Agriculture Equipment Market Size:

Agriculture Equipment Market is estimated to reach over USD 284.72 Billion by 2032 from a value of USD 174.51 Billion in 2024 and is projected to grow by USD 183.49 Billion in 2025, growing at a CAGR of 5.6% from 2025 to 2032.

Agriculture Equipment Market Scope & Overview:

Agriculture equipment refers to the various mechanical tools, vehicles, and machinery used in farming to improve efficiency and productivity. The equipment ranges from simple hand tools to complex machinery like tractors and harvesters that automate tasks such as soil cultivation, planting, and irrigation. The key trends driving the demand for agricultural equipment include the rapid adoption of precision farming technologies like GPS and AI to optimize resource use, as well as the urgent need to address global labor shortages through automation. Additionally, increasing government subsidies and a shift toward sustainable, electric-powered machinery are empowering farmers to modernize their operations while reducing environmental impacts.

How is AI Impacting the Agriculture Equipment Market?

AI is revolutionizing the agriculture equipment market by infusing machines with unprecedented intelligence. Tractors, harvesters, and sprayers are no longer just mechanical tools; they are becoming autonomous, data-driven systems. AI enables these machines to analyze real-time data from sensors and cameras, identifying soil variations, crop health issues, and weed infestations with remarkable accuracy. This leads to precision application of fertilizers and pesticides, reducing waste and environmental impact. Furthermore, AI powers predictive maintenance, optimizing equipment performance and minimizing costly downtime. Autonomous vehicles, guided by AI, can perform tasks like planting and harvesting with minimal human intervention, enhancing efficiency and addressing labor shortages, ultimately driving higher yields and sustainability in farming.

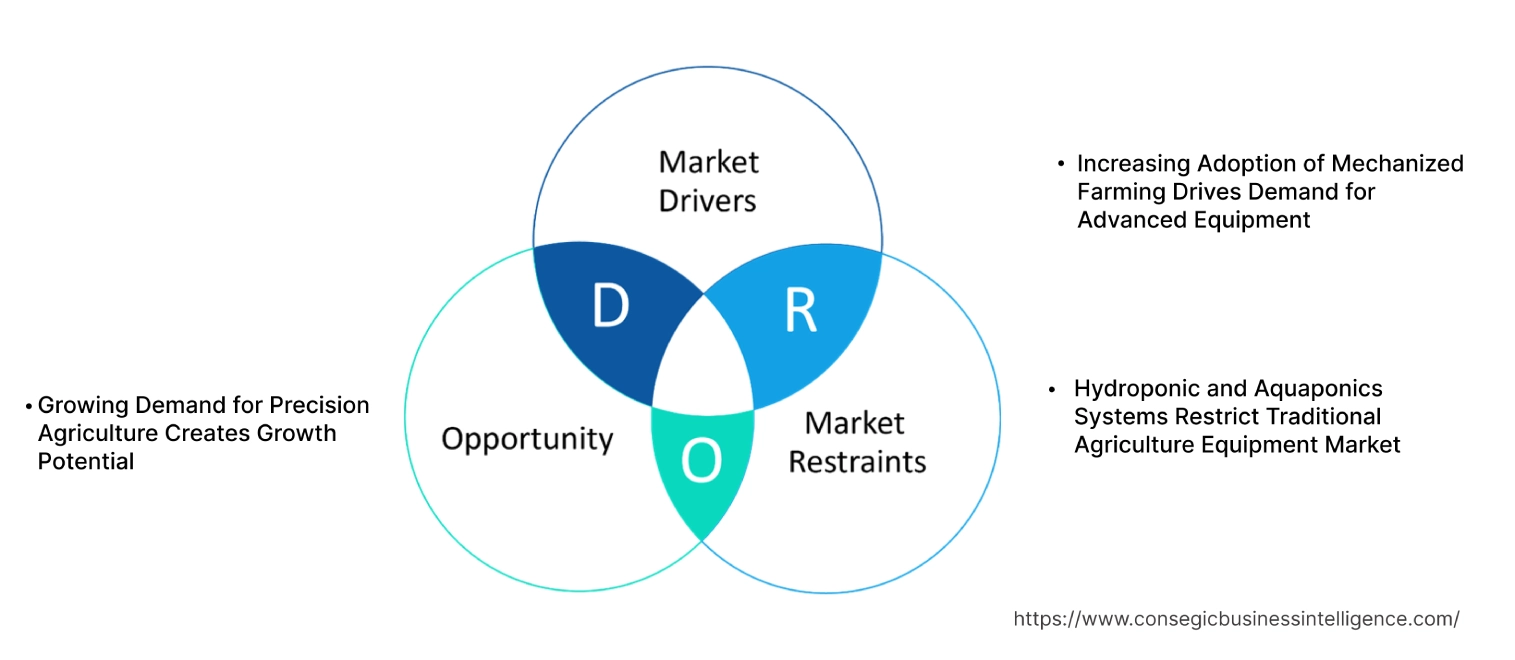

Agriculture Equipment MarketDynamics - (DRO) :

Key Drivers:

Increasing Mechanization in Farming Drives the Agriculture Equipment Market Growth

The increasing mechanization of farming serves as the primary engine for market growth by addressing the critical global challenge of rural labor shortages and rising operational costs. As farmers transition from manual labor to powered machinery, they achieve a significant boost in productivity and precision, often reducing input waste by up to approximately 20% while increasing overall crop yields. This shift is further accelerated by government subsidies and the expansion of commercial farming, which demand high-efficiency tools like autonomous tractors and smart harvesters. Ultimately, mechanization transforms traditional farming into a high-tech, capital-intensive industry capable of meeting the food demands of a growing global population.

- For instance, in July 2024, PÖTTINGER Landtechnik GmbH introduced two new high-efficiency mower combinations designed to maximize grassland farming output while significantly reducing fuel consumption. The NOVACAT H 9500 and H 11200 models offer impressive working widths of 9.46 meters and 11.14 meters.

Thus, labor shortage, government subsidies and need for increased productivity contributes significantly to the agriculture equipment market size.

Key Restraints :

High Initial Investment and Limited Adoption in Developing Region is Limiting the Market

The high initial investment required for modern machinery remains the most significant barrier to the agriculture equipment market, particularly in developing regions. Smallholder farmers often struggle with high interest rates and a lack of accessible credit, making advanced technology like precision planters and autonomous harvesters financially unreachable. This capital intensity is compounded by a digital and infrastructure divide, where a shortage of skilled technicians and stable power grids limits the practical adoption of smart equipment. Consequently, many regions remain dependent on manual labor or aging machinery, creating a market bottleneck that slows the transition to high-efficiency, commercialized farming.

Future Opportunities :

Growing Emphasis on Electric-Powered Equipment Drives the Agriculture Equipment Market Opportunities

The growing emphasis on electric-powered equipment is creating massive market opportunities by aligning agricultural productivity with global decarbonization goals. Manufacturers are capturing new revenue streams by offering battery-electric and hybrid machinery that significantly reduces the total cost of ownership through lower fuel and maintenance expenses. This shift is particularly lucrative in the specialty crop and greenhouse segments, where zero-emission and low-noise operations are essential. Furthermore, the transition to electric platforms serves as a gateway for advanced autonomous technologies and "Battery-as-a-Service" business models, allowing companies to provide integrated, high-tech energy solutions that appeal to both environmentally conscious and cost-sensitive modern farmers.

- For instance, in September 2024, AGCO Corporation announced the launch of the Fendt e107 Vario electric tractor will be available for order starting in autumn 2024. Expanding beyond its initial pilot markets, Fendt is rolling out the machine to Austria, Switzerland, Denmark, Sweden, Italy, and Spain through qualified dealerships.

Thus, growing focus on sustainability and rising innovations in battery technology drive the agriculture equipment market opportunities.

Agriculture Equipment Market Segmental Analysis :

By Equipment Type:

Based on the equipment type, the market is segmented into tractors, harvesting & threshing equipment, tillage equipment, planting & seeding equipment, irrigation & crop processing equipment, and haying & forage.

Trends in the Equipment Type:

- The increasing integration of sensors to monitor soil moisture and temperature during the tilling process is driving the agriculture equipment market trends.

- Planter machines use hydraulic sensors to ensure every seed is placed at the same depth regardless of soil hardness, which in turn drives the agriculture equipment market size.

Tractors accounted for the largest revenue share in the year 2024 and is anticipated to register a significant CAGR during the forecast period.

- There is a growing trend of developing electric, hydrogen, and methane-powered engines to reduce carbon footprints, which in turn drives the agriculture equipment market share.

- Further, fully driverless tractors are moving from prototype to mainstream for repetitive field tasks, which in turn drives the agriculture equipment market expansion.

- Furthermore, real-time data sharing between the tractor and the cloud allows for remote diagnostics and instant performance tuning, which drives the agriculture equipment market trends.

- Thus, as per the agriculture equipment market analysis, autonomous operations, fuel diversification, and smart telemetry are driving the market.

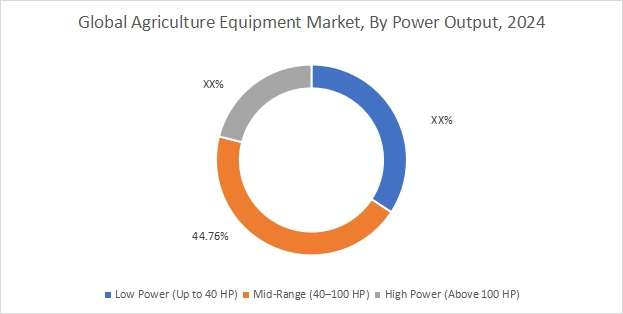

By Power Output:

Based on the power output, the market is segmented into low power (up to 40 HP), mid-range (40–100 HP), and high power (above 100 HP).

Trends in the Power Output:

- Increased need for compact tractors from residential and small-scale lifestyle farmers is driving the agriculture equipment market demand.

- Stricter local pollution laws for small equipment are forcing a shift away from traditional diesel engines in this power class, which in turn drives the agriculture equipment market growth.

Mid-range (40–100 HP) accounted for the largest revenue share of 44.76% in the year 2024.

- Manufacturers are using hybrid powertrains to provide an electric boost for peak loads while maintaining diesel's long-range reliability.

- Further, increased shift from 2WD to 4WD for better traction and soil preservation needs drives the agriculture equipment industry.

- Furthermore, basic GPS and remote monitoring are now standard features rather than premium add-ons, which is driving the market.

- Thus, as per the agriculture equipment market analysis, hybrid-electric extension, factory-fitted telematics, and universal 4WD adoption are driving the market.

High Power (Above 100 HP) is anticipated to register the fastest CAGR during the forecast period.

- Growing focus on hydrogen fuel cells and renewable diesel (HVO) for heavy-duty applications, which is driving the market.

- Further, high-power platforms now feature integrated AI cameras that identify and target individual weeds at high speeds, which propels the market.

- Furthermore, heavy articulated tractors are increasingly using rubber tracks instead of wheels to reduce soil compaction on massive industrial farms.

- Therefore, based on analysis, the aforementioned trends are anticipated to boost the growth of the market during the forecast period.

By Application:

Based on the application, the market is segmented into land development & seed bed preparation, sowing & planting, plant protection, harvesting & threshing, and post-harvest processing.

Trends in the Application:

- In post-harvest processing, there is rising integration of high-speed cameras and deep learning algorithms for sorting which in turn drive the agriculture equipment market expansion.

- Technological advancements including UV-light weeding,autonomous swarm spraying, predictive pest analytics, drone-assisted seeding, and others, are propelling the agriculture equipment market.

Land Development & Seed Bed Preparation accounted for the largest revenue share in the year 2024.

- Increasing integration of sensors for mapping soil compaction in real-time to adjust plow depth automatically, saving fuel and protecting soil structure.

- Further, advanced grading equipment uses satellite positioning to ensure perfectly flat fields, optimizing water distribution for irrigation, which drives the market growth.

- Furthermore, there is a rising demand for new equipment designs that prioritize low-disturbance tilling to keep carbon trapped in the soil and meet environmental credits.

- Thus, based on analysis, variable-depth tillage,laser-guided leveling, and carbon-smart plowing are driving the market growth.

Harvesting & Threshing is anticipated to register a significant CAGR during the forecast period.

- Combine harvester machine uses near-infrared (NIR) sensors to measure moisture, protein, and oil content, which in turn drives the agriculture equipment market share.

- Further, sensors are increasingly being integrated at the rear of the machine to alert the operator for grain loss, which drives the agriculture equipment market demand.

- Furthermore, modern threshers finely chop and spread the straw based on wind direction to ensure an even nutrient return to the soil.

- Therefore, based on analysis, the aforementioned trends are anticipated to boost the market during the forecast period.

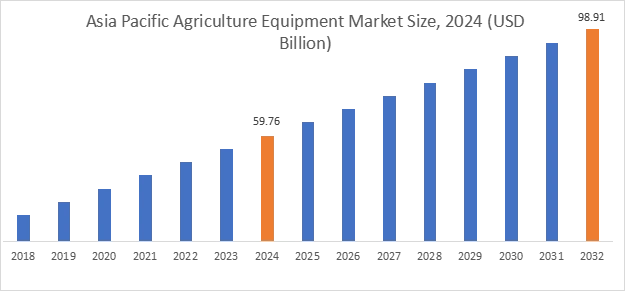

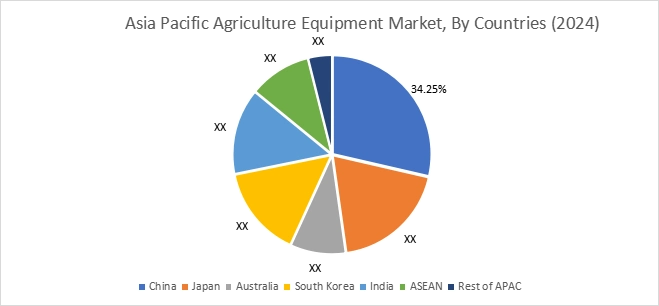

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 59.76 Billion in 2024. Moreover, it is projected to grow by USD 62.91 Billion in 2025 and reach over USD 98.91 Billion by 2032. Out of this, China accounted for the maximum revenue share of 34.25%. The market growth for agriculture equipment is mainly driven by rising demand for efficient agricultural machinery to enhance productivity and rising government support.

- For instance, in October 2025, Gromax Agri Equipment Ltd. (a Mahindra-Gujarat government joint venture) launched eight new 2WD and 4WD tractor models in Mumbai. The highlight of this release is the introduction of India’s first factory-fitted cabin series in the sub-50 HP segment, specifically designed to improve operator comfort during specialized tasks like orchard cultivation, puddling, and haulage.

North America is estimated to reach over USD 85.70 Billion by 2032 from a value of USD 52.41 Billion in 2024 and is projected to grow by USD 55.12 Billion in 2025. The North American market is primarily driven by significant adoption of modern farming techniques, presence of large number of established players, and advancements in precision agriculture.

- For instance, in February 2024, Linamar Corporation finalized its 100% equity acquisition of Bourgault Industries Ltd. This strategic move solidifies Linamar’s standing as a premier global manufacturer of agricultural equipment.

The regional trends analysis depicts strict environmental regulations promoting the adoption of electric and sustainable farm equipment in Europe is driving the market. Additionally, the factors driving the market in the Middle East and African region are rising government incentives to modernize agricultural practices and increasing investments in infrastructure to improve food security. Further, growing focus on agricultural mechanization to improve productivity is paving the way for the progress of market in Latin America region..

Top Key Players & Market Share Insights:

The global agriculture equipment market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the agriculture equipment industry. Key players in the global agriculture equipment market include-

- John Deere (U.S.)

- CNH Industrial (UK)

- AGCO Corporation (U.S.)

- Mahindra & Mahindra (India)

- Kubota Corporation (Japan)

- TAFE (India)

- Yanmar Co., Ltd. (Japan)

- CLAAS KGaA mbH (Germany)

- SDF Group (Italy)

- Exel Industries (France)

Recent Industry Developments :

Product Launch

- In January 2025, John Deere debuted its second-generation autonomy kit across a new fleet of machines for agriculture, construction, and landscaping. The fully electric, autonomous zero-turn mower equipped with a 21.4kWh battery, providing up to 10 hours of runtime and a 60-inch rear-discharge deck.

- In March 2025, CLAAS KGaA mbH launched a new generation of DISCO front mower featuring a redesigned look and an optional double roller drive for FRC (front-rear combination with roller conditioner) models.

- In March 2025 CNH Industrial N.V unveiled its most advanced Steiger 785 Quadtrac, the brand’s most powerful tractor with a peak output of 853 HP. The launch also marked the return of the Farmall M series, reimagined for modern utility with integrated technology and premium comfort.

Agriculture Equipment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 284.72 Billion |

| CAGR (2025-2032) | 5.6% |

| By Equipment Type |

|

| By Application |

|

| By Automation Level |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the agriculture equipment market? +

The agriculture equipment market is estimated to reach over USD 284.72 Billion by 2032 from a value of USD 174.51 Billion in 2024 and is projected to grow by USD 183.49 Billion in 2025, growing at a CAGR of 5.6% from 2025 to 2032.

What specific segmentation details are covered in the agriculture equipment report? +

The agriculture equipment report includes specific segmentation details for equipment type, power output, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the agriculture equipment market, harvesting & threshing is the fastest-growing segment during the forecast period.

Who are the major players in the Agriculture Equipment market? +

The key participants in the Agriculture Equipment market are John Deere (U.S.), CNH Industrial (UK), AGCO Corporation (U.S.), Mahindra & Mahindra (India), Kubota Corporation (Japan), TAFE (India), Yanmar Co., Ltd. (Japan), CLAAS KGaA mbH (Germany), SDF Group (Italy), Exel Industries (France), and others.

What are the key trends in the agriculture equipment market? +

The agriculture equipment marketis being shaped by several key trends including rapid transition toward autonomous and electric machinery, growing focus on improving the productivity, and the integration of AI and IoT sensors.