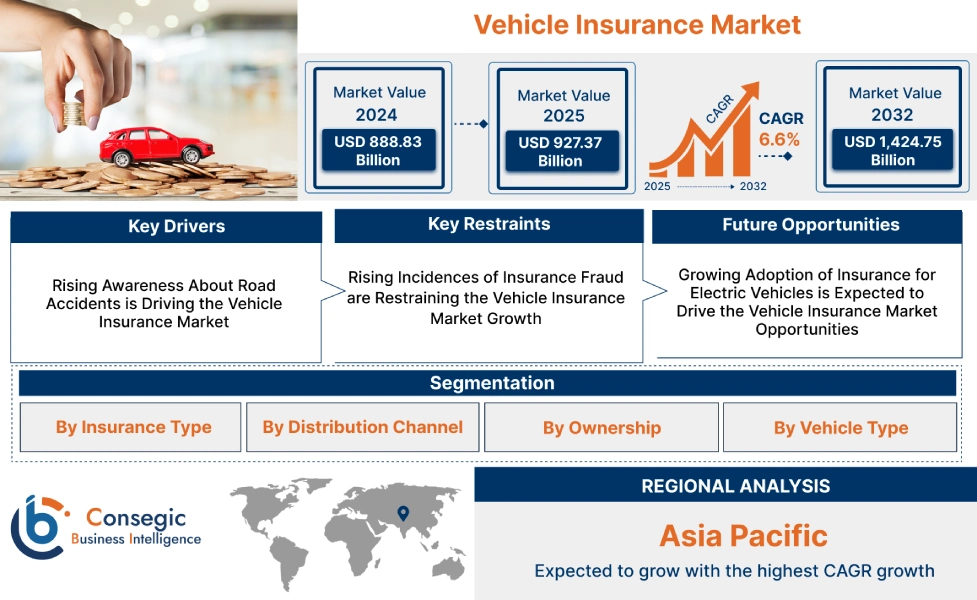

Vehicle Insurance Market Size:

Vehicle Insurance Market size is estimated to reach over USD 1,424.75 Billion by 2032 from a value of USD 888.83 Billion in 2024 and is projected to grow by USD 927.37 Billion in 2025, growing at a CAGR of 6.6% from 2025 to 2032.

Vehicle Insurance Market Scope & Overview:

Vehicle insurance or auto insurance refers to a type of insurance that protects vehicles from unexpected events like accidents, theft, and natural disasters. The main aim of auto insurance products is to protect the vehicle's owner or driver from financial losses. Many insurance providers today provide features like on-the-spot claim settlement, damage from third-party liability risk, own damage, and theft, among others. Further, increasing awareness among consumers to protect from unexpected risks like road accidents has resulted in robust growth in the auto insurance market. Furthermore, information-based websites also offer tools to compare auto insurance policies, making auto insurance for end consumers more prevalent.

How is AI Transforming the Vehicle Insurance Market?

AI is transforming the vehicle insurance market by enabling smarter risk assessment, personalized pricing, and faster claims processing. Through telematics and connected car data, AI analyzes driving behavior such as speed, braking patterns, and route history to offer tailored insurance premiums based on individual risk profiles. Machine learning models help insurers detect fraud by identifying unusual claim patterns, improving accuracy and reducing losses. AI-powered chatbots streamline customer service, assisting with policy management and claim filing in real time. Additionally, predictive analytics enhance underwriting decisions and forecast claim trends more effectively. As automation and data-driven insights become central to the industry, AI is making vehicle insurance more efficient, transparent, and customer-centric globally.

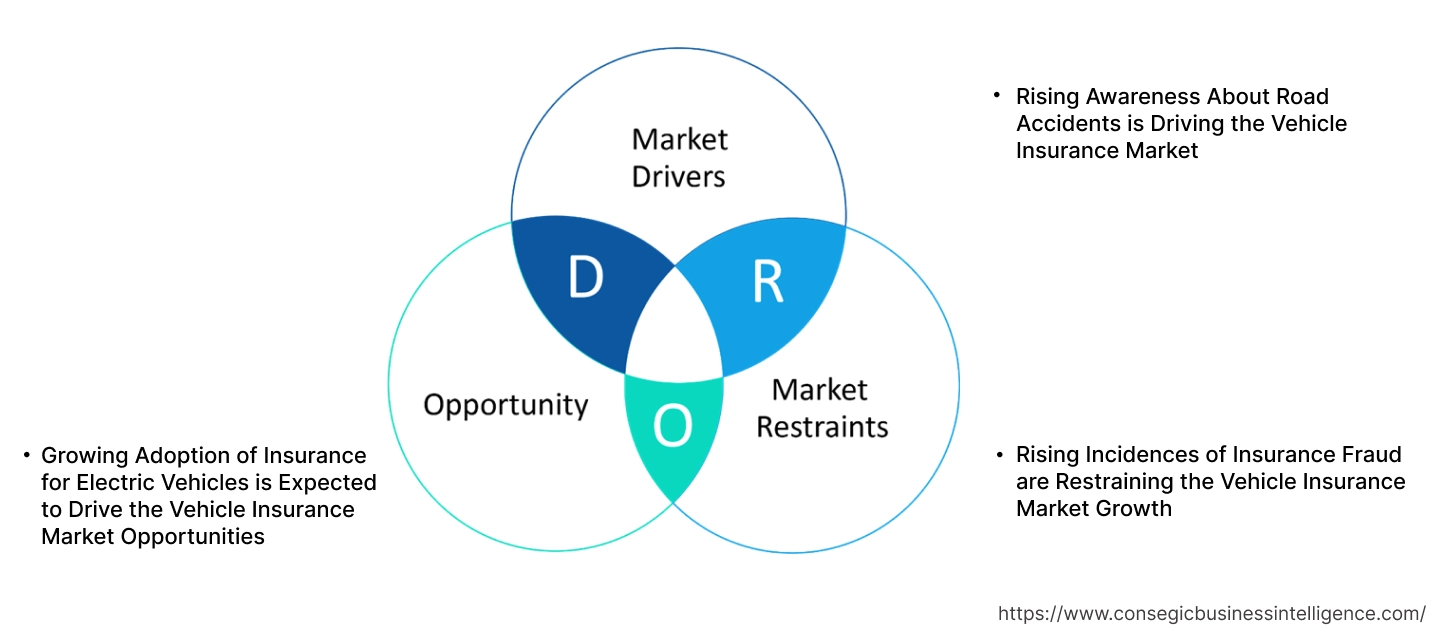

Vehicle Insurance Market Dynamics - (DRO) :

Key Drivers:

Rising Awareness About Road Accidents is Driving the Vehicle Insurance Market

Drivers are becoming increasingly aware of the risks and rising number of road accidents and the financial losses which in turn drive the market. Further, the increase in risk management awareness among consumers has driven the growth in the vehicle insurance market as many consumers turn to insurance providers to protect from financial loss. Furthermore, insurance providers today also provide roadside assistance services such as flat tire assistance, towing assistance, and first aid assistance to protect from potential serious injuries to the driver.

- For instance, according to the WHO, approximately 1.19 million people each year lose their lives due to road traffic accidents. The increasing number of accidents and awareness about services offered by insurance providers in the event of an accident are expected to drive the auto insurance market.

Hence, the growing awareness among consumers about road accidents is driving the vehicle insurance market size.

Key Restraints:

Rising Incidences of Insurance Fraud are Restraining the Vehicle Insurance Market Growth

Auto insurance fraud refers to fraud committed by policyholders to deceive the insurance provider and exaggerate the nature of vehicle damage or lie about vehicle theft to gain compensation. Fraud can also be caused by vehicle garage owners overcharging for vehicle repairs or installing third-party equipment instead of original equipment, and then filing a claim to the insurance provider for the full cost of the original equipment. Further, a third party like a garage owner can make the end consumer sign an Assignment of Benefits (AOB) agreement to make the garage eligible for financial compensation directly from the insurer. As a result, auto insurance fraud results in financial loss to the insurance provider as well loss to the policyholder in the form of higher premiums. Thus, the rise in auto insurance fraud poses a threat to the vehicle insurance market growth.

Future Opportunities :

Growing Adoption of Insurance for Electric Vehicles is Expected to Drive the Vehicle Insurance Market Opportunities

Electric vehicles have seen an upward trend in sales globally due to reduced CO2 emissions, making them environmentally friendly. Electric vehicle parts can be expensive to replace or repair in the event of an accident due to the presence of fewer companies in the segment. The expensive price of repair presents an ideal opportunity for auto insurance products to grow as the cost of repair, in the event the vehicle is insured, is borne by the provider. Many insurance providers offer customized insurance plans for electric vehicle owners by considering factors like battery power for premiums.

- For instance, Acko provides auto insurance for electric cars based on the battery power capacity of electric vehicles. The premium charged by the company increases as the battery power increases.

Thus, the rising demand and cost of repairs associated with electric vehicles are projected to drive the vehicle insurance market opportunities during the forecast period.

Vehicle Insurance Market Segmental Analysis :

By Insurance Type:

Based on insurance type, the market is segmented into third party liability, collision/own damage cover, personal accident cover, comprehensive coverage, and others.

Trends in the insurance type:

- Increasing preference for comprehensive coverage by consumers for protection against non-collision events, including vandalism and vehicle break-ins.

- Increase in third party liability cover to protect drivers in the event the driver causes injury to another person or third party property.

Third Party Liability accounted for the largest revenue share in the year 2024.

- Third party liability insurance in auto insurance protects the driver from financial loss that may result from legal proceedings in the event of an accident.

- The financial losses or liabilities can also include medical liabilities that may result due to an accident, making third party liability cover popular among drivers.

- Additionally, many governments today have made it mandatory for vehicle owners to have third party liability insurance, resulting in growth.

- For instance, in India, third party liability insurance is mandatory as per the Motor Vehicle Act, 1988.

- According to the market analysis, the rising adoption of third party liability insurance due to law mandates and coverage of legal and medical fees is driving the vehicle insurance market.

Comprehensive coverage is anticipated to register the fastest CAGR during the forecast period.

- Comprehensive coverage protects the vehicle from minor and major damages resulting from natural disasters.

- Companies have started offering comprehensive coverage to protect the vehicle if it comes into contact with an animal.

- For instance, Reliance General Insurance offers comprehensive car insurance to protect car owners from accidents where an animal crashes into the car.

- Thus, the rising need to protect the vehicle from damages incurred due to natural disasters and animal attacks has driven the comprehensive coverage segment, in turn, propelling the overall market.

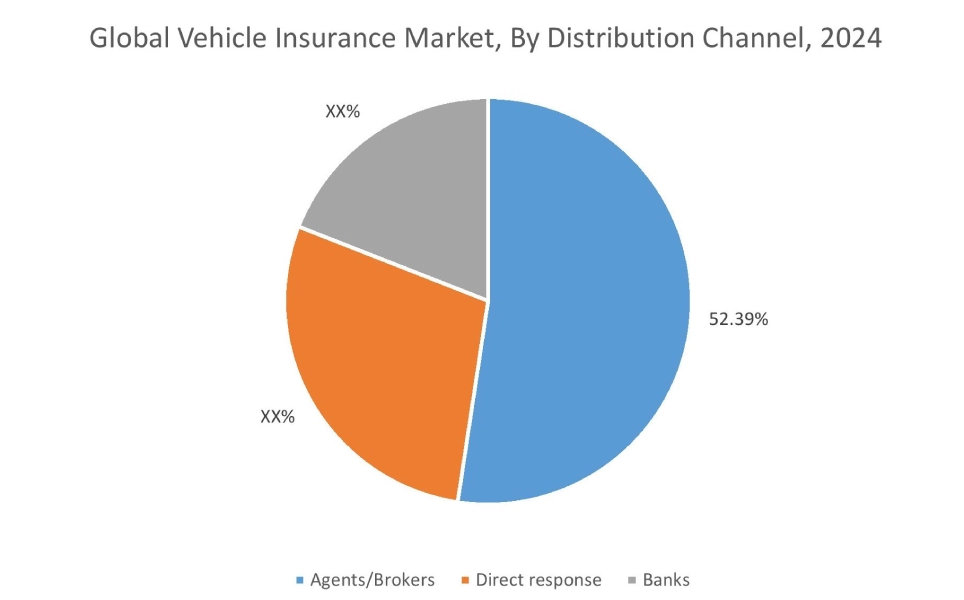

By Distribution Channel:

Based on distribution channel, the market is segmented into agents/brokers, direct response, and banks.

Trends in the distribution channel:

- Rising adoption of direct response channels for insurance due to faster processing and no intermediaries is driving the vehicle insurance market share.

- Factors including expertise & guidance and access to multiple insurance carriers are driving the agents/brokers segment.

Agents/Brokers accounted for the largest revenue share of 52.39% in the year 2024.

- Agents/Brokers of auto insurance offer deep expertise and guidance to consumers making them popular among consumers.

- Many insurance brokers offer a wide variety of auto insurance products from different financial institutions making it easier for consumers to compare policies.

- Additionally, many online services today offer a marketplace where consumers can connect with local independent agents.

- For instance, Trusted Choice is an online marketplace that connects people interested in buying insurance, including auto insurance, to independent agents located near them.

- Thus, as per the vehicle insurance market analysis, the growing adoption of agents/brokers due to better expertise and advice is driving the overall market.

Direct Response is anticipated to register the fastest CAGR during the forecast period.

- In direct response channel the insurance provider sells insurance directly to the consumer without any intermediary.

- Many auto insurance providers offer information in the form of articles and calculators for consumers making insurance buying easier without intermediaries.

- Direct response insurance channels have been on the rise due to ease of buying insurance through websites or mail order which helps consumers in saving money.

- For instance, Sompo Insurance offers a direct sales channel for consumers interested in buying auto insurance directly from the company.

- According to the vehicle insurance market analysis, the increasing advancements related to direct insurance are anticipated to boost the vehicle insurance market trends during the forecast period.

By Ownership:

Based on the ownership, the market is segmented into new vehicle and used vehicle.

Trends in the ownership:

- Increasing adoption of auto insurance for used cars due to the growth in the sales of used cars is driving the vehicle insurance market trends.

- Factors including growing demand for new bikes, are driving the new vehicles insurance market.

New vehicles accounted for the largest revenue share in the year 2024.

- New auto insurance sales have been on the rise due to the benefits of insuring a new vehicle, like damage to the body panel, glass, and damage from natural disasters.

- Many car companies today have started offering insurance through their own in-house insurance broking services to offer customers insurance services for their cars.

- The services provided by the car companies through their insurance broking firms include add-ons to offer more customization based on their cars.

- For instance, Hyundai India offers Insurance services through HIIB , in which they offer insurance on Hyundai vehicles with add-ons like covering the cost of consumables like engine oil, coolants, and gear oil.

- Therefore, the increasing adoption of auto insurance for new vehicles due to in-house insurance is driving the vehicle insurance market size.

Used vehicle is anticipated to register the fastest CAGR during the forecast period.

- Used vehicle sales have experienced rising adoption due to the benefits of buying used vehicles, like reduced depreciation since the initial depreciation is already borne by the original owner. The increase in used vehicle sales has driven the used vehicle insurance market.

- Moreover, many insurance providers today offer a wide network of garages for repairs, keeping in mind the wear and tear of components of used cars .

- For instance, Tata AIG offers a network of more than 5400 garages across India where policyholders can avail cashless insurance.

- Thus, the rising adoption of used auto insurance for used vehicles due to increased sales and a wide network of garage repairs is propelling the vehicle insurance market expansion during the forecast period.

By Vehicle Type:

Based on the vehicle type, the market is segmented into passenger vehicles and commercial vehicles.

Trends in the vehicle type:

- Increasing adoption of auto insurance by individuals for vehicles like motorcycles and SUVs.

- There is a rising trend towards the utilization of auto insurance by businesses for commercial vehicles like trucks and buses, as well as for taxis.

Passenger vehicles accounted for the largest revenue share in the year 2024.

- The dominance of passenger auto insurance is attributed to the ownership of cars and bikes, especially in Asian markets.

- Insurance providers today offer specific insurance coverage plans for different types of vehicles like SUVs and MUVs with add-ons like zero depreciation cover to ensure the consumer receives the entire claim amount without considering depreciation.

- For instance, Bajaj Finserv offers a depreciation add-on to its auto insurance for SUVs. The add-on is particularly useful for SUVs in the luxury vehicle segment, as the policyholder is protected from the depreciation cost.

- Therefore, the increasing development of auto insurance solutions for passenger vehicles with features like zero-depreciation cover is propelling the vehicle insurance market expansion.

Commercial vehicles is anticipated to register the fastest CAGR during the forecast period.

- Commercial vehicles cover many vehicles used for commercial purposes, like transportation of goods and people.

- Many companies offer auto insurance products catered to small/medium business owners, like taxi fleet owners.

- For instance, Aviva offers a sole trader coverage option for vehicles registered in a sole trader’s name.

- Hence, the growing demand for commercial auto insurance by small/medium-sized businesses is driving the market during the forecast period.

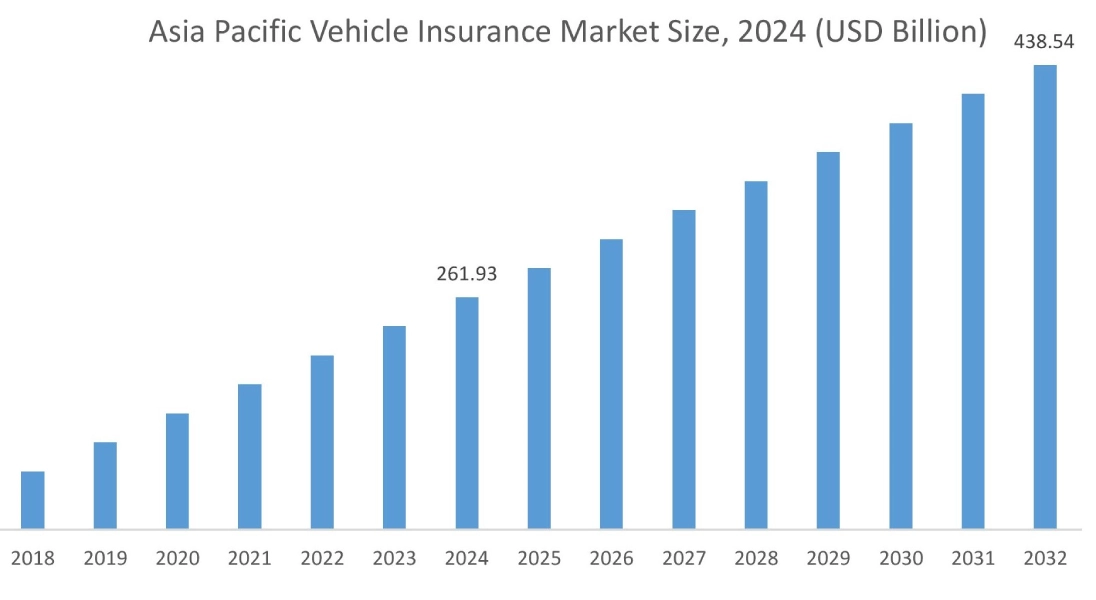

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

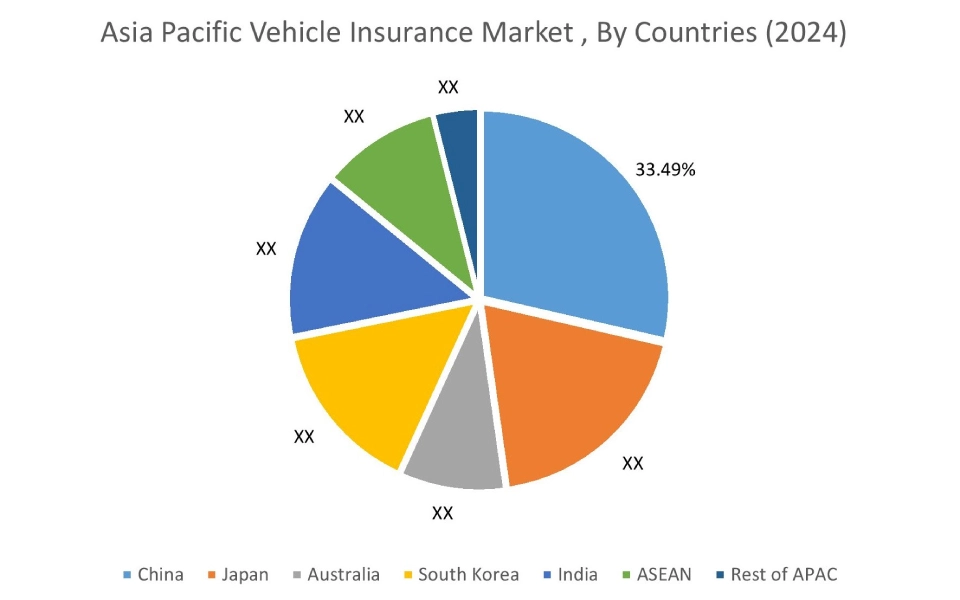

Asia Pacific region was valued at USD 261.93 Billion in 2024. Moreover, it is projected to grow by USD 274.30 Billion in 2025 and reach over USD 438.54 Billion by 2032. Out of this, China accounted for the maximum revenue of 33.49%. As per the vehicle insurance analysis, the adoption of vehicle insurance in the Asia-Pacific region is primarily driven by the growing awareness about vehicle insurance, stringent regulations, and increasing use of online tools.

- For instance, Policybazaar offers users the option to search top insurers for vehicles by simply putting the car number in the search bar. The user is presented with top insurance providers, giving them the option to compare premium prices. The increase in online services offering information related to auto insurance shows the rising need for auto insurance.

North America is estimated to reach over USD 449.37 Billion by 2032 from a value of USD 282.95 Billion in 2024 and is projected to grow by USD 294.99 Billion in 2025. In North America, the growth of the vehicle insurance industry is driven by the growing need to protect drivers from road accidents. Moreover, the increase in the number of insurance agents offering expertise to potential consumers and helping them buy insurance policies is contributing to the vehicle insurance market demand.

- For instance, according to the Insurance Information Institute, the number of insurance agents and brokers stood at approximately one million in 2024. The growing number of agents and brokers shows the increasing need for expert guidance for insurance products, including auto insurance.

Additionally, the regional analysis depicts that the growing commercial vehicle segment for small business owners is driving the vehicle insurance market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America is expected to grow at a considerable rate due to the rise in direct response channels of auto insurance. The Middle East and Africa market is expected to grow at a considerable rate due to factors such as the increasing number of insurance companies offering different insurance products for motorbikes and three-wheelers, and an increase in the number of used car marketplaces.

Top Key Players and Market Share Insights:

The global vehicle insurance market is highly competitive, with major players providing solutions to the national and international markets. Key industry players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the vehicle insurance market. Key players in the vehicle insurance industry include-

- Berkshire Hathaway Inc. (U.S.)

- Farmers Insurance (U.S.)

- Acko Technology and Services Private Limited (India)

- Sompo International Holdings Ltd. (Japan)

- HDFC Ergo General Insurance Company Limited (India)

- Aviva (U.K)

- IFFCO-Tokio General Insurance Company Limited (India)

- Geico (U.S.)

- Allianz (Germany)

- Assicurazioni Generali S.p.A. (Italy)

Recent Industry Developments :

Product Launch

- In March 2025, PhonePe announced the launch of a vehicle insurance tool for two-wheelers and four-wheelers. The company aims to provide new vehicle buyers with an alternative option to traditional dealerships by providing an online search for vehicle insurance options from top insurers.

Merger and Acquisition

- In December 2024, Arthur J. Gallagher & Co. announced the acquisition of Assured Partners, an insurance brokerage company with a broad footprint in the United States. The acquisition aims to leverage Arthur J. Gallagher’s expertise in data analytics and access to specialty products, among others, with the offerings of Assured Partners to boost future growth.

Vehicle Insurance Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1,424.75 Billion |

| CAGR (2025-2032) | 6.6% |

| By Insurance Type |

|

| By Distribution Channel |

|

| By Ownership |

|

| By Vehicle Type |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the vehicle insurance market? +

The vehicle insurance market is estimated to reach over USD 1,424.75 Billion by 2032 from a value of USD 888.83 Billion in 2024 and is projected to grow by USD 927.37 Billion in 2025, growing at a CAGR of 6.6% from 2025 to 2032.

Which is the fastest-growing region in the vehicle insurance market? +

Asia-Pacific region is experiencing the most rapid growth in the vehicle insurance market.

What specific segmentation details are covered in the vehicle insurance market report? +

The vehicle insurance market report includes specific segmentation details for insurance type, distribution channel, ownership, vehicle type, and region.

Who are the major players in the vehicle insurance market? +

The key participants in the vehicle insurance market are Berkshire Hathaway Inc. (U.S.), Aviva (U.K), IFFCO-Tokio General Insurance Company Limited (India), Geico (U.S.), Allianz (Germany), Assicurazioni Generali S.p.A. (Italy), Farmers Insurance (U.S.), Acko Technology and Services Private Limited (India), Sompo International Holdings Ltd. (Japan), HDFC Ergo General Insurance Company Limited (India), and Others.