Logistics Automation Market Size:

Logistics Automation Market size is estimated to reach over USD 147.35 Billion by 2032 from a value of USD 64.85 Billion in 2024 and is projected to grow by USD 70.72 Billion in 2025, growing at a CAGR of 12.05% from 2025 to 2032

Logistics Automation Market Scope & Overview:

Logistics automation refers to the integration of technologies to streamline and optimize various processes within the supply chain by reducing manual efforts. The goal is to enhance speed, accuracy, and overall operational efficiency, ultimately leading to reduced costs and improved customer satisfaction, which in turn is boosting the logistics automation market growth. Additionally, the key benefits include increased efficiency, reduced costs, and improved customer satisfaction, which is driving the logistics automation market demand. Further, the proliferation of the Internet of Things (IoT) is driving the market progress.

How is AI Transforming the Logistics Automation Market?

AI is being utilized in the logistics automation market, primarily for facilitating real-time supply chain visibility, predictive analytics for demand forecasting and maintenance, optimized route planning and warehouse operations, and enhanced customer experiences through chatbots and faster deliveries. This leads to increased efficiency, reduced costs, improved resource allocation, improved sustainability, and greater flexibility in supply chains.

Additionally, AI-powered automation solutions enable businesses to manage complex supply chains more effectively by analyzing vast datasets to predict needs, identify potential disruptions, and automate routine tasks, which contributes to improved inventory management, reduced fuel consumption, and faster delivery times. Thus, the above factors are expected to create lucrative prospects for market growth in upcoming years.

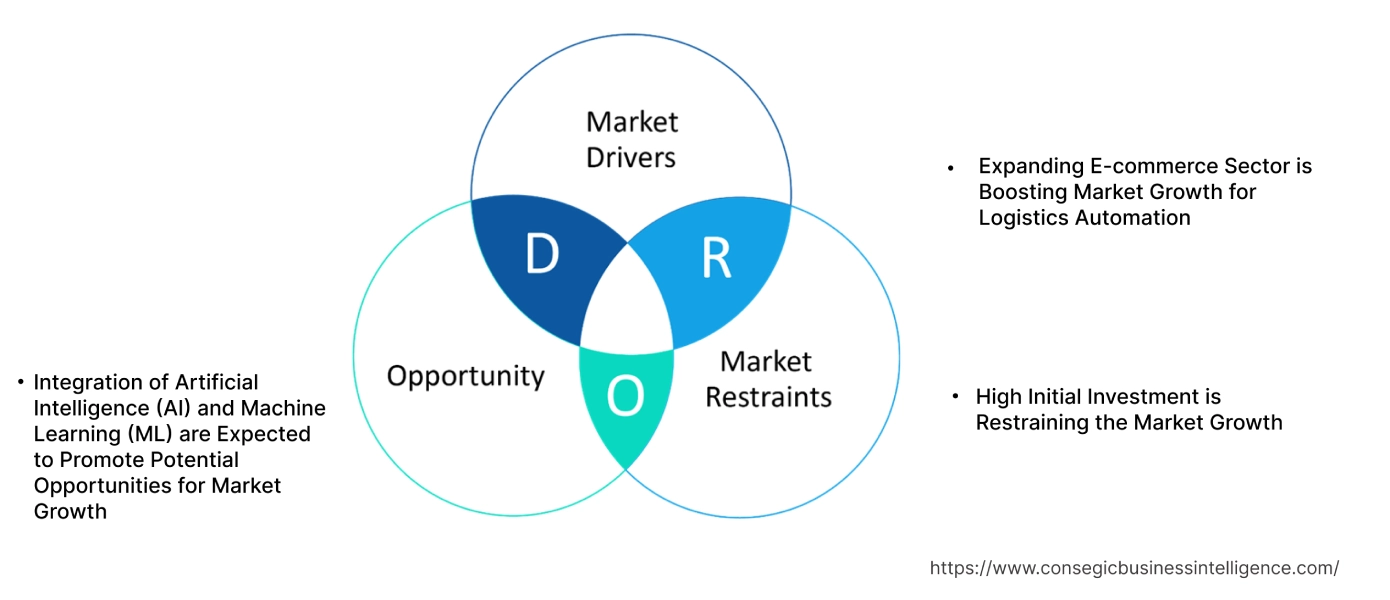

Key Drivers:

Expanding E-commerce Sector is Boosting Market Growth for Logistics Automation

The surging online shopping is driving the demand for efficient and automated logistics solutions to manage the increased volume of orders, storage, and delivery, which in turn is boosting the logistics automation market growth. Additionally, the rising investment in automation technologies across various aspects of the supply chain is driving the logistics automation market demand. Further, the increasing focus on optimizing warehouse operations is driving the logistics automation industry.

- For instance, according to the India Brand Equity Foundation (IBEF), Indian e-commerce platforms generated sales worth USD 5.67 billion GVM in 2023, which in turn is paving the way for market progress.

Therefore, the expanding e-commerce sector is driving the adoption of automation in transportation & logistics, in turn, proliferating the growth of the market.

Key Restraints:

High Initial Investment is Restraining the Market Growth

The high initial investment cost is much higher due to advanced technologies, infrastructure, and other factors, which are hindering the logistics automation market expansion. Additionally, implementing automation requires upfront capital for purchasing equipment, as well as careful planning and execution to avoid disruptions, in turn restraining the market progress.

Therefore, the high initial investment for implementing automation is hindering the logistics automation market expansion.

Future Opportunities :

Integration of Artificial Intelligence (AI) and Machine Learning (ML) are Expected to Promote Potential Opportunities for Market Growth

logistics automation market opportunities. Additionally, AI and ML algorithms analyze historical data and other relevant factors for demand forecasting with greater accuracy, in turn driving the market development. Further, AI and ML integration helps to reduce transportation costs, faster delivery times, reduce human error, and improve fuel efficiency, thereby propelling the market progress.

- For instance, in April 2025, Freight Technologies launched an AI lab to enhance cross-border freight logistics between the United States and Mexico. The launch aims to expand the potential of AI applications in the freight industry.

Hence, the rising adoption of AI and ML algorithms is anticipated to increase the utilization of automation in logistics, in turn driving the logistics automation market opportunities during the forecast period.

Logistics Automation Market Segmental Analysis :

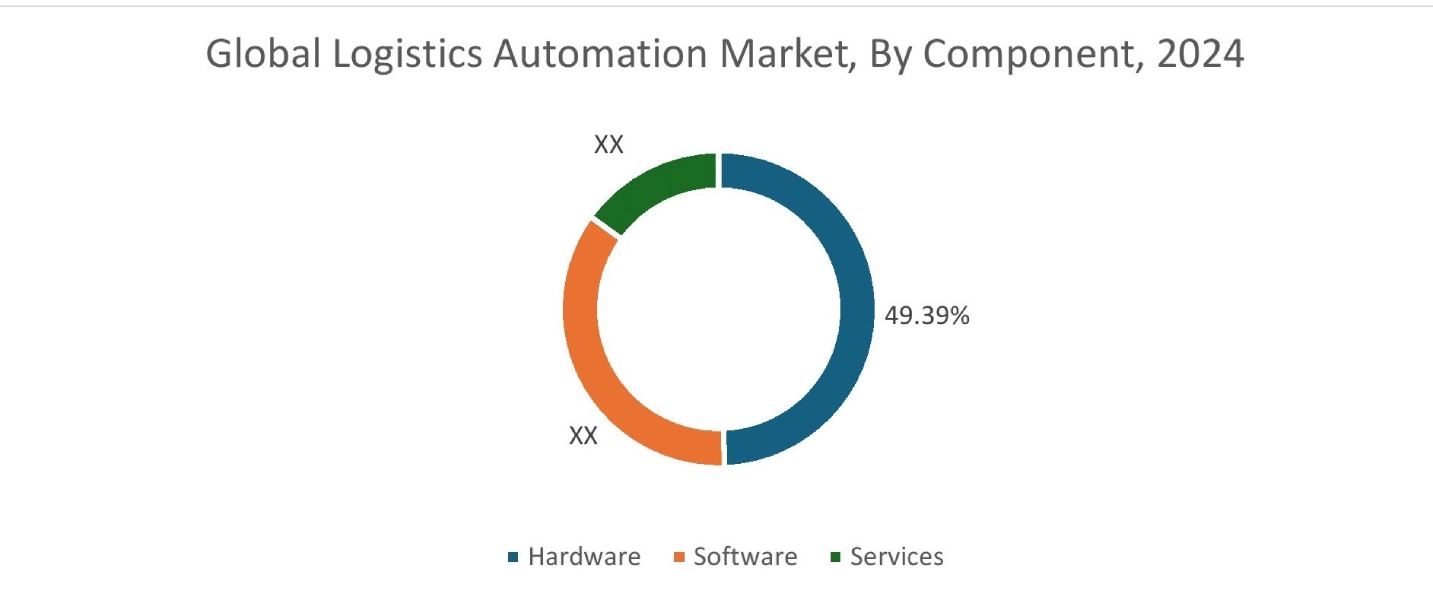

By Component:

Based on the component, the market is segmented into hardware, software, and services.

Trends in the component:

- The rising use of digital twins for transforming warehouse operations and supply chain management is driving the need for software, in turn driving the logistics automation market trends.

- The integration of blockchain technology with software for enhancing supply chain transparency and traceability is driving the logistics automation market trends.

Hardware accounted for the largest revenue share of 49.39% in the year 2024.

- Hardware component comprises automated storage and retrieval systems (AS/RS), conveyors, automated guided vehicles, and others.

- Additionally, the rising adoption of mobile robots is gaining traction and is becoming a vital part of many automated systems, particularly for high-throughput operations, which in turn is boosting the logistics automation market share.

- Further, the increasing adoption of advanced technologies, such as AI and ML integrated with hardware to optimize performance, predict maintenance needs, and improve overall efficiency, is fueling the optimization of performance, predict maintenance needs, and improve overall efficiency.

- For instance, in March 2025, Onward Robotics deployed Pyxis software and Lumabot autonomous mobile robots to FST Logistics, which is designed for its 3PL customers.

- Thus, as per the market analysis, the increasing adoption of advanced technologies such as AI and ML is driving the market's progress.

Services segment is anticipated to register the fastest CAGR during the forecast period.

- Autonomous vehicles, including drones and self-driving trucks, are being increasingly adopted for last-mile delivery, and even long-haul transportation, which is driving the demand for the services segment.

- Additionally, the proliferation of IoT for training, maintenance, and remote collaboration within logistics operations fuels the logistics automation market size.

- Further, the services component contributes to sustainability efforts by optimizing routes, reducing fuel consumption, and minimizing waste, in turn boosting the logistics automation market size.

- Therefore, as per the market analysis, the proliferation of IoT for training, maintenance, and remote collaboration within logistics operations is anticipated to boost the market during the forecast period.

By Functions:

Based on the functions, the market is segmented into inventory management, order management, vendor management, transport management, and others.

Trends in the Functions:

- The rising trend towards real-time monitoring of inventory, shipments, and equipment for better tracking and proactive problem-solving is driving the adoption of IoT sensors and connected devices for order management.

- The trend towards remote and hybrid work models is driving the adoption of cloud-based vendor management systems for better collaboration and accessibility.

Inventory management segment accounted for the largest revenue share in the year 2024.

- Inventory management functions encompass the processes of tracking, controlling, and optimizing the flow of goods and materials throughout the supply chain.

- Additionally, the proliferation of omnichannel sales is driving the adoption of automation technology for tracking stock in real-time and fulfilling orders, which in turn is fueling the logistics automation market share.

- Further, the rising adoption of automated guided vehicles (AGVs), automated mobile robots (AMRs), and other technologies for inventory management is boosting the market progress.

- For instance, in June 2023, Primetals Technologies partnered with ABF for the development of autonomous inventory management solutions, which include tracking, identifying, and locating items for the metals industry.

- Thus, according to the logistics automation market analysis, the above factors are driving the market.

Transport management segment is anticipated to register the fastest CAGR during the forecast period.

- The transport management function focuses on planning, executing, and optimizing the movement of goods from origin to destination, aiming to improve efficiency and reduce costs associated with transportation activities.

- Additionally, the increasing need for speed and reliability in last-mile delivery and long-haul transportation is driving the adoption of self-driving trucks and drones.

- Further, the integration of AI and machine learning for predictive analytics and route optimization is driving the need for transport management.

- Therefore, according to the logistics automation market analysis, the integration of AI and machine learning for predictive analytics and route optimization is anticipated to boost the market during the forecast period.

By End User:

Based on the end user, the market is segmented into manufacturing, healthcare, automotive, retail & e-commerce, electronics & semiconductor, aerospace & defence, and others.

Trends in the End User:

- The rising trend towards adoption of automation and digitalization by the automotive sector to reduce expenses and improve margins is driving the market progress.

- The rising trend towards adoption of advanced cold chain logistics solutions in the healthcare sector for maintaining the integrity of temperature-sensitive medications and products is driving the market progress.

Retail & e-commerce segment accounted for the largest revenue share in the year 2024.

- The rapid growth of retail and e-commerce due to increasing customer expectations for faster, more reliable, and convenient delivery is driving the market demand.

- Additionally, the key benefits of automation in the retail & e-commerce segment include streamlining processes, reducing labor costs, minimizing errors, and optimizing resource allocation.

- Further, globalization and increased product variety are propelling the adoption of automation, which in turn leads to increased productivity and lower operational costs.

- For instance, in March 2023, DB Schenker implemented the largest automated e-commerce facilities in Spain, Portugal, and France. Additionally, the facility has more than 200 robots, and an optimized packaging system in turn is paving the way for adoption of automation in the retail and e-commerce sector.

- Thus, as per the market analysis, the aforementioned factors are driving the market demand.

Electronics & semiconductor segment is anticipated to register the fastest CAGR during the forecast period.

- Logistics automation plays a crucial role in the electronics and semiconductor sector by enhancing efficiency, reducing costs, and improving overall supply chain resilience.

- Additionally, the growing electric vehicle (EV) market, which is dependent on the electronics & semiconductor sector for power management, control systems, and other components, is driving the market progress.

- Further, the increasing digitalization and rising need for efficient supply chains are fueling the market adoption in the electronics & semiconductor sector.

- Therefore, as per the market analysis, the above factors are anticipated to boost the market during the forecast period.

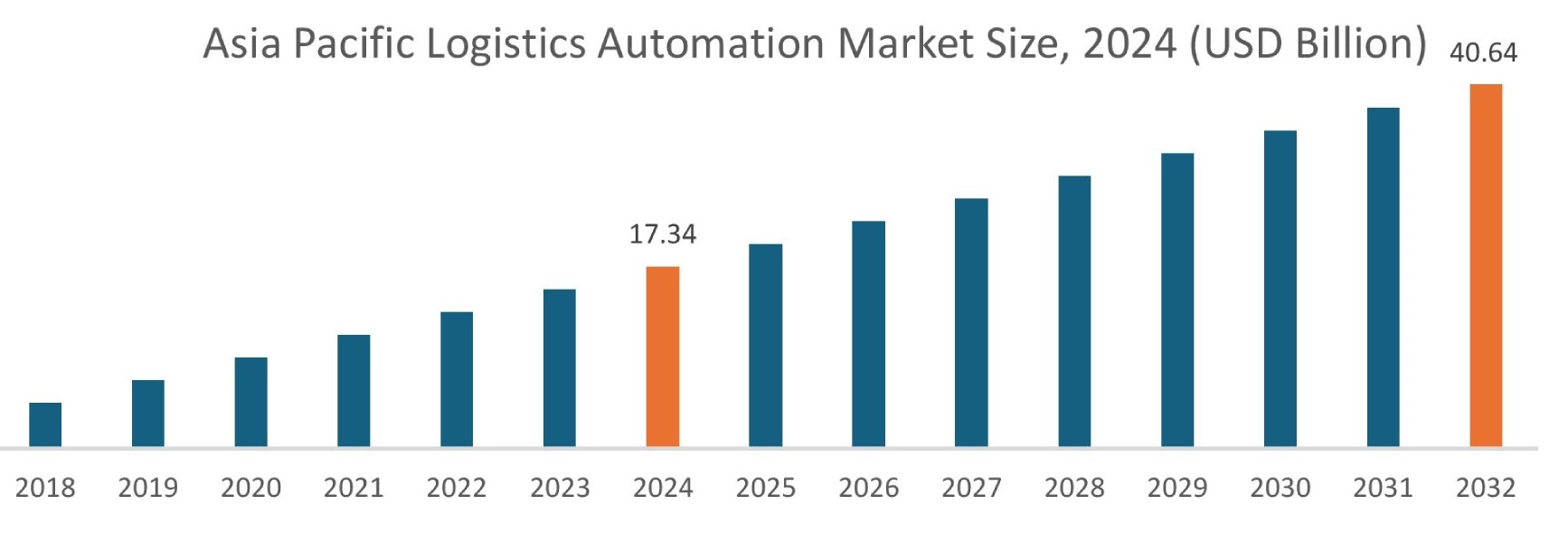

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

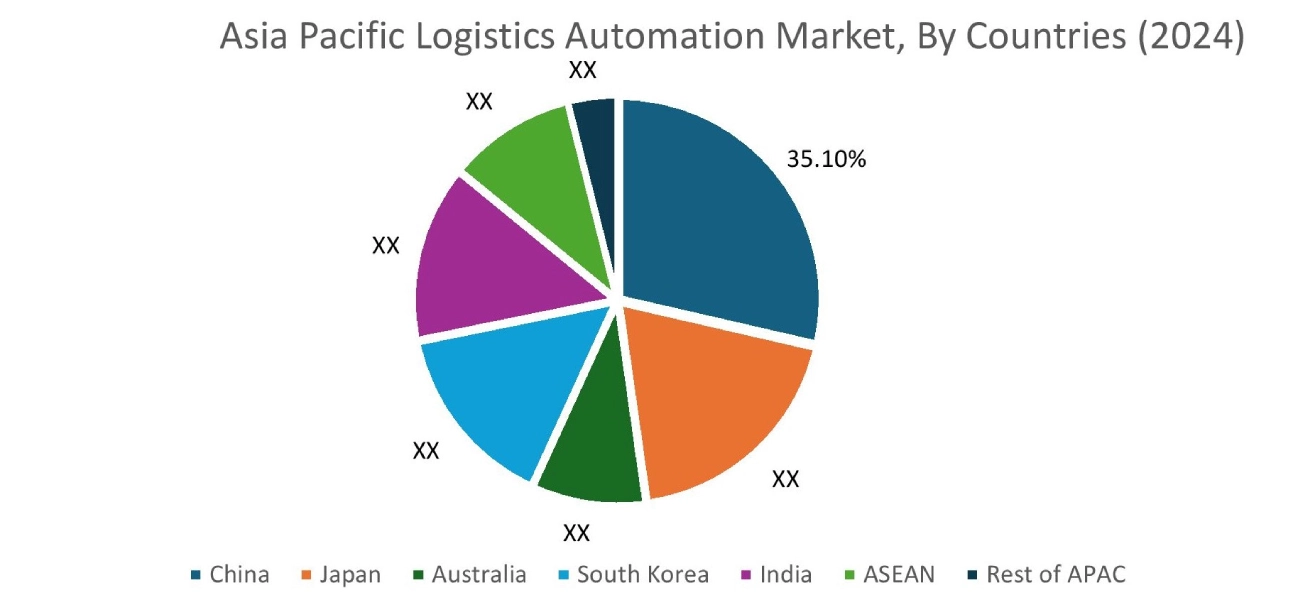

Asia Pacific region was valued at USD 17.34 Billion in 2024. Moreover, it is projected to grow by USD 18.96 Billion in 2025 and reach over USD 40.64 Billion by 2032. Out of this, China accounted for the maximum revenue share of 35.10%. The market progress is mainly driven by the adoption of automated technologies such as AGVs, AMRs, and advanced warehouse management systems. Furthermore, factors including government support and investments in infrastructure are projected to drive the market progress in the Asia Pacific region during the forecast period.

- For instance, in October 2024, Floatic partnered with Geek+ to deliver an integrated robotic solution for warehouse automation. The partnership aims to establish a joint sales pipeline in Asia-Pacific to deliver integrated robotics solutions.

North America is estimated to reach over USD 45.47 Billion by 2032 from a value of USD 19.95 Billion in 2024 and is projected to grow by USD 21.77 Billion in 2025. The North American region's increasing focus on real-time data analytics and IoT devices to track shipments and monitor conditions to make informed decisions offers lucrative growth prospects for the market. Additionally, the surge in e-commerce is driving the market progress.

- For instance, in April 2025, Locus Robotics surpassed the 5 billion units picked milestone across its global customer deployments with the help of AI-driven, mobile warehouse automation.

The regional analysis depicts that the rising focus on sustainability and e-commerce is driving the market in Europe. Additionally, the key factor driving the market is the growing emphasis on green logistics, as well as initiatives to modernize the manufacturing and logistics sectors in turn are propelling the market adoption in the Middle East and African region. Further, the rapid progress of e-commerce and integration of digital technologies such as AI and IoT are paving the way for market development in the Latin America region.

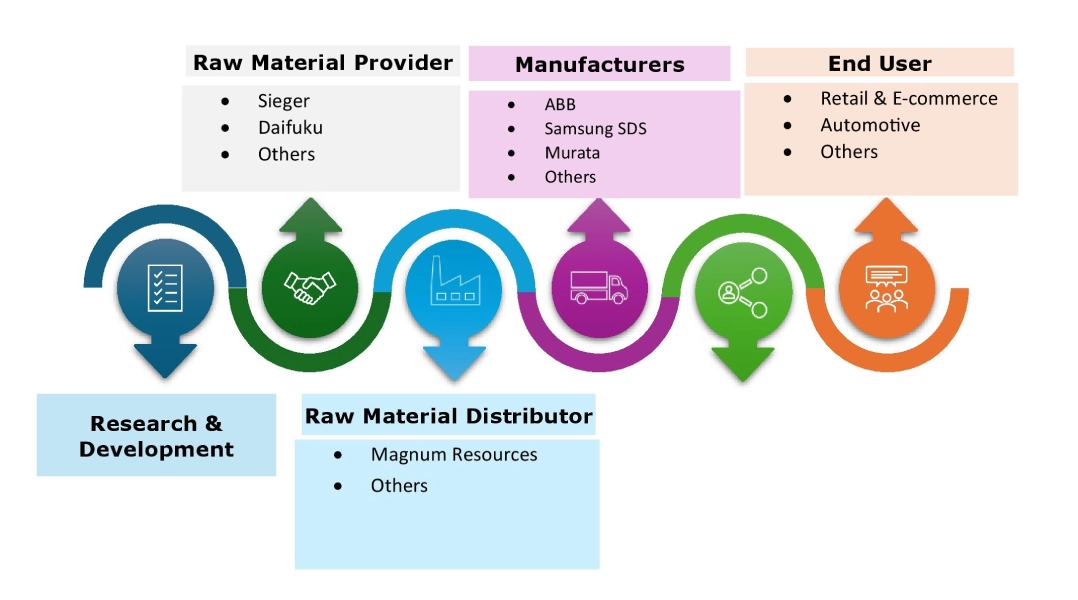

Top Key Players and Market Share Insights:

The global logistics automation market is highly competitive with major players providing logistics automation to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in the logistics automation industry. Key players in the logistics automation market include-

- Jungheinrich AG (Germany)

- Blue Yonder Group, Inc. (USA)

- Zebra Technologies (USA)

- IBM (USA)

- Oracle (USA)

- KUKA AG (Germany)

- ABB (Switzerland)

- Samsung SDS (South Korea)

- Murata Machinery (Japan)

- Toshiba (Japan)

Recent Industry Developments :

Product launches

- In March 2025, ABB expanded its portfolio of robotic solutions designed for logistics and e-commerce supply chains. The portfolio includes AI-powered vision technology and functional modules, designed for greater levels of speed and accuracy in selecting and receiving items.

Partnerships & Collaborations:

- In February 2025, Saksoft partnered with Cleo to provide real-time data, integration, and automation to logistics companies, including logistics & transportation, retail, fintech, and more.

Logistics Automation Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 147.35 Billion |

| CAGR (2025-2032) | 12.05% |

| By Component |

|

| By Functions |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the logistics automation market? +

The logistics automation market size is estimated to reach over USD 147.35 Billion by 2032 from a value of USD 64.85 Billion in 2024 and is projected to grow by USD 70.72 Billion in 2025, growing at a CAGR of 12.05% from 2025 to 2032.

Which segmentation details are covered in the logistics automation report? +

The logistics automation report includes specific segmentation details for component, functions, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the logistics automation market, transport management is the fastest-growing segment during the forecast period due to the integration of AI and machine learning for predictive analytics and route optimization.

Who are the major players in the logistics automation market? +

The key participants in the logistics automation market are Jungheinrich AG (Germany), Blue Yonder Group, Inc. (USA), KUKA AG (Germany), ABB (Switzerland), Samsung SDS (South Korea), Murata Machinery (Japan), Toshiba (Japan), Zebra Technologies (USA), IBM (USA), Oracle (USA), and others.

What are the key trends in the logistics automation market? +

The logistics automation market is being shaped by several key trends, including rising adoption of automation and digitalization, as well as rising use of digital twins for transforming warehouse operations and supply chain management, and others.