Optocoupler IC Market Size:

Optocoupler IC Market size is estimated to reach over USD 4,454.47 Million by 2032 from a value of USD 2,793.71 Million in 2024 and is projected to grow by USD 2,972.53 Million in 2025, growing at a CAGR of 6.4% from 2025 to 2032.

Optocoupler IC Market Scope & Overview:

Optocouplers, also called optical isolators, are integrated circuits that use light to bridge the gap between two electrically separate circuits for signal transmission. These devices house an LED and a photodetector, often a phototransistor, within a single package. When the LED lights up, the photo detector senses this light and activates, enabling signal transfer without any physical electrical connection between the circuits. This optical link provides crucial benefits such as electrical isolation, which helps to minimize noise and offers protection against damaging voltage spikes, improving the safety of the circuit. Consequently, optocouplers are essential components in a wide range of applications, including power supplies, microcontroller systems, and industrial equipment, where they are used to isolate control signals and mitigate interference in environments with high voltages.

Optocoupler IC Market Dynamics - (DRO) :

Key Drivers:

Rising adoption of Electric Vehicles (EVs) is driving optocoupler IC market growth

Optocouplers, particularly isolation amplifiers, are essential for safely and accurately measuring the voltage and current of individual battery cells and the entire battery pack. This isolation prevents high voltages from damaging sensitive control electronics and ensures the accuracy of critical battery data, driving the optocoupler IC market demand. Additionally, optocouplers facilitate the control signals for cell balancing circuits, which equalize the charge across all battery cells, maximizing battery life and performance. The isolation provided by optocouplers is crucial in these high-voltage environments, consequently driving the optocoupler IC market size.

- For instance, in 2024, according to India Brand Equity Foundation (IBEF) electric vehicles accounted for over 50% of 3-wheeler sales, roughly 5% of 2-wheeler sales, and 2% of car sales in India. The Indian EV battery market is anticipated to grow significantly from USD 16.77 billion in 2023 to USD 27.70 billion by 2028.

Consequently, rising adoption of electric vehicles (EVs) is driving optocoupler IC market growth.

Key Restraints :

Limitations in high current and high voltage applications, coupled with potentially slower response times is restraining the global optocoupler IC market demand

Standard optocouplers have output current ratings in the tens of milliamperes, which restricts their direct use in applications requiring the control of high-current devices like motors or high-power actuators without additional circuitry (e.g., using them to drive transistors or relays). This necessitates more complex and potentially costlier designs in high-power applications, limiting the direct adoption of optocouplers. Additionally, compared to some other isolation technologies or direct electrical connections, optocouplers, particularly those using phototransistors, have slower response times, often in the microsecond range. This is a significant drawback in high-speed digital communication, high frequency switching power supplies, and real-time control systems where faster signal transfer is crucial, further hampering the market expansion.

Therefore, as per the analysis, these combined factors are significantly hindering optocoupler IC market share.

Future Opportunities :

Rising adoption of renewable energy sources is projected to create optocoupler IC market opportunity

Optocouplers are crucial components in solar inverters, which convert the direct current (DC) electricity generated by solar panels into alternating current (AC) electricity for use in homes, businesses, or the power grid. They provide essential galvanic isolation between the high-voltage DC side (from the solar panels) and the low-voltage AC side, ensuring the safety of the system and preventing damage from voltage surges. Similarly, wind turbines generate AC power which needs to be converted and regulated. Optocouplers are used in the control and power conversion systems of wind turbines to isolate control signals and protect sensitive electronics from the high voltages and harsh electrical environments present, hence boosting optocoupler IC market trend.

- For instance, in Apr 2025, Suzlon secured a new 378 MW wind energy project from NTPC Green Energy Ltd., boosting their total partnership to 1,544 MW. This order involves the supply of 120 of Suzlon's S144 3.15 MW wind turbine generators with Hybrid Lattice Towers, along with foundation work, erection, commissioning, and subsequent maintenance.

Hence, based on the analysis, the rising adoption of renewable energy sources is expected to create optocoupler IC market opportunities.

Optocoupler IC Market Segmental Analysis :

By Product Type:

Based on the Product Type, the market is categorized into IC Output Optocouplers, Transistor Output Optocouplers, and Others.

An IC output optocoupler refers to a type of optocoupler that integrates an output integrated circuit to provide enhanced signal processing and electrical isolation. It offers multiple benefits including higher integration, compact design, faster switching speeds, and improved control of output characteristics among others. Transistor output optocouplers offer numerous benefits including simple and cost-effective design, high-speed operation, and good isolation voltage. Additionally, transistor output optocouplers are often used in several industrial control applications, attributing to their robust performance and ability to handle numerous signal levels.

Trends in the Product Type:

- Rising trend towards the adoption of consumer electronics is driving the demand of IC output optocouplers.

- Trend towards the advancements in IC design are leading to higher integration, lower power consumption, and smaller form factors for IC output optocouplers.

IC Output Optocouplers accounted for the largest revenue share in the market in 2024.

An IC output optocoupler is an advanced type of optocoupler that integrates an output integrated circuit to provide enhanced signal processing and electrical isolation. This design offers several advantages, including high signal accuracy, rapid response times, robust electrical isolation, and effective reduction of noise interference, thereby increasing industry demand. Consequently, these optocouplers are widely employed in critical applications such as battery management systems, microcontroller interfaces, motor drives, and industrial automation systems to ensure reliable signal isolation, thereby boosting the optocoupler IC market size. Thus, as per the optocoupler IC market analysis, the aforementioned factors are driving IC output optocoupler segment trend.

Transistor Output Optocouplers are projected to register the fastest CAGR during the forecast period.

Transistor output optocouplers offer a good balance of performance and cost-effectiveness, suitable for a broad spectrum of applications. They can be used in both AC and DC circuits for signal isolation and interface in various applications like power supplies, motor control, digital logic interfaces, and general-purpose isolation. Additionally, transistor output optocouplers are well-suited for many industrial control applications due to their robust performance and ability to handle various signal levels. Therefore, as industrial automation continues to expand with Industry 4.0 and smart factories, the demand for these optocouplers is also expected to increase during the forecast period.

- For instance, Panasonic offers PhotoIC Couplers, ideal for applications in diverse devices and equipment where physical separation and rapid communication are essential.

Thus, as per the optocoupler IC market analysis, the aforementioned factors are accelerating transistor output optocouplers segment growth.

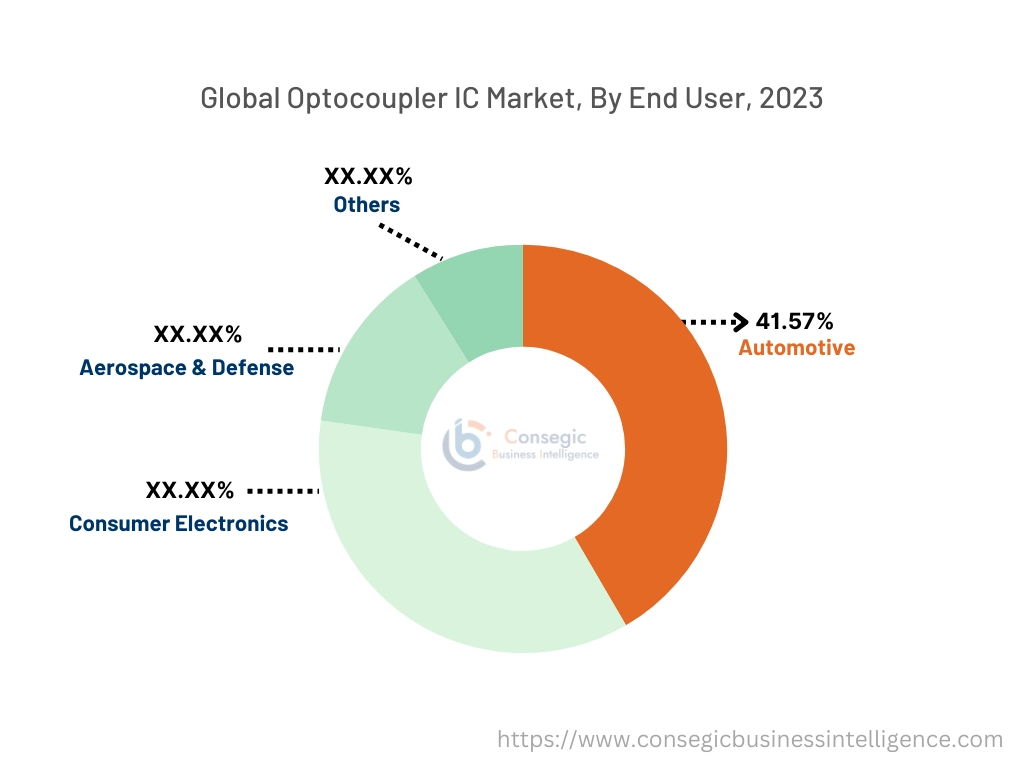

By End-User:

Based on the end-user, the market is classified into automotive, consumer electronics, aerospace & defense, and others.

In automotive sector, optocouplers are used for facilitating safe and reliable communication between different components while maintaining electrical isolation. They are used in automotive electronics systems including antilock braking system, electronic stability control system, and others. In consumer electronics sector, optocouplers are mainly used for improving the reliability and performance of various electronic devices while providing electrical isolation and minimizing noise. Additionally, optocouplers are often used in aerospace & defense sector for application in avionic systems, control systems, and others.

Trends in the End-User:

- Rising trend towards the adoption of optocouplers in the aerospace and defense industries require highly reliable optocouplers that can withstand harsh environments, extreme temperatures, and significant vibrations.

- Increasing trend of using optocouplers are used in various critical applications such as in-flight control systems, avionics interfaces, power supply and distribution, and communication systems where signal integrity and isolation are paramount.

Automotive accounted for the largest market share of 41.57% in the market in 2024.

In the realm of electric vehicles, optocouplers play a vital role in maintaining operational safety by providing crucial isolation between high-voltage and low-voltage systems and circuits. This isolation is particularly essential for the reliable and secure functioning of battery management systems and motor control units. Furthermore, optocouplers are indispensable components in safety-critical systems like antilock braking and electronic stability control, where they offer robust protection against potentially damaging voltage spikes and electromagnetic interference, thereby enhancing overall vehicle safety and dependability.

- For instance, Broadcom provides a comprehensive portfolio of optocouplers, and isolation amplifiers tailored for the automotive sector, including digital, IPM interface, and gate drive types. Their AEC-Q100 qualified R2Couplerproducts find application in critical automotive systems such as CANBus interface isolation, motor inverter drives, AC-DC and DC-DC converters for battery chargers, battery/inverter voltage monitoring, and battery management systems.

Thus, as per the optocoupler IC market analysis, the aforementioned factors are driving automotive segment growth.

Consumer Electronics is predicted to register the fastest CAGR during the forecast period.

The widespread use of devices like smartphones, digital TVs, and smart appliances has led to the extensive integration of optocouplers in consumer electronics. These components are crucial for providing electrical isolation and minimizing noise, thereby ensuring the reliable operation of these devices. As consumer electronics continue to become more compact and powerful, optocouplers play an increasingly important role in maintaining signal integrity and safeguarding circuits within these sophisticated systems.

- For instance, government initiatives like Digital India and Make in India are significantly bolstering India's electronic manufacturing sector, successfully attracting USD 1.06 billion in foreign direct investment (FDI) specifically for the production of electronic components and semiconductors.

Subsequently, the above-mentioned factors are contributing notably in spurring optocoupler IC market expansion.

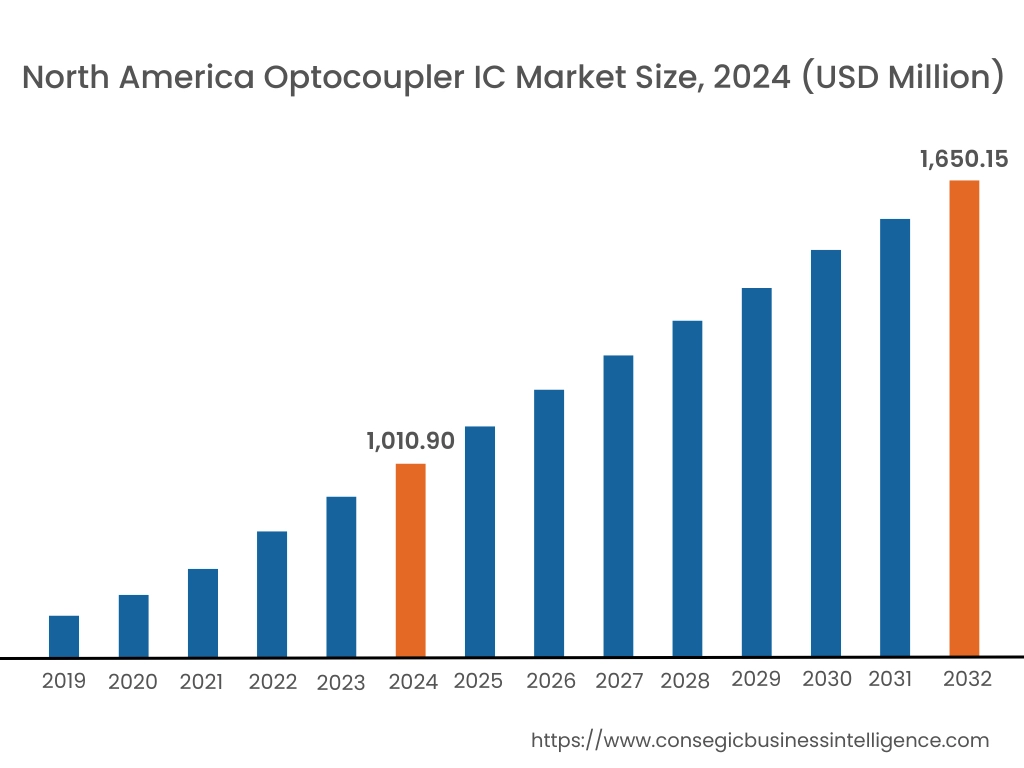

Regional Analysis:

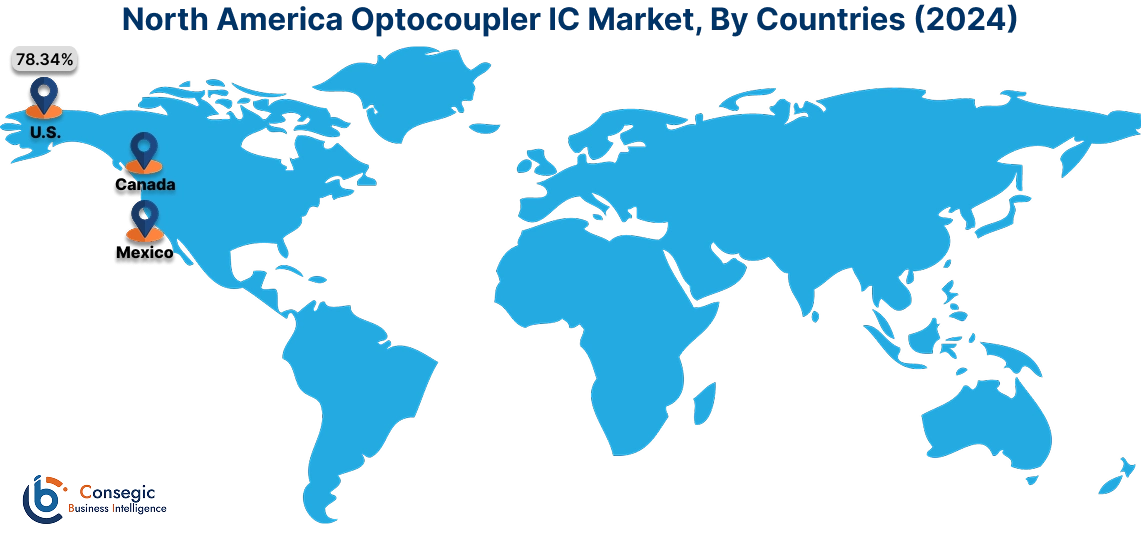

The global optocoupler IC market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

In 2024, North America was valued at USD 1,010.90 Million and is expected to reach USD 1,650.15 Million in 2032. In North America, U.S. accounted for the highest share of 78.34% during the base year of 2024. The optocoupler IC market is experiencing substantial growth, largely fueled by its extensive use in consumer electronics, especially in smartphones and other portable devices. Furthermore, the inherent benefits of optocoupler ICs, such as signal isolation and power supply regulation in consumer electronics, are projected to be key drivers for market expansion in North America throughout the forecast period.

- For instance, in May 2024, Vishay Intertechnology launched a new 25 MBd optocoupler with a CMOS logic digital output for easy connection to digital systems.

Asia Pacific region was valued at USD 751.71 Million in 2024 and is expected to reach over USD 1,293.23 Million by 2032. The Asia Pacific region is the frontrunner in the optocoupler IC industry, fueled by rapid technological progress and the expanding automotive industry. The increasing popularity of electric vehicles is a key factor accelerating the adoption of optocoupler ICs within the automotive sector across the region.

- For instance, according to China's Ministry of Public Security there a substantial surge in electric vehicle sales in 2022, reaching 13.1 million units, which represents a notable increase of 67.13% compared to the sales figures in 2021.

As per the analysis, stringent safety regulations and increasing adoption of electric vehicles and industrial automation are driving optocoupler market growth in Europe. Additionally, growing industrialization and increasing demand for consumer electronics are boosting the optocoupler market in Latin America. Moreover, rising investments in infrastructure development and expanding automotive and telecommunications sectors in Middle East and Africa are fueling optocoupler market growth.

Top Key Players & Market Share Insights:

The market is highly competitive with major players providing optocoupler IC to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the optocoupler IC industry include-

- Broadcom (United States)

- Vishay Intertechnology (United States)

- Renesas Electronics Corporation (Japan)

- Toshiba Corporation (Japan)

- TT Electronics (United Kingdom)

- ON Semiconductor (United States)

- Infineon Technologies AG (Germany)

- Lite-On Technology Corporation (Taiwan)

- Texas Instruments (United States)

- STMicroelectronics (Switzerland)

Optocoupler IC Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 4,454.47 Million |

| CAGR (2024-2031) | 6.4% |

| By Product Type |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the optocoupler IC market? +

The optocoupler IC market size is estimated to reach over USD 4,454.47 Million by 2032 from a value of USD 2,793.71 Million in 2024 and is projected to grow by USD 2,972.53 Million in 2025, growing at a CAGR of 6.4% from 2025 to 2032.

What specific segmentation details are covered in the Optocoupler IC report? +

The optocoupler IC report includes specific segmentation details for product type, end-user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the optocoupler IC market, consumer electronics is the fastest growing segment during the forecast period.

Who are the major players in the optocoupler IC market? +

The key participants in the optocoupler IC market are Broadcom (United States), Vishay Intertechnology (United States), Renesas Electronics Corporation (Japan), Toshiba Corporation (Japan), ON Semiconductor (United States), Infineon Technologies AG (Germany), Lite-On Technology Corporation (Taiwan), Texas Instruments (United States), STMicroelectronics (Switzerland), TT Electronics (United Kingdom), and Others.