Medical Tubing Market Size:

The Medical Tubing market size is growing with a CAGR of 8.2% during the forecast period (2025-2032), and the market is projected to be valued at USD 21.81 Billion by 2032 from USD 11.65 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 12.56 Billion.

Medical Tubing Market Scope & Overview:

Medical tubing is specialized, flexible conduits that are engineered from a variety of biocompatible materials that are selected for their unique mechanical, chemical, and thermal properties essential for specific clinical applications. These tubing are used for the precise transfer of fluids, gases, and even electronic signals within and between medical devices, patients, and healthcare systems. The stringent requirements for sterility, chemical inertness, kink resistance, and patient safety underlines the advanced material science and manufacturing precision inherent in the production of these vital components, making them fundamental to diagnostics, therapeutics, and patient care across all healthcare settings.

How is AI Transforming the Medical Tubing Market?

AI analyzes sensor data to predict when equipment needs maintenance, minimizing downtime and ensuring continuous production of high-quality tubing. AI-powered systems monitor manufacturing processes in real-time to detect deviations and defects early, maintaining regulatory compliance and reducing waste. Also, AI-integrated systems use advanced computer vision for automated inspection, improving the accuracy and speed of quality control to ensure dimensional tolerances and detect defects. Further, these advancements increase safety and efficiency, reduce costs, and improve patient outcomes by ensuring high-quality, compliant, and precisely engineered tubing for diverse medical applications.

Medical Tubing Market Dynamics - (DRO) :

Key Drivers:

Growing Adoption of Minimally Invasive Procedures to Propel the Medical Tubing Market Expansion.

Medical tubing is an important component in all minimally invasive procedures. For example, in endoscopy, flexible tubing with integrated cameras and instruments allows physicians to visualize and operate within the body through natural orifices or small incisions. In catheterization procedures, these specialized tubing delivers diagnostic tools, therapeutic devices, and fluids directly to the target site. Additionally, in cosmetic procedures, tubing for medical applications is used in liposuction where specialized aspiration tubing is crucial. This tubing connects the cannula to a suction pump. The rise in the number of minimally invasive procedures is influencing the use of these tubes.

For instance,

- The data published in the Plastic Surgery report, states that in 2023, the total minimally invasive procedures in cosmetic settings was observed to be 23,672,269 in 2022 and 25,442,640 in 2023. The number shows a rise of 7%.

Thus, the rise in the adoption of minimally invasive procedures for various applications is propelling the Medical Tubing market demand.

Key Restraints:

Stringent Regulations to Hinder Medical Tubing Market Expansion.

The global Medical Tubing industry, while continuously innovating to meet evolving requirements for enhanced material properties, faces a significant restraint in the form of stringent regulations. Governing bodies such as the U.S. Food and Drug Administration (FDA) in North America, the European Medicines Agency (EMA) and the Medical Device Regulation (MDR) in Europe, and equivalent authorities globally, impose rigorous requirements on medical device manufacturers, including those producing tubing. These regulations require extensive biocompatibility testing, ensuring the material is safe for human contact and does not leach harmful substances. This slows down the introduction of novel high-performance solutions. As a result, the above-mentioned factors limit the Medical Tubing market demand.

Future Opportunities :

Advancements in Thermoplastic Elastomer (TPE) Tubing to Create Medical Tubing Market Opportunities.

Modern TPE formulations provide an attractive alternative to traditional materials such as PVC and silicone, which is influenced by their superior combination of flexibility, durability, and enhanced biocompatibility and chemical resistance. Innovations in TPE material science allow for the development of highly specialized tubing with properties such as improved kink resistance, better clarity, and reduced extractables, making them ideal for sensitive applications like drug delivery systems and high-precision catheters. Additionally, TPEs are easier to process and sterilize compared to some traditional materials, contributing to more efficient manufacturing. Manufacturers are introducing novel tubing that are mainly designed for various applications.

For instance,

- In 2025, DuPont introduced Liveo Pharma TPE Ultra-Low Temp Tubing, a new thermoplastic elastomer tubing designed to withstand the low temperatures required for many of today’s biopharmaceutical processing applications.

Thus, as per the market analysis, these advancements are making tubing for medical applications more reliable, versatile, and appealing for a wider range of medical applications, thereby influencing the medical tubing market opportunities.

Medical Tubing Market Segmental Analysis :

By Material Type:

Based on material type, the market is categorized into polyvinyl chloride (PVC), thermoplastic elastomer (TPE), polyethylene (PE), polypropylene (PP), polyurethane (PU), and others.

Trends in Material Type:

- The Medical Tubing market trends are influenced by the growing need for materials that provide inherent flexibility, visual clarity, strong chemical resistance, and cost-effectiveness for disposable medical devices.

- The growing trend for compounds that provides versatile combination of rubber-like elasticity and thermoplastic processing advantages is influencing the use of TPE.

The Polyvinyl Chloride (PVC) segment accounted for the largest market share in 2024.

- Polyvinyl Chloride (PVC) has been an important raw material for medical tubing, primarily due to its exceptional combination of properties that make it highly suitable for diverse medical applications.

- Its widespread adoption is because of its inherent flexibility, especially when plasticized, allowing for easy handling and patient comfort in applications such as IV sets, drainage tubes, and respiratory circuits. Beyond flexibility, PVC provides excellent clarity, allowing healthcare professionals to visually monitor fluid flow and detect air bubbles or blockages.

- Its strong chemical resistance makes it compatible with a wide range of medical fluids, drugs, and disinfectants, while its relatively low cost of production provides an economical solution for high-volume, disposable medical devices.

- Thus, as per the market analysis, the aforementioned factors are influencing the growth of the segment.

The thermoplastic elastomer (TPE) segment is expected to grow at the fastest CAGR over the forecast period.

- Thermoplastic elastomers (TPEs) have emerged as a highly versatile and increasingly preferred raw material for medical tubing, offering a convincing balance of properties that address critical demands in healthcare applications.

- These materials combine the flexibility and elasticity of traditional rubber with the processing advantages of thermoplastics, allowing for efficient manufacturing through extrusion and injection molding done using injection molding machines.

- Various manufacturers are providing novel thermoplastic elastomer compounds for various tubing applications.

- For instance, in 2024, Teknor Apex, announce the expansion of its medical-grade thermoplastic elastomer portfolio with new grades specifically designed for biopharmaceutical tubing applications.

- Thus, as per the market analysis, the development of the TPE for medical applications including tubing is influencing the medical tubing market growth.

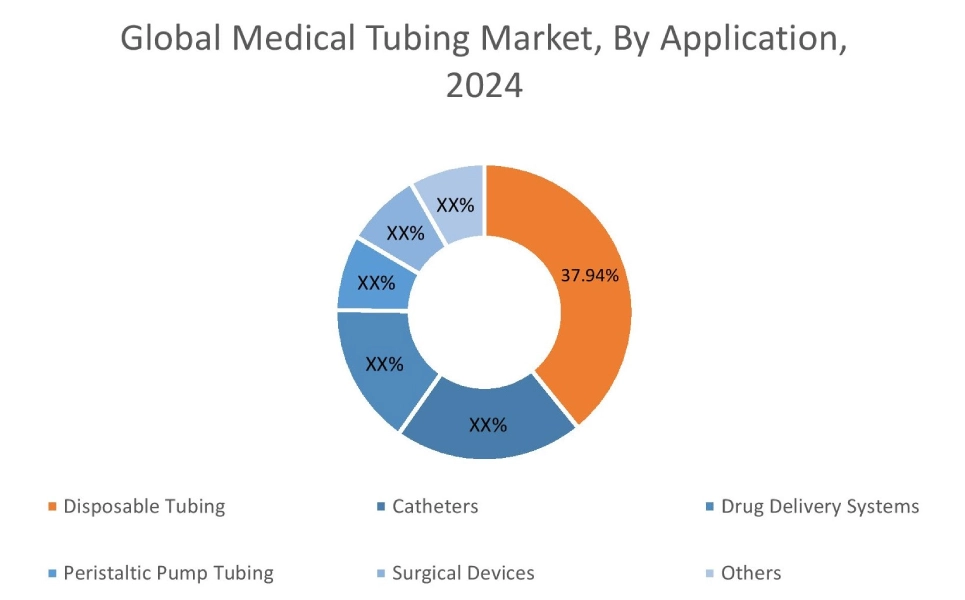

By Application:

Based on application, the market is categorized into disposable tubing, catheters, drug delivery systems, peristaltic pump tubing, surgical devices, and others.

Trends in the Application:

- The growing requirement for minimizing cross-contamination risks in medical and laboratory settings is influencing the use of disposable tubing.

- The trend for drug delivery systems is characterized by a strong push towards innovative, patient-centric solutions, and user-friendly designs, particularly in homecare and self-administration contexts.

The disposable tubing segment accounted for the largest Medical Tubing market share of 37.94% in 2024.

- Disposable tubing represents single-use components crucial for maintaining sterility and preventing cross-contamination in healthcare settings.

- These tubing solutions are designed for a wide array of applications, including intravenous (IV) fluid administration sets, blood collection and transfusion lines, respiratory circuits for ventilators, drainage tubes, feeding lines, and various components in dialysis and single-use bioprocessing systems.

- The primary advantage which is driving the widespread adoption of disposable tubing is its inherent ability to reduce infection risks by eliminating the need for sterilization between uses, thereby enhancing patient safety and reducing the operational burden on healthcare providers.

- This convenience, along with stringent regulatory requirements for hygiene and patient protection, solidifies disposable tubing's role in modern medical practices across hospitals, clinics, and homecare environments.

- Thus, as per the market analysis, the rise in the adoption of disposable tubing is influencing segment share.

The drug delivery systems segment is expected to grow at the fastest CAGR over the forecast period.

- Medical tubing plays an important role in drug delivery systems including drug delivery devices, serving as the crucial conduit through which pharmaceutical agents are safely and effectively administered to patients.

- These specialized tubes are integral components in a wide array of devices, including intravenous (IV) infusion sets, enteral feeding tubes, insulin pumps, and syringe drivers.

- Their flexibility, kink resistance, and ability to withstand various sterilization methods are important for maintaining the sterility and integrity of the drug formulation throughout the delivery process, minimizing the risk of contamination or dosage errors.

- Manufacturers are introducing various novel therapy devices that use medical tubing.

- For instance, in 2021, Vyaire Medical launched a new oxygen therapy device to advance the standard of care for those patients receiving low-flow oxygen therapy. In Dubbed AirLife™ Oxygen, the mask consists of various nasal cannula, oxygen mask and others.

- Hence, owing to the above-mentioned analysis, the drug delivery systems segment is expected to grow at the fastest rate over the future years, creating Medical Tubing market trends.

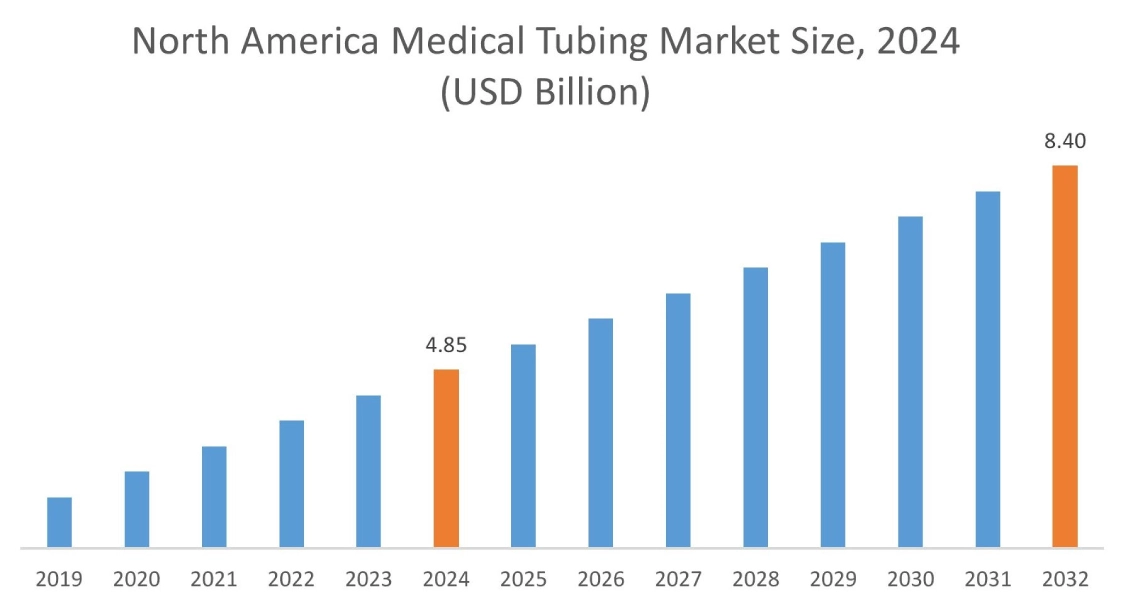

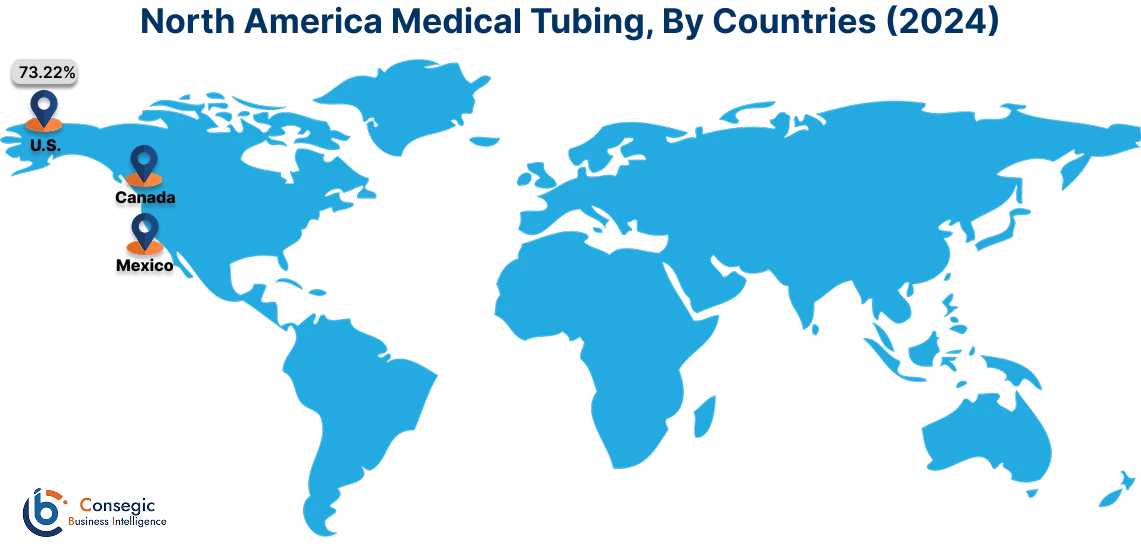

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, North America accounted for the highest Medical Tubing market share at 41.65% and was valued at USD 4.85 Billion and is expected to reach USD 8.40 Billion in 2032. In North America, the U.S. accounted for a market share of 73.22% during the base year of 2024. The Medical Tubing Market in North America is experiencing robust growth, significantly propelled by the rise in minimally invasive procedures and the development of new production sites for medical tubing within the region. Minimally invasive surgeries, which include laparoscopy, endoscopy, catheterization, and robotic-assisted procedures, require highly specialized, smaller diameter, and more precise tubing that direct complex anatomical pathways with minimal patient trauma. Additionally, the development of new production sites for enhanced tubing for various applications including biopharma tubing is increasing.

For instance,

- IN 2022, DuPont officially opened its new biopharma tubing manufacturing site in the U.S. The new facility aims to expand its capacity for biopharmaceutical tubing extrusion to meet increased demand from Liveo customers.

Thus, as per the medical tubing market analysis, these factors create a strong upward trajectory for the North America market, positioning it as a key region for players.

In Asia Pacific, the industry is experiencing the fastest growth with a CAGR of 9.9% over the forecast period. The rise in advancements in the Asia Pacific region is being driven by various factors, including rapid industrialization, increasing healthcare expenditure, an aging population, and a strong emphasis on sustainability and patient safety. A primary driver for TPE tubing's rise in APAC is its superior properties compared to traditional materials like PVC. Manufacturers are increasingly favoring TPEs for their excellent biocompatibility, which is crucial for direct patient contact applications, along with their flexibility, clarity, and resistance to kinking and harsh chemicals. Recent advancements in TPE formulations have led to compounds with enhanced sterilizability allowing for broader application in sterile medical environments. Thus, as per the market analysis, advancements in TPE tubing are driving the market trends in this region.

The adoption of disposable tubing within the European medical sector has seen an increase, driven by factors prioritizing patient safety, operational efficiency, and stringent regulatory compliance. European healthcare systems are increasingly focused on minimizing the risk of Healthcare-Associated Infections (HAIs), and disposable tubing offers enhanced solutions by eliminating the need for complex and error-prone cleaning and sterilization processes. This single-use approach significantly reduces the potential for cross-contamination between patients, enhancing overall patient safety and meeting the high standards demanded by regulatory bodies like the EU's Medical Device Regulation. Hence, as per the medical tubing market analysis, the rise in the use of disposable tubing is proposing the growth of the market in this region.

Despite evolving preferences for alternative materials, Polyvinyl Chloride (PVC) continues to hold a significant position as a material for medical tubing in the Latin America region. Its widespread use is primarily attributed to its cost-effectiveness, versatility, clarity, and excellent chemical resistance, which make it suitable for a broad spectrum of medical applications. PVC tubing is extensively utilized in Latin America for single-use devices such as intravenous (IV) sets, and various disposable components due to its ease of processing, flexibility, and well-established sterilization methods. Thus, these aforementioned factors are contributing to the trends of the market in this region.

In the Middle East and Africa (MEA) region, the rise in hospitals and associated healthcare infrastructure growth is a primary factor for the increasing demand of medical tubing. Each new or upgraded medical facility requires a vast array of medical equipment and consumables, with these tubing being an important component. From intravenous (IV) fluid administration sets and drug delivery systems to catheters, respiratory tubing for ventilators, and various disposable components used in surgical procedures and diagnostic tests, tubing for medical applications is fundamental to nearly every aspect of patient care. Thus, the aforementioned factors are influencing the medical tubing market growth in this region.

Top Key Players and Market Share Insights:

The Global Medical Tubing Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Medical Tubing market. Key players in the Medical Tubing industry include

- Nordson Corporation (U.S.)

- Saint-Gobain (France)

- Zeus Company LLC (U.S.)

- Freudenberg Medical (Germany)

- Optinova (Finland)

- Promepla Group (France)

- Teleflex Incorporated (U.S.)

- MicroLumen Inc (U.S.)

- Kent Elastomer Products (U.S.)

- DuPont (U.S.)

Medical Tubing Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 21.81 Billion |

| CAGR (2025-2032) | 8.2% |

| By Material Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Medical Tubing market? +

In 2024, the Medical Tubing market is USD 11.65 Billion.

Which is the fastest-growing region in the Medical Tubing market? +

Asia Pacific is the fastest-growing region in the Medical Tubing market.

What specific segmentation details are covered in the Medical Tubing market? +

By Material Type, and Application segmentation details are covered in the Medical Tubing market.

Who are the major players in the Medical Tubing market? +

Nordson Corporation (U.S.), Saint-Gobain (France), Promepla Group (France) are some of the major players in the market.