Accelerator Card Market Size:

Accelerator Card Market Size is estimated to reach over USD 214.07 Billion by 2032 from a value of USD 18.96 Billion in 2024 and is projected to grow by USD 25.33 Billion in 2025, growing at a CAGR of 35.4% from 2025 to 2032.

Accelerator Card Market Scope & Overview:

Accelerator card is a specialized hardware component, which is designed to accelerate particular tasks by offloading them from the main processor. These cards significantly hasten computations in areas such as machine learning, data analytics, high-frequency trading, and scientific simulations. They are available in diverse forms, including cryptographic accelerators, graphics, and AI. These cards can be tailored and optimized for specific workloads, frequently leveraging parallel processing to execute computations more rapidly than conventional central processing units (CPUs).

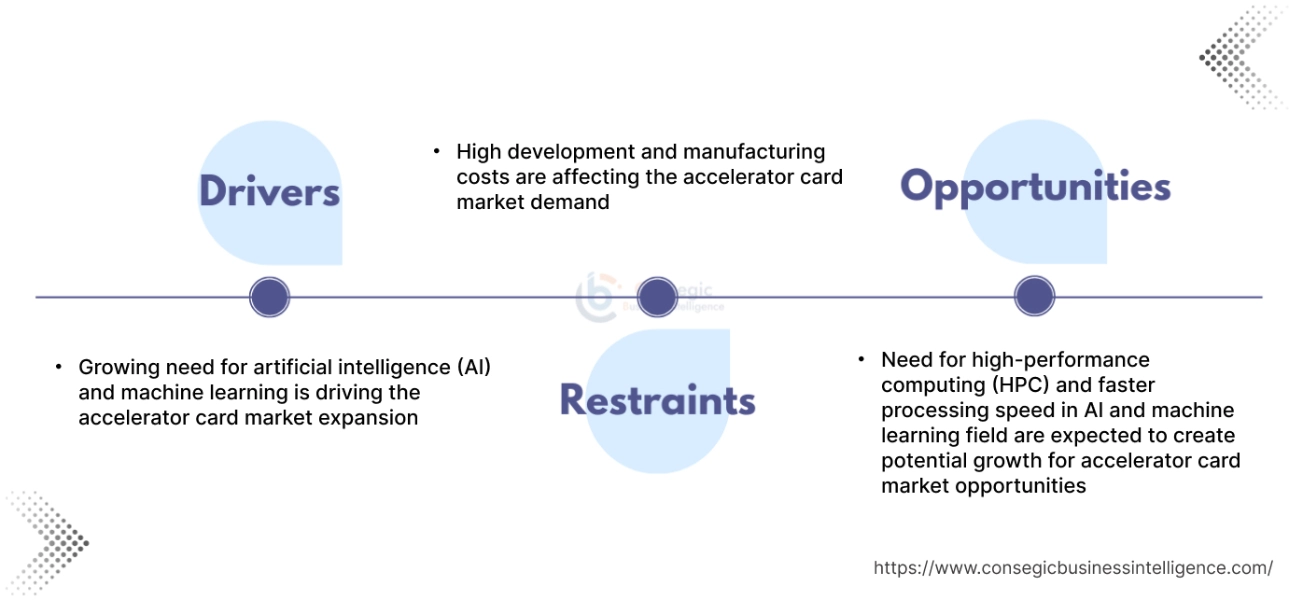

Accelerator Card Market Dynamics - (DRO):

Key Drivers:

Growing need for artificial intelligence (AI) and machine learning is driving the accelerator card market expansion

An artificial intelligence (AI) accelerator, also known as an AI chip or deep learning processor, is a specialized hardware designed to accelerate machine learning tasks and AI neural networks. Currently, AI accelerators are found in a wide range of devices, including autonomous vehicles, robotics, personal computers smartphones, internet of things (IoT) devices, and edge computing. Their specialized parallel-processing capabilities enable them to perform billions of calculations simultaneously. This capability is critical for speeding up the data processing necessary to develop and deploy AI applications at scale.

- For instance, in March 2025, Aetina, an edge AI solutions specialist and part of the Innodisk Group, announced a collaboration with Axelera AI, a prominent edge-inference company. This partnership aims to provide powerful, energy-efficient AI inference solutions for sectors such as smart transportation, surveillance, and retail. Responding to the increasing demand for compact, high-performance AI at the edge, their collaboration offers a complete range of AI-optimized systems. These systems seamlessly combine Axelera AI's robust AI accelerator cards with Aetina's advanced hardware.

Thus, according to the accelerator card market analysis, the growing need for artificial intelligence (AI) and machine learning is driving the accelerator card market size.

Key Restraints:

High development and manufacturing costs are affecting the accelerator card market demand

Accelerators are expensive due to their specialized, high-performance design, complex manufacturing processes, and high requirements in sectors like cloud computing and AI, which drive up costs. They are designed for specific tasks, such as AI/ML training or processing, requiring highly specialized hardware and software, leading to increased development and manufacturing costs. The manufacturing of these cards involves complex processes, including the use of advanced semiconductor technologies and intricate circuit board designs, which are expensive to implement. The initial investment required for research, development, and manufacturing of specialized accelerators can be substantial, potentially making them unaffordable for some businesses. Thus, the aforementioned factors would further impact the accelerator card market size and trends.

Future Opportunities:

Need for high-performance computing (HPC) and faster processing speed in AI and machine learning field are expected to create potential growth for accelerator card market opportunities

High-performance computing (HPC) leverages robust computing resources to tackle intricate calculations and simulations that are impractical or too time-consuming for conventional computers. Accelerators, frequently graphics processing units (GPUs) or field-programmable gate arrays (FPGAs), play a pivotal role in HPC by facilitating parallel processing and significantly speeding up computations in applications such as scientific simulations and machine learning.

Unlike traditional central processing units (CPUs) that are optimized for sequential tasks, accelerators are engineered for parallel processing, enabling them to process vast datasets and complex calculations with much greater speed. HPC stands as a cornerstone in advancing scientific computing. Researchers are increasingly integrating traditional simulations with AI, machine learning, big data analytics, and edge computing across various fields, including weather forecasting, energy exploration, computational fluid dynamics, and life sciences.

These specialized hardware components within HPC systems are designed to offload and accelerate specific tasks, thereby significantly expediting computations for applications like scientific simulations, machine learning, and data analytics. Their design prioritizes excellence in specific tasks, in contrast to general-purpose CPUs which are optimized for a broad spectrum of workloads.

- For instance, in February 2025, SynaXG announced the partnership with Kalray, to introduce a new arm-based lookaside acceleration solution specifically for open RAN deployments. This collaboration enhances SynaXG's current inline acceleration offerings, providing operators with more adaptable, energy-efficient, and cost-effective ways to optimize network performance.

Thus, based on the above accelerator card market analysis, the requirement for powerful computing and high processing speed is expected to drive the accelerator card market opportunities and trends.

Accelerator Card Market Segmental Analysis :

By Processor Type:

Based on processor type, the market is segmented into central processing unit (CPU), graphics processing unit (GPU), field-programmable gate arrays (FPGA), and application-specific integrated circuit (ASIC).

Trends in the processor type:

- The emergence of edge computing and the internet of things (IoT) is presenting new prospects for market players.

- With advancements in CPU architectures, such as multi-core designs and enhanced instruction sets, CPU-based cards continue to offer significant computational power for various applications, such as scientific simulations and enterprise data analytics.

- Thus, based on the above analysis, these factors are driving the accelerator card market demand and trends.

The graphics processing unit (GPU) segment accounted for the largest revenue share in the year 2024.

- Leveraging the parallel processing capabilities of graphics processing units (GPUs), these cards excel in highly parallelizable workloads such as machine learning, deep learning, and computer graphics rendering.

- GPUs are specifically designed to handle a large number of tasks simultaneously, making them crucial in scenarios where massive data sets need to be processed rapidly.

- The evolution of GPU architectures, including the integration of specialized tensor cores for AI workloads, has further enhanced the performance and efficiency of GPU-based cards, driving their adoption across industries.

- For instance, in February 2025, AMD launched RDNA 4 graphics architecture, with the AMD Radeon RX 9070 XT and RX 9070 graphics cards as part of the new Radeon RX 9000 series. These new cards are equipped with 16GB of memory and feature substantial enhancements for superior gaming graphics.

- Thus, based on the above analysis, these factors are further creating opportunities in the industry.

The field-programmable gate arrays (FPGA) segment is anticipated to register the fastest CAGR during the forecast period.

- Field-programmable gate arrays (FPGAs) offer superior flexibility and customization, allowing users to implement bespoke hardware accelerators tailored to their specific applications.

- FPGA-based cards are particularly well-suited for workloads with unique computational requirements or those that demand low latency and high throughput.

- Industries such as telecommunications, finance, and cybersecurity increasingly rely on FPGA-based accelerator cards to achieve real-time processing and decision-making capabilities.

- Moreover, FPGAs enable rapid prototyping and iterative optimization, making them invaluable tools for research and development in emerging technologies like quantum computing and neuromorphic computing.

- For instance, in January 2025, Pascaline Technology announced the launch of its Veloxity V200 FPGA accelerator card. This powerful new addition to the Veloxity family delivers unprecedented memory capacity, storage connectivity, and network bandwidth, designed to meet the requirements of data-intensive applications in AI/ML, networking, FinTech, biotech, and general research.

- Thus, based on the above analysis, these factors are expected to drive the accelerator card market share during the forecast period.

By Accelerator Type:

Based on the accelerator type, the market is segmented into cloud accelerator and high-performance computing accelerator.

Trends in the accelerator type:

- The proliferation of artificial intelligence (AI) and deep learning applications has propelled the demand for accelerator or display cards, as these tasks require immense computational power and parallel processing capabilities.

- As organizations increasingly prioritize efficiency and scalability in their computing infrastructure, the adoption of accelerator cards is expected to surge in the upcoming years.

The cloud accelerator segment accounted for the largest revenue share in the year 2024.

- Cloud accelerators are designed to boost technological performance. Their primary role is to streamline cloud adoption and accelerate the operational speed of applications for both users and developers.

- These accelerators offer predefined steps and best practices to facilitate the migration of applications and data to the cloud.

- By providing a secure and operationally efficient cloud ecosystem, cloud accelerators enable companies to concentrate on their core objective while delivering value to their customers.

- Thus, based on the above analysis, these factors would further supplement the accelerator card market

The high-performance computing accelerator segment is anticipated to register the fastest CAGR during the forecast period.

- High-performance computing fundamentally relies on the parallel processing of complex computational operations.

- An HPC system breaks down large workloads into smaller tasks, distributing them across multiple resources for simultaneous processing. These parallel computing capabilities allow HPC clusters to execute substantial workloads much faster and more effectively than a traditional computing setup.

- These are specialized hardware components designed to significantly boost the performance of specific computational tasks.

- For instance, in November 2024, IBM announced a partnership with AMD to offer AMD Instinct MI300X accelerators as a service on IBM Cloud. This initiative aims to improve the performance and power efficiency of generative high-performance computing (HPC) applications.

- These factors are anticipated to further drive the accelerator card market trends and share during the forecast period.

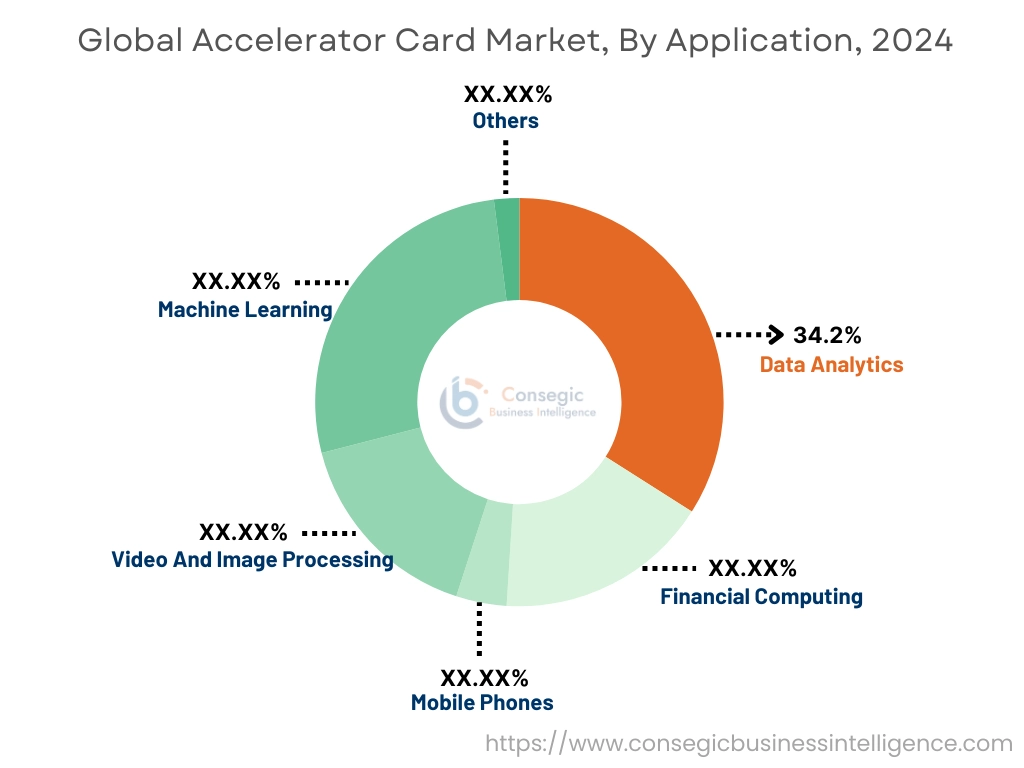

By Application:

Based on application, the market is segmented into video and image processing, machine learning, data analytics, financial computing, mobile phones, and others.

Trends in the application:

- Companies are investing heavily in research and development to create power-efficient and cost-effective accelerator solutions that cater to the evolving needs of diverse industries.

- The development of cloud-based HPC solutions is significantly contributing to market growth. Cloud-based HPC offerings provide scalable and cost-effective alternatives to traditional on-premises solutions, making high-performance computing more accessible to small and medium enterprises (SMEs) and organizations with limited budgets.

The data analytics segment accounted for the largest revenue share of 34.2% in the year 2024.

- Data analytics applications require processing vast amounts of both structured and unstructured data at high speeds, which significantly rely on accelerator cards within the enterprise infrastructure.

- These cards are crucial for generating real-time insights and enabling advanced data modeling in industry verticals, such as BFSI (banking, financial services, and insurance), retail, and manufacturing, where large datasets are processed daily.

- The integration of GPUs (graphics processing units) and FPGAs (field-programmable gate arrays) in analytics accelerators significantly boosts query performance and enables the execution of complex algorithms with minimal delay.

- Therefore, the above factors are driving the accelerator card market growth and trends.

The machine learning segment is anticipated to register the fastest CAGR during the forecast period.

- Machine learning workloads benefit from parallel processing architectures and deep learning processors, to optimize model training and inference operations.

- Rapid deployment of AI-based systems across healthcare, automotive, and financial services sectors further facilitates accelerator card market growth in this application.

- For instance, in November 2024, Anthropic announced an expanded collaboration with Amazon Web Services (AWS), to advance and deploy advanced AI systems. The partnership is focused on the development and optimization of advanced Trainium accelerators while enhancing the capabilities of specialized machine learning hardware.

- These factors are anticipated to further drive the accelerator card market trends and growth during the forecast period.

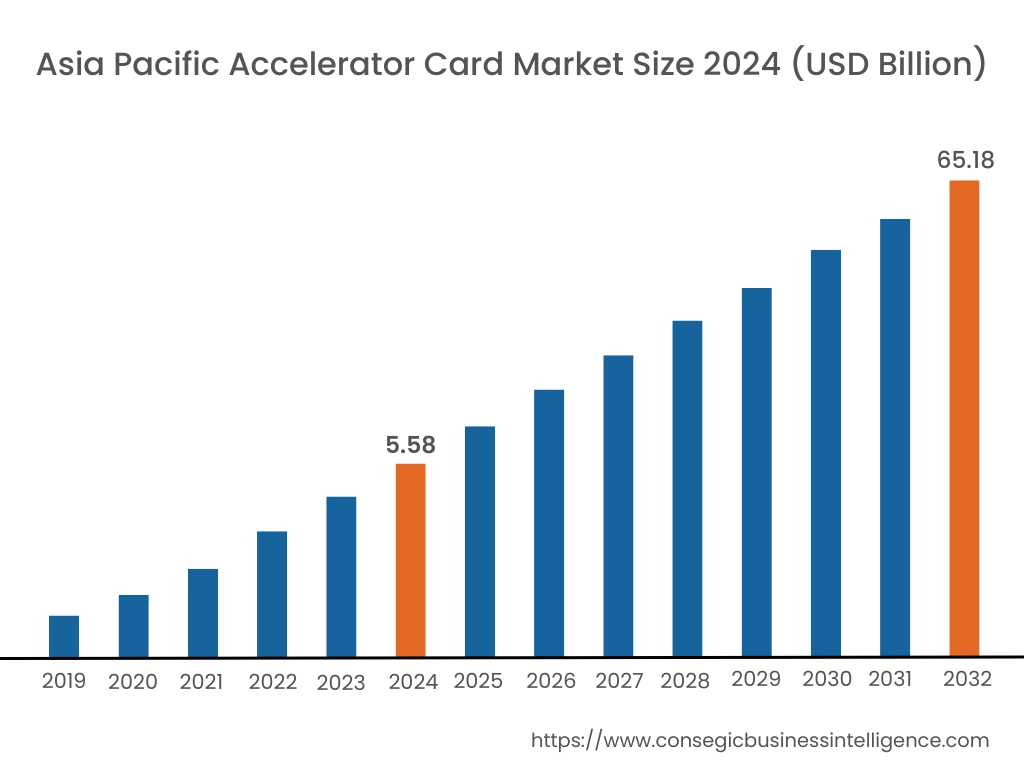

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

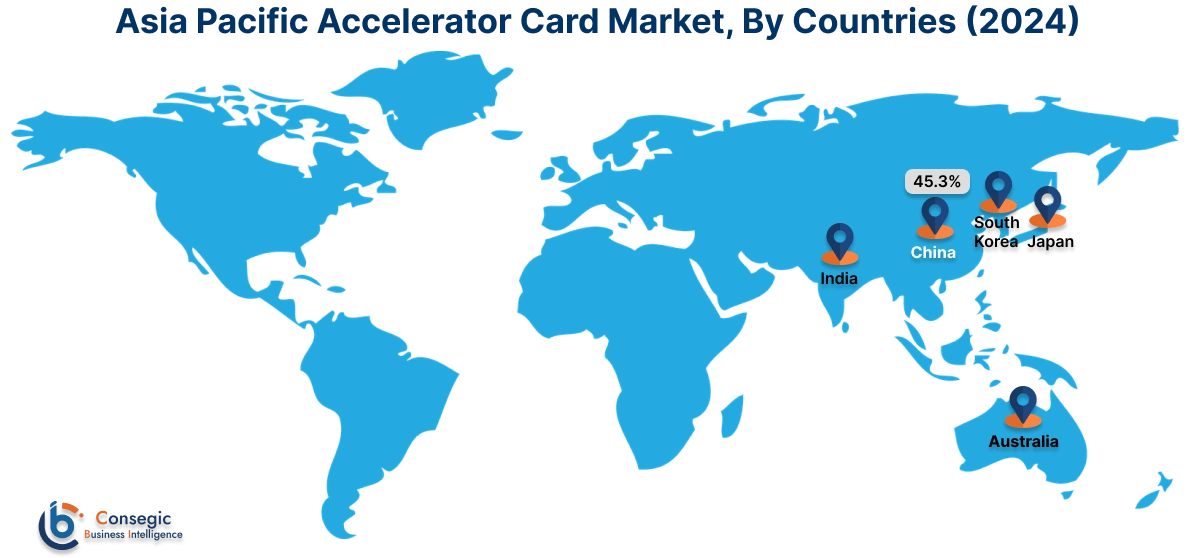

Asia Pacific accelerator card market expansion is estimated to reach over USD 65.18 billion by 2032 from a value of USD 5.58 billion in 2024 and is projected to grow by USD 7.48 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 45.30%. Across the Asia-Pacific region, data center accelerators are widely employed for tasks such as financial computing, machine learning, computational storage, and data search and analytics, with China and India serving as major markets. The surge in demand in this region is fueled by the rapid expansion of cloud computing, rise of AI and machine learning, and the growing need for high-performance computing within data centers and other industries. As data centers increase in complexity and data volumes continue to grow, the requirement for energy-efficient and high-performance computing solutions becomes vital. The above factors would further drive the regional accelerator card market during the forecast period.

- For instance, in February 2025, Calligo Technologies created posit arithmetic hardware implemented in the FPGA platform by incorporating it into a general-purpose computing platform using an RISC-V design. Calligo is set to be the first company in the world to offer posit-enabled silicon and is well placed to bring out the end-product, accelerator card, for general-purpose computing.

North America market is estimated to reach over USD 69.38 billion by 2032 from a value of USD 6.29 billion in 2024 and is projected to grow by USD 8.39 billion in 2025. In North America, accelerators, particularly GPUs, are widely used for gaming, supporting multiple monitors, and in data centers for tasks such as machine learning, financial computing, and blockchain technology applications like cryptocurrency mining. They provide the necessary video output and processing power to drive multiple displays simultaneously, beneficial for tasks like video editing, programming, and multitasking. The strong parallel processing capabilities of these accelerators, particularly GPUs, are essential for tasks including cryptocurrency mining and verifying transactions on decentralized networks. These factors would further drive the market trends in North America.

- For instance, in October 2024, AMD introduced the AMD Alveo UL3422 accelerator card. This card is specifically engineered for ultra-low latency electronic trading applications. The new card offers financial institutions, market makers, and trading firms compact, cost-effective, and rack-space-optimized accelerators.

According to the analysis, the accelerator card industry in Europe is anticipated to witness significant development during the forecast period. In this region, accelerators are increasingly used to enhance performance in various industries, particularly for AI/ML workloads, by offloading CPU processing, and the market is expected to witness significant growth due to the increasing adoption of these technologies. The Latin American region is witnessing substantial investments in high-performance computing infrastructure to address the escalating need for data processing and analysis in sectors such as e-commerce, telecommunications, and healthcare. In the Middle East and Africa, startup accelerators are vital for nurturing innovation and entrepreneurship. They achieve this by offering post-revenue ventures access to mentorship, investors, and capacity-building services, eventually aiming to speed up growth and tackle regional challenges.

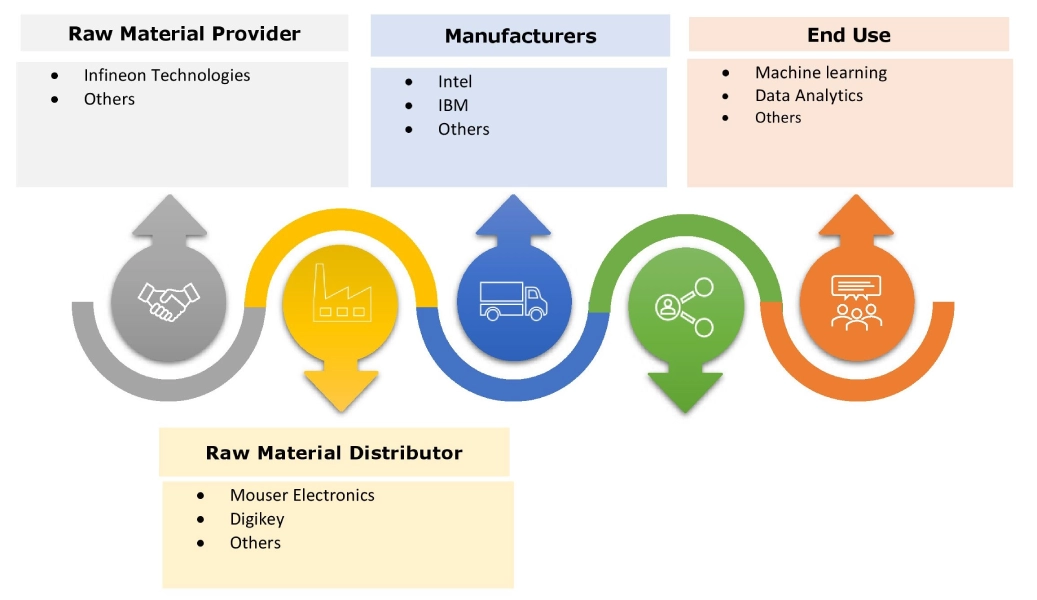

Top Key Players & Market Share Insights:

The global accelerator card market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the accelerator card industry include-

- NVIDIA (U.S.)

- Intel (U.S.)

- Oracle (U.S.)

- Ditto Labs (U.S.)

- Achronix Semiconductor Corporation (U.S.)

- IBM (U.S.)

- Vantis PLC (U.K.)

- Xilinx (U.S.)

- Lattice Semiconductor (U.S.)

- Lenovo (China)

Recent Industry Developments :

- In January 2024, Sivoo, a global network supporting multicultural on-demand entertainment programming and development of AI related modelling, announced that it will incorporate FuriosaAI’s advanced AI accelerator into servers across their private cloud network. This partnership also aims to deploy the company’s accelerator card for large language models and other generative AI tasks.

Accelerator Card Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 214.07 Billion |

| CAGR (2025-2032) | 35.4% |

| By Processor Type |

|

| By Accelerator Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

What are Accelerator Cards? +

Accelerator cards are specialized hardware components designed to accelerate specific tasks. The are primarily used in High-performance computing systems to perform calculations for scientific simulations with high speed. They are externally added to computer systems to enhance performance.

What are the major drivers of market? +

The rising demand of Artificial Intelligence and machine learning for processing large amounts of data required to run AI applications is driving the market. AI accelerators have the ability to perform billions of calculations simultaneously. The rising trend of Crypto mining is also driving the Accelerator market. GPUs are used to perform tasks such as transaction verification on decentralized networks and for big data analysis.

What are the major segments covered in the Accelerator Card Market report, and which segment dominates the market? +

The major segmentation of the Accelerator Card market is done on the basis of processor type, accelerator type, and application. Graphics Processing Unit, a sub segment, accounts for the largest market due to its ability to rapidly process and render visual content, its excellency in processing data, and parallel processing.

Who are the major key players of the Accelerator Card Market? +

NVIDIA (US), Intel (US), IBM (US), Lenovo (China), Oracle (US), Ditto Labs (US), Achronix Semiconductor Corporation (US), Vantis PLC (UK), Xilinx (US), Lattice Semiconductor (US).