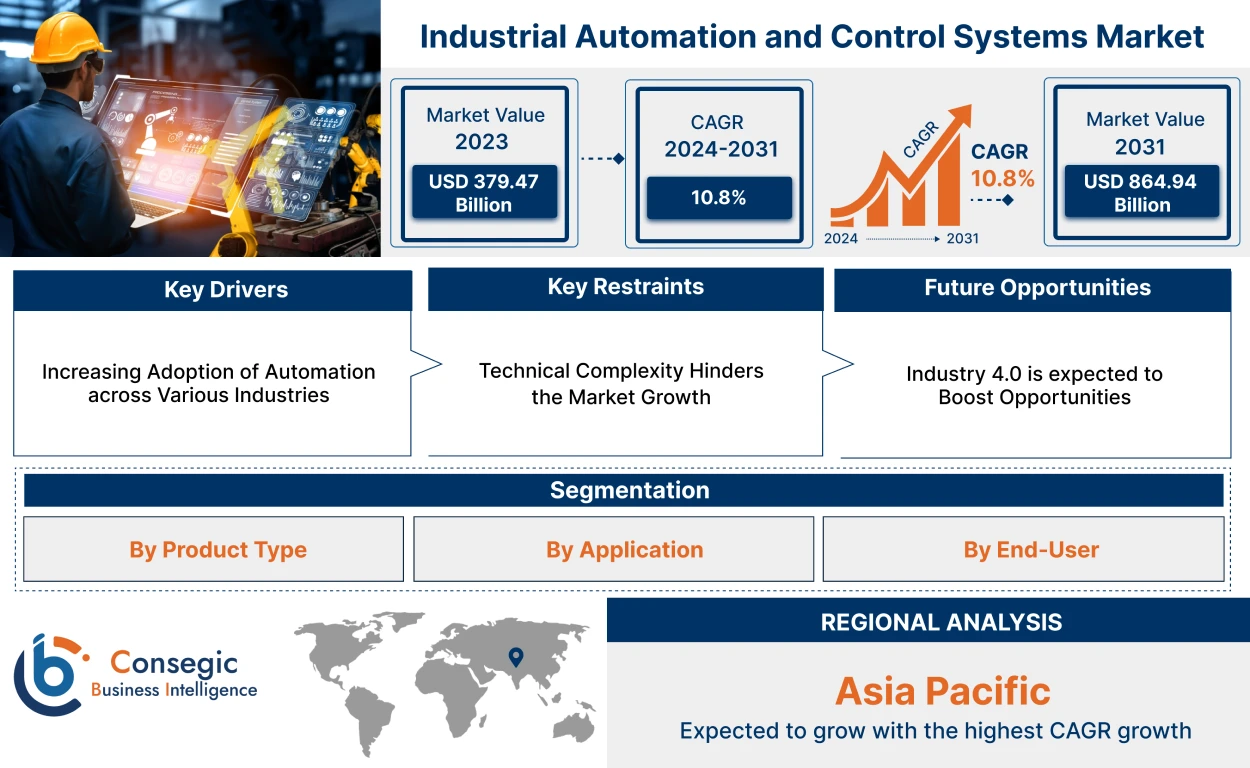

Industrial Automation and Control Systems Market Size:

Industrial Automation and Control Systems Market size is estimated to reach over USD 862.33 Billion by 2032 from a value of USD 408.03 Billion in 2024 and is projected to grow by USD 440.94 Billion in 2025, growing at a CAGR of 10.81% from 2025 to 2032

Industrial Automation and Control Systems Market Scope & Overview:

Industrial automation and control systems refer to the combination of hardware and software that are used to automate industrial processes, eliminating human intervention in tasks such as manufacturing, production, and other industrial activities. Additionally, the key benefits include increased productivity, reduced costs, improved safety, and enhanced quality control, which in turn is boosting the industrial automation and control systems market demand. Further, the integration of new technologies such as IoT and AI is driving the industrial automation and control systems market growth.

Industrial Automation and Control Systems Market Insights:

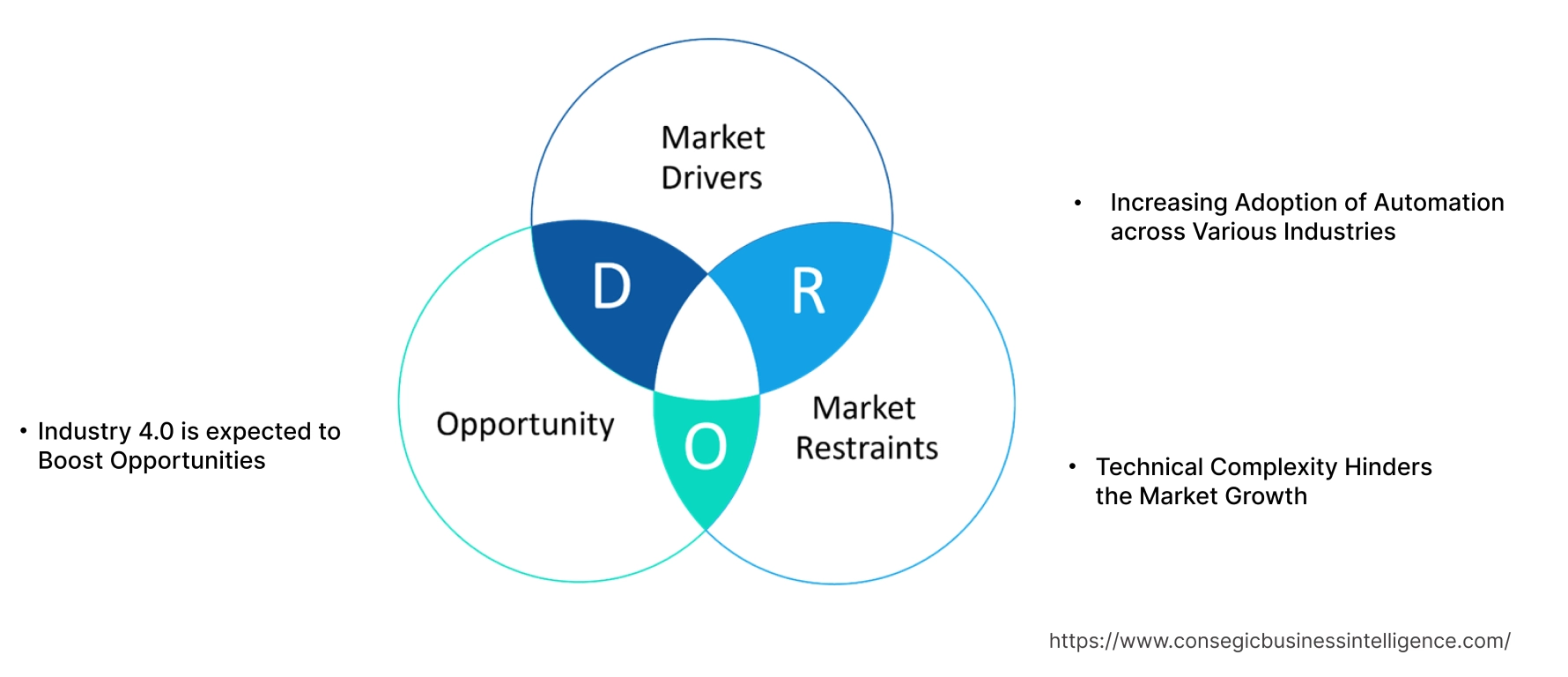

Industrial Automation and Control Systems Market Dynamics - (DRO) :

Key Drivers:

Increasing Focus on Efficiency and Productivity is Boosting Market Growth for Industrial Automation and Control Systems

Industries are adopting automation technologies to improve production speed, reduce costs, enhance quality, and minimize human error, which in turn is driving the industrial automation and control systems market demand. Additionally, the adoption of advanced control systems enables real-time monitoring of processes, allowing for quick adjustments and optimized operations, which in turn fuels the industrial automation and control systems market growth.

- For instance, in January 2023, according to the Association for Advancing Automation, automation helps various industries such as healthcare and manufacturing among others. Additionally, automation in healthcare aims to enhance the accuracy of diagnosis and refine surgical techniques among others.

Therefore, the rising adoption of automation for improving efficiency and productivity is driving the adoption of systems, in turn, proliferating the industrial automation and control systems industry.

Key Restraints :

High Initial Investment Costs are Restraining the Market Growth

The integration of automation systems with existing infrastructure is complex and time-consuming, adding to the initial investment, which in turn is hindering the industrial automation and control systems market expansion. Additionally, the high cost restricts small and medium-sized enterprises from adopting advanced technologies, which in turn hinders the market evolution. Further, the rising cost of advanced technologies, infrastructure, and training is hindering the market adoption.

Therefore, the high initial investment is hindering the industrial automation and control systems market expansion.

Future Opportunities :

Advanced Technologies are Expected to Promote Potential Opportunities for Market Growth

The advanced technologies such as AI, IoT, and machine learning are transforming manufacturing into smart manufacturing, providing manufacturers with data-driven insights to optimize production and reduce costs, which in turn is paving the way for industrial automation and control systems market opportunities. Additionally, AI and machine learning are enhancing predictive maintenance, optimizing production processes, and enabling autonomous decision-making. Further, automation is helping businesses improve efficiency, reduce costs, and enhance product quality which in turn fuels the market development.

- For instance, in May 2025, Siemens launched AI Agents for industrial automation, designed to work seamlessly across its established Industrial Copilot ecosystem. The AI agent is capable of improving performance through continuous learning is driving adoption in various industries.

Hence, the rising adoption of artificial intelligence and other advanced technologies is anticipated to increase the utilization, in turn promoting prospects for industrial automation and control systems market opportunities during the forecast period.

Industrial Automation and Control Systems Market Segmental Analysis :

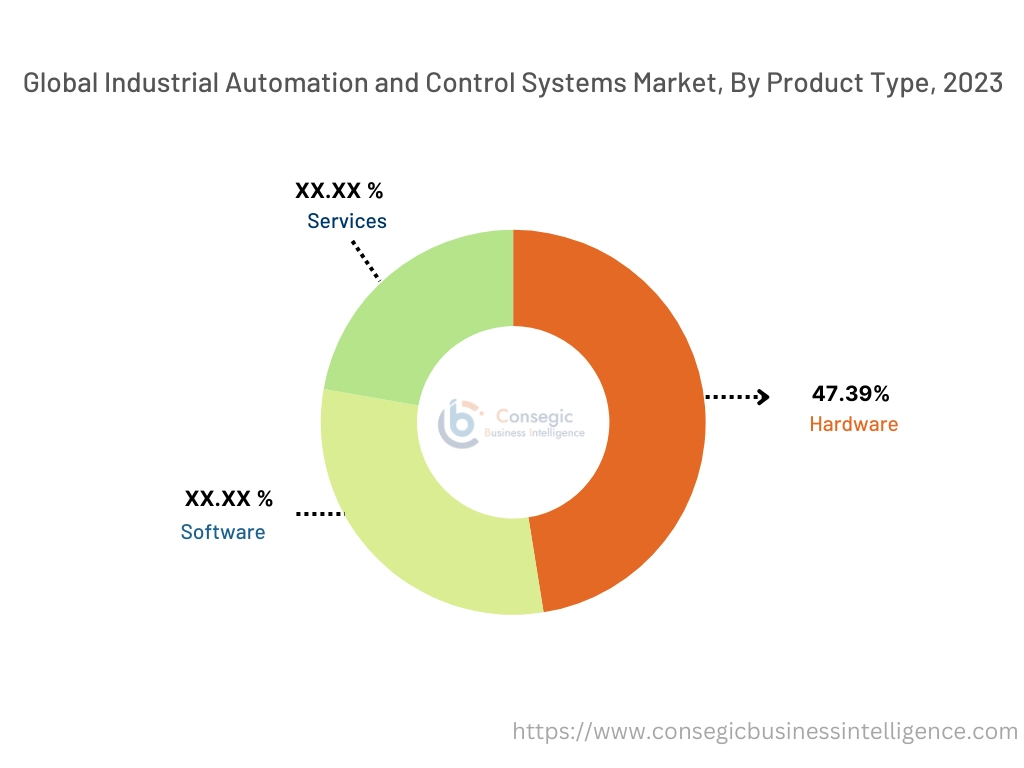

By Type:

Based on the type, the market is segmented into hardware, software, and service.

Trends in the Type:

- The trend towards the rise of AI and machine learning for predictive maintenance and optimization is driving the demand for the software segment.

- The trend towards the increasing use of digital twins and edge computing is boosting the need for the hardware segment, which in turn fuels the market growth.

Hardware accounted for the largest revenue share of 47.39% in the year 2024.

- The hardware component includes a programmable logic controller (PLC), human machine interface (HMI), sensors & actuators, communication networks, and others.

- Additionally, the key benefits of adopting hardware components include improved productivity, flexibility, quality control, cost savings, and worker safety.

- Further, the rising adoption of the hardware segment in chemical industries, steel manufacturing, power generation, and other industrial applications is boosting the market progress.

- Furthermore, technological advancements and the integration of the Internet of Things (IoT) and Artificial Intelligence (AI) in control systems are fueling the adoption of the hardware segment.

- For instance, in March 2024, FANUC America Corporation launched a PLC/CNC motion controller designed for CNC machine tools, which in turn provides a one-stop-shop automation solution to the supply chain industry.

- Thus, as per the market analysis, the technological advancements and integration of the Internet of Things (IoT) and artificial intelligence (AI) in control systems are driving the market progress.

Services are anticipated to register the fastest CAGR during the forecast period.

- The services segment comprises of system integration, maintenance and support, consulting and advisory, and others.

- Additionally, the services encompass a range of solutions designed to enhance efficiency, productivity, and safety in various industries.

- Further, the services segment helps to provide expert support for diagnosing and resolving issues in automated systems, minimizing downtime.

- Furthermore, the rising adoption of training programs and ongoing support ensures users to effectively operate and maintain automated systems.

- Therefore, as per the market analysis, the rising adoption of training programs and the ongoing support segment are anticipated to boost the market during the forecast period.

By Application:

Based on the application, the market is segmented into HVAC (Heating, Ventilation & Air-Conditioning), safety & security, industrial automation, assembly line, chemical processing, smart home devices, water treatment, food processing, lighting, and others.

Trends in the Application:

- The trend towards rising demand for energy-efficient and eco-friendly HVAC systems due to escalating energy price is driving the market adoption.

- The trend towards rising need for convenience, security, and energy-efficient smart home devices is boosting the market progress.

Industrial Automation accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- The proliferation of advanced technologies such as edge computing and the Industrial Internet of Things (IIoT) embedded with industrial automation systems capabilities is leading to higher productivity and reduced human error, improving product quality and consistency.

- Additionally, the system provides capabilities such as remote monitoring, data-driven decision making, and improved supply chain management, which in turn boosts the industrial automation and control systems market size.

- Further, the rising adoption of industrial automation to perform hazardous tasks, enhancing workplace safety, fuels the performance of hazardous tasks, enhancing workplace safety which in turn boosts the industrial automation and control systems market size.

- For instance, in November 2024, Red Hat, Inc. partnered with Intel to develop a smart building and industrial automation controller designed to empower manufacturers with scalable, edge-optimized industrial automation.

- Thus, according to the industrial automation and control systems market analysis, the rising adoption of industrial automation to perform hazardous tasks, enhancing workplace safety, is driving the market trends.

By End-User:

Based on the end-user, the industrial automation and control systems market is segmented into manufacturing, food & beverage, pharmaceuticals, transportation, healthcare, agriculture, oil & gas, and others.

Trends in the End User:

- The rising adoption of augmented reality (AR) in industries to enhance operational efficiency and productivity is driving the industrial automation and control systems market trends.

- The rising need to automate irrigation by adopting sensor-based irrigation systems to ensure optimal moisture levels for crops is driving the industrial automation and control systems market trends.

Manufacturing accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Manufacturing industries are increasingly leveraging automation to enhance productivity and cut labor costs, leading to cost reduction, improved quality, enhanced safety, and increased production.

- Additionally, the changing safety regulations in industries are boosting the market adoption in manufacturing sectors which in turn is boosting the industrial automation and control systems market share.

- Further, the increasing initiatives to promote industrial automation are driving the industrial automation and control systems market share.

- For instance, according to Invest India, the manufacturing sector is shifting towards the integration of artificial intelligence and machine learning solutions which in turn is driving adoption in smart factories.

- Thus, according to the industrial automation and control systems market analysis, the increasing initiatives to promote industrial automation are driving the market progress.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

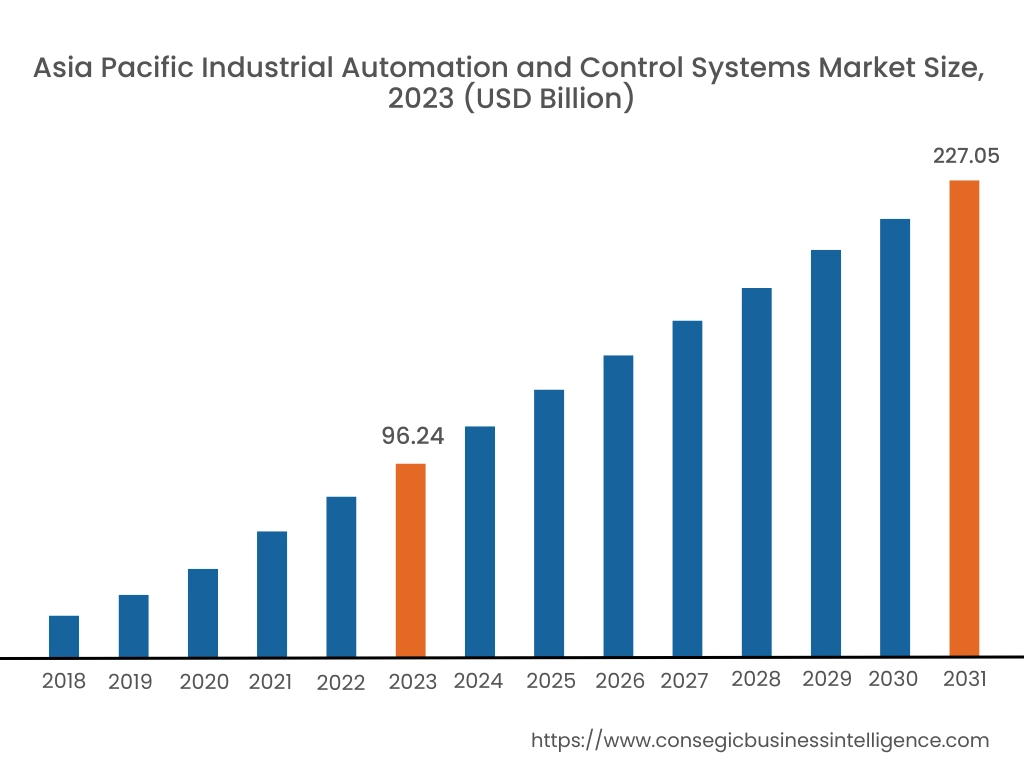

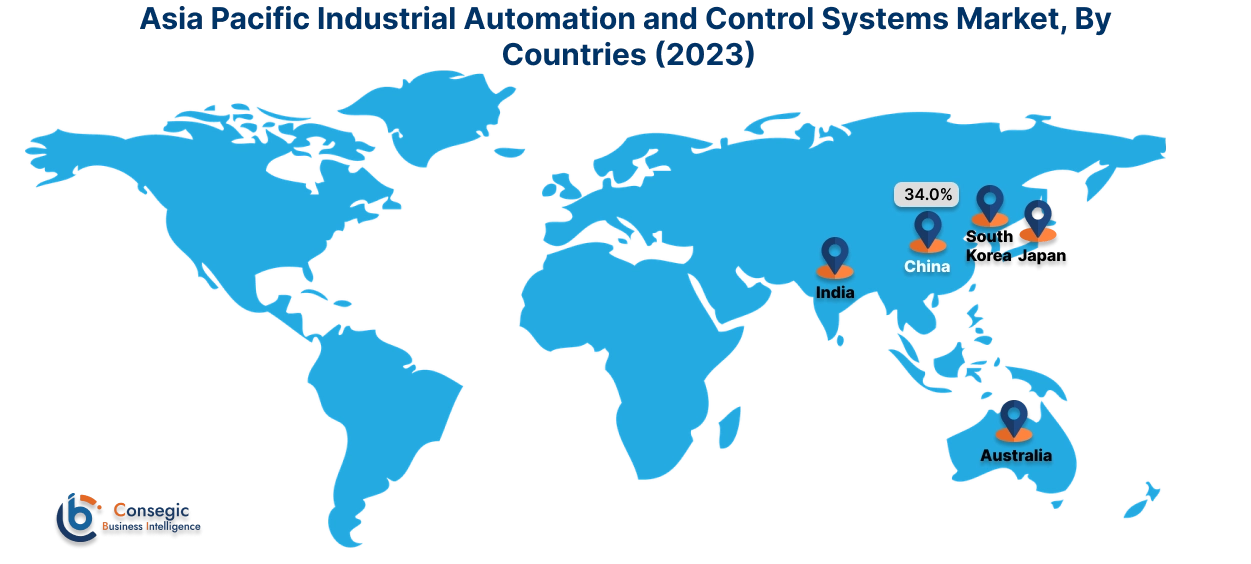

Asia Pacific region was valued at USD 113.32 Billion in 2024. Moreover, it is projected to grow by USD 122.83 Billion in 2025 and reach over USD 248.18 Billion by 2032. Out of this, China accounted for the maximum revenue share of 34.10%. The market progress is mainly driven by the rising adoption of automation and expanding industrialization across the Asia Pacific region. Furthermore, factors including the shifting toward adoption of Industry 4.0 are projected to drive the market growth in the Asia Pacific region during the forecast period.

- For instance, in March 2024, Rockwell Automation launched CUBIC, designed for the power and electrical panels in industries such as mining, renewable energy, chemical, food and beverage, and infrastructure across the Asian region. The launch aims to optimize processes which in turn provide safer, more sustainable, smart manufacturing environments.

North America is estimated to reach over USD 277.33 Billion by 2032 from a value of USD 129.82 Billion in 2024 and is projected to grow by USD 140.41 Billion in 2025. The North American region's rapid industrialization offers lucrative growth prospects for the market. Additionally, as per the market analysis, the advancements in technologies such as AI and IoT, and others are driving the market progress.

- For instance, in October 2023, Rockwell Automation partnered with Microsoft to leverage generative AI capabilities to enhance productivity and faster time-to-market for customers building industrial automation systems.

The regional analysis depicts that the rising adoption of smart factories as well as growing investment in IoT technologies is driving the market in Europe. Additionally, the key factor driving the market is the rising industrialization, as well as the need for energy-efficient solutions is propelling the market adoption in the Middle East and African region. Further, the increasing demand for automation in manufacturing, healthcare, and other industries is paving the way for the progress of the market in the Latin American region.

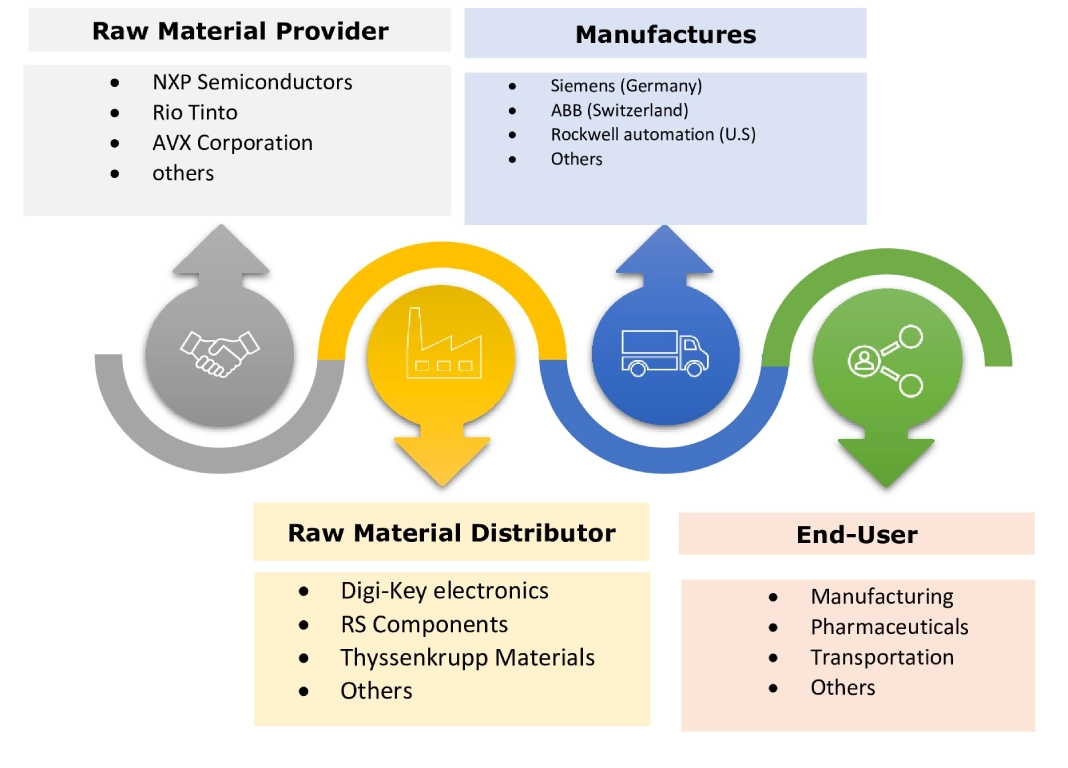

Top Key Players & Market Share Insights:

The global industrial automation and control systems market is highly competitive with major players providing industrial automation and control systems to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in the industrial automation and control systems industry. Key players in the industrial automation and control systems market include-

- Siemens (Germany)

- ABB (Switzerland)

- Yokogawa Electric (Japan)

- Omron Corporation (Japan)

- Danaher Industrial Ltd (USA)

- Rockwell Automation (USA)

- Schneider Electric (France)

- Honeywell International Inc. (USA)

- Mitsubishi Electric Corporation (Japan)

- Emerson Electric Co. (USA)

Recent Industry Developments :

Product launches

- In May 2024, Comau launched a range of new robots and intelligent solutions. The launch includes the portfolio of S-Robot Family, MI.RA/OnePicker, MATE-XB and MATE-XT, and others to make the next generation of robotics more accessible during physically demanding tasks.

Mergers & Acquisitions

- In January 2024, March Engineering acquired Automated Control Solutions Holdings Limited, including its subsidiaries Automated Control Solutions Limited and ACS. This acquisition aims to enhance the digitalization capabilities, expanding systems integration and OT automation capacity.

- In April 2024, Hitachi Ltd. acquired MA Micro Automation GmbH. The acquisition is valued at USD 77.38 Billion and includes high-speed linear handling systems and high-speed vision inspection technology among others which have a strong presence in Europe, North America, and Southeast Asia.

Industrial Automation and Control Systems Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 862.33 Billion |

| CAGR (2025-2032) | 10.81% |

| By Type |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the industrial automation and control systems market? +

The industrial automation and control systems market size is estimated to reach over USD 862.33 Billion by 2032 from a value of USD 408.03 Billion in 2024 and is projected to grow by USD 440.94 Billion in 2025, growing at a CAGR of 10.81% from 2025 to 2032.

Which segmentation details are covered in the industrial automation and control systems report? +

The report includes specific segmentation details for type, application, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the industrial automation and control systems market, industrial automation is the fastest-growing segment during the forecast period due to the rising adoption of industrial automation to perform hazardous tasks, enhancing workplace safety.

Who are the major players in the industrial automation and control systems market? +

The key participants in the industrial automation and control systems market are Siemens (Germany), ABB (Switzerland), Rockwell Automation (USA), Schneider Electric (France), Honeywell International Inc. (USA), Mitsubishi Electric Corporation (Japan), Emerson Electric Co. (USA), Yokogawa electric (Japan), Omron Corporation (Japan), Danaher Industrial Ltd (USA), and others.

What are the key trends in the industrial automation and control systems market? +

The industrial automation and control systems market is being shaped by several key trends, including the rising adoption of augmented reality (AR) in industries to enhance operational efficiency and productivity, and others.