Transformerless UPS Market Size:

Transformerless UPS Market is estimated to reach over USD 6,069.36 Million by 2032 from a value of USD 2,781.30 Million in 2024 and is projected to grow by USD 3,017.88 Million in 2025, growing at a CAGR of 11.4% from 2025 to 2032.

Transformerless UPS Market Scope & Overview:

Transformerless UPS systems, also known as transformer-free UPS, do not use a transformer to provide isolation and voltage conversion. These UPS systems use electronic components instead of a transformer to convert and condition power, offering benefits including smaller size, higher efficiency, and lower costs. They are used in applications where space is limited and energy efficiency is crucial, such as in data centers. They are also commonly used in IT and networking applications where space and energy efficiency are important. Moreover, these systems are also used in certain industrial settings where power quality requirements are not extremely high and space is limited.

How is AI Impacting the Transformerless UPS Market?

AI is impacting the transformerless UPS market by enabling smarter, more efficient, and reliable power management. AI-driven analytics and machine learning algorithms are integrated into these systems to provide predictive maintenance, analyzing data from sensors to anticipate potential component failures before they cause an outage. This reduces unplanned downtime and extends the equipment's lifespan. AI also helps optimize energy consumption by dynamically balancing power loads and adjusting to fluctuating demands, which is particularly crucial for supporting the unpredictable, high-density power requirements of AI workloads in data centers. This enhanced intelligence and efficiency are making transformerless UPS systems a more compelling and future-proof solution for critical applications.

Transformerless UPS Market Dynamics - (DRO) :

Key Drivers:

Rising adoption of transformerless UPS in data centers is boosting the market growth

Transformerless UPS systems are more efficient than their transformer-based systems, particularly at lower loads. This leads to lower energy consumption and reduced utility costs for data centers. By eliminating the bulky transformer, transformer-free UPS systems are significantly smaller and lighter. The absence of a transformer reduces the initial capital cost of the UPS system. Additionally, lower energy consumption and maintenance needs contribute to reduced operating costs. These systems are often designed with modularity in mind, allowing data centers to easily scale their power backup capacity as needed.

- For instance, in February 2025, Colt Data Centre Services, a global provider of hyperscale and large enterprise data centre solutions, launched its new hyperscale data centre in Tokyo, Japan. The data center is developed to fulfil the rising demand for data centre capacity and public cloud services in Japan as well as the Asia-Pacific region.

- Additionally, in April 2023, Datadog, Inc. launched its new data center situated in Tokyo, Japan. The new data center in Japan is responsible for storing and processing data locally while assisting Datadog and its customers comply with local data security and privacy regulations.

Thus, based on analysis, the increasing development of data centers are driving the adoption of these systems, in turn proliferating the transformerless UPS market growth.

Key Restraints:

High initial cost and limited overload capacity is limiting the market growth

Transformerless systems, particularly those using insulated gate bipolar transistor (IGBT), may have a lower tolerance for short-term overloads compared to transformer-based systems. They might not be able to handle high inrush currents or sustained high loads as well. While long-term operating costs can be lower, the initial purchase price of a transformer-free UPS system might be higher than a similarly rated transformer-based system. Consequently, while transformerless technology advances, these cost and overload considerations direct potential buyers towards alternative solutions, restricting transformerless UPS market demand.

Future Opportunities :

Increasing innovations associated with transformerless UPS are anticipated to promote opportunities for market growth

UPS system manufacturers are constantly investing in the development of new uninterruptible power supply systems integrated with updated features to ensure its efficient utilization in residential, commercial, and industrial applications. Additionally, UPS companies are launching new products with updated features and advancements, which are expected to provide lucrative aspects for market growth.

- For instance, in July 2023, Fuji Electric Co., Ltd. expanded its 7500WX series of high-capacity uninterruptible power supply system, with the launch of a new UPS product featuring a single-unit capacity of 2,400 kVA. The uninterrupted power supply system is designed for application in hyperscale data centers.

Therefore, the market trend analysis depicts that the increasing innovations associated with uninterruptible power supply systems are projected to promote transformerless UPS market opportunities in the upcoming years.

Transformerless UPS Market Segmental Analysis :

By Component:

Based on the component, the market is segmented into rectifier, battery system, inverter, capacitors, and others.

The components of the transformerless UPS systems play a key role in achieving backup power without a traditional low-frequency transformer. The rectifier converts incoming AC power to DC for charging the battery and supplying the inverter during normal operation. Further, the battery system composed of either VRLA or lithium-ion batteries, stores energy for backup during power outages. Furthermore, the inverter converts DC power into an AC output while capacitors are critical throughout the system are used for smoothing DC voltage in the rectifier and filtering the AC output in the inverter.

Trends in the Component:

- Increasing trend in the adoption of film capacitors in UPS system components due to their longer lifespan, higher reliability, and better high-frequency performance.

- Increasing incorporation of sensors and analytics to optimize maintenance schedules and predict potential failures that improves reliability and reduces downtime is boosting the transformerless UPS market size.

Battery system accounted for the largest revenue share in the transformerless UPS market share in 2024.

In transformer-free UPS systems, battery systems provide backup power during grid outages, and their management is crucial for performance and longevity. These systems utilize electronic converters to boost the battery voltage and ensure reliable power delivery to critical loads. These systems incorporate advanced battery management systems and techniques, such as open-circuit rest, to extend battery lifespan and improve performance. They also manage the charging process more effectively, potentially leading to longer battery life and improved overall system efficiency. Thus, as per market trends analysis, increasing adoption of battery systems is driving the transformerless UPS market growth.

Inverter is anticipated to register the fastest CAGR during the forecast period.

In transformer-free UPS systems, the inverter is a crucial component that converts DC power from batteries into AC power, providing a backup power source during outages. The core function is to convert the DC power stored in the batteries to AC power, mirroring the functionality of a standard inverter. During a power outage or grid instability, the inverter takes over, providing a stable and reliable AC power source to critical loads. The inverter ensures that the AC output voltage remains within acceptable limits, protecting connected devices from damage due to voltage variations. These systems, with their IGBT-based inverters, are known for their high efficiency, reducing energy losses and improving overall system performance. Therefore, as per market trends analysis, aforementioned factors are expected to boost the transformerless UPS market trends during the forecast period.

By Power Capacity:

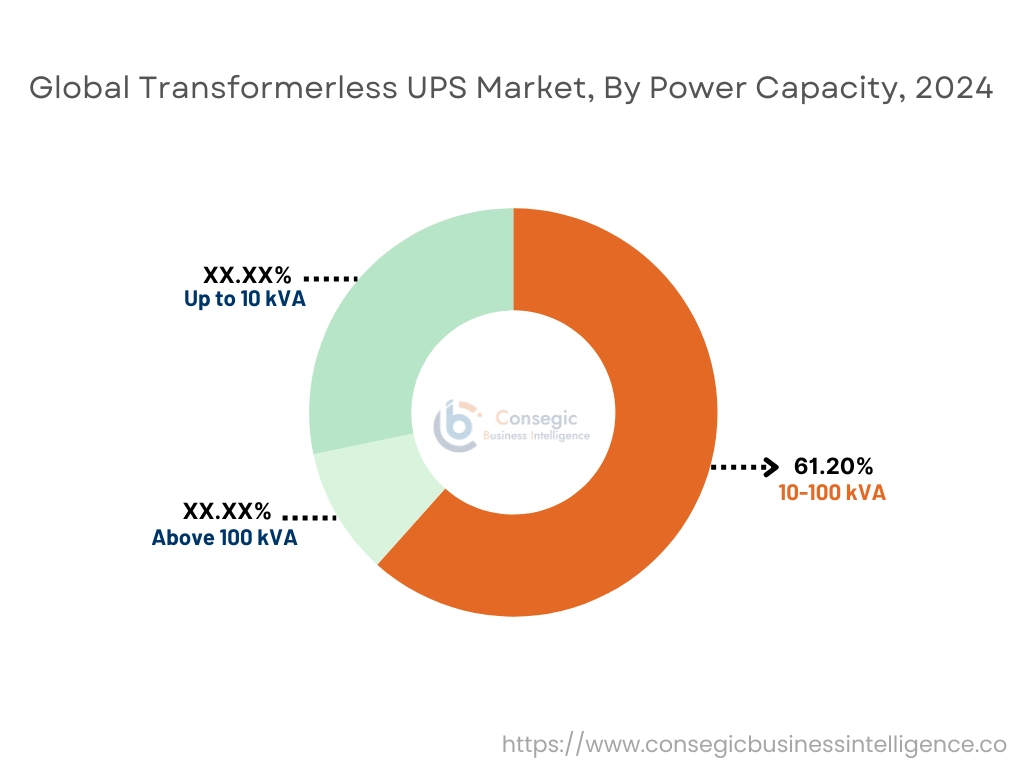

Based on the power capacity, the market is segmented into up to 10 kVA, 10-100 kVA, and above 100 kVA.

The power capacity is defined as the maximum electrical load that the UPS can consistently support during normal operation and power outages.

The transformerless UPS systems with power capacity of up to 10 kVA cater to smaller power requirements, commonly used in homes, small offices, and for individual critical devices such as servers workstations, and network equipment. Further, 10-100 kVA power capacity range addresses the needs of medium-sized businesses, branch offices, and larger server rooms. Also, these UPS systems offer a balance between power capacity, features, and scalability. Furthermore, systems with power capacity of above 100 kVA are designed for large data centers, hospitals, warehouses, industrial facilities, and others. The high capacity UPS are engineered for high efficiency and robust performance to ensure continuous power supply to critical loads.

Trends in the Power Capacity:

- Factors including reliable backup power, improved power conditioning, high efficiency, and enhanced scalability are among the key prospects driving the adoption of 10-100 kVA power capacity UPS, in turn boosting the transformerless UPS market size.

- Factors including growing demand for continuous power supply solutions from commercial and industrial sectors, combined with characteristics such as high capacity, enhanced power quality, and improved load management are major determinants projected to boost the adoption of above 100 kVA power capacity UPS.

10-100 kVA accounted for the largest revenue share of 61.20% in the transformerless UPS market share 2024.

10-100 kVA power capacity provides a critical backup power source, ensuring that essential equipment and systems continue operating even during power outages or fluctuations. This is particularly important for applications where even brief interruptions lead to data loss, equipment damage, or disruption of critical operations.

- For instance, Vertiv offers Liebert MTP Online UPS in 40kVA and 80kVA power rating models. Moreover, there are various operation mode available in these systems including standby mode, ECO mode, line mode (AC mode), bypass mode, shutdown mode, battery mode, and maintenance bypass mode.

Thus, based on the analysis, a wide range of applications and high scalability & flexibility is driving the global transformerless UPS market expansion.

Above 100 kVA is anticipated to register the fastest CAGR during the forecast period.

Above 100 kVA transformer-free UPS are used for medium to large-scale applications, such as data centers, industrial processes, and critical IT infrastructure, providing reliable power backup and protection. In industrial settings, these UPS systems protect sensitive equipment and processes from power fluctuations and outages, maintaining production and safety. These UPS systems are designed to handle significant power loads, providing ample backup power for critical applications. They are built to provide reliable and uninterrupted power, even during prolonged outages. They protect connected equipment from power surges, spikes, and other disturbances, extending the lifespan of sensitive devices. UPS systems are designed to be scalable, allowing for increased capacity and redundancy as needed.

- For instance, Eaton offers UPS solutions with above 100 kVA power rating. These solutions are available in 160kVA, 200kVA, 250kVA and 400kVA UPS specifications. These solutions also offer an extensive range of three-phase systems designed to handle higher loads with greater efficiency.

Therefore, very high-power capacity & scalability and increasing integration with power grids is anticipated to boost the transformerless UPS market trends during the forecast period.

By End-User:

Based on the end user, the market is segmented into BFSI, IT and telecommunication, healthcare, government, manufacturing, and others.

The UPS systems are widely used across a wide range of industries including BFSI, healthcare, manufacturing and others for constant power supply. The BFSI sector heavily relies on transformerless UPS system to ensure uninterrupted operation of critical systems such as transaction processing, data centers, and communication networks. Further, IT and telecommunication sector utilize UPS systems to protect servers, networking equipment, and communication infrastructure which are crucial for maintaining connectivity and data availability. Further, in healthcare, transformerless UPS are vital for powering essential medical equipment, diagnostic tools, and life support systems, ensuring patient safety and continuous care. Furthermore, manufacturing sector uses transformerless UPS to protect sensitive control systems, automated machinery, and robotic equipment, preventing downtime and production losses.

Trends in the End User:

- Rising demand for UPS systems to protect critical infrastructure, including communication networks, transportation systems, and public safety facilities is boosting the transformerless UPS market expansion.

- Increasing adoption of UPS systems due to factors including rising pace of urbanization, increasing investments in commercial construction, and growing demand for reliable backup power supply in commercial spaces are key prospects boosting the transformerless UPS market demand.

IT & telecommunication accounted for the largest revenue share in the year 2024 and it is anticipated to register the fastest CAGR during the forecast period.

Transformer-free UPS systems are well-suited for small IT rooms, data centers, and other environments where space is valuable. They provide reliable backup power to servers, networking equipment, and other critical IT infrastructure, ensuring minimal downtime during power outages or fluctuations. The telecommunications industry relies on uninterrupted power for mobile networks, data centers, and communication hubs. Transformer-free UPS systems offer the necessary stability and reliability to maintain seamless connectivity during power disturbances, preventing service disruptions.

- For instance, Socomec Group offers DELPHYS GP, which utilizes advanced technologies to achieve high efficiency in online double conversion mode (VFI), minimizing energy losses and reducing operating costs. Further, DELPHYS GP is suitable for a wide range of applications including data centers, IT and telecommunications, and others.

Thus, according to analysis, growth of data centers & cloud computing and the rise of edge computing is driving the transformerless UPS market opportunities.

Regional Analysis:

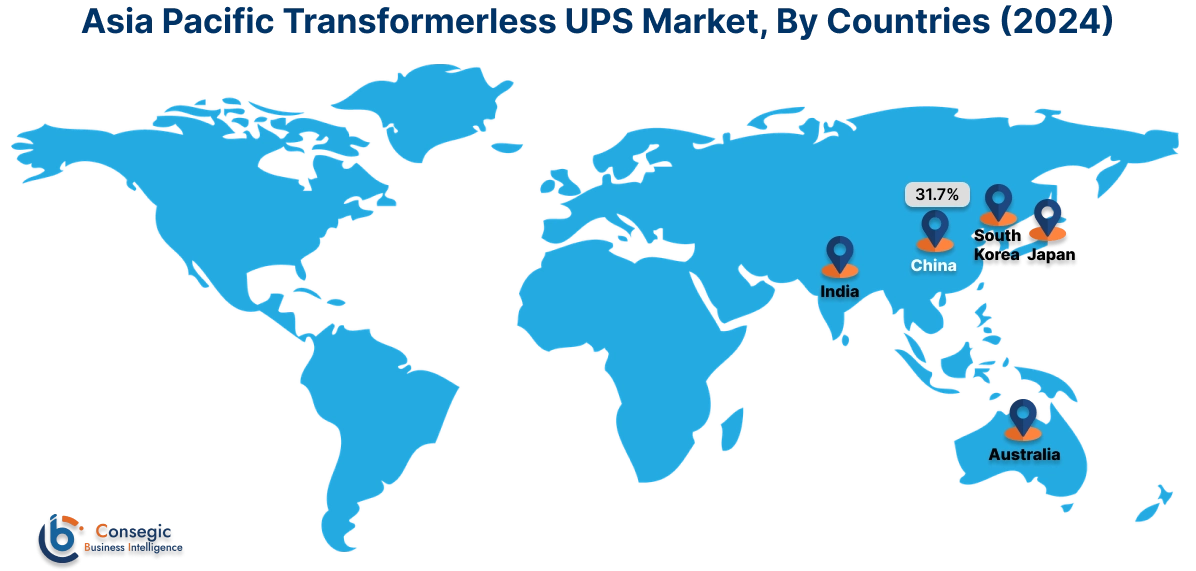

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

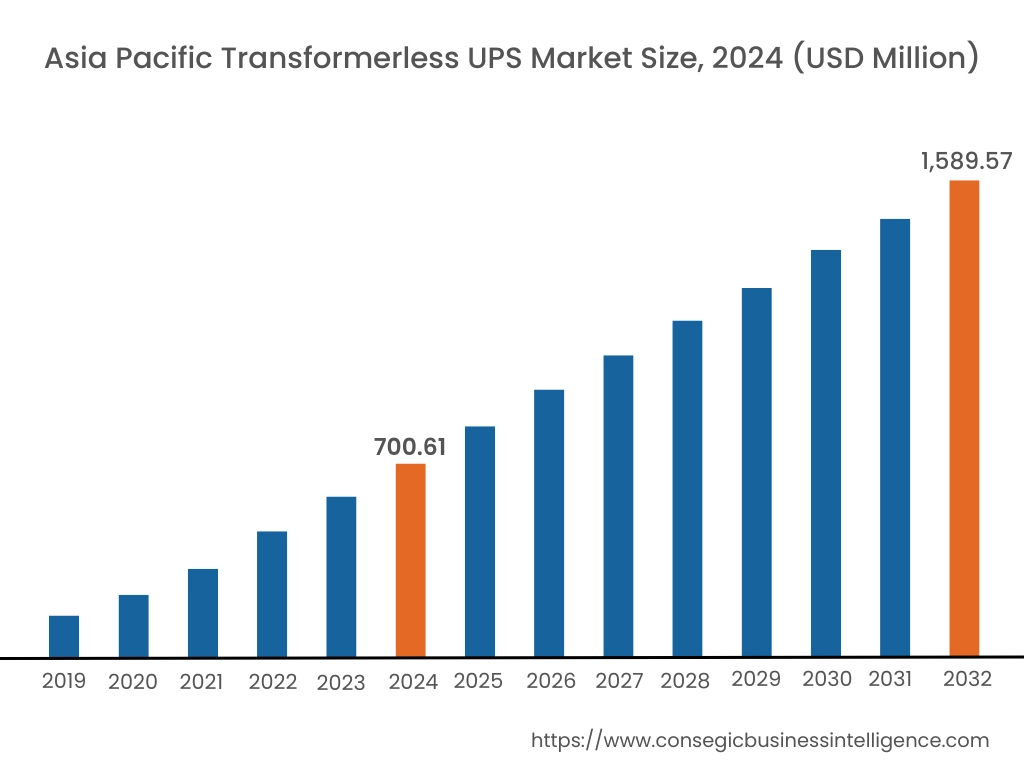

Asia Pacific region was valued at USD 700.61 Million in 2024. Moreover, it is projected to grow by USD 762.72 Million in 2025 and reach over USD 1,589.57 Million by 2032. Out of this, China accounted for the maximum revenue share of 31.7%. The transformerless UPS market analysis depicts that the market is mainly driven by rapid industrialization, increasing investments in data centers and IT infrastructure, the rising adoption of advanced technologies, growing awareness of energy efficiency, and supportive government initiatives promoting digitalization and infrastructure development.

North America is estimated to reach over USD 2,269.33 Million by 2032 from a value of USD 1,059.09 Million in 2024 and is projected to grow by USD 1,147.45 Million in 2025. Further, rising development of industrial manufacturing facilities, development of commercial spaces, and increasing need for constant power supply solutions in commercial and industrial spaces are among the key prospects anticipated to drive the market growth during the forecast period.

- For instance, Vertiv Group Corp. a key player in US market, offers Liebert APM UPS which is a transformerless, online UPS system designed for data centers and other critical applications. It offers modular power scalability, which allows users to easily increase capacity as their needs grow, without requiring additional floor space.

The transformerless UPS market analysis depicts that the stringent energy efficiency regulations, increasing investments in renewable energy integration, and a strong focus on data center and IT infrastructure development in Europe are driving the market. Further, the market in the Latin America is growing due to increasing need for reliable power solutions, rising investments in IT and telecommunications, and expanding data center construction. Additionally, in the Middle East and African region, the market is primarily driven due to increasing industrialization and infrastructure development, growing investments in IT and telecommunications and rising awareness of the importance of reliable power backup.

Top Key Players and Market Share Insights:

The global transformerless UPS market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the transformerless UPS industry. Key players in the Transformerless UPS industry include-

- Socomec Group (France)

- Eaton Corporation (Ireland)

- Vertiv Group Corp. (US)

- Toshiba Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- GE Vernova (US)

- Norden (Denmark)

- ABB Ltd. (Switzerland)

- Borri S.p.A (Italy)

- Emerson Electric Co. (US)

Recent Industry Developments :

Product Launch:

- In May 2024, Eaton launched its new 9395X model of intelligent, space-saving uninterruptible power supply system. Eaton 9395X uninterruptible power supply system occupies a footprint that is up to 30 percent smaller as compared to similar UPS models while delivering improved energy efficiency. The UPS has a maximum power rating up to 1700 kVA and features superior power density and robust capabilities.

Transformerless UPS Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 6,069.36 Million |

| CAGR (2025-2032) | 11.4% |

| By Component |

|

| By Power Capacity |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Transformerless UPS Market? +

The Transformerless UPS Market is estimated to reach over USD 6,069.36 Million by 2032 from a value of USD 2,781.30 Million in 2024 and is projected to grow by USD 3,017.88 Million in 2025, growing at a CAGR of 11.4% from 2025 to 2032.

What specific segmentation details are covered in the Transformerless UPS report? +

The transformerless UPS report includes specific segmentation details for component, power capacity, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the Transformerless UPS Market, IT and Telecommunication is the fastest growing segment during the forecast period due to the critical need for uninterrupted power to protect sensitive electronic equipment and to ensure continuous operation of essential digital services.

Who are the major players in the transformerless UPS market? +

The key participants in the Transformerless UPS Market are Socomec Group (France), Eaton Corporation (Ireland), GE Vernova (US), Norden (Denmark), ABB Ltd. (Switzerland), Borri S.p.A (Italy), Emerson Electric Co. (US), Vertiv Group Corp. (US), Toshiba Corporation (Japan), Mitsubishi Electric Corporation (Japan), and others.

What are the key trends in the Transformerless UPS Market? +

Transformerless UPS Market is being shaped by several key trends including increasing demand from data centers, advancements in power electronics and IGBT technology, a growing focus on energy efficiency, the rising adoption of modular and scalable UPS systems, and the increasing integration of smart monitoring and management capabilities.