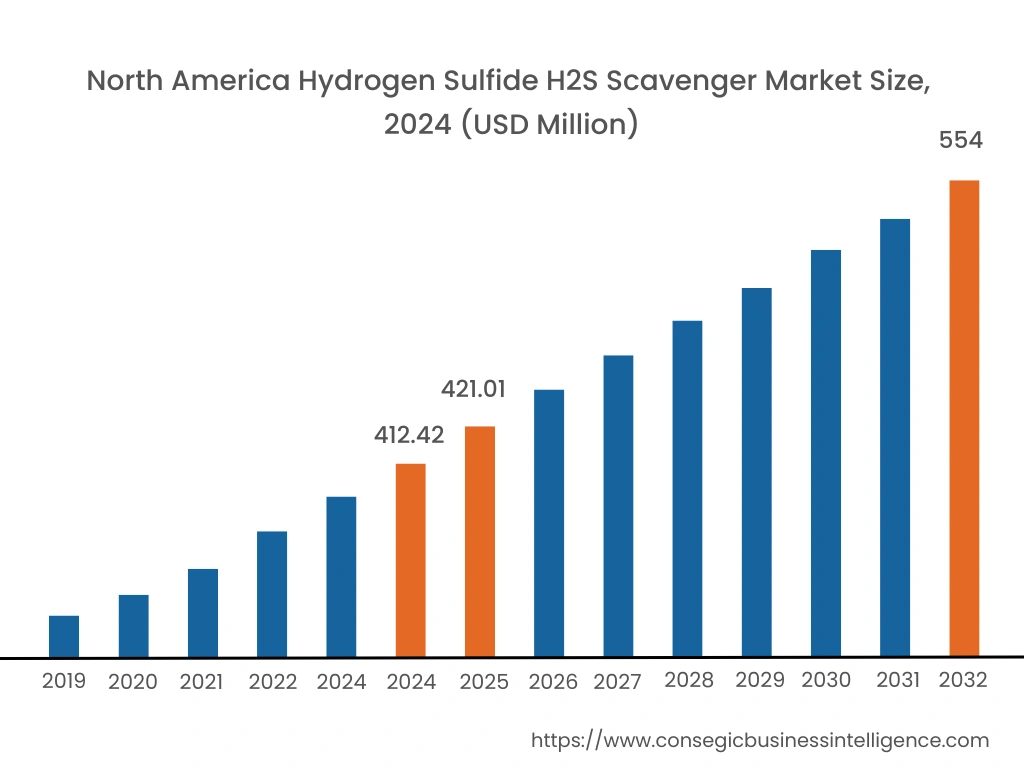

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, North America was valued at USD 412.42 Million and is expected to reach USD 554 Million in 2032. In North America, the U.S. accounted for the highest share of 64.15% during the base year of 2024. North America is a major producer of oil and gas, and H2S is a common contaminant in oil and gas. H2S scavengers are used to remove H2S from natural gas and wastewater produced by oil and gas wells. Growing oil and gas consumption in the region is driving the market growth. For instance, according to the report by the U.S. Energy Information Administration in October 2023, the U.S. consumption of oil is expected to increase by 6% in 2024 with more than 1.7 million barrel/day in 2023. Thus, the growing consumption of oil in the region is increasing the production of oil and gas and thus driving the hydrogen sulfide H2S scavenger market demand and trends in the North American region.

Furthermore, In Asia Pacific, the market is experiencing the fastest growth with a CAGR of 4.5% over the forecast period. Based on the hydrogen sulfide H2S scavenger market analysis, the significant growth in the oil and gas projects across the region is improving the trends for hydrogen sulfide for various oil and gas activities. For instance, in April 2023, Cairn Oil & Gas, which is a unit of Vedanta Limited, announced the test production of Hazarigaon field in Assam to commence the gas flow from DSF block. Thus, the growing oil and gas projects across the region is driving the hydrogen sulfide H2S scavenger market trends over the forecast period.

Top Key Players & Market Share Insights :

The hydrogen sulfide H2S scavenger Market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The hydrogen sulfide H2S scavenger industry is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market revenue through mergers, acquisitions, and partnerships. The key players in the market include-

- Schlumberger Limited

- Haliburton

- AkzoNobel N.V.

- Axalta Coating Systems

- Dow

- BASF SE

- Dorf Ketal

- Baker Hughes

- Nalco Champion

- Hexion

- Arkema S.A.

- Lonza

- SUEZ

Recent Industry Developments :

- In June 2020, BASF SE launched a new hydrogen sulfide scavenger product called LIXSCAV™. This product is designed for the oil and gas sector and offers efficient and cost-effective removal of hydrogen sulfide from gas streams.

Key Questions Answered in the Report

What was the market size of the hydrogen sulfide H2S scavenger market in 2024? +

In 2024, the market size of hydrogen sulfide H2S scavenger market was USD 1,243.32 million.

What will be the potential market valuation for the hydrogen sulfide H2S scavenger market industry by 2032? +

In 2032, the market size of hydrogen sulfide H2S scavenger market will be expected to reach USD 1,709.35 million.

What are the key factors driving the growth of the hydrogen sulfide H2S scavenger Market? +

Growing demand for hydrogen sulfide H2S scavenger from oil and gas industry across the globe is fueling market growth at the global level.

What is the dominant segment in the hydrogen sulfide H2S scavenger market for the end-user industry? +

In 2024, the oil and gas segment accounted for the highest market share of 33.24% in the overall Hydrogen Sulfide H2S Scavenger Market.

Based on current market trends and future predictions, which geographical region is the dominating region in the hydrogen sulfide H2S scavenger market? +

North America accounted for the highest market share in the overall market.