Multilayer Varistor Market Size:

Multilayer Varistor Market Size is estimated to reach over USD 1,182.95 Million by 2032 from a value of USD 689.23 Million in 2024 and is projected to grow by USD 725.39 Million in 2025, growing at a CAGR of 6.3% from 2025 to 2032.

Multilayer Varistor Market Scope & Overview:

A multi-layer varistor (MLV) is a compact, surface-mountable chip that offers voltage-dependent, non-linear, and bidirectional protection for electronic circuits. It acts as a transient voltage suppressor, clamping voltage spikes and protecting against electrostatic discharge (ESD), inductive switching transients, and other voltage surges. MLVs are often used in place of discrete components like Zener diodes, simplifying circuit design and reducing size.

How is AI Transforming the Multilayer Varistor Market?

AI is impacting the multilayer varistor market by enhancing design precision, performance monitoring, and predictive reliability. Multilayer varistors, widely used for surge protection in electronics, benefit from AI-driven simulations that optimize material composition and structural design for improved energy absorption and faster response times. AI-powered analytics monitor device performance in real-world conditions, detecting early signs of degradation or abnormal surges, which helps extend product life and ensure system safety. In manufacturing, AI streamlines quality control by identifying micro-defects and improving yield rates. Additionally, predictive modeling enables tailored varistor solutions for specific applications like automotive electronics, IoT, and industrial systems. Overall, AI is making multilayer varistors smarter, more durable, and better aligned with evolving global electronics demands.

Multilayer Varistor Market Dynamics - (DRO) :

Key Drivers:

Rapid development of the automotive sector is driving the multilayer varistor market expansion

Modern vehicles are equipped with numerous electronic components, from entertainment systems to sophisticated advanced driver-assistance systems (ADAS). These sensitive electronics are vulnerable to voltage fluctuations and need robust protection to function reliably and last longer. They are becoming a popular solution in the automotive industry due to their dependability and small footprint. This increased adoption of MLVs is a significant factor for market growth.

- For instance, Eaton's automotive MLVs are transient voltage surge suppression devices engineered to protect against various transient events. They meet standards such as IEC 61000-4-2 and other electromagnetic compatibility (EMC) requirements. These MLVs are offered in diverse voltage ranges, enabling highly reliable protection for numerous applications across the power supply, control, and signal lines.

Thus, according to the multilayer varistor market analysis, rapid development of the automotive sector is driving the multilayer varistor market size.

Key Restraints:

Intense competition within the market is affecting the multilayer varistor market demand

While MLVs provide dependable protection from voltage spikes and transient surges, they face competition from other effective technologies such as transient voltage suppression (TVS) diodes and gas discharge tubes (GDTs). End-users might opt for these alternatives based on their specific needs and budget, potentially challenging the MLV market. Furthermore, price fluctuations in raw material prices and disruptions to the supply chain could affect MLV production and pricing, posing another threat to market stability. Thus, the above analysis depicts that the aforementioned factors would further impact on multilayer varistor market size.

Future Opportunities :

Increasing need for advanced electronic devices is expected to create potential growth for multilayer varistor market opportunities

As consumers continue to need more sophisticated and compact devices, the need for effective protection solutions becomes more critical. Multi-layer varistors, with their ability to provide reliable protection without compromising on space, are well-positioned to capitalize on this growing need. Additionally, advancements in technology and the development of new materials are expected to enhance the performance and reliability of multi-layer varistors, further driving their adoption into various applications.

- For instance, in April 2025, Bourns, Inc. introduced two new product series of MLV, the BVRA1210 and BVRA1812, to its automotive portfolio. These new low-voltage MLVs are specifically engineered to provide superior surge protection for increasingly sensitive automotive circuits. They feature excellent transient energy absorption and advanced power dissipation through their state-of-the-art energy volume distribution and design.

Thus, based on the above multilayer varistor market analysis, the increasing need for advanced electronic devices is expected to drive multilayer varistor market opportunities.

Multilayer Varistor Market Segmental Analysis :

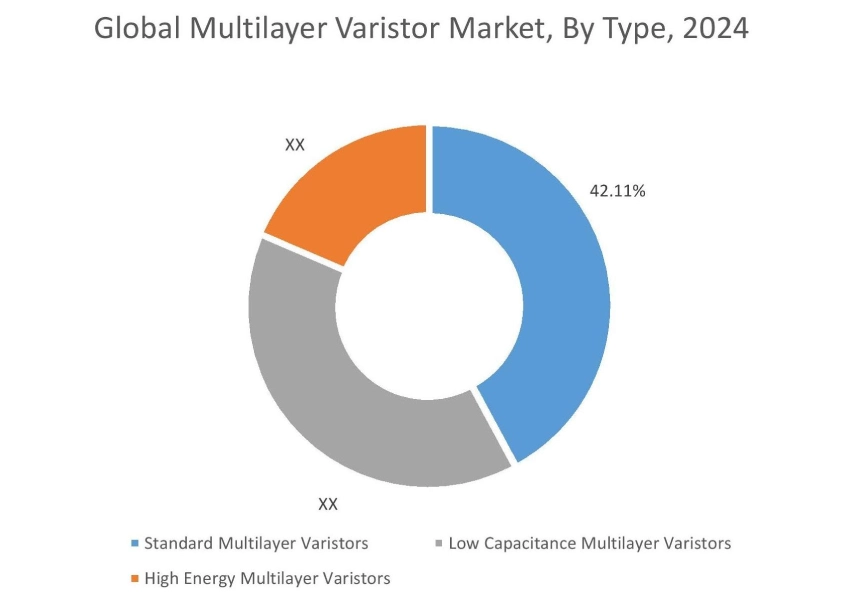

By Type:

Based on type, the multilayer varistor market is segmented into standard multilayer varistors, low capacitance multilayer varistors, and high energy multilayer varistors.

Trends in the type:

- The shift towards electric and hybrid vehicles is a major catalyst. EVs and HEVs feature highly complex electrical systems, including battery management systems (BMS), inverters, and onboard chargers, all of which are highly vulnerable to voltage transients. MLVs are necessary for protecting these critical circuits.

- The rise of AI-powered devices across consumer and industrial applications further amplifies the need for high-quality MLVs to ensure the reliability and longevity of complex electronics.

The standard multilayer varistors segment accounted for the largest share of 42.11% in the year 2024.

- Standard MLVs are widely used across various applications due to their balanced performance characteristics and cost-effectiveness.

- These varistors provide reliable protection against voltage spikes and transient surges in consumer electronics, automotive, and industrial applications.

- The massive scale of consumer electronics production necessitates cost-effective yet reliable protection solutions. Standard MLVs offer a good balance of performance and price, making them an ideal choice for many manufacturers.

- For instance, Panasonics’ standard MLVs are used in small electronic devices, TVs, and AV equipment, including smartphones. This product offers outstanding electrostatic discharge (ESD) suppression, due to its innovative and advanced material technology.

- Thus, based on the above analysis, these factors are further driving the multilayer varistor market growth.

The low capacitance multilayer varistors segment is anticipated to register the fastest CAGR during the forecast period.

- Low capacitance MLVs are specifically designed for high-frequency applications where minimizing noise and maintaining signal integrity are crucial.

- These varistors are commonly used in telecommunications and high-speed data transfer applications.

- The increasing need for high-speed internet and advanced communication technologies is driving the adoption of low-capacitance multi-layer varistors, as they help maintain the performance and reliability of high-frequency circuits.

- Thus, based on the above analysis, these factors are expected to drive the multilayer varistor market share during the forecast period.

By Voltage:

Based on voltage, the market is segmented into upto 30V, 31V-45V, 46V-75V, 76V-100V, and above 100V.

Trends in the voltage:

- IoT devices are deployed in a wide range of environments, some of which can be harsh (e.g., industrial settings, and outdoor installations), increasing their exposure to electrical disturbances. This fuels the need for low-voltage and standard MLVs.

- The expansion of telecom infrastructure, including base stations, small cells, and networking equipment, requires surge protection for power lines and data lines, which is driving the development of the segment.

The upto 30V segment accounted for the largest revenue in the year 2024.

- The improvements in material science and manufacturing processes are leading to low-voltage MLVs that offer more stable performance across wider temperature ranges and longer operational lifespans.

- Continuous R&D focuses on further reducing the clamping voltage of low-voltage MLVs to protect even more sensitive ICs as semiconductor technology advances.

- Companies prioritize the reliability and longevity of their electronic products to reduce warranty costs and enhance brand reputation. Integrating high-quality low-voltage MLVs is a key strategy for this process.

- Thus, based on the above analysis, these factors would further supplement the global market share.

The 76V-100V segment is anticipated to register the fastest CAGR during the forecast period.

- Solar panels that generate higher voltages, control circuitry, communication interfaces, and auxiliary power supplies within inverters or charge controllers for smaller solar installations might utilize voltages in this range. MLVs provide essential protection against surges from the array or lightning.

- In various applications, DC-DC converters are used to step down or step up voltages. The intermediate bus voltages or specific stages within these converters might operate in the 76V-100V range. MLVs protect these stages from transients originating from either the input or output side.

- The above factors are anticipated to further drive the multilayer varistor market trends during the forecast period.

By Termination Type:

Based on termination type, the multilayer varistor market is segmented into nickel barrier termination, silver barrier termination, silver palladium barrier termination, and others.

Trends in the termination type:

- The restriction of hazardous substances directive and similar global regulations have mandated the elimination of lead from electronic components and soldering processes. This pushed manufacturers to move away from traditional tin-lead (SnPb) solders and consequently forced a transition in component terminations.

- Modern PCB assembly relies heavily on high-speed pick-and-place machines and automated reflow ovens. Consistent and high-quality terminations are essential for smooth, defect-free automated manufacturing processes, minimizing rework.

- These factors are anticipated to further drive the multilayer varistor market trends during the forecast period.

The nickel barrier termination segment accounted for the largest revenue share in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- Nickel barrier terminations ensure consistent, high-quality solder wetting and strong adhesion on increasingly small solder pads.

- Modern electronics manufacturing relies heavily on high-speed pick-and-place machines and precise reflow ovens. Consistent and uniform nickel barrier terminations promote reliable self-alignment during reflow and consistent solder fillet formation, leading to higher manufacturing yields and reduced rework.

- For instance, TDK’s nickel barrier termination prevents the leaching of the silver-base metal layer, which allows greater flexibility in the soldering parameters.

- Thus, based on the above analysis, these developments are driving the multilayer varistor market growth and trends.

By Mounting Type:

Based on mounting type, the multilayer varistor market is segmented into surface mount technology (SMT), and through hole.

Trends in the mounting type:

- The growing need for easier assembly and miniaturization is driving the growth of the segment.

- The choice of varistor type depends on factors such as the operating environment, required level of protection, and performance characteristics. Manufacturers are continuously innovating to enhance the performance and reliability of these varistors, further driving their adoption across various sectors.

The surface mount technology segment accounted for the largest revenue in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- SMT is designed for high-speed, automated pick-and-place machines and reflow soldering processes, enabling efficient and cost-effective mass production.

- SMT allows higher component density on PCBs, enabling complex circuitry within a compact footprint, with MLVs providing crucial localized protection.

- IoT devices are found in a wide range of environments, some of which are electrically noisy or prone to ESD events. SMT MLVs provide strong protection in these varied conditions.

- Thus, the above factors are driving the multilayer varistor market demand.

By Application:

Based on application, the market is segmented into high flexure stress, variable temperature applications, module interfaces, switches, sensors, camera modules, data lines, EMI TVS module control, high speed ASICS, circuit protection, power supply devices protection, and others.

Trends in application:

- As telecommunication companies invest heavily in upgrading their systems to accommodate faster data speeds and increased connectivity, the need for effective protection devices is expected to surge significantly.

- With the increasing need for high-speed internet and advanced communication technologies, the adoption of reliable protection devices has become more critical.

The circuit protection segment accounted for the largest revenue in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- Many new integrated circuits (ICs) operate at very low core voltages requiring protection devices with extremely low clamping voltages. MLVs are being continuously developed to achieve lower clamping voltages to match these requirements.

- The growing complexity and criticality of advanced driver-assistance systems (ADAS) and autonomous driving systems demand extremely reliable circuit protection.

- MLVs variants are essential for safeguarding these mission-critical sensors and electric control units (ECUs).

- Thus, the aforementioned factors are driving the global market.

By End Use:

Based on end use, the market is segmented into automotive, consumer electronics, manufacturing, aerospace and defense, healthcare, telecommunications, and others.

Trends in the end use:

- The growing investments in telecommunications infrastructure are expected to drive the need for multi-layer varistors.

- The adoption of MLVs in industrial applications is driven by the need for durable and effective protection solutions that can handle large energy surges. This segment is expected to witness steady growth due to the increasing adoption of automation and advanced industrial technologies.

The consumer electronics segment accounted for the largest revenue share in the year 2024.

- The growing consumer need for advanced electronic devices with higher performance and compact dimensions is driving the need for effective protection solutions.

- MLVs offer reliable protection without compromising on space, making them ideal for use in consumer electronics such as smartphones, tablets, laptops, and wearables among others.

- Thus, based on the above factors, rising developments in the consumer electronics segment are driving the global market.

The automotive segment is anticipated to register the fastest CAGR during the forecast period.

- The growing number of electronic systems in modern vehicles, such as infotainment, navigation, and safety features, demands robust surge protection.

- MLVs are a common choice in the automotive sector to shield sensitive electronic components from voltage spikes and transient surges, thereby extending the life and maintaining the performance of these crucial systems.

- For instance, in December 2024, TDK Corporation unveiled five new surface-mount device (SMD) MLVs, which are designed specifically for automotive applications. They protect critical vehicle systems such as engine management, electronic control units (ECUs), airbags, anti-lock braking systems (ABS), and electronic stability programs (ESP) from transient overvoltages on battery lines, which can occur during events like load dumps and jump starts.

- These factors are anticipated to further drive the global market during the forecast period.

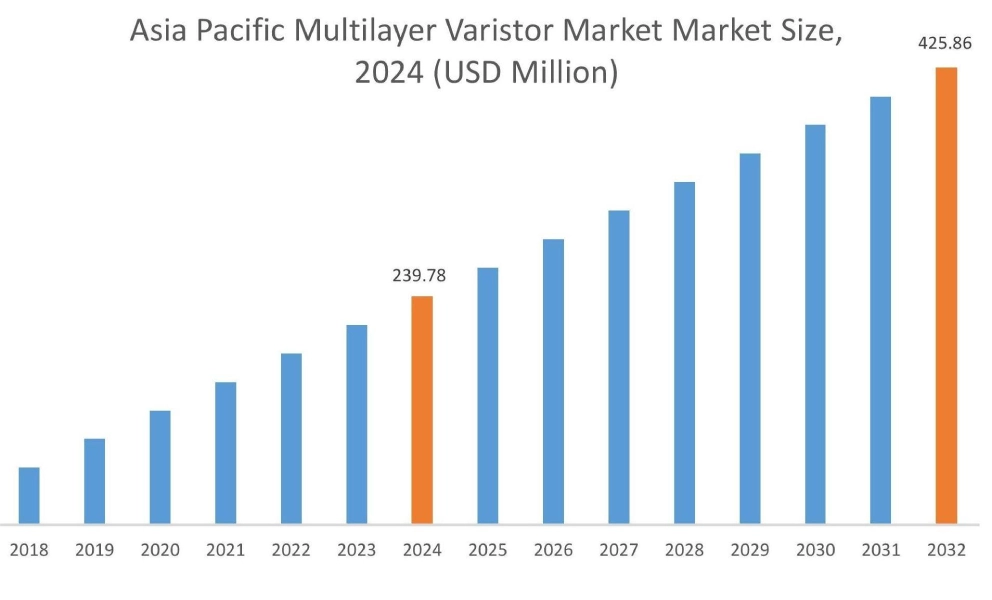

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

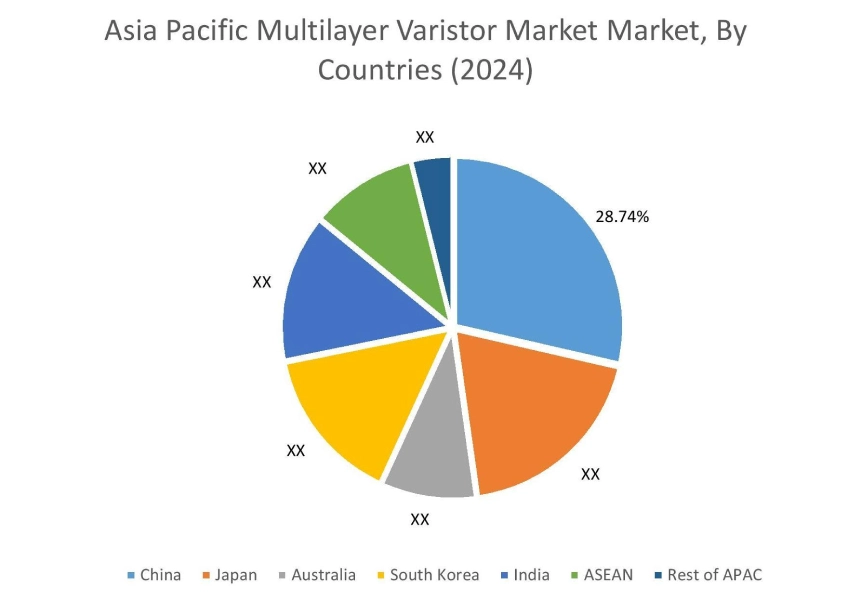

Asia Pacific multilayer varistor market expansion is estimated to reach over USD 425.86 million by 2032 from a value of USD 239.78 million in 2024 and is projected to grow by USD 253.09 million in 2025. Out of this, the China market accounted for the maximum revenue split of 28.74%. The regional growth can be attributed to rapid industrialization, a robust electronics manufacturing sector, and substantial investments in telecommunications infrastructure. Further, the region's expanding consumer electronics and automotive market, coupled with the increasing adoption of electric vehicles , is expected to drive the market. These factors would further drive regional multilayer varistor market share during the forecast period.

- For instance, in March 2022, TDK Corporation expanded its product portfolio with a new chip varistor, for automotive applications. Through advanced multilayer technology and refined manufacturing and process design, this product achieves a tight capacitance tolerance of 4.7±0.57 pF and robust ESD protection up to 25 kV.

The North American market is estimated to reach over USD 312.65 million by 2032 from a value of USD 183.55 million in 2024 and is projected to grow by USD 193.06 million in 2025. North America represents a significant market of the protection devices market, supported by well-established automotive and aerospace industries. The region's focus on innovation and adherence to stringent safety standards fosters the demand for multi-layer varistors. Furthermore, the growing trend of digitalization and smart manufacturing in the region is contributing to the increased adoption of MLV solutions across various industries. These factors would further drive the regional market.

Additionally, according to the analysis, the multilayer varistor industry in Europe is expected to witness significant progress during the forecast period. Europe's stringent regulatory framework for electronics safety is propelling the adoption of MLV devices, ensuring compliance with industry standards and enhancing product reliability.

Latin America is experiencing a rapid increase in internet penetration and mobile technology adoption. This drives strong demand for smartphones, tablets, wearables, and smart TVs. As these devices become more sophisticated and integrated, they require robust circuit protection against transient surges. Further, the rise of EV charging stations and automotive electronics is boosting the demand for high-voltage and durable MLVs in the Middle East & Africa region, to protect critical vehicle systems like battery management systems, infotainment consoles, and electronic control units (ECUs).

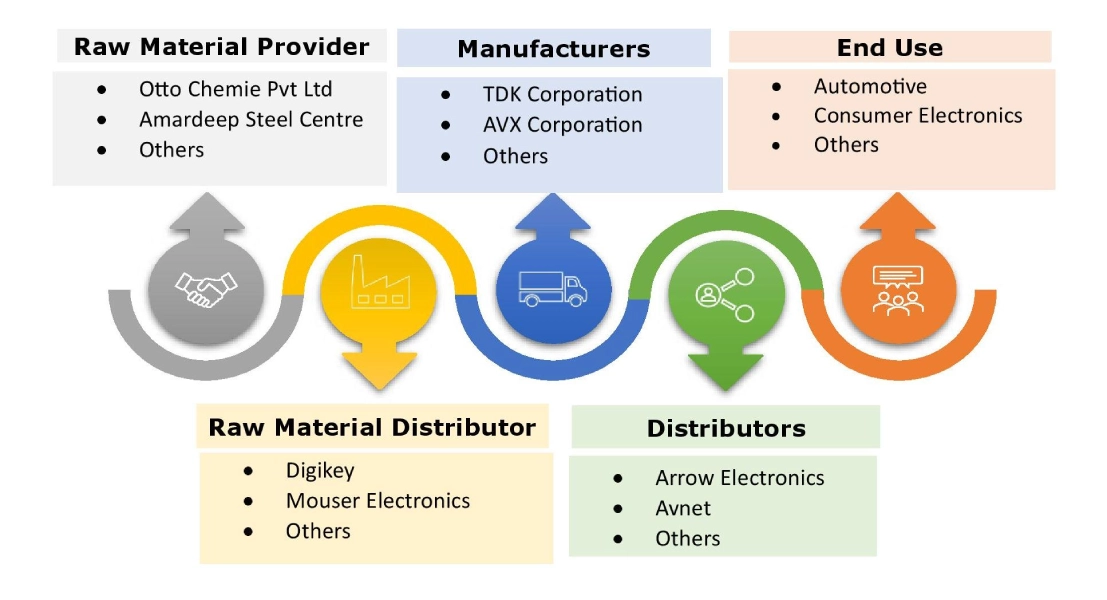

Top Key Players and Market Share Insights:

The global multilayer varistor market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the multilayer varistor industry include-

- TDK Corporation (Japan)

- Murata Manufacturing Co., Ltd. (Japan)

- Bourns, Inc. (U.S.)

- Taiyo Yuden Co., Ltd (Japan)

- KOA Corporation (Japan)

- AVX Corporation (U.S.)

- Vishay Intertechnology, Inc. (U.S.)

- Panasonic Corporation (Japan)

- Littelfuse, Inc. (U.S.)

- Würth Elektronik GmbH & Co. KG (Germany)

Recent Industry Developments :

Product Launch:

- In July 2024, KOA Speer Electronics unveiled its new NV73S series, a line of multilayer metal oxide varistors designed for superior circuit protection. These varistors can withstand surge currents up to 6,000 Amperes, a significant improvement (five times greater) compared to previous products. The NV73S series provides defense against both electrostatic discharge (ESD) and electromagnetic interference (EMI) for various electronic devices. Furthermore, they offer robust surge suppression for components like motors, relays, and solenoid valves .

Multilayer Varistor Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1,182.95 Million |

| CAGR (2025-2032) | 6.3% |

| By Type |

|

| By Voltage |

|

| By Termination Type |

|

| By Mounting Type |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Multilayer Varistor Market? +

Multilayer Varistor Market Size is estimated to reach over USD 1,182.95 Million by 2032 from a value of USD 689.23 Million in 2024 and is projected to grow by USD 725.39 Million in 2025, growing at a CAGR of 6.3% from 2025 to 2032.

Which is the fastest-growing region in the Multilayer Varistor Market? +

Asia-Pacific is the region experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Multilayer Varistor report? +

The multilayer varistor report includes specific segmentation details for type, voltage, termination type, mounting type, application, end use, and region.

Who are the major players in the Multilayer Varistor Market? +

The key participants in the market are TDK Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), AVX Corporation (U.S.), Vishay Intertechnology, Inc. (U.S.), Panasonic Corporation (Japan), Littelfuse, Inc. (U.S.), Würth Elektronik GmbH & Co. KG (Germany), Bourns, Inc. (U.S.), Taiyo Yuden Co., Ltd (Japan), KOA Corporation (Japan), and others.