Smartphone Application Processor Market Size:

Smartphone Application Processor Market size is estimated to reach over USD 26,095.86 Million by 2032 from a value of USD 14,896.55 Million in 2024 and is projected to grow by USD 15,712.61 Million in 2025, growing at a CAGR of 6.5% from 2025 to 2032.

Smartphone Application Processor Market Scope & Overview:

A smartphone application processor processes all instructions and computations needed to run the phone. It acts as a system-on-chip (SoC), integrating CPU, GPU, and other functionalities on a single chip. The application processor's speed, efficiency, and the number of cores significantly impact the phone's overall performance, including app functionality, multitasking, and battery life. It processes graphics and video data for display on the screen, making it possible to run games and other visually intensive applications.

Smartphone Application Processor Market Insights:

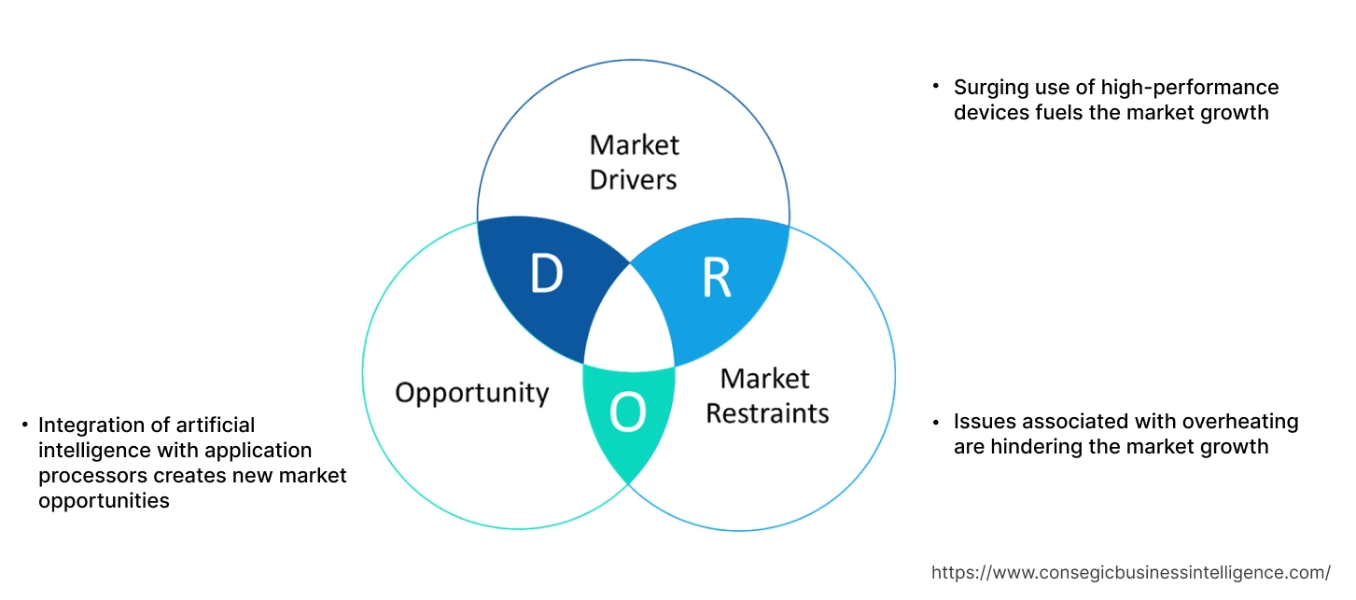

Key Drivers:

Surging use of high-performance devices fuels the market growth

In high-performance smartphone devices, the application processor is crucial for handling demanding tasks like gaming, AI, and advanced multimedia experiences. These processors contain the CPU, GPU, and other essential components within a single chip, optimizing for speed, efficiency, and integrated capabilities. The market for these processors is driven by the growing demand for more powerful and feature-rich smartphones, with key players focusing on innovation and improvement in performance, energy efficiency, and AI capabilities.

- For instance, in January 2022, Intel(US) unveiled the 12th Gen Intel Core H-series mobile processor, with up to 5 GHz frequencies, 14 cores (6 P-cores and 8 E-cores), and 20 threads, delivering the fastest and most high-performance processor.

Thus, the aforementioned factors are boosting the adoption of application processors, in turn driving the smartphone application processor market growth.

Key Restraints :

Issues associated with overheating are hindering the market growth

Smartphone overheating, particularly involving the application processor, is often caused by excessive usage, demanding apps, or environmental factors. Games, video editing, and other apps that demand high processing power can strain the processor and cause it to overheat. Moreover, running too many apps open simultaneously puts a strain on the processor as it attempts to manage multiple tasks. Direct sunlight, high temperatures, or prolonged use without breaks can contribute to overheating.

Thus, the market analysis shows that the aforementioned factors are restraining the smartphone application processor market demand.

Future Opportunities :

Integration of artificial intelligence with application processors creates new market opportunities

Integrating AI with smartphone application processors enhances various aspects of the user experience and overall device performance. AI-powered chips and algorithms optimize resource allocation, leading to faster app loading, smoother multitasking, and improved battery life. This also allows personalized user experiences, smart functionalities, and on-device intelligence, as AI can learn from user behavior and provide tailored recommendations and assistance.

- For instance, In January 2024, ASUS Republic of Gamers (ROG) launched the ROG Phone 8 series with a SnapDragon processor featuring AI-powered performance, ultra-bright display, and AniMe Vision.

Thus, the integration of AI with application processors is projected to drive smartphone application processor market opportunities during the forecast period.

Smartphone Application Processor Market Segmental Analysis :

By Type:

Based on type the market is segmented into dual-core processor, quad-core processor, hex-core processor, octa-core processor, deca-core processor, and others.

Trends in the Type:

- Rising adoption of deca-core processors, due to their improved performance, reduced latency, enhanced multitasking, and increased reliability is boosting the smartphone application processor market size.

- Increasing trend in the adoption of quad-core processors due to their enhanced multitasking, faster performance for demanding applications, and improved gaming experiences.

The octa-core processor segment accounted for the largest revenue share of smartphone application processor market share in 2024.

- An octa-core processor, found in many smartphones, is a CPU with eight processing cores.

- This allows parallel processing, enabling devices to handle multiple tasks simultaneously without slowdowns.

- This translates to smoother multitasking, faster app loading, and enhanced performance in demanding applications like gaming and video editing.

- Thus, the aforementioned factors are boosting the smartphone application processor market growth.

The deca-core processor segment is anticipated to register significant CAGR growth during the forecast period.

- A deca-core processor in a smartphone has ten CPU cores and offers enhanced performance and efficiency for demanding tasks like gaming, AI, and multitasking.

- These processors are designed to handle multiple operations simultaneously, reducing latency and improving overall device responsiveness.

- Some deca-core processors use different core types, allowing a balance between high-performance cores and power-efficient cores.

- Therefore, the market analysis shows that the aforementioned factors are expected to boost the smartphone application processor market trends during the forecast period.

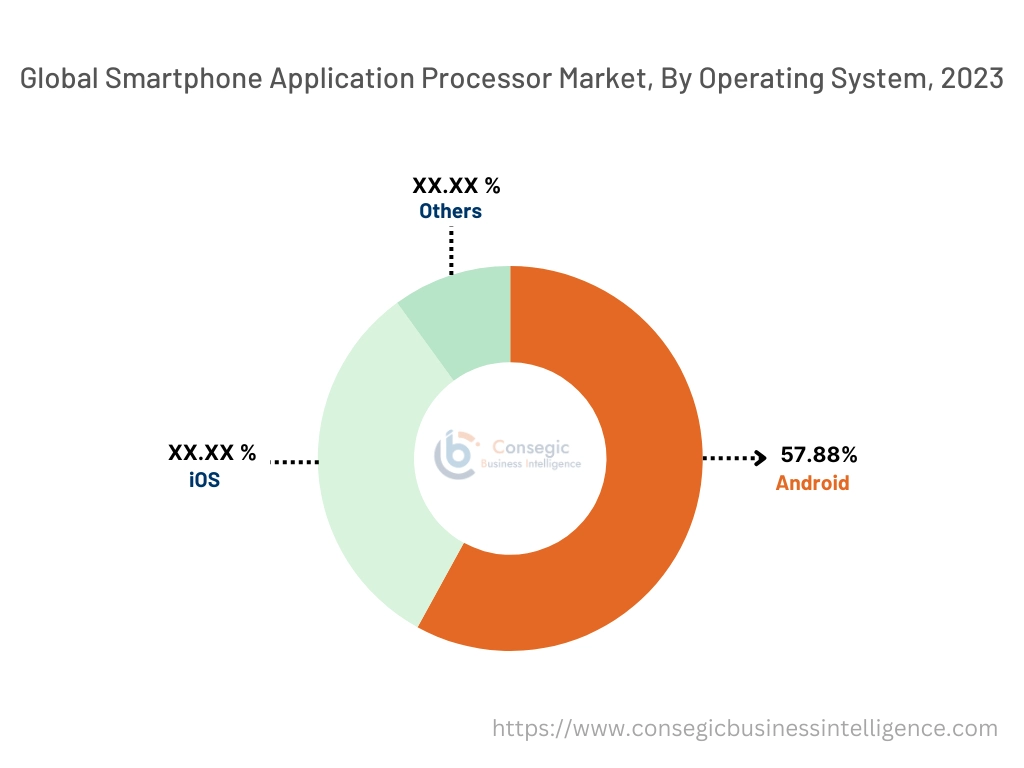

By Operating System :

Based on the operating system, the market is segmented into iOS, Android, and others.

Trends in the Operating System:

- Rising adoption of Android due to affordability, excellent features, and variety of available options is boosting the smartphone application processor market size.

- Increasing trend in the adoption of iOS as it provides timely and consistent software updates across its devices, for seamless and lag-free usage of the smartphone.

The Android segment accounted for the largest revenue share of 57.88% in 2024.

- The application processor interprets commands and performs calculations, allowing Android to run apps, manage tasks, and handle various functions.

- The processor's performance and efficiency impact the overall speed, multitasking capabilities, and battery life of the device.

- Different processors are designed for various performance levels, from entry-level to high-end.

- Thus, the aforementioned factors are boosting the smartphone application processor market demand.

The iOS segment is expected to witness significant CAGR growth during the forecast period.

- iOS devices, specifically iPhones and iPads, utilize Apple's silicon, known as the A series, for their application processors.

- These processors are designed specifically for Apple's ecosystem, allowing tightly integrated hardware and software optimization.

- Apple's processors are known for their powerful performance and efficient power consumption, enabling smooth multitasking and extended battery life.

- For instance, in September 2023, Apple unveiled the iPhone 15 and iPhone 15 Plus with iOS system processors highlighting advanced camera system, display, super high-resolution, enhanced security, and customization.

- Therefore, the market analysis shows that the aforementioned factors are expected to boost the smartphone application processor market trends during the forecast period.

By End User:

Based on end user, the market is segmented into individuals, professionals, gamers, students, photographers, and others.

Trends in the End User:

- Rising adoption of processors by photographers due to their portability, convenience, and powerful image-processing capabilities.

- Increasing trend in the adoption of processors by students for their ability to handle multitasking, run demanding apps, and support various learning tools.

The individuals segment accounted for the largest revenue share of the smartphone application processor market share in 2024.

- Smartphones, powered by high-performance processors, are widely used by individuals for various tasks.

- High-end processors offer faster speeds and improved performance, enhancing the user experience, particularly for tasks like gaming, multitasking, and running resource-intensive apps.

- These processors also contribute to smoother and more efficient device operation, including camera performance and image processing.

- Thus, the aforementioned factors are boosting the smartphone application processor market expansion.

The gamers segment is anticipated to register the fastest CAGR growth during the forecast period.

- Smartphones, especially those with high-end processors, are increasingly popular among gamers due to their portability and ability to run graphically intensive games.

- Key features include powerful processors like the Snapdragon 8 Gen 3 or MediaTek Dimensity 9400 for smooth gameplay, high refresh rate displays for reduced lag, and dedicated gaming features like enhanced cooling and custom controls.

- Some smartphones have features like enhanced cooling, custom controls, and gaming modes that optimize performance for specific games.

- Therefore, the market analysis shows that the aforementioned factors are expected to boost the smartphone application processor market opportunities during the forecast period.

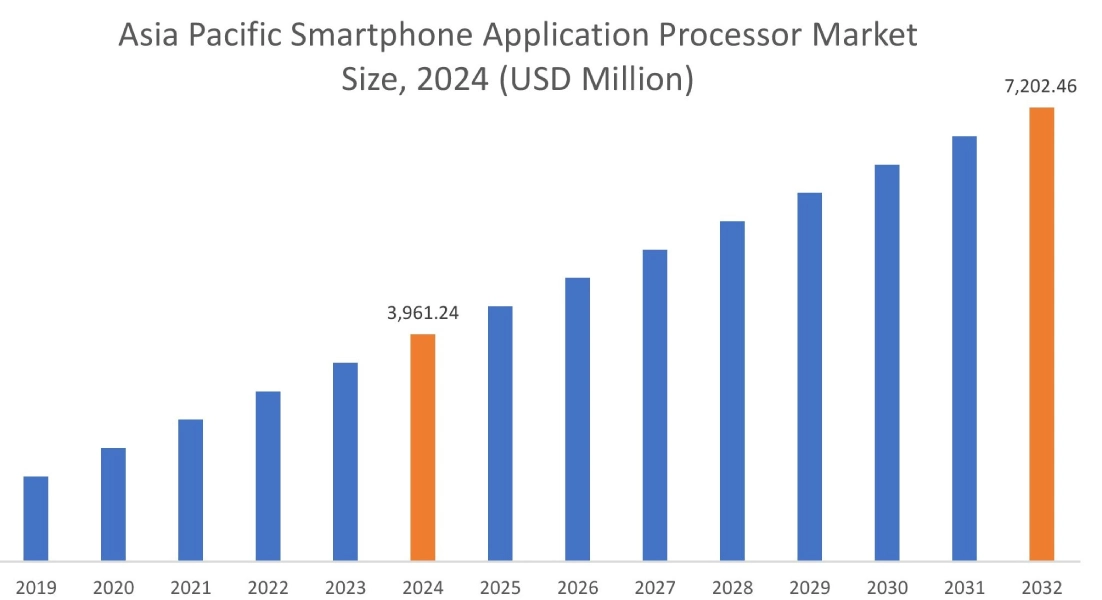

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

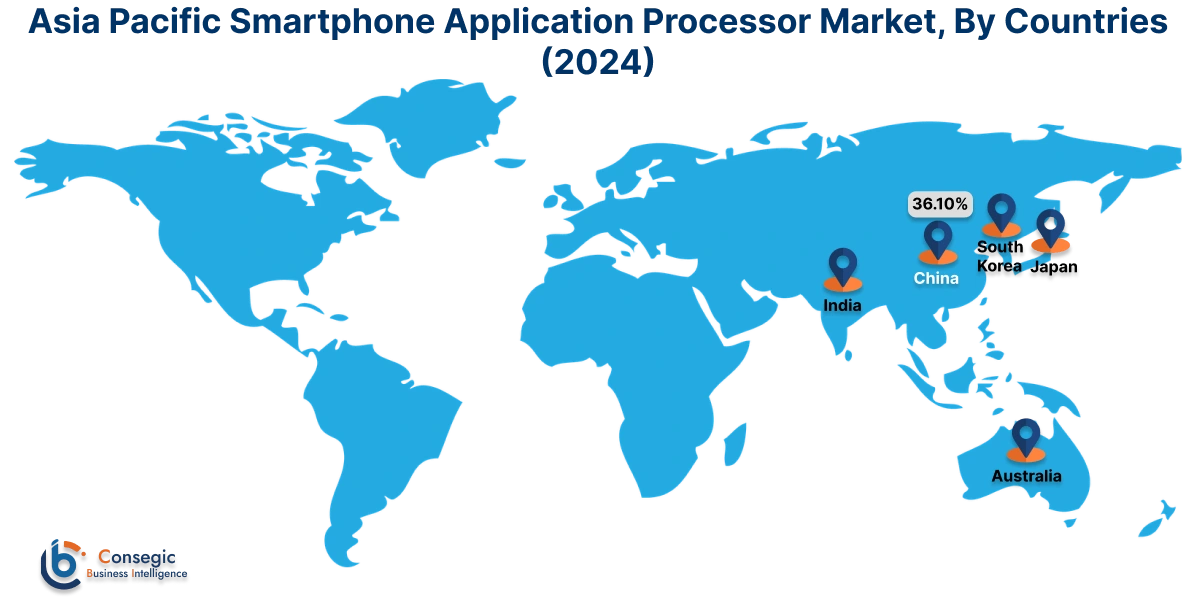

Asia Pacific region was valued at USD 3,961.24 Million in 2024. Moreover, it is projected to grow by USD 4,191.45 Million in 2025 and reach over USD 7,202.46 Million by 2032. Out of this, China accounted for the maximum revenue share of 36.10%. The smartphone application processor market analysis shows that the market is primarily driven due to increasing disposable incomes, a rising middle class, and technological advancements like 5G. Moreover, the growing popularity of mobile apps for e-commerce, gaming, travel, and other services further drives smartphone adoption and usage.

- For instance, in April 2023, Vivo launched the T2 5G series with an Android processor, AMOLED display, and a 64MP OIS Anti-Shake camera. It also includes enhanced personalization choices, updated privacy and security elements, and fresh control features for a seamless, continuous user experience.

North America is estimated to reach over USD 9,577.18 Million by 2032 from a value of USD 5,439.72 Million in 2024 and is projected to grow by USD 5,740.12 Million in 2025. The market is primarily driven by technological innovation, particularly in AI and 5G, driving smartphone features and adoption. Moreover, the rise of social media, content creators, and influencers also boost the smartphone application processor market expansion.

- For instance, in February 2024, Micron Technology, Inc.revealed that Samsung integrated Micron's LPDDR5X memory and UFS 4.0 mobile flash storage in certain devices from the Samsung Galaxy S24 series, powered by an Android system processor, bringing advanced AI capabilities to mobile users.

The smartphone application processor market analysis shows that in Europe, the market is growing due to increasing demand for advanced mobile technologies, rise in smartphone penetration, and the adoption of 5G and AI-powered devices. In Latin America, the Middle East, and Africa, the market growth is driven by growing demand for premium and mid-range devices, price competitiveness, and increasing importance of ecosystem innovation among others.

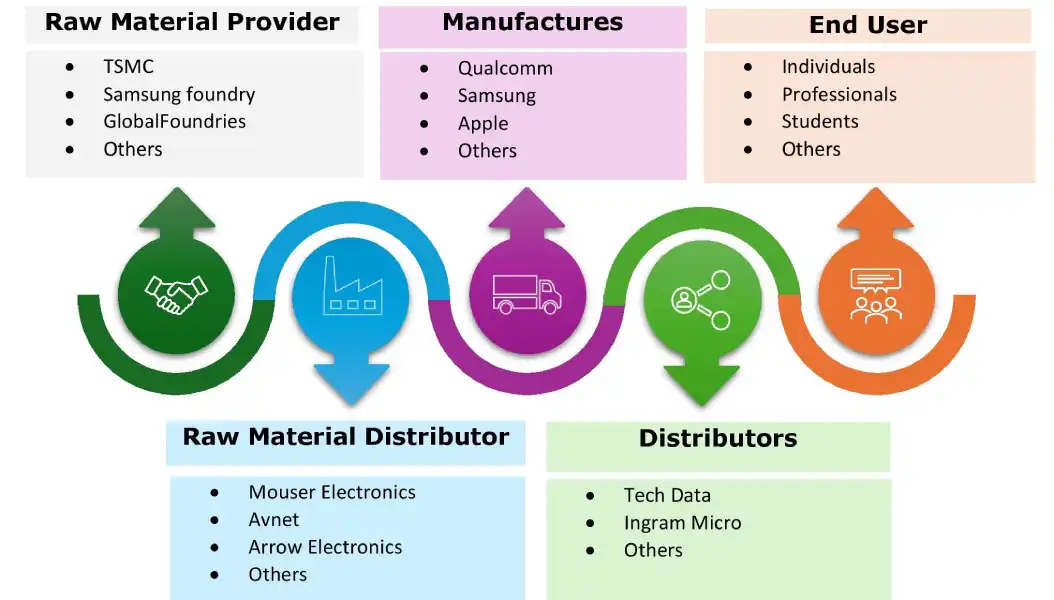

Top Key Players & Market Share Insights:

The smartphone application processor industry is highly competitive with major players providing solutions and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global smartphone application processor market. Key players in the smartphone application processor industry include -

- MediaTek Inc. (Taiwan)

- Samsung Electronics (South Korea)

- Nvidia Corporation (US)

- Huawei Technologies Co (China)

- Analog Devices, Inc (US)

- Qualcomm Technologies, Inc (US)

- Intel Corporation (US)

- Lenovo Group Ltd (Hong Kong)

- Apple Inc. (US)

- HTC Corporation (Taiwan)

Recent Industry Developments :

Collaborations:

- In January 2024, Samsung and Google Cloud collaborated to introduce Gemini-powered AI on the Samsung Galaxy S24 Series using an Android processor system, efficiently handling various types of information such as text, code, images, and video.

Smartphone Application Processor Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 26,095.86 Million |

| CAGR (2025-2032) | 6.5% |

| By Panel Type |

|

| By Operating System |

|

| By End Users |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the smartphone application processor market? +

Smartphone Application Processor Market size is estimated to reach over USD 26,095.86 Million by 2032 from a value of USD 14,896.55 Million in 2024 and is projected to grow by USD 15,712.61 Million in 2025, growing at a CAGR of 6.5% from 2025 to 2032.

What are the major segments covered in the smartphone application processor market report? +

The segments covered in the report are type, operating system, end user, and region.

Which region holds the largest revenue share in 2024 in the smartphone application processor market? +

North America holds the largest revenue share in the smartphone application processor market in 2024.

Who are the major key players in the smartphone application processor market? +

The major key players in the market are MediaTek Inc. (Taiwan), Samsung Electronics (South Korea), Qualcomm Technologies, Inc (US), Intel Corporation (US), Lenovo Group Ltd (Hong Kong), Apple Inc. (US), HTC Corporation (Taiwan), Nvidia Corporation (US), Huawei Technologies Co (China), and Analog Devices, Inc (US).