Indoor Lighting Management Market Size:

Indoor Lighting Management Market size is estimated to reach over USD 21.85 Billion by 2032 from a value of USD 14.60 Billion in 2024 and is projected to grow by USD 15.10 Billion in 2025, growing at a CAGR of 5.6% from 2025 to 2032.

Indoor Lighting Management Market Scope & Overview:

Indoor lighting management encompasses the technologies and systems employed to intelligently regulate artificial light within buildings. By leveraging sensors, automation, and smart controls, these solutions dynamically adjust light levels in response to occupancy, natural light penetration, and individual preferences. The primary benefits of indoor lighting management are enhanced energy efficiency, improved occupant comfort, and reduced operational expenses, all achieved through the provision of optimal illumination in diverse settings, including homes, offices, and factories.

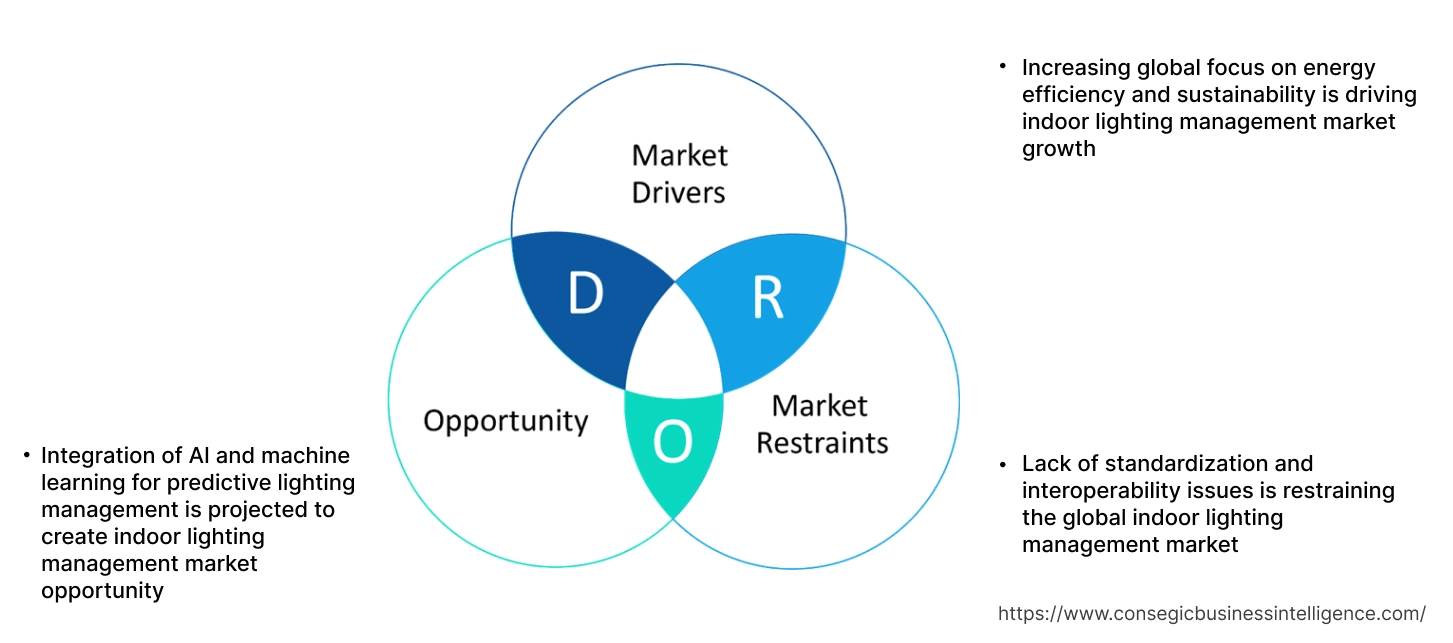

Indoor Lighting Management Market Dynamics - (DRO) :

Key Drivers:

Increasing global focus on energy efficiency and sustainability is driving indoor lighting management market growth

Increasing awareness of climate change and the environmental impact of energy consumption is driving the adoption of sustainable practices, which in turn, is spurring the market size. Energy-efficient lighting, enabled by smart management systems, plays a crucial role in reducing carbon footprints and promoting a greener environment. This aligns with the corporate social responsibility (CSR) initiatives of many organizations and the growing eco-consciousness of consumers, consequently driving the indoor lighting management market size.

- For instance, in Oct 2022, Philips launched "Ultra Efficient" indoor and outdoor lights and expanded its range of Ultra Efficient bulbs, addressing the urgent need for energy savings in Europe and the fight against climate change. These long-lasting (50,000 hours) luminaires use 50% less energy than standard Philips LEDs with the same light quality and meet strict EU regulations. Philips estimates that a typical household switching to these products could save approximately €14,000 over their lifetime.

Consequently, increasing global focus on energy efficiency and sustainability is driving indoor lighting management market growth.

Key Restraints :

Lack of standardization and interoperability issues is restraining the global indoor lighting management market

The lack of standardization in the indoor lighting management market, particularly in terms of interoperability between different devices and platforms, poses a major constraint. As more companies develop smart lighting solutions, the industry has seen an influx of proprietary systems that may not be compatible with other IoT-enabled building management systems. This creates difficulties for businesses looking to integrate lighting solutions into existing infrastructure or across different manufacturers. The absence of universal standards for smart lighting protocols and communication systems has resulted in fragmented solutions that can be difficult to manage, reducing the overall efficiency of the system. This lack of interoperability slows down the deployment of smart lighting solutions and increases the risk of vendor lock-in, where companies are forced to rely on a single vendor for all future upgrades and maintenance, limiting flexibility and increasing long-term costs, further hampering the market expansion.

Therefore, as per the analysis, these combined factors are significantly hindering indoor lighting management market share.

Future Opportunities :

Integration of AI and machine learning for predictive lighting management is projected to create indoor lighting management market opportunity

AI algorithms can analyze historical data, occupancy patterns, and even weather forecasts to predict lighting needs and proactively adjust levels, optimizing energy use and user comfort. Additionally, ML can learn individual user preferences and automatically adjust lighting levels and color temperatures to suit their needs, enhancing comfort and productivity. Further, AI can analyze sensor data to predict potential lighting failures, enabling proactive maintenance and reducing downtime, hence boosting indoor lighting management market trend.

- For instance, in Mar 2025, Telefónica Tech enhanced its smart outdoor lighting solution by adding AI capabilities through its Smart Steps platform. This integration will enable city councils to dynamically adjust lighting levels on streetlights in real time based on data from sensors (using NB-IoT), mobility patterns, points of interest, and weather conditions. By adapting the power of each streetlight to the actual needs of specific locations, the company anticipates energy savings of up to 30%.

Hence, based on the analysis, integration of AI and machine learning for predictive lighting management is expected to create indoor lighting management market opportunities.

Indoor Lighting Management Market Segmental Analysis :

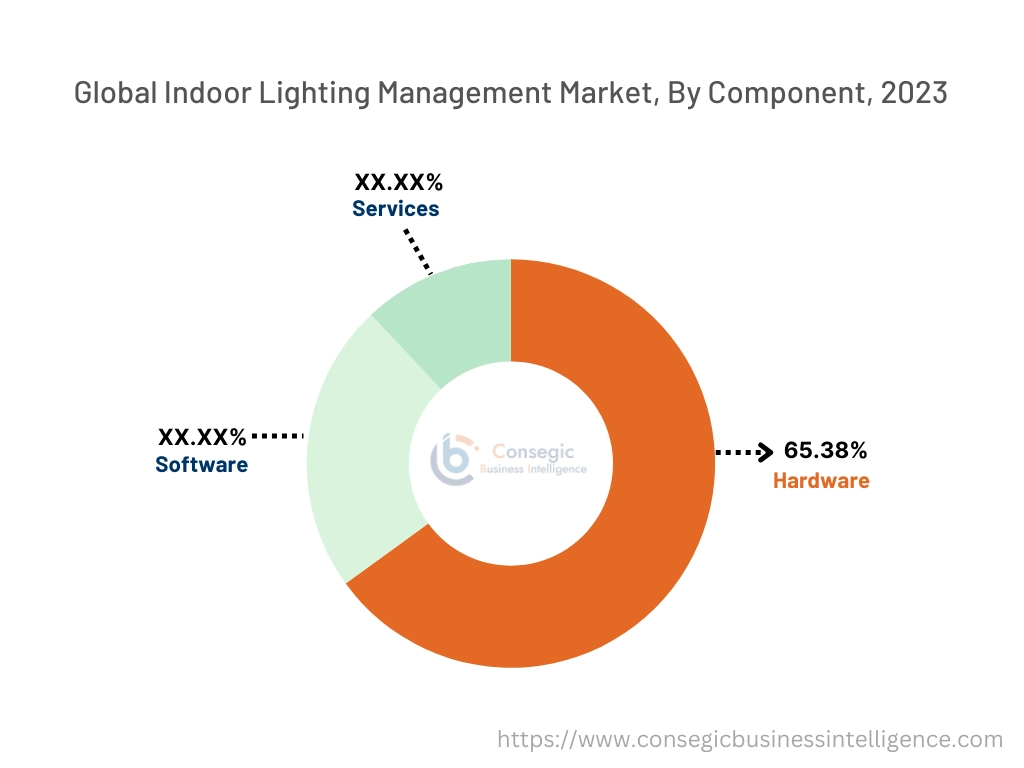

By Component:

Based on the Component, the market is categorized into Hardware, Software, and Services.

Indoor lighting management systems rely on a combination of hardware, software, and services to control and optimize lighting in buildings. Hardware includes lighting fixtures, sensors, and controllers, while software provides control, monitoring, and analysis capabilities. Services range from system design and installation to ongoing maintenance and support. Lighting control systems significantly reduce energy consumption by adjusting lighting levels based on occupancy, daylight availability, and other factors. By providing customized lighting levels and color temperatures, these systems can enhance the comfort and productivity of occupants.

Trends in the Component:

- Rising trend towards the adoption of Cloud-based software solutions for remote monitoring, management, control, and analysis of lighting systems across multiple locations.

- Software is leveraging data analytics and AI/ML algorithms to optimize energy consumption, predict maintenance needs, personalize lighting experiences, and automate lighting schedules.

Hardware accounted for the largest revenue share of 65.38% in 2024.

The hardware segment, encompassing crucial elements like sensors, controllers, and lighting fixtures, forms the backbone of indoor lighting systems. Sensors enable efficient lighting control by detecting occupancy, ambient light, and motion, while controllers manage operations based on this data. The rising adoption of energy-efficient LEDs, coupled with sophisticated sensors and controllers for optimized energy consumption, fuels the demand for these hardware components, thereby boosting the indoor lighting management market size.

- For instance, in Dec 2020, OSI Systems' Optoelectronics and Manufacturing division has secured a USD 6 million order to supply smart grow light controllers to a major original equipment manufacturer (OEM).

Thus, as per the indoor lighting management market analysis, the aforementioned factors are driving hardware segment.

Services are also projected to register the fastest CAGR during the forecast period.

The services segment, including essential installation, maintenance, and consulting, is crucial for the successful deployment and operation of increasingly complex indoor lighting management systems, especially in commercial and industrial settings. As organizations seek to optimize efficiency and save costs, the demand for expert guidance and ongoing support for integrated lighting solutions is rising, leading to rapid growth in this sector. Thus, as per the indoor lighting management market analysis, the aforementioned factors are driving the services segment.

By Technology:

Based on the Technology, the market is classified into Wired Lighting Control Systems, Wireless Lighting Control Systems, and IoT-based Lighting Control Systems.

Wired, wireless, and IoT-based lighting control systems offer different approaches to managing indoor lighting, each with its own advantages and disadvantages. Wired systems use physical wiring for communication, while wireless systems rely on radio frequencies, and IoT systems integrate smart devices and networking to control lighting remotely.

Trends in the Technology:

- Continued reliance on established wired protocols like DALI, KNX, and BACnet for robust and secure communication, integrating with digital controls for enhanced functionality and energy efficiency.

- The rise of hybrid systems that combine wired and wireless components to leverage the strengths of both.

Wireless Lighting Control Systems accounted for the largest market share in 2024.

There is a continued dominance of protocols like Z-Wave, Zigbee, Wi-Fi, and Bluetooth Low Energy (BLE) for various applications. With Z-Wave currently strong in residential and BLE and Zigbee gaining traction due to their low power consumption and mesh networking capabilities. Additionally, user-friendly mobile applications and web-based dashboards for intuitive control, scheduling, customization, and monitoring of wireless lighting systems.

- For instance, in Feb 2022, Daintree released new wireless wall dimmers and switches offering simple and scalable room-based lighting control. These controllers are available in a 2-button version for easy dimming and a 4-button version for programmed scene-based light adjustments tailored to specific tasks within space.

Thus, as per the indoor lighting management market analysis, the aforementioned factors are driving the wireless lighting control systems segment.

IoT-based Lighting Control Systems is projected to register the fastest CAGR during the forecast period.

Utilizing data collected from connected lighting devices and sensors to gain insights into energy usage, occupancy patterns, and system performance, with AI/ML algorithms enabling predictive maintenance, personalized lighting, and optimized energy savings. Additionally, seamless integration with other IoT-enabled systems within smart cities and buildings, such as HVAC, security, energy management, and building management systems (BMS), for holistic automation and control. Thus, as per the indoor lighting management market analysis, the aforementioned factors are driving IoT-based lighting control systems segment growth.

By Control Type:

Based on the Control Type, the market is divided into Dimming Control, Occupancy-Based Control, Daylight Control, Color Control, and Others.

In indoor lighting management, control types like dimming, occupancy-based, daylight, and color control are commonly used. Dimming control allows users to adjust the brightness of lights to suit their needs or the environment. Occupancy-based control uses sensors to detect presence and automatically turn lights on when someone enters a space and off when the space is unoccupied, saving energy. Daylight control system integrates natural light from windows and adjusts artificial lighting accordingly, optimizing energy consumption and daylight utilization. Color control allows for adjusting the color temperature of the light (e.g., from warm yellow to cool blue), creating different moods or atmospheres. Beyond these main categories, other lighting control types include time-based controls, manual controls, and networked lighting systems.

Trends in the Control Type:

- Increasing trend of more accurate and spectrally sensitive photosensors that can precisely measure daylight levels and adjust artificial lighting accordingly.

- Advancement in both closed-loop (sensor measures total light in the space) and open-loop (sensor measures external daylight) systems, with more intelligent algorithms to optimize the balance between natural and artificial light.

Dimming Control accounted for the largest revenue in the market in 2024.

Dimming control, the ability to adjust light brightness for specific needs, is a leading technology in indoor lighting management due to its significant energy-saving potential and ability to create adaptable lighting environments in both commercial and residential spaces. Its effectiveness, especially with LEDs which benefit from extended lifespan and precise illumination control, coupled with the increasing demand for energy efficiency and adaptive lighting, drives its widespread adoption.

- For instance, in Aug 2022, Wemo introduced a new Smart Dimmer that utilizes Thread technology, providing users with a faster and more reliable connection for controlling their lights remotely via the Home app, Wemo Stage, or Siri voice commands.

Thus, the aforementioned factors are driving the market.

Occupancy-Based Control is predicted to register the fastest CAGR during the forecast period.

Occupancy-based control systems, automatically adjust lighting based on detected presence, are gaining rapid traction as a key energy-saving solution, especially in intermittently used spaces like meeting rooms and restrooms. Driven by the increasing emphasis on energy conservation and the rise of smart building technologies, organizations are increasingly adopting these automated systems to optimize energy usage and reduce operational costs, leading to significant market growth. Subsequently, the above-mentioned factors are contributing notably in spurring indoor lighting management market expansion.

By Application:

Based on the Application, the market is divided into Commercial, Residential, and Industrial.

Indoor lighting management in commercial, residential, and industrial spaces focuses on optimizing lighting for energy efficiency, user comfort, and operational costs. Offices, retail stores, and warehouses benefit from lighting control systems that optimize lighting for specific tasks and create a comfortable environment for employees and customers. Homes utilize various lighting types like ambient, task, accent, and decorative lighting to enhance aesthetics and create a functional living space. Factories and warehouses require robust and efficient lighting to ensure safety, productivity, and compliance with safety regulations.

Trends in the Application:

- Increasing trend of lighting with other smart home devices and platforms (Amazon Alexa, Google Home, Apple HomeKit) for voice control, automation, and centralized management.

- Growing trend minimizing energy consumption in large industrial facilities through LED upgrades, occupancy-based controls in storage areas and low-traffic zones, and daylight harvesting in areas with natural light access.

Commercial accounted for the largest revenue in 2024 and is also projected to register the fastest CAGR.

The commercial sector in indoor lighting management is focused on creating productive and comfortable environments through Human-Centric Lighting (HCL) and smart, integrated lighting systems connected via IoT for optimized energy efficiency and centralized control. There's a strong drive towards personalized and flexible lighting solutions that can be adapted to various tasks and preferences, alongside a significant emphasis on aesthetic design and the retrofitting of outdated systems to meet green building standards and reduce operational costs.

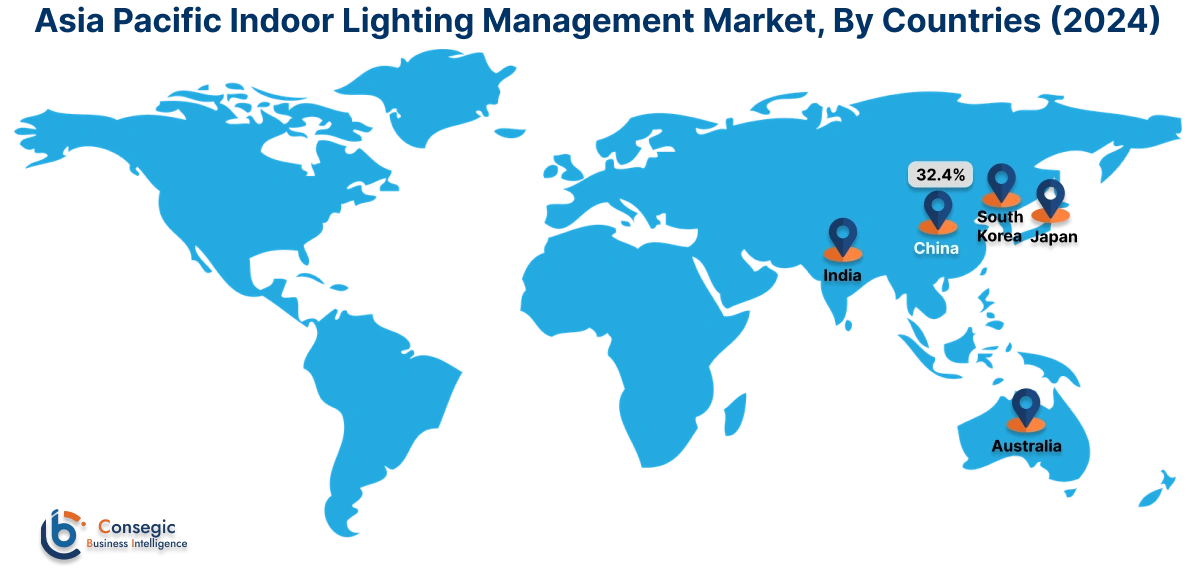

Regional Analysis:

The global indoor lighting management market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

In 2024, Asia Pacific was valued at USD 3.94 Billion and is expected to reach USD 7.06 Billion in 2032. In Asia Pacific, China accounted for the highest share of 32.4% during the base year of 2024. With growing energy consumption and environmental concerns, governments across the Asia Pacific are implementing stringent regulations and offering incentives to promote energy-efficient lighting solutions like LEDs and smart lighting controls.

- For instance, UJALA initiative in India, distributed over 360 million LED lights, stands as a prime example of this trend. Evolving into the world’s largest zero-subsidy domestic lighting program, UJALA underscores India's dedication to lowering energy consumption, promoting environmental consciousness, and boosting economic efficiency.

North America region was valued at USD 5.06 Billion in 2024. Moreover, it is projected to grow by USD 5.27 Billion in 2025 and reach over USD 8.30 Billion by 2032. North America is a major indoor lighting management market, fueled by a rising focus on energy efficiency and widespread smart home integration. The US is a key player with increasing demand for automated and LED lighting in homes, businesses, and industries. Energy-saving regulations like Energy Star and building codes further boost high-efficiency lighting adoption. The growth of IoT-powered smart buildings also drives intelligent lighting management. Canada follows a similar path with its strong commitment to sustainability and energy conservation, contributing to market growth.

Europe is a key market for intelligent lighting management, with Germany, the UK, France, and the Netherlands at the forefront. Driven by a strong emphasis on energy efficiency and environmental responsibility, smart lighting adoption is widespread across building types. Additionally, UAE leads with smart city projects integrating energy-efficient lighting. Saudi Arabia's Vision 2030 aims to cut energy use in lighting, boosting demand for smart solutions.

Top Key Players & Market Share Insights:

The market is highly competitive with major players providing indoor lighting management to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the indoor lighting management industry include-

- Signify (Netherlands)

- Acuity Brands (USA)

- Crestron Electronics (USA)

- Honeywell International (USA)

- Osram (LEDVANCE) (Germany)

- Cooper Lighting Solutions (USA)

- Zumtobel Group (Austria)

- Leviton (USA)

- Lutron Electronics (USA)

- Schneider Electric (France)

- Eaton Lighting (Ireland)

- Legrand (France)

- ABB (Switzerland)

- Helvar (Finland)

- Siemens (Germany)

Recent Industry Developments :

Product Launch:

- In Apr 2025, LEDVANCE introduced breakthrough OPTI-SELECT technology allowing users to change beam angles with a switch.

- In June 2024, Signify launched NatureConnect lighting in India, a system designed to enhance well-being by mimicking the natural rhythm of sunlight indoors.

- In Apr 2024, Signify expanded its UltraEfficient (UE) range with new LED panels, recessed luminaires, and downlights. These products, like the Philips UltraEfficient TrueBlend recessed fitting, help businesses cut carbon emissions and save costs.

Indoor Lighting Management Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 21.85 Billion |

| CAGR (2024-2031) | 5.6% |

| By Component |

|

| By Technology |

|

| By Control Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the indoor lighting management market? +

The indoor lighting management market size is estimated to reach over USD 21.85 Billion by 2032 from a value of USD 14.60 Billion in 2024 and is projected to grow by USD 15.10 Billion in 2025, growing at a CAGR of 5.6% from 2025 to 2032.

What specific segmentation details are covered in the indoor lighting management report? +

The indoor lighting management report includes specific segmentation details for component, technology, control type, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the indoor lighting management market, services is the fastest growing segment during the forecast period.

Who are the major players in the indoor lighting management market? +

The key participants in the Indoor Lighting Management market are Signify (Netherlands), Acuity Brands (USA), Lutron Electronics (USA), Schneider Electric (France), Eaton Lighting (Ireland), Legrand (France), ABB (Switzerland), Helvar (Finland), Siemens (Germany), Zumtobel Group (Austria), Crestron Electronics (USA), Honeywell International (USA), Osram (LEDVANCE) (Germany), Cooper Lighting Solutions (USA), Leviton (USA), and Others.